India’s power shortage crisis is an opportunity to spur the clean energy transition

- Continuing high temperatures in India are creating massive demand for electricity, which distribution companies struggle to meet.

- The power shortage crisis has revealed that the cost of coal-based generation is high and inflationary.

- The government needs to invest in sustainable energy choices and accelerate the deployment of domestically produced, deflationary renewables.

Heatwaves are sweeping across India. March 2022 was the hottest March since 1901, according to Indian Meteorological Department data. The high temperatures have continued in April and this is adding to the woes of the distribution companies which are trying to meet increasing electricity demand.

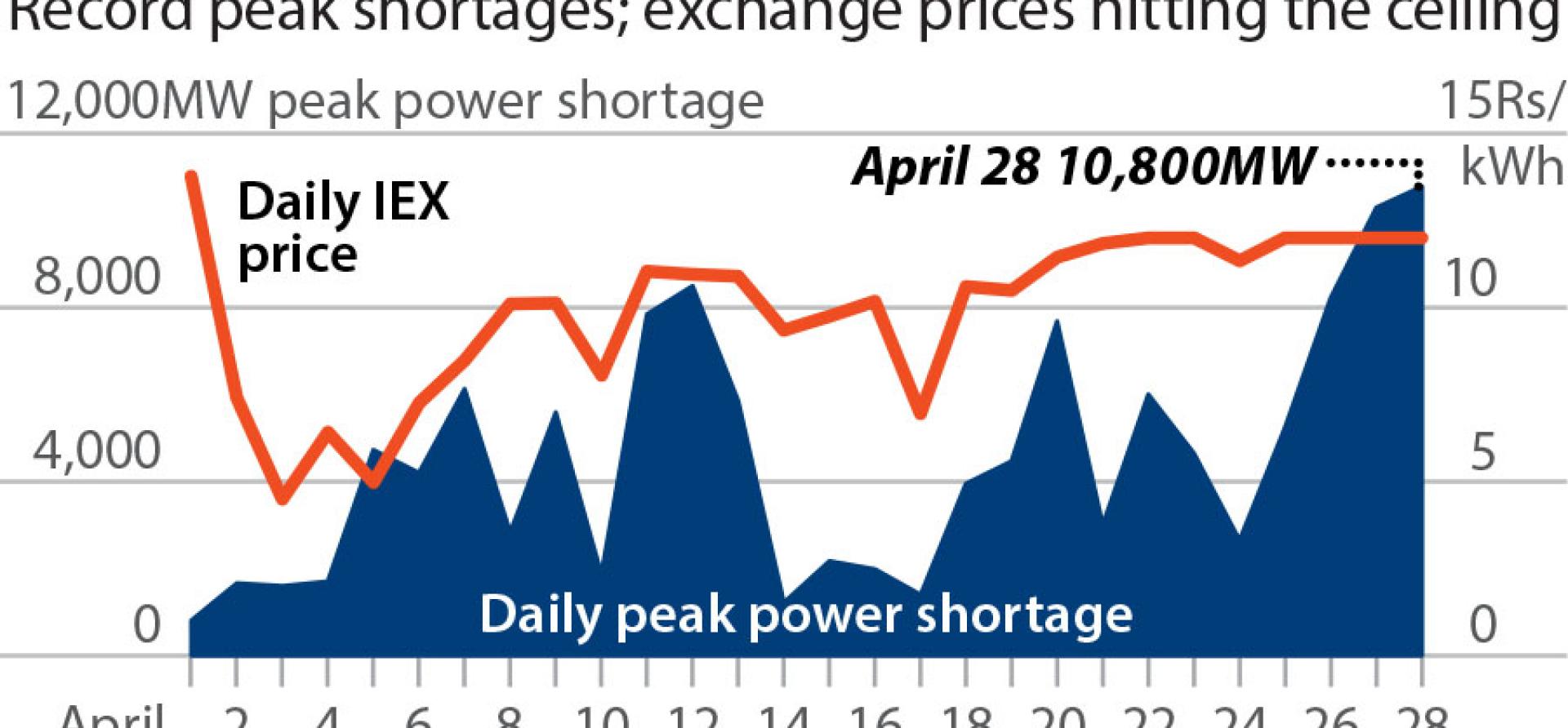

India experienced peak demand of 200 gigawatts (GW) in March and April, an increase of 8% over the previous year. On 12 April, the peak power shortage was 8500MW and on 28 April it was 10,778MW, while the maximum demand met was a record 204GW. The rising demand is being met through an increase in both thermal and renewable energy generation.

What is causing the power outages?

India has a total installed capacity of 400GW (as of March 2022), which is almost twice the peak demand. However, about 12% of the capacity mix is hydro, which is seasonal, and 28% is renewable energy, which is intermittent and may not be available during peak hours unless firmed up with storage capacity.

About 51% (204GW) is coal-based, firm capacity. However, coal plants are running at low capacity utilisation with average plant load factors (PLFs) of 68%. Coal shortages are a key reason for the low PLFs.

Issues with logistics have also led to lower coal offtake. There is a need for greater availability of freight rakes for coal transportation. In fact, the Ministry of Power has asked power generation companies to buy their own rakes under a Ministry of Railways scheme to deal with logistical constraints in coal supply.

Also, coal inventories at power plants on 1 April had an average stock of just nine days, the lowest level since at least 2014 (power plants are required to maintain at least two weeks of supply).

At the start of March, there were 80 plants with critical coal supplies. On 12 April (one of the maximum peak shortage days), this reached 97, and on April 28, it was 108. Importantly, developers have not maintained enough stock even when coal was available.

Record-high global coal prices mean that bridging the gap in the domestic coal requirement through imports is expensive. Newcastle coal futures, the benchmark for Asia, the top consuming region, are about US$325 per ton from US$90 per ton a year back, supported by skyrocketing demand amid tight supplies of alternative energy products and sanctions on Russian coal.

The increasing power prices will add to the financial woes of debt-laden power distributors, which owe Rs1.1 lakh crore rupees to power generators, especially with global coal prices trading at steep premiums compared to average levels in 2021 due to the Russia-Ukraine war.

Power cuts will also dampen the growth of industrial activity

Commercial and industrial consumers who rely on open access will bear the brunt of having to source expensive electricity from the open market, with average prices at the power exchange in the range of Rs9-12/kWh and peak prices reaching Rs12/kWh consistently in the past few days.

In March prices hit Rs15-18/kWh. In early April, the regulator reduced the ceiling price to Rs12/kWh. The prices in the short-term market have skyrocketed on account of the domestic coal shortage and high imported coal prices. Due to supply shortages, prices at the power exchange are hitting the ceiling during most hours.

Power cuts will also dampen the growth of industrial activity. Coal India is cutting supplies of coal to the non-power sector. This means that industries such as aluminium and steel could face power shortages – just as they begin to revive after COVID-19 and witness increasing demand.

How to tackle the crisis

The government’s immediate response is to try to avert the crisis by increasing imports and asking captive generators to generate at maximum capacity. Several states have asked idle thermal power plants to resume operations and are willing to pay higher prices for coal and gas power to stave off a crisis. The power ministry is asking utilities to increase coal imports for blending to 36 million tonnes.

The power shortage crisis has revealed that the cost of coal-based generation is high and, further, is inflationary. With energy demand likely to go up further, India needs to invest in sustainable energy choices. The government should accelerate the deployment of domestically produced, deflationary renewable energy.

India has set huge targets for renewable energy by 2030 and net zero by 2070. In order to achieve these targets and to integrate large amounts of renewable energy into the grid, India now needs to push for more firming capacity such as pumped hydro and battery storage.

The government should encourage domestic battery and electrolyser manufacturing

The government should provide incentives through investing in research and development (R&D) on energy storage and green hydrogen, and a Production Linked Incentive (PLI) scheme to encourage the domestic manufacturing of batteries and electrolysers for green hydrogen production.

Financial support could be provided initially through schemes such as Viability Gap Funding (VGF) to make these technologies more affordable. When economies of scale occur, these technologies would become price-competitive on their own, enabling more firming capacity and an increase in the share of renewable energy.

Investing in thermal energy to help India through the power crisis risks diverting limited financial resources away from cheaper clean energy. In addition, investing in a thermal asset at any stage of the value chain effectively locks in investment for 25-30 years or more.

Related articles:

IEEFA: The energy transition in India – upwards and onwards

IEEFA: Private sector driving renewable energy wave in India

IEEFA: Fuel price crisis should accelerate India’s energy transition

By Vibhuti Garg, Energy Economist and Lead India, Institute for Energy Economics and Financial Analysis (IEEFA)

This article was published in Money Control.