IEEFA: Emerging Asia’s unrealistic LNG-to-power project pipeline threatens macroeconomic and financial stability

15 December (IEEFA Asia): The liquefied natural gas (LNG) industry has framed LNG as a cheap, reliable “bridge fuel” to help countries reduce coal consumption and transition to cleaner renewable energy. For many project developers and countries in emerging Asia, however, LNG is a bridge that may never be built, according to the latest report from the Institute for Energy Economics and Financial Analysis (IEEFA).

Emerging Asia is widely anticipated to be one of the largest growth markets for global LNG demand, but a granular project-by-project and country-level analysis by IEEFA of seven emerging Asian markets reveals that only a small fraction of LNG related infrastructure proposals will be viable.

Emerging Asia is widely anticipated to be one of the largest growth markets for global LNG demand

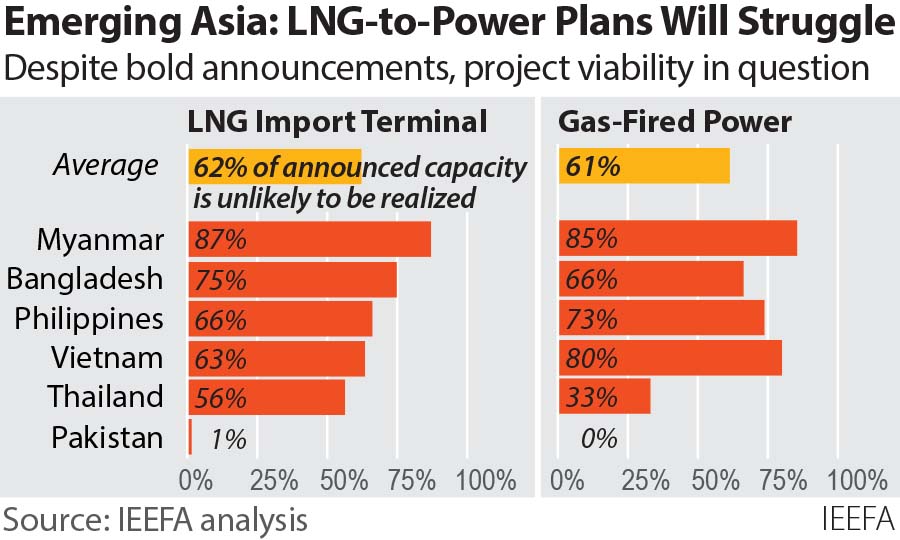

The analysis finds that, across the country studies, 62% of proposed LNG import terminal capacity and 66% of gas-fired power capacity is unlikely to be built due to fundamental project, country-level, and financial market constraints.

“Over the past two years, spot market prices for LNG in Asia have hit all-time lows, followed by record highs. These wild price swings have demonstrated—perhaps more clearly than ever before—the immense challenges that highly volatile, US dollar-denominated LNG markets present for nearly every emerging Asian energy market,” says report co-author, Sam Reynolds.

“Still, the LNG industry’s excitement around perceived opportunities in the region has spawned an unrealistic pipeline of proposed LNG projects at various stages of development.

“This is overpromising and under-delivering on a regional scale. Fundamental project, country, and financial market constraints in emerging Asia are likely to significantly reduce the pipeline of feasible LNG-related projects and prevent rapid, sustained growth in regional LNG demand.”

IEEFA’s report examines the proposed pipeline of LNG-to-power projects on a project-by-project basis in seven countries: Vietnam, Thailand, the Philippines, Cambodia, Myanmar, Pakistan, and Bangladesh.

After comparing the valuation of feasible projects to credit risk appetite in the commercial lending sector, IEEFA found a further 20% of the remaining portfolio may need to shift its financial close date due to lending market capacity constraints, and 5% of the power plant pipeline is unlikely to be realized due to unavailability of funds.

“The significantly reduced pipeline of LNG-related infrastructure proposals is likely to shrink even further, as projects will still have to compete for project finance capital, which is severely constrained by prudential limits on banks’ exposure to individual countries, sectors, and borrowers,” says report co-author, Grant Hauber.

62% of proposed LNG import terminal capacity and 66% of gas-fired power capacity is unlikely to be built

In total, within the country studies, only 38% of the announced LNG terminal capacity and 34% of the announced gas-fired power capacity have the potential to be built. These remaining LNG projects will still have to navigate each country’s unique market, financial, and regulatory risks.

“Despite limitations in the commercial project finance lending market, multilateral development banks (MDBs) and bilateral development institutions (BDIs) may not come to the rescue,” says Hauber.

“MDBs are unlikely to provide more than 25% of per-project lending requirements due to their catalytic mandates, while BDIs typically only back their home country investors and industries when entering foreign markets.

“Both MDBs and BDIs are under significant pressure to adhere to global low-carbon or net-zero standards. As time goes on, there will be fewer cross-border lenders willing to support fossil fuel projects.”

Along with assessing the viability of proposed LNG-to-power projects in the region, the report examines the broader macroeconomic and financial risks of increasing dependence on imported LNG. Some of these risks include:

Commodity price volatility. The inherent volatility of global gas markets significantly impacts delivered gas and power prices.

Foreign exchange volatility. US dollar-denominated LNG charges expose consumer prices to macroeconomic impacts, mostly felt through inflation.

The inherent volatility of global gas markets significantly impacts delivered gas and power prices

Higher power tariffs for end-users. In markets that pass through fuel price fluctuations to end-users, expensive LNG imports can raise final gas and power tariffs.

Higher government subsidy burdens. In subsidized markets, government entities must pay for fuel price fluctuations via additional national budget allocations, payments ultimately borne by taxpayers.

Limited project financing available for fossil gas assets. The supply of money for a given market is not endless. Absent sovereign guarantees or risk insurance, commercial banks may hit prudential lending limits in emerging Asia countries.

Stranded asset risk for LNG-to-power investments. Volatile global fuel prices and penetration of low-cost renewables can limit the utilization of LNG-to-power assets. If gas producing countries in emerging Asia can see their way to revise currently unattractive production pricing formulas, renewed growth in domestic gas production can reduce or even eliminate the need for LNG import assets.

Imported fossil fuel lock-in limits renewables penetration. Fixed LNG offtake volumes and minimum power plant capacity payments can cause long-term dependence on imported fossil fuels, limiting each country’s ability to benefit from declining renewables energy costs.

Disruptions in global LNG trade can cause gas shortages

Fuel supply insecurity. Disruptions in global LNG trade can cause gas shortages. High prices can force buyer countries out of spot markets, causing fuel shortages. Even countries with long-term supply contracts face fuel shortages if exporters opt to cancel deliveries and redirect cargoes into higher-priced spot markets.

Growth of sustainable investing makes long-term LNG financing unreliable. Cross-border financiers, including multilateral development banks and bilateral development institutions, are under increasing pressure to support global decarbonization and sustainable development. Over time, fewer institutions will offer financing to fossil fuel related projects.

“Energy sector planners in emerging Asia face an unenviable multitude of competing goals, including national energy security, affordability, self-sufficiency, and environmental sustainability,” says Reynolds.

“The reality is that LNG does not contribute to any of these goals, despite the LNG industry’s insistence that imported gas is a be-all-end-all solution. Global LNG markets are highly volatile, and LNG-to-power projects will be subject to a suite of risks, including major financial market constraints.

“Countries looking to grow their energy sources must determine the most sustainable, reliable funding pathway for infrastructure growth.”

Read the report: Examining Cracks in Emerging Asia’s LNG-to-Power Value Chain

Read the media brief.

View the presentation.

Media contact: Paige Nguyen ([email protected]) Ph: +61 433 048 877

Author contacts: Sam Reynolds, Energy Finance Analyst ([email protected])

Grant Hauber, Energy Finance Analyst ([email protected])

*Authors are available for media interviews and background briefings*

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)