Guyana Gas to Energy Project is unnecessary and financially unsustainable

Download Full Report

View Press Release

Key Findings

The Guyana Gas to Energy Project will result in a substantially overbuilt electrical system.

A new natural gas plant would be capable of generating far more electricity than Guyana Power & Light (GPL) customers are likely to need over the coming decade.

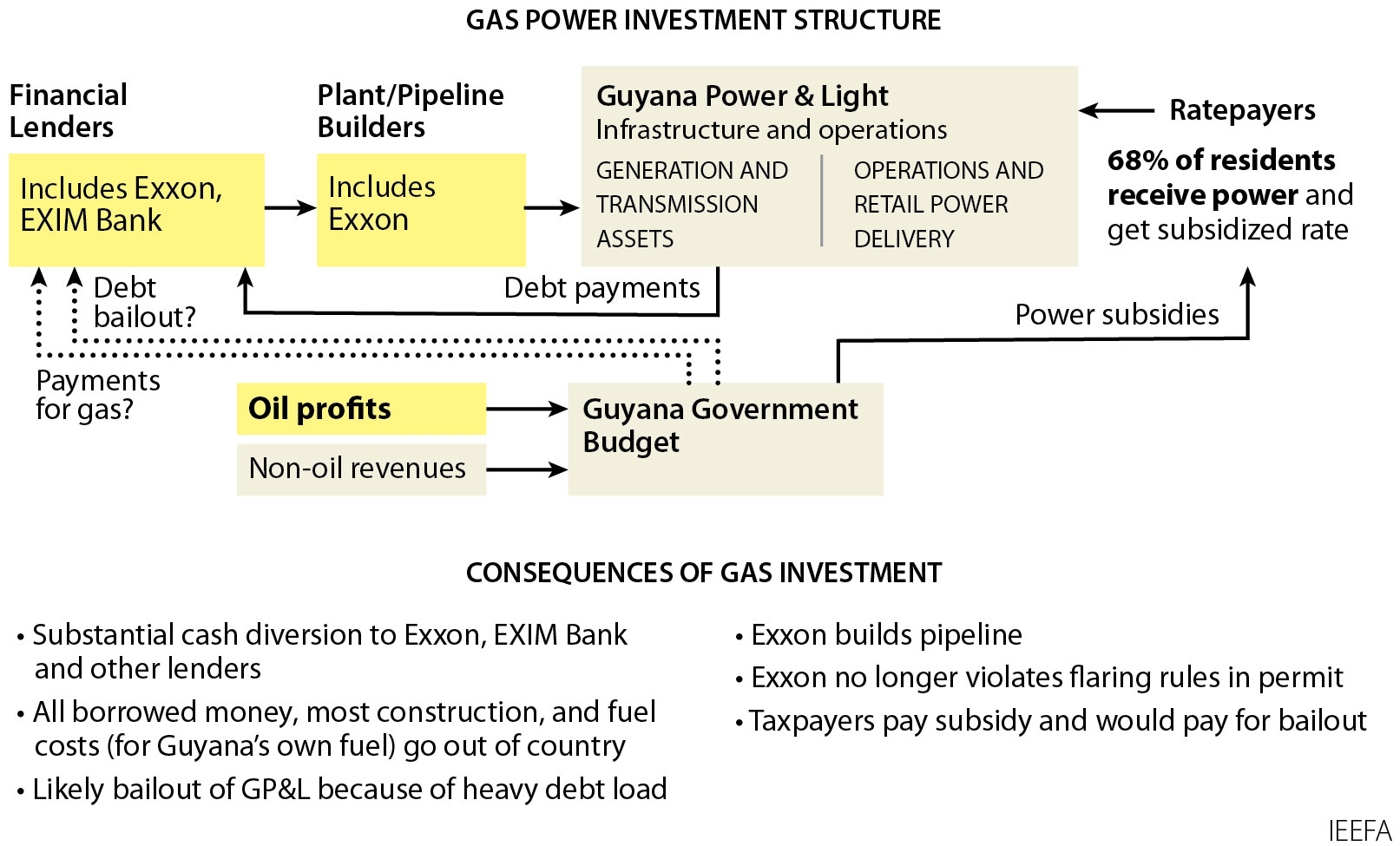

ExxonMobil would gain the most from the Gas to Energy Project, through profits from pipeline construction, lending money to Guyana, and selling natural gas.

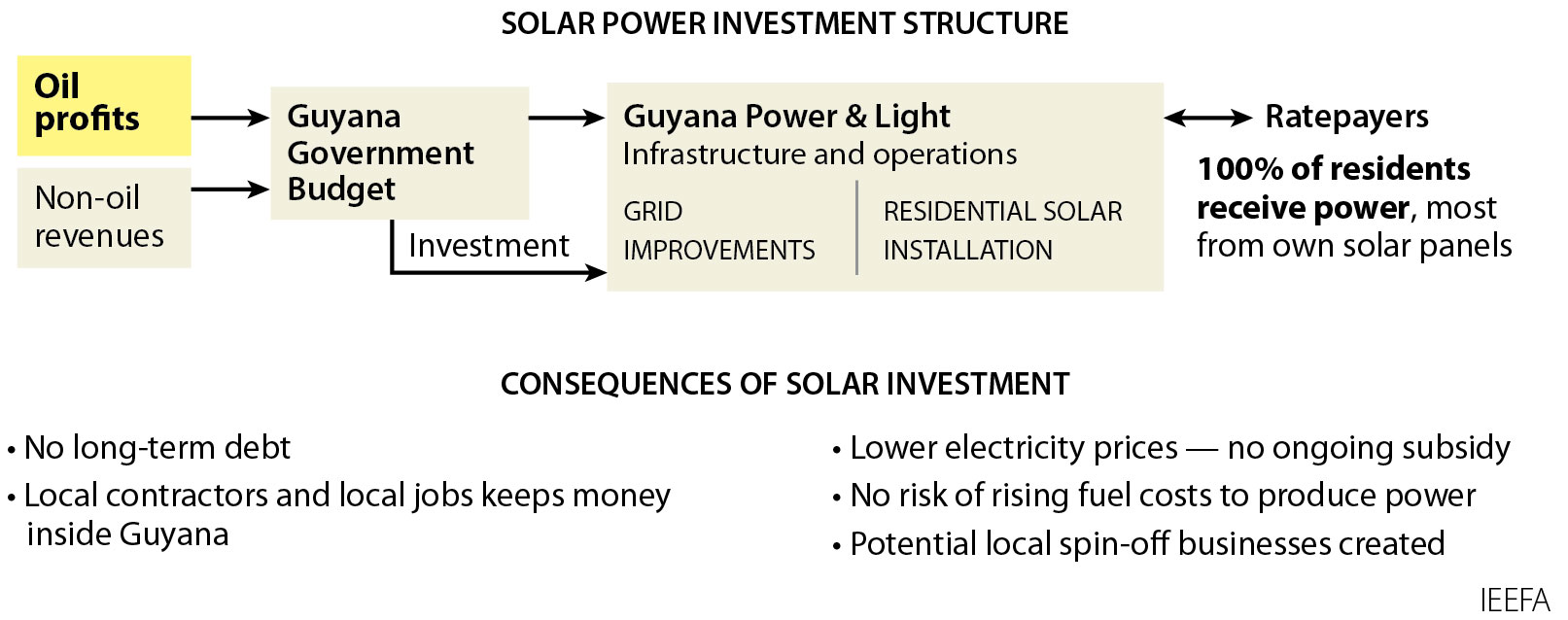

Solar would cost less, reduce costs for ratepayers, generate more local jobs and put Guyana on a path toward meeting its climate goals of 100% renewable energy.

Executive Summary

Guyana’s proposed Gas to Energy project will use natural gas from the country’s offshore wells to produce electricity for 68% of Guyana’s population—those that are connected to the Demerara-Berbice Isolated System, owned and operated by Guyana Power & Light (GPL). The government has also promised to reduce GPL’s electricity rates by 50% as a consequence of the project.

This report finds:

- The new natural gas plant, combined with the current system and GPL’s additional plans for new power generation, will result in a substantially overbuilt electrical system, capable of generating far more electricity than GPL’s customers are likely to need over the coming decade.

- Although the details are not clear, the new infrastructure will cost more than $2 billion and be financed by ExxonMobil and others, including possibly the U.S. Export-Import (Ex-Im) Bank.

- Guyana’s leaders have promised to cut the electricity rate by half by 2025, which will require subsidies from the Guyanese government.

- GPL’s future debt load is increasingly raising questions regarding its viability.

- To relieve this growing debt burden, the government of Guyana is likely to have to bail out the utility.

- Guyana has promised to move toward 100% renewable energy. The new Gas to Energy plan will prevent a substantial increase in solar energy.

- For less than the cost of the Gas to Energy project, solar energy can reach every Guyanese household. It will cost less to taxpayers, lower the cost of electricity to ratepayers, hire more Guyanese workers from local businesses and put Guyana on a path toward meeting its climate goals.

Figure ES-1: Gas Power Investment Structure

Figure ES-2: Solar Power Investment Structure

The overbuilding that results from the Gas to Energy project will undermine Guyana’s promise to meet its climate goals. The country will go into debt for no good reason, and the money borrowed will go to build gas infrastructure that will be financed largely by foreign financiers and built by largely foreign workers. To finance the Gas to Energy project, Guyanese officials will effectively take a substantial portion of Guyana’s future profit oil from the Payara and Liza offshore wells being drilled by an ExxonMobil-led consortium. Over the longer term, Guyanese taxpayers and ratepayers are likely to have to pay for the fluctuating prices of natural gas, notwithstanding public promises from the government that future gas supplies will be free.

The alternative—substantial investment in solar energy—will help Guyana meet its climate goals. An investment in rooftop solar panels for residents and businesses will employ local people and help small contracting businesses grow. Money borrowed or money from oil profits, will be spent locally. The benefits will also be in lower electricity prices and the electricity prices will not be tied to inflation caused by oil and gas price increases.

The Gas to Energy project is an example of money badly spent. A renewable energy plan that focuses heavily on rooftop solar is an example of money well spent.