Cleaning up the last pile of India’s power sector non-performing assets

Download Full Report

View Press Release

Key Findings

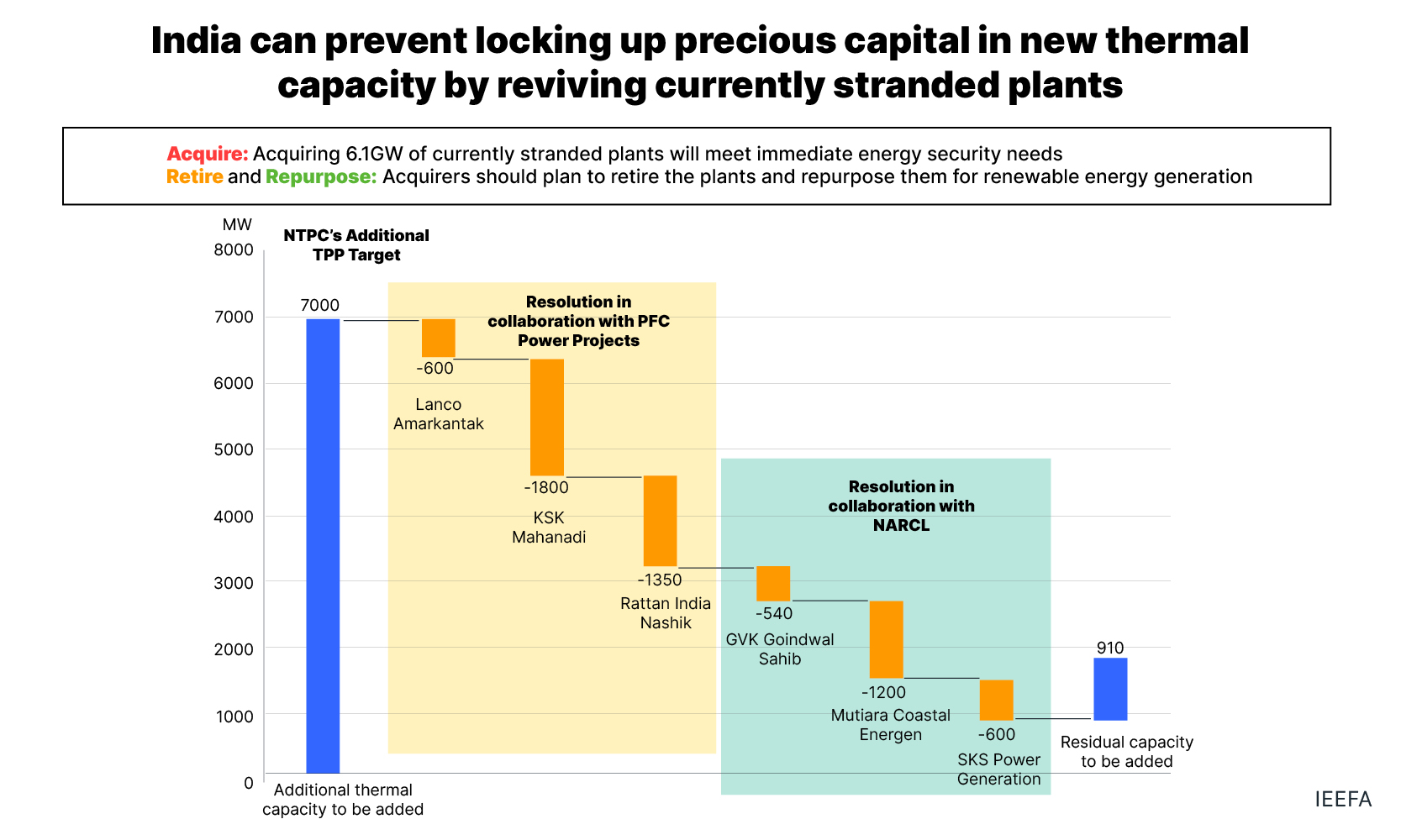

In light of energy security concerns, strategic acquisitions and subsequent revival of the stranded power sector capacity present in India can be a viable alternative to adding new thermal assets.

Opportunity for NTPC to acquire 6.1 gigawatt (GW) of stressed thermal assets through partnership with Power Finance Corporation-REC and National Asset Reconstruction Company Limited.

An acquire-retire-repurpose strategy ensures India’s short-term power needs are met while keeping intact the acquirer’s environmental, social and governance (ESG) profile.

The Indian banking industry is in a better state than it has been in years and a pivot towards thermal power, despite the benefits of renewables, could increase credit and climate risks for the banks.

Executive Summary

Non-performing assets (NPA) have plagued the Indian banking sector over the last decade. The problem is now in the last leg of resolution, with net NPAs of Indian scheduled commercial banks down to around 1.3% in September 2022 from a high of 6.1% in March 2018.

Huge write-offs of bad loans (close to US$124 billion over the past five years[1]), robust credit demand and low slippages (new NPAs) have contributed to the banking sector being in its best health in years.

The Indian power sector, which has long contributed to the country’s NPA problem, has also seen the resolution of several stressed assets. The 37th Parliamentary Standing Committee on Energy reported that the Ministry of Power deemed 34 coal-based thermal power plants “stressed” in March 2018, with a combined debt of US$23 billion. Our analysis shows that as of April 2023, 26 of these stressed assets had been resolved fully or partially, with strategic buyers acquiring 11 of these plants.

The power sector has been growing dynamically, with India steadily moving towards achieving its 2030 renewable energy targets. However, a relook at thermal power in light of short-term energy security concerns has the potential to derail India’s energy transition journey. A higher reliance on coal power also diverts bank financing towards these high carbon-emitting assets, which leads to capital lock-in that could otherwise go for renewable energy assets.

IEEFA believes any new investment in thermal power can potentially lead to stranded asset risk, given the clear economic case of renewable energy over thermal power. Financing these thermal plants will expose domestic banks to another set of potential power sector NPAs and a higher climate risk on their portfolios.

Resolution of the power sector NPA capacity can be a viable alternative against installing additional thermal capacity. Strategic acquisitions have successfully resolved some power sector NPAs as they result in higher bids and lower haircuts for lenders, given the higher value of underlying assets for strategic buyers.

The newly formed Power Finance Corporation (PFC)-REC joint venture, PFC Projects Limited (PPL), and India’s bad bank, the National Asset Reconstruction Company Limited (NARCL), can make these acquisitions through partnerships. PFC and REC formed PPL to acquire stressed power assets and bring in strategic investors to operate, maintain and complete them wherever required. On the other hand, the Indian government set up NARCL to resolve the banking sector’s overall stressed assets in a time-bound manner and possibly acquire and aggregate the stressed debt from various lenders to the power assets for a resolution.

This report identifies a set of six stressed power sector assets, with a combined capacity of 6.1 gigawatts (GW), currently identified as NPA accounts and fit for acquisition by NTPC, India’s largest power producer, in collaboration with PPL and NARCL. NTPC has an opportunity to acquire these stressed assets and provide for the short-term power needs of the nation with a strategic player like PPL ensuring working capital investment to restart the operations.

A post-acquisition strategy to retire and repurpose acquired stressed thermal assets will align well with ESG investors and prevent future stranded non-renewable energy assets on NTPC’s books.

But the acquisition of such assets should be just the first step. IEEFA believes adding thermal assets to NTPC’s new or acquired portfolio will lead to stranded asset risk and harm the company’s environmental, social and governance (ESG) profile. NTPC has a target of installing 60GW of renewable energy capacity by 2030, which would require securing capital from global ESG investors. Hence, a post-acquisition strategy to retire and repurpose acquired stressed thermal assets will align well with ESG investors and prevent future stranded non-renewable energy assets on NTPC’s books. The company can also explore the burgeoning market for carbon credits trading to further improve returns from repurposed projects.

[1] Indian Express. In last 5 years, Rs 10 lakh crore in write-offs help banks halve NPAs. November 2022.