Latest Prairie State Energy Campus Research

See more >IEEFA Update: Navajo Generating Station in Arizona, Next Big Hit to Peabody’s Portfolio

April 27, 2018

Tom Sanzillo

Analysis

Our Op-Ed in the New York Times: ‘After Bankruptcies, Coal’s Dirty Legacy Lives On’

April 14, 2016

Tom Sanzillo, David Schlissel

Analysis

That $57 Million Payout to Peabody? It Should Go to Ratepayers Stuck Holding the Bag Now on Prairie State Energy Campus

February 25, 2016

Tom Sanzillo

Analysis

Uncomfortable Questions in the Wake of Peabody’s Sale of Its Remaining Stake in a Costly Midwestern Coal-Fired Plant

January 22, 2016

Tom Sanzillo

Analysis

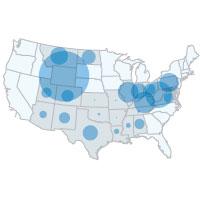

Data Bite: U.S. Coal Production Is Down Almost Everywhere, and Off by Double Digits in Key States

January 13, 2016

Seth Feaster

Analysis

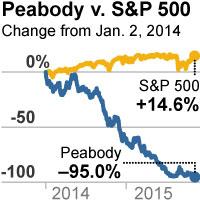

Peabody Comes Clean. But Not Very.

November 09, 2015

Tom Sanzillo

Analysis

Slovenians, in Their Rebuke of a Misbegotten Power Plant, Put U.S. Elected Officials to Shame

September 09, 2015

David Schlissel

Analysis

Prairie State, Sold as a Clean Coal Plant, Wants a Pass on New EPA Rules

July 09, 2015

Sandy Buchanan

Analysis

Asterisks: Taints in Peabody’s Financial Reporting

April 28, 2015

Tom Sanzillo

Analysis

The Truth About Prairie State Energy Campus (Part 4): There Are Ways Out of This Bad Deal

April 09, 2015

Tom Sanzillo, David Schlissel

Analysis

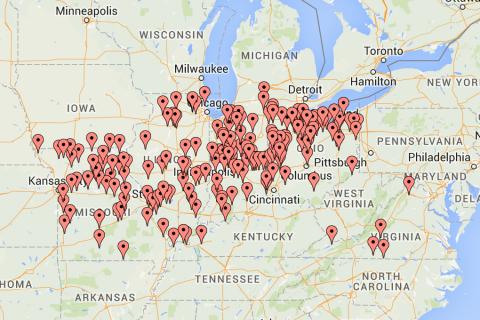

The Truth About Prairie State Energy Campus (Part 3): A Crippling Burden to Its Many Towns and Cities

April 08, 2015

Sandy Buchanan

Analysis

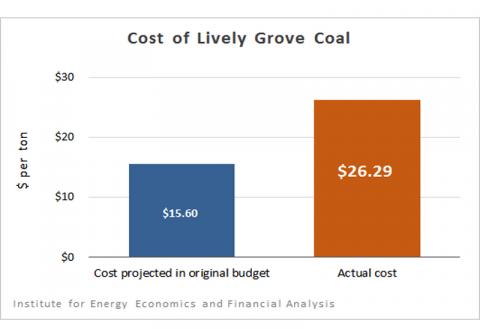

The Truth About Prairie State Energy Campus (Part 2): Its Coal Isn’t Cheap

April 07, 2015

Tom Sanzillo

Analysis

Latest Prairie State Energy Campus Reports

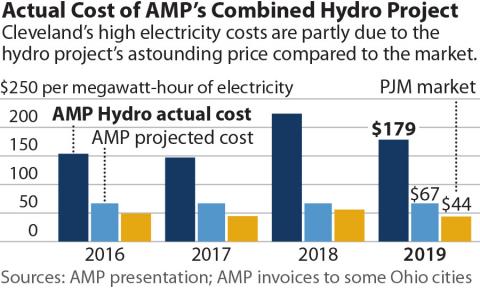

See more >Costs of buying power from AMP's Prairie State and combined hydro project continue to mount for municipal ratepayers

September 01, 2021

David Schlissel

Report

Long-term power plant contracts saddle AMP communities with high electricity prices

September 21, 2020

David Schlissel

Report

Buying power from AMP's Prairie State and combined hydro project has been a financial disaster for Cleveland Public Power and its ratepayers

September 01, 2020

David Schlissel

Report

Cost of coal from 'mine-mouth' Prairie State plant isn’t the bargain that was promised

April 01, 2015

Tom Sanzillo

Report

2014 - another year of unmet promises for the Prairie State Energy Campus

February 01, 2015

David Schlissel

Report

How the High Cost of Power from Prairie State is Affecting Bowling Green Municipal Utilities' Customers

October 01, 2014

David Schlissel

Report

Analysis of Paducah Power System’s recent and future costs of power from the Prairie State Energy Campus

October 01, 2014

David Schlissel

Report

No evidence of a turnaround at Prairie state

September 01, 2014

David Schlissel

Report

Latest Prairie State Energy Campus Press Releases

See more >IEEFA U.S.: Municipal ratepayers face mounting costs from expensive American Municipal Power projects

September 09, 2021

Press Release

IEEFA U.S.: Long-term contracts with American Municipal Power (AMP) saddle local communities with high prices

September 21, 2020

Press Release

IEEFA U.S.: Long-term contracts with AMP are ‘financial disaster’ for Cleveland Public Power customers

September 11, 2020

Press Release

IEEFA Update: Lazard Risks Its Reputation by Working With Peabody

April 27, 2018

Press Release

The True Cost of Prairie State Energy Campus Coal

April 07, 2015

Press Release

Call to Action in Paducah; IEEFA Makes Page 1 of The Guardian, Coal Phaseout in Denmark

November 03, 2014

Press Release

‘A Constellation of Risks’ on Tar Sands; Press Notes on IEEFA’s Galilee Coal Report; More on Prairie State-Paducah

October 28, 2014

Press Release

Press release: Losses Show Peabody Energy ‘Is Not a Healthy Company’

October 22, 2014

Press Release

Updates: Australia, Kentucky, Ohio, FirstEnergy, Peabody …

October 21, 2014

Press Release

IEEFA Report Sees Bowling Green, Ohio, Customers Paying as Much as $94 Million More Than Necessary in High-Cost Electricity From Prairie State Energy

October 13, 2014

Press Release

Prairie State Backlash Grows: A Call for Bankruptcy; Trouble in Fulton and Hannibal, Mo.; Legal Review Sought in Batavia, Ill.

September 29, 2014

Press Release

Media advisory: Prairie State coal plant continues to fail; Public backlash in Kentucky and Illinois

September 26, 2014

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

14900 Detroit Avenue Suite 206

14900 Detroit Avenue Suite 206

Lakewood, OH 44107

T: 216-712-6612

© 2024 Institute for Energy Economics & Financial Analysis.