The Truth About Prairie State Energy Campus (Part 2): Its Coal Isn’t Cheap

‘Annual Per Ton Operating Costs of the Mine Remain Higher Than Those Originally Assumed …’

Among the many claims made to dozens of communities across the Midwest and South to induce them to sign onto the Prairie State Energy Campus deal was that it would be supplied by cheap coal from a mine across the street.

Here’s the truth: The coal from Lively Grove Mine isn’t as cheap as Prairie State’s creators and supporters led member cities and towns to believe (we describe our findings in a research memo we posted today).

American Municipal Power in Ohio, Prairie State’s biggest participant in the deal, acknowledges in very recent refinancing documents that “annual per ton operating costs of the mine remain higher than those originally assumed.”

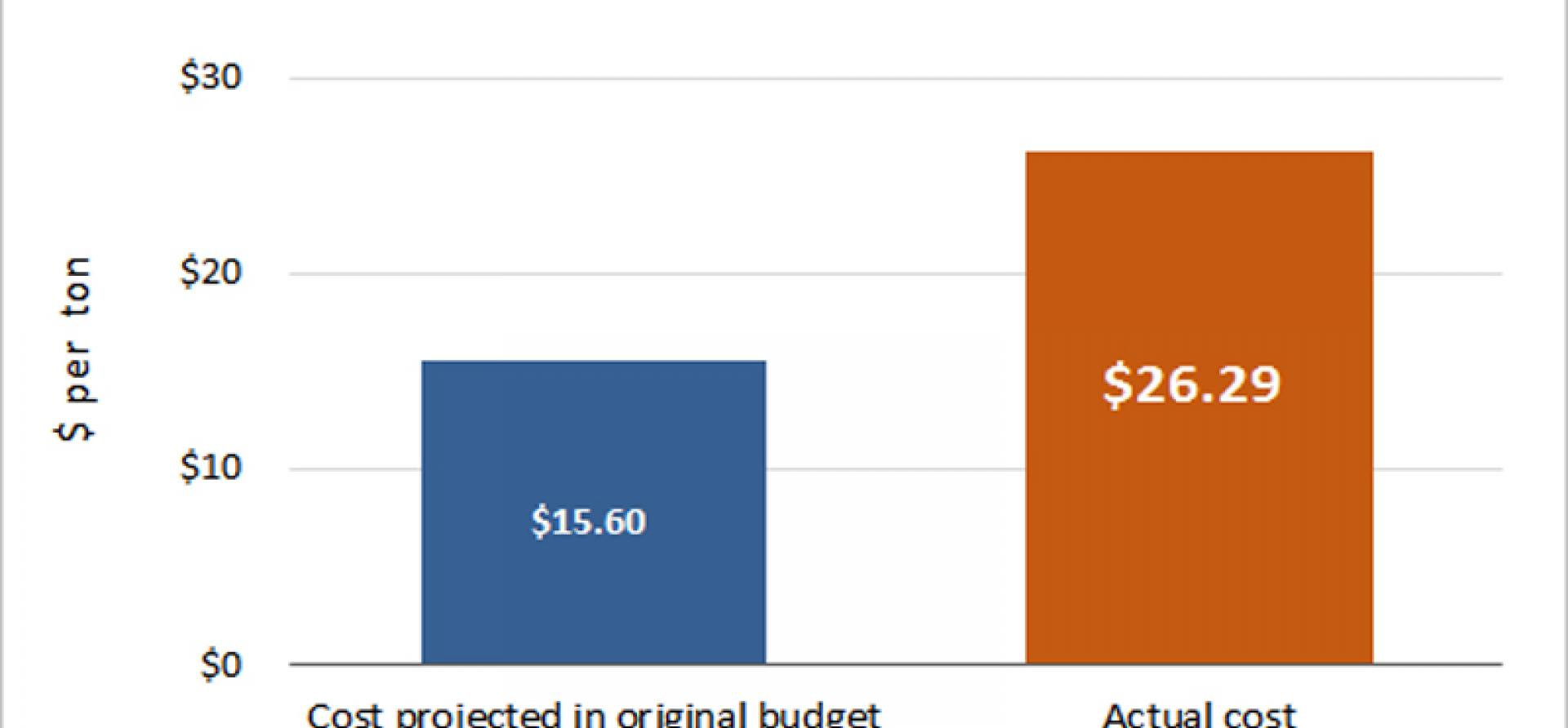

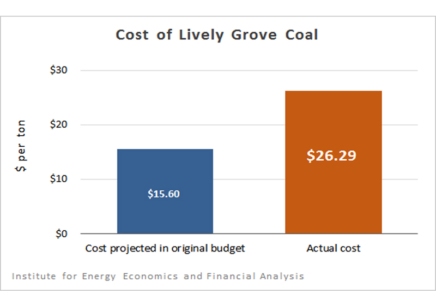

That part is factual enough. The original 2013 budgeted cost of production for Lively Grove coal was $14.44 per ton and the actual cost of production in 2013—the latest figures available—was $18.98 per ton.

This was no small miscalculation, representing a 31 percent understatement, but it does not tell the whole story.

THE LIVELY GROVE MINE ADVANTAGE IS A MYTH

In presentations by Prairie State officials to member-utility representatives in Cleveland and Batavia, Ill., coal from Lively Grove Mine was touted in cost-favorable terms compared to other coals on the market. That’s because those official cost-of-production figures didn’t include the debt service required to buy and build the mine, an omission that exaggerates any purported cost advantage.

In presentations by Prairie State officials to member-utility representatives in Cleveland and Batavia, Ill., coal from Lively Grove Mine was touted in cost-favorable terms compared to other coals on the market. That’s because those official cost-of-production figures didn’t include the debt service required to buy and build the mine, an omission that exaggerates any purported cost advantage.

Perhaps Prairie State executives rationalize this omission by the fact that their business model puts state authorities and local governments on the hook for the mine’s debt service while Prairie State itself accounts separately for production costs.

Still, there is no central public ledger that logs both costs. This is an eccentricity, to put it mildly, by industry standards. When coal producers sell coal to a utility or power generator, they typically include in their market price both the cost of production and debt. What Prairie State is doing, by contrast, is an industry anomaly.

This failure to adjust for debt-service costs—by both Prairies State representatives and the consultants representing the respective states and communities—has robbed local officials of any chance to clearly compare Prairie State power costs with those of other generation facilities, particularly other coal-generating facilities

HOW MUCH DOES PRAIRIE STATE’S COAL REALLY COST?

When you include debt service in the acknowledged and over-budget $18.98 price per ton of the coal that Prairie State Energy Campus burns you get a much bigger number than plant proponents will acknowledge: $26.29.

And when you compare the true price of coal from Lively Grove Mine with market prices from competing mines, there’s almost no difference, especially between nearby high-quality Illinois Basin coal and the lower-quality stuff Lively Grove Mine produces. It pans out to about a 1 percent divergence, by our calculations, which is to say Lively Grove Coal is not the big money-saver portrayed in Prairie State’s presentations to member utilities.

Similar lower-quality Powder River Basin coal is only slightly more expensive, which means that Lively Grove isn’t producing coal at any substantial savings even over what it would cost if it were shipped in from Wyoming.

In fact, coal from other Illinois Basin mines, even Powder River Basin mines, actually costs less when you factor in the plant’s operational losses in its first two years and the difficulties the plant has had burning the coal (the low quality of the Lively Grove coal has been cited by plant managers themselves as one of the reasons for Prairie State’s poor performance).

WHY THE TRUE COST OF PRAIRIE STATE’S COAL MATTERS

Electricity from Prairie State Energy Campus costs its member towns and cities roughly twice that of electricity that can be purchased on the open market.

The project has been a mismanaged boondoggle from the beginning. Its construction costs came in substantially over budget, its mine-mouth model does not live up to cost-advantage promises, and it has serious operational problems.

Add to all this two more things: Its tangled finances have never been independently audited and no financial consultant and no local utility administrator has yet sorted out all the many clarifications that member utilities need to help them understand why electricity costs from Prairie State Energy Campus are so out of control.

This much is known:

- Peabody Energy was paid for the mine and for its development and is still being paid to manage it;

- Bechtel Corp. was paid for the construction costs, including the overruns;

- Many investment banks, lawyers and accountants were paid to underwrite the bonds that made it all possible;

- Hundreds of thousands of households and businesses across the heartland are now paying much more for electricity than they should.

Tom Sanzillo is IEEFA’s director of finance.

Tomorrow (Part 3): How Prairie State Energy Campus Is Hurting Its Member Communities

Related posts:

The Truth About Prairie State Energy Campus (Part 1): Failing, Year by Year

(Part 3): A Crippling Burden to Its Many Towns and Cities

(Part 4): There Are Ways Out of This Bad Deal