Latest Energy Investment Trends Research

See more >

Sustainable investing outlook: Strong returns amid net flow pressures

July 08, 2025

Shu Xuan Tan, Ramnath N. Iyer

Briefing Note

Ignoring methane emissions leaves Australia’s Big Four banks exposed

July 03, 2025

Anne-Louise Knight

Briefing Note

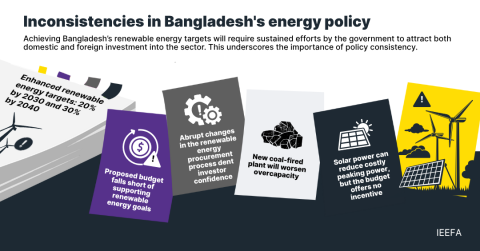

Bangladesh’s energy policy changes raise more questions than they answer

June 18, 2025

Shafiqul Alam

Insights

Abu Dhabi’s takeover bid for Santos raises Australian national interest concerns

June 18, 2025

Kevin Morrison

Insights

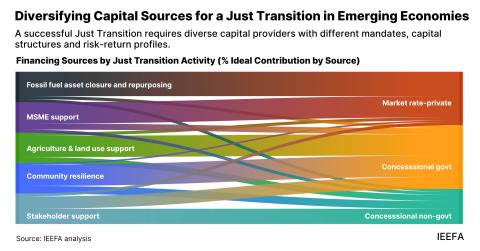

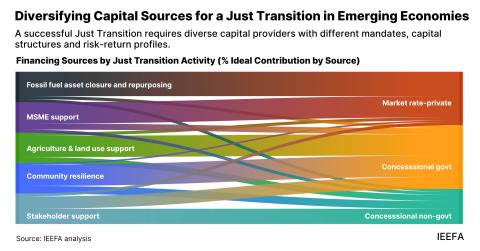

Financing Just Transitions in emerging economies

June 17, 2025

Shantanu Srivastava, Soni Tiwari

Report

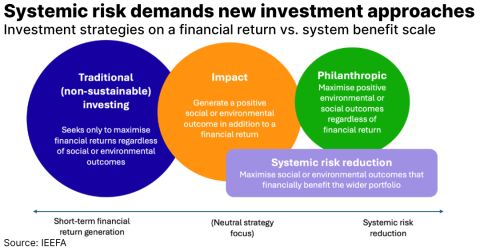

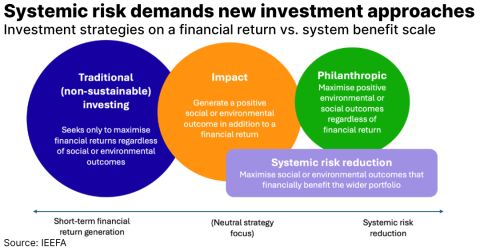

Systemic risk reduction funds: Why impact investing needs to get selfish

June 16, 2025

Alasdair Docherty

Report

New fossil fuel developments: A net economic benefit or cost for Australia?

June 03, 2025

Amandine Denis-Ryan

Fact Sheet

Importance of project preparation in scaling the energy transition

May 07, 2025

Grant Hauber, Ramnath N. Iyer, ESCAP...

Insights

Accelerating renewables investment in Indonesia: Shared use of the transmission network

April 29, 2025

Mutya Yustika, Grant Hauber, RE 100...

Report

Critical minerals: India must step up its strategies

April 24, 2025

Saloni Sachdeva Michael

Insights

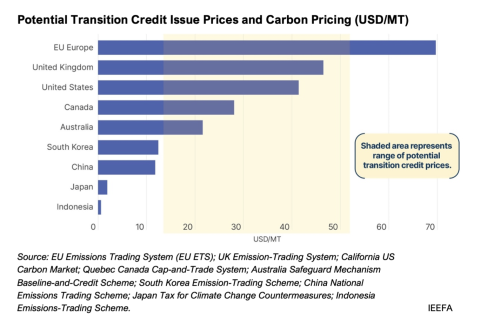

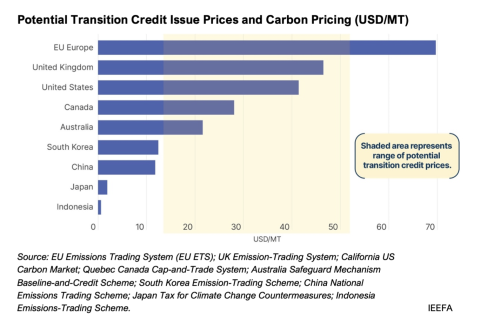

Transition credits: A potential financial enabler for the coal-to-clean switch

April 15, 2025

Ramnath N. Iyer

Report

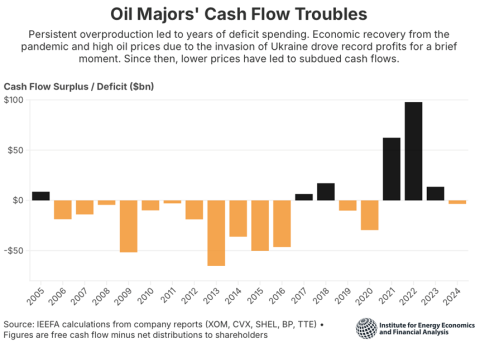

Oil producers face profit squeeze amid shifting policy landscape

April 03, 2025

Connor Chung

Insights

Latest Energy Investment Trends Reports

See more >

Financing Just Transitions in emerging economies

June 17, 2025

Shantanu Srivastava, Soni Tiwari

Report

Systemic risk reduction funds: Why impact investing needs to get selfish

June 16, 2025

Alasdair Docherty

Report

Accelerating renewables investment in Indonesia: Shared use of the transmission network

April 29, 2025

Mutya Yustika, Grant Hauber, RE 100...

Report

Transition credits: A potential financial enabler for the coal-to-clean switch

April 15, 2025

Ramnath N. Iyer

Report

LNG build-out in Mexico based on U.S. gas: Rising risks for consumers in the U.S. and Mexico

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Expansión del GNL en México con gas importado de EE. UU.: Nuevos riesgos para los consumidores en EE. UU. y México

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

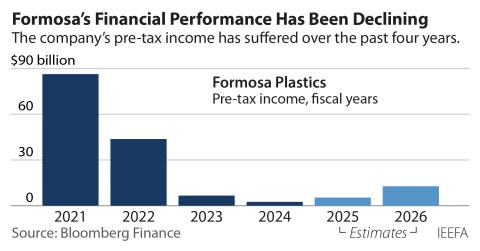

Formosa's proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Abhishek Sinha

Report

European oil: Navigating credit risk towards net zero

March 13, 2025

Kevin Leung

Report

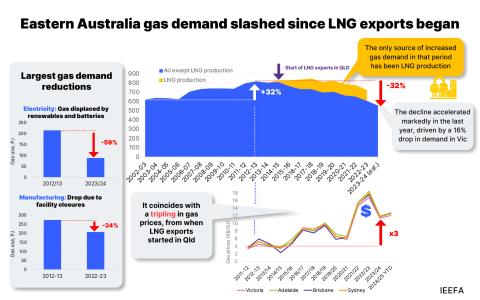

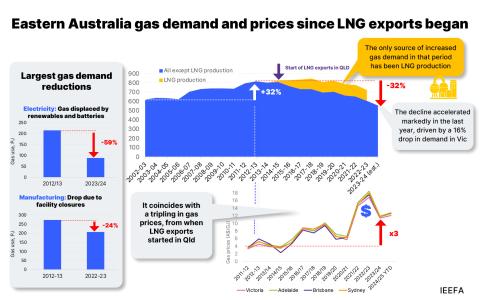

LNG exports prompt fall in eastern Australia's gas demand

December 10, 2024

Kevin Morrison, Amandine Denis-Ryan

Report

Cambodia at a crossroads: An economic assessment of LNG-to-power plans

November 26, 2024

Sam Reynolds, Christopher Doleman

Report

The declining significance of the petrochemical industry in Louisiana

October 28, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Report

Indonesia’s nickel companies: The need for renewable energy amid increasing production

October 24, 2024

Ghee Peh

Report

Latest Energy Investment Trends Press Releases

See more >

Big Four banks exposed over methane emissions

July 03, 2025

Press Release

How Targeted Co-Financing can Enable a Just Transition in Emerging Economies

June 17, 2025

Press Release

A joint transmission network for renewable energy could deliver a USD 150 billion boost to Indonesia

April 29, 2025

Press Release

Transition credits could unlock finance for some early coal plant retirements

April 15, 2025

Press Release

LNG buildout in Mexico could mean rising risks for consumers in the U.S. and Mexico

April 02, 2025

Press Release

La expansión del GNL en México podría implicar mayores riesgos para los consumidores de EE. UU. y México

April 02, 2025

Press Release

Formosa’s proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Press Release

MENA poised to lead global green iron and steel transition

March 06, 2025

Press Release

IEEFA highlights Indonesia’s renewable energy and supply chain opportunities at the Mandiri Investment Forum

February 18, 2025

Press Release

Another bad year – and decade – for fossil fuel stocks

January 27, 2025

Press Release

The export effect

December 10, 2024

Press Release

Understanding the opportunities and challenges in Cambodia’s LNG ambitions

November 26, 2024

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.