Bangladesh’s energy policy changes raise more questions than they answer

Key Findings

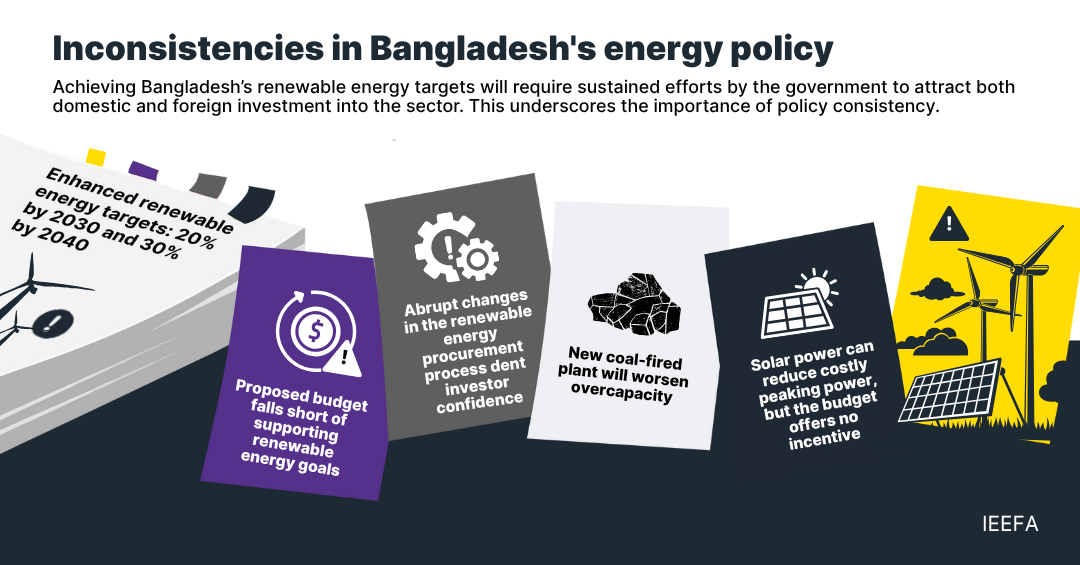

The Bangladesh government’s approval of a new Renewable Energy Policy that sets higher targets of 20% and 30% electricity generation from renewables by 2030 and 2040, respectively, is a welcome step towards advancing the energy transition. However, despite enhanced commitments, a lack of support and policy inconsistencies hinder potential progress in the country’s renewable energy sector.

While solar power can reduce the country’s reliance on costly oil-fired power, the proposed budget for FY2025-26 does not provide any incentives for its adoption. It does not offer incentives for other renewable energy technologies either.

The exclusion of the “implementation agreement clause” – similar to a guarantee – from the tender, means that new renewable energy projects lack bankability. Project developers might find it difficult to raise debt capital without this clause.

While the previous government had decided to scrap 10 coal-fired plants, the current government is considering reviving one of them. It plans to build a coal-fired power plant of 1,200MW capacity in Matarbari. Although it has cited generating cheaper electricity compared with oil-fired power as one of the reasons for this decision, this rationale seems short-sighted.

The Bangladesh government’s approval of a new Renewable Energy Policy that sets higher targets of 20% and 30% electricity generation from renewables by 2030 and 2040, respectively, is a welcome step towards advancing the energy transition. However, despite enhanced commitments, a lack of support and policy inconsistencies hinder potential progress in the country’s renewable energy sector.

While the national budget for fiscal year (FY) 2025-26 unveiled on 2 June 2025 shared an ambitious goal of establishing a society grounded on three zeroes, i.e., zero poverty, zero unemployment and zero net carbon emissions, it does not offer incentives to the private sector to scale up renewable energy.

Further, the government has made some sweeping changes in the energy and power sectors. It has repealed the Quick Enhancement of Electricity and Energy Supply Act (QEEESA) 2010, which allowed the previous government to accept unsolicited project proposals without competitive bidding. The government has also suspended renewable energy projects that received letters of Intent (LOIs) under QEEESA before August 2024. It has floated four packages of tenders inviting the private sector to implement renewable energy projects with a combined capacity of more than 5,000 megawatts (MW) but has removed the payment guarantee clause. Such frequent policy changes pose challenges for investors.

The government’s recent announcement to build a coal-fired plant to generate cheaper power than oil-fired peaking plants also highlights policy consistency. A baseload power plant is unlikely to contain the share of oil-fired plants in total generation. Instead, it will intensify the sector’s overcapacity amid sluggish power demand growth.

Proposed budget fails to incentivise renewable energy

While solar power can reduce the country’s reliance on costly oil-fired power, the proposed budget for FY2025-26 does not provide any incentives for its adoption. It does not offer incentives for other renewable energy technologies either. Moreover, the proposed budget excludes the renewable energy funding of Bangladeshi Taka 1 billion (US$8.2 million), allocated in the FY2024-25 budget. While the new Renewable Energy Policy outlines the government’s enhanced ambitions, the proposed budget does not reflect the same priorities.

Abrupt policy changes dent investor confidence

The sudden transition to competitive bidding and suspension of more than 30 renewable energy projects cost investors and developers dearly as many of them had spent considerable time and resources to acquire land.

Furthermore, the exclusion of the “implementation agreement clause” – similar to a guarantee – from the tender document, means that new renewable energy projects lack bankability. Project developers might find it difficult to raise debt capital without this clause. The challenge is already evident as Bangladesh failed to attract prospective bidders for the first tender package of 12 projects totalling 453MW, prompting the government to extend the deadline for document submission six times.

While 20 local companies finally submitted documents against 12 projects included in the first of the four tender packages, no foreign company expressed interest.

The lack of interest from foreign companies spells out challenges for Bangladesh in achieving a combined renewable energy capacity of 6,145MW by 2030. Domestic capital is not enough to fund increasing renewable energy capacity of around 750MW per annum between July 2025 and December 2030 (the country’s combined renewable energy capacity stands at 1,562MW and utility-scale projects of 400MW are under construction). Bangladesh requires affordable and long-term funding, with foreign investment playing a pivotal role, alongside support from multilateral and bilateral agencies.

New coal plant will strain power sector

Bangladesh scrapped 10 coal-fired plants in June 2021 amid the power sector’s growing overcapacity and fund scarcity led by international financial institutions’ rising environmental, social and governance (ESG) concerns. However, the government attributed this decision to its enhanced greenhouse gas (GHG) mitigation ambitions, creating optimism for a rapid uptake of renewable energy.

Fast forward to June 2025, the present government has altered the previous government’s decision and is considering reviving one of the coal-fired plants. It reportedly plans to build a coal-fired power plant of 1,200MW capacity in Matarbari, adjacent to another coal plant. Although it has cited generating cheaper electricity compared with oil-fired power as one of the reasons for this decision, this rationale seems short-sighted. On the policy front, the new decision contradicts Bangladesh’s intention to amplify GHG mitigation highlighted in June 2021.

At this stage, building a coal-fired plant comes with considerable challenges. The country experienced a slump in peak power demand in 2025 by around 1.1% compared with 2024 (peak power demand fell to 16,999MW in 2025 from 17,200MW in 2024). Moreover, the new coal-fired plant, coupled with under-construction baseload power plants of more than 7,000MW capacity, could exacerbate the country’s high reserve margin by 2030 (Bangladesh’s current reserve margin hovers around 61% based on the peak demand of 16,999MW recorded in May 2025 against the installed capacity of 27,424MW). This overcapacity will worsen the power sector’s financial position as capacity payment obligations continue to surge in the absence of sufficient power demand.

As the government looks to finalise the budget for FY2025-26, it should reconsider allocating a special fund for the renewable energy sector and waiving import duty on components for rooftop solar projects. Achieving Bangladesh’s renewable energy targets will require sustained efforts by the government to attract both domestic and foreign investment into the sector. This also underscores the importance of avoiding abrupt policy changes.

This article was first published in The Daily Star.