Transition credits could unlock finance for some early coal plant retirements

A new type of carbon credit could potentially bridge the economic gap in Asia’s clean energy transition

Transition credits, a proposed category of carbon credits, aim to monetize the emissions avoided through early coal-fired power plant (CFPP) closures and their replacement with clean energy. A new Institute for Energy Economics and Financial Analysis (IEEFA) report explores the potential for transition credits as financing instruments, the opportunities and limitations of scalability and replicability, and the expected trade or transaction values.

“Transition credits could establish more realistic benchmarks for carbon prices and stimulate market development in Asia, especially in countries where such pricing does not exist or is insufficient to drive the early retirement of coal-fired power plants,” says report author Ramnath N. Iyer, IEEFA's Sustainable Finance Lead, Asia.

Iyer discusses how the early shutdown of fossil fuel projects presents substantial economic hurdles and extensive financing requirements, which could be met by financial instruments such as transition credits.

The financing gap in the coal-to-clean switch

The Asia-Pacific region is home to nearly 5,000 CFPPs, making the rapid elimination of coal a particularly complex challenge. Over 90% of the region’s coal-fired energy plants operate in highly regulated markets, often insulated from market forces through government ownership, long-term purchase agreements, or subsidies.

“While clean energy adoption alongside fossil fuel elimination is expected to deliver economic benefits, immediate financing solutions are needed to overcome hurdles, many of which relate to electricity market design,” notes Iyer.

Extended contracts or power purchase agreements (PPAs) with clauses guaranteeing capacity fees and operations for up to 25 years hinder the transition to more affordable, clean alternatives.

Many of these plants are relatively new, and premature shutdowns could result in substantial financial losses to their owners, investors, and lenders due to compensation clauses in PPAs and locked-in financial costs.

Covering the plant retirement and transition costs

Closing a profitable CFPP early usually lowers the net present value (NPV) of the plant’s future cash flows. Early shutdown requires compensation up to the NPV of foregone cash, and replacing its capacity with renewables can add further investment costs.

By assigning a value to the emissions saved by an early plant shutdown, transition credits could be a new financial instrument with varied income potential. Various income streams can be distributed to investors based on risk-return preferences when closing CFPPs and shifting to renewables. The value created could help bridge the economic gap, making early closures viable.

The financing could complement income from new PPAs for renewable power generation. The transition credits would be one form of income flow, which could serve as assets and collateral for loans, attracting equity and debt investors.

Evaluating transition credits

The transition credit mechanism relies on appropriately pricing avoided carbon emissions. Ensuring the credibility and durability of the counterparties is crucial in structuring such deals.

Buyers would then pay a price that helps fill the financing gap, making a coal-to-clean project viable.

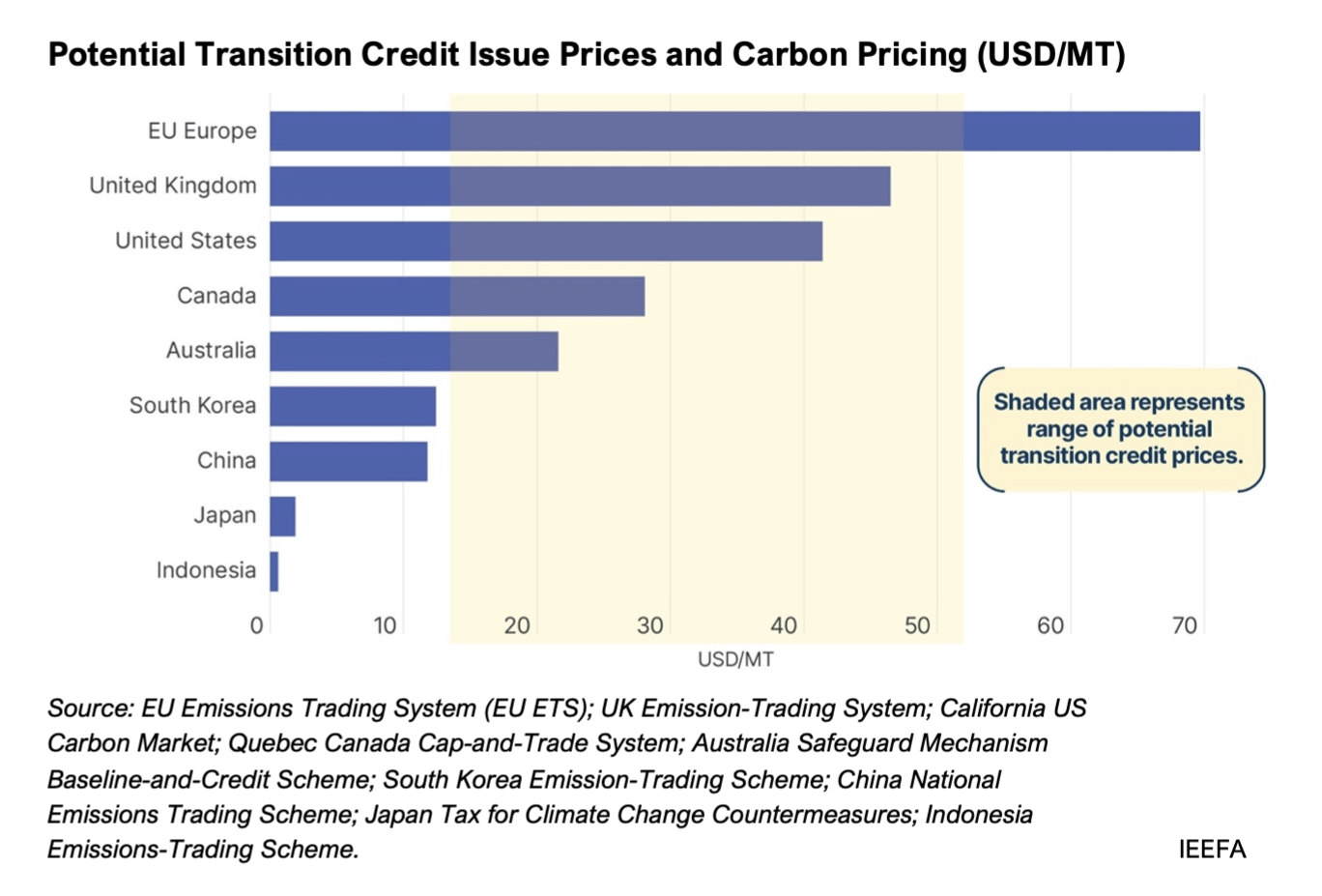

The valuation of a transition credit would depend on specific switching costs and the CFPP’s age and emissions profile. These credits would likely have unique values depending on the project from which they are derived. Based on various studies and pilots, these are estimated to range from USD11-52 per metric tonne of carbon dioxide equivalent (MTCO2e) avoided.

According to Iyer, with falling renewables investment and energy costs, the early shutdown of coal plants and their replacement with clean energy is increasingly economical. However, while the levelized cost of energy (LCOE) for a new fossil-based plant in some countries is uneconomical compared to that of a renewable project, the short-run marginal cost (SRMC) of an existing fossil-based plant may be lower. Transition credits are ideal as a financial instrument to bridge the gap in such situations. This is particularly true for older, almost fully depreciated CFPPs, where the near-term profitability setback in switching to clean energy may otherwise ensure the plant’s continued operation.

However, transition credits may face challenges in replicability and pricing. Estimating social and "just transition" costs can also be difficult, and falling renewable energy costs may raise additionality concerns.

“Multiple approaches are needed to accelerate power system decarbonization in many Asian countries and to reduce future emissions from younger coal plants. Despite the challenges, transition credits can open new avenues to finance the decarbonization of power plants,” says Iyer.

Read the report: Transition credits: A potential financial enabler for the coal-to-clean switch

Author contact: Ramnath N. Iyer ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)