Europe

Europe is a leader in the global energy transition, aiming to become the world’s first climate-neutral continent by 2050. This target, legally binding in the European Union (EU) and UK, is being achieved through many different initiatives but notably requires more renewables, electrification, efficiency and flexibility, as well as phasing out coal.

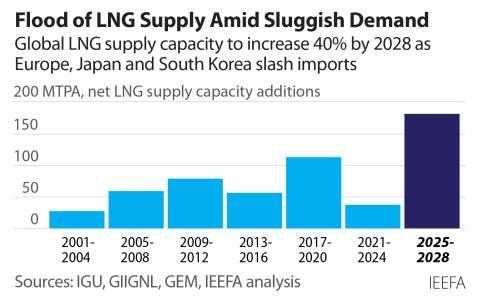

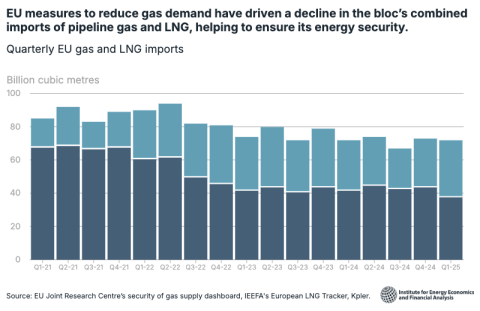

Since 2021, Europe has successfully navigated an unprecedented energy crisis related to Russia’s war in Ukraine, emerging with a more resilient and diverse energy system. Imports of Russian fossil fuels have been rapidly reduced, while countries across the continent have raised their clean energy ambitions to curb future import dependencies. In the near term, liquified natural gas (LNG) and gas storages have become key to maintaining security of supply, particularly through the winter.

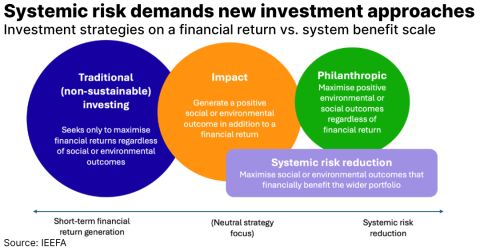

To finance the transition away from fossil fuels and help channel investment to a climate-neutral economy, the EU has developed a sustainable finance regulatory regime. Its many elements, such as the EU taxonomy, disclosure and reporting requirements for companies, emissions trading system and green bond standard, are helping to guide and enable this vast transformation. Europe is home to a growing base of sustainability-conscious issuers and investors whose actions can have global implications.

However, many challenges remain. For example, renewables developers are increasingly faced with grid connection and permitting delays. Credit rating agencies do not fully integrate sustainability or transition factors into their ratings. New investment is required, and Europe is competing with other regions to be at the forefront of key technologies such as batteries, heat pumps, demand response, new nuclear power, electrolytic hydrogen, and carbon capture and storage, among others.

European LNG Tracker

IEEFA's European LNG Tracker is an interactive data set to visualize Europe's LNG infrastructure, demand and capacity outlook, and import and export flows. (Updated: February 2025)

EU Gas Flows Tracker

IEEFA’s EU Gas Flows Tracker is an interactive data tool to visualise Europe’s gas pipeline flows. (Updated: April 2025)