Will Europe’s new standard help or hinder green bond market growth?

Download Full Report

View Press Release

Key Findings

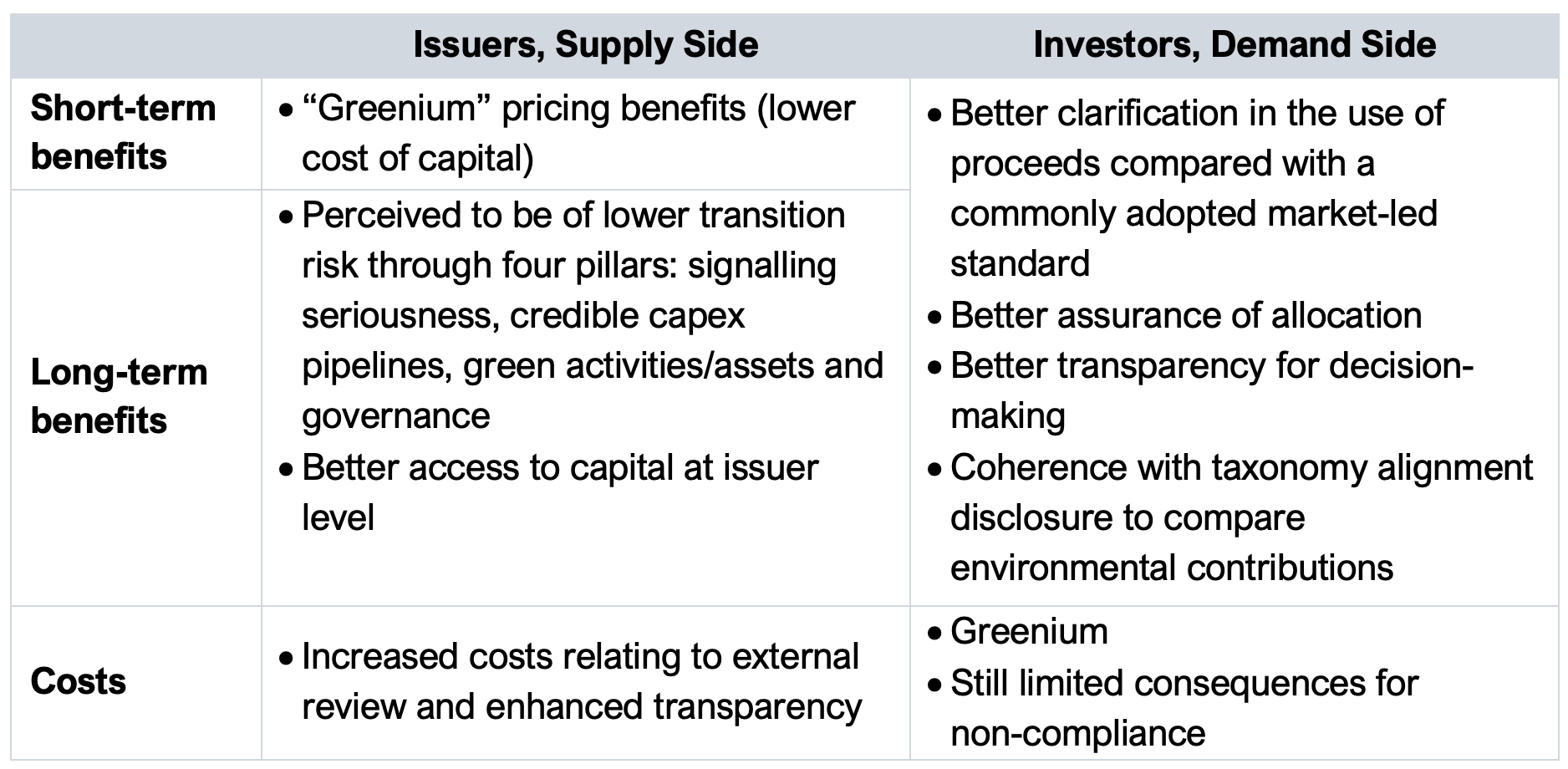

The European Green Bond Standard (EUGBS) can potentially benefit both issuers and investors; its uptake is key for continued market growth.

Issuers can translate European Green Bond issuance into lower transition risks through four pillars: commitments, capex pipelines, green asset delivery and governance.

Investors can turn to the EUGBS for improved transparency and creditability, thereby incentivising flows to support ample climate investment needs.

The low readiness of the EU-issued green bonds to align with the EUGBS raises useability concerns—IEEFA calls for post-implementation reviews of the standard coherent with the overall EU sustainable finance strategy and the bloc’s improved practices towards green bond issuances.

Executive Summary

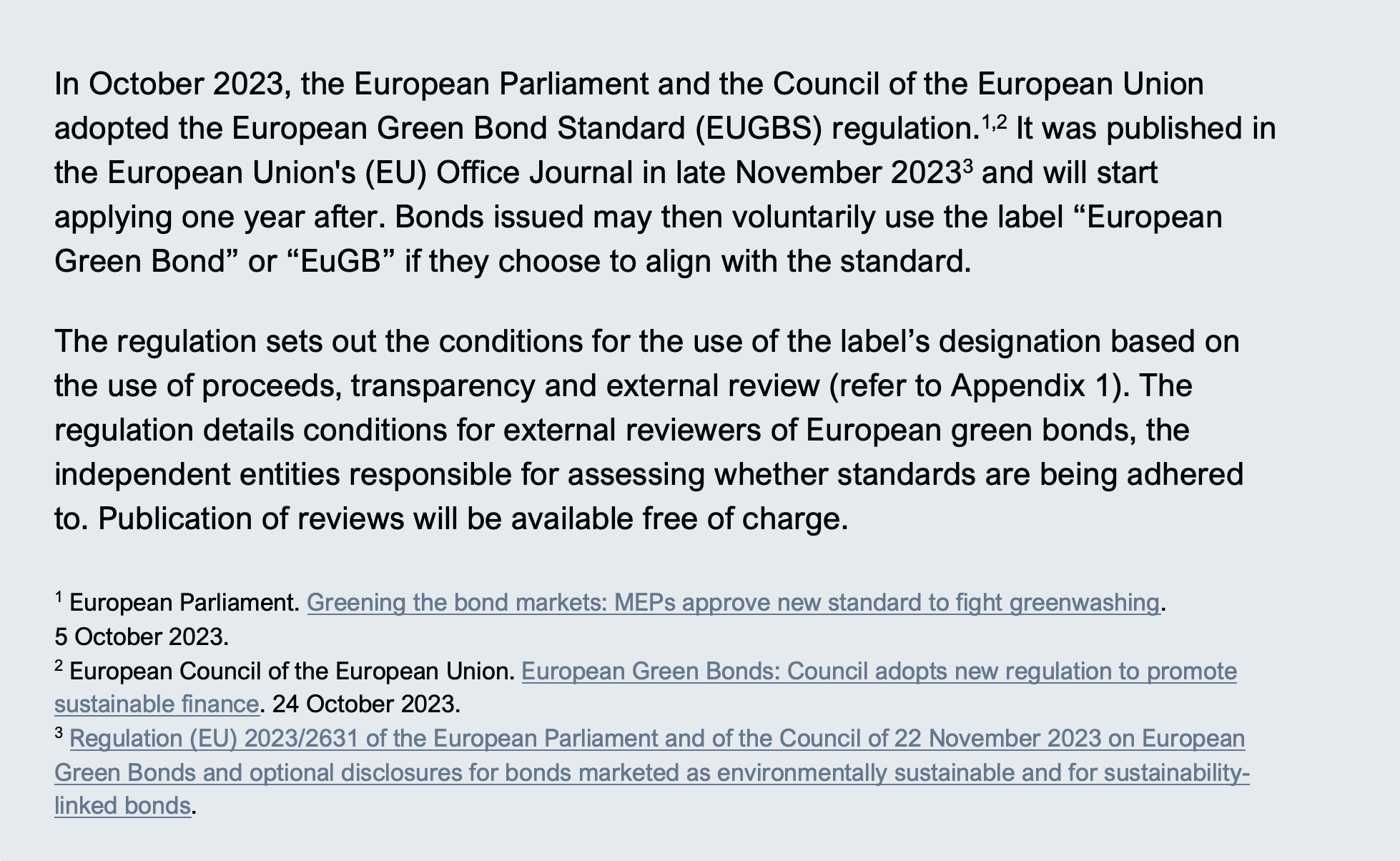

The upcoming EUGBS aims to improve the green bond market’s transparency and credibility, tackle greenwashing and set a “gold” standard.[1] But can it fulfil its objectives while supporting the green bond market, or will it disincentivise issuance altogether? This report focuses on what the standard means for Europe, which accounts for more than half of global issuance. In 2023, Europe’s green bond issuance grew 11% and reached a record high of US$341 billion, outperforming the global market.

IEEFA believes that long-term green bond supply is underpinned by ample projects and investment needs for the net-zero transition. There are potential long-term benefits for issuers of issuing high-quality green bonds—this allows the adoption of the EUGBS to complement issuers’ project development.

Green bond supply will likely be supported by investor demand amid growing social pressure to expand green investing and meet portfolio emissions targets. The EUGBS could address limitations of existing market-led guidance. It could also cater to investors’ increasing sustainability preferences and support continued demand growth.

Table 1: Adoption of the EUGBS Will Generate Long-term Supply- and Demand-side Growth Incentives but May Impose Short-term Costs That Hinder Growth

Source: IEEFA

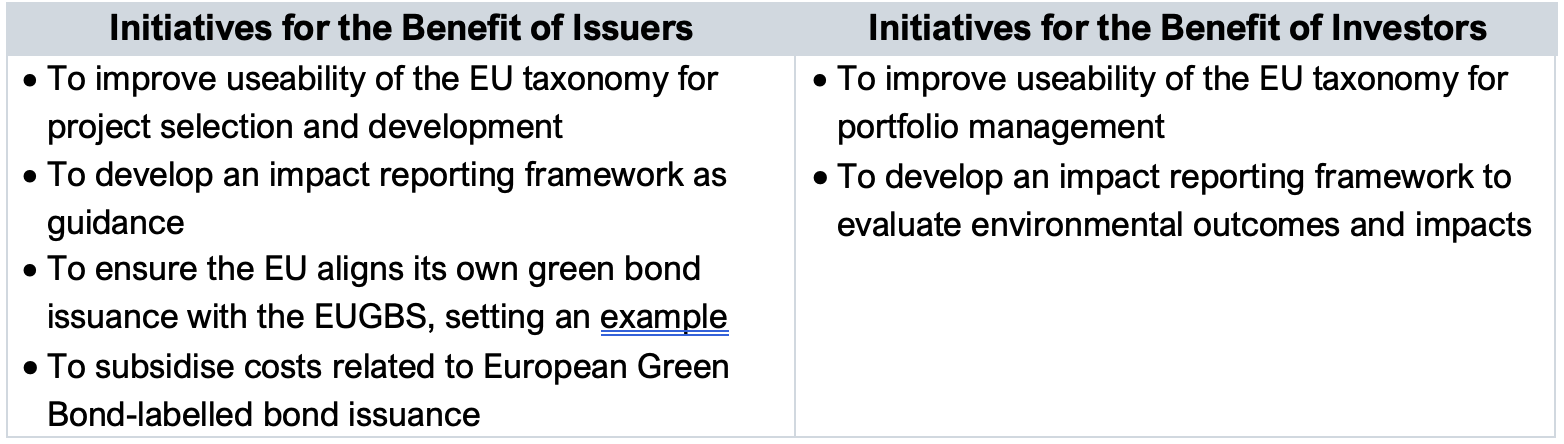

The European Commission (Commission) plays a key role in ensuring all incentives are aligned, thereby facilitating continued growth of the green bond market. While the EUGBS appears coherent with the EU sustainable finance regime, it inherits stakeholders’ concerns around the EU taxonomy. The Commission is also contemplating further green bond issuance in the first half of 2024; but IEEFA finds that it is not ready to adopt the EUGBS, which does not help incentivise the use of the label nor signal good useability of the standard.

Table 2: Complementary Initiatives to Support the Uptake of EUGBS Are Necessary to Ensure the Continued Growth of the Market

Source: IEEFA

[1] European Commission. The European green bond standard – Supporting the transition.