Indonesia's planned coal capacity expansion for captive plants hampers decarbonization progress

Financing by the country’s major banks could flow into investments in captive coal-fired power plants

June 13, 2024 (IEEFA Asia): Financing from banks and companies continues to fuel coal capacity expansion in Indonesia. Notably, two Jakarta-headquartered banks, Bank Mandiri (the largest bank in Indonesia in terms of assets, loans, and deposits) and Bank Permata, are contributing to these new coal investments, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The report analyzes Indonesia's seven largest coal producers, which account for 27% of the country's coal production. These producers, listed in descending order of 2023 coal sales are: Adaro Energy, Bayan Resources, PT Bukit Asam Tbk (PTBA), Indika Energy, Indo Tambangraya Megah (ITMG), Geo Energy Resources, and Harum Energy.

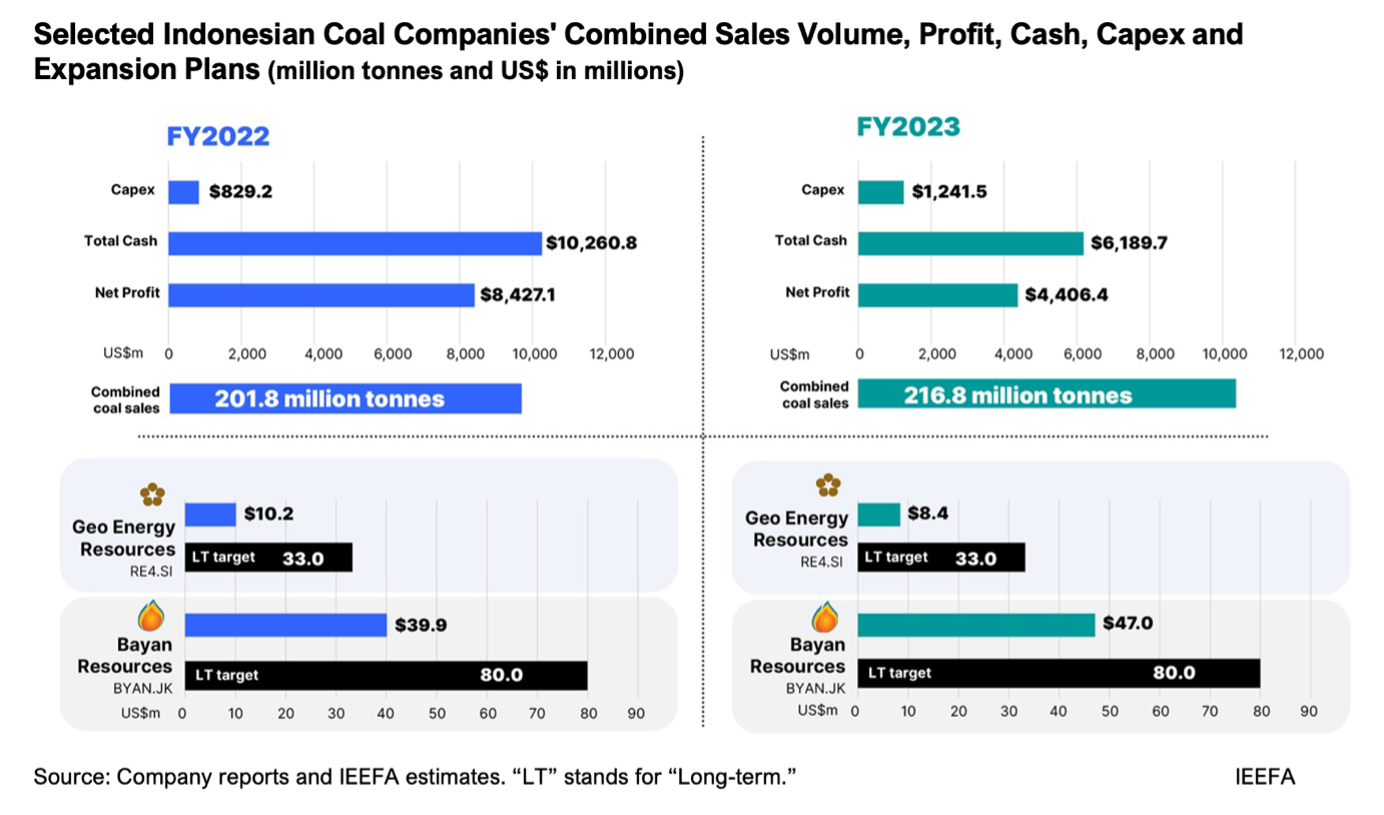

These seven companies reported record profits due to surging coal prices in 2022, achieving a new high cash level of US$10.3 billion, along with healthy financial results in 2023.

Accelerating divestments

Having paid out dividends in the first half of 2023, the seven companies had a combined cash pile of US$6.5 billion at the end of the year. This level of return to shareholders indicates that these companies believe payouts and diversifications were a better use of their net earnings than reinvestment in core mining businesses.

However, the high profits and cash levels could also prompt companies to expand coal capacity for captive coal-fired power plants.

While five of the seven companies have not indicated large coal capacity expansions, Bayan Resources and Geo Energy's plans could collectively increase coal capacity by up to 58 million tonnes (mt), says Ghee Peh, an Energy Finance Analyst at IEEFA and author of the new report.

Bayan Resources secured a US$200 million loan from Bank Permata and another US$200 million from Bank Mandiri, while Geo Energy secured a US$220 million loan from Bank Mandiri.

Peh points out that in 2023, these two companies spent the most relative to their cash levels, significantly raised their debt levels, and boosted their borrowings as part of their plans to expand coal capacity in the medium term.

“The 58mt coal capacity expansion of Bayan Resources and Geo Energy could support 21 gigawatts (GW) of planned captive coal plants, potentially adding 53mt of carbon dioxide (CO2) emissions,” says Peh.

Potential greenwashing

Five of the seven companies are investing in non-coal assets, such as Adaro Energy in aluminum smelting and Harum Energy in nickel smelting.

However, Peh highlights that Adaro currently has a fleet of 2.3GW coal power plants and may also build 2.2GW of coal capacity.

While Adaro is considering adding renewable sources to power its proposed 2.2GW facilities for Phase 2 of the aluminum smelter, its smelter will come with captive power facilities that would increase coal-fired power capacity.

“We believe that captive coal plants are threatening to be the major driver of future Indonesian coal demand,” says Peh. “While the Indonesian government encourages the production of materials such as nickel or aluminum to support the energy transition, it is important to be aware of the potential risks of greenwashing surrounding investments in captive power plants.”

In October 2023, PTBA commissioned the Sumsel-8 2 x 660 megawatt (MW) coal-fired power plant. Meanwhile, at the Weda Bay Industrial Park, five captive coal-fired plants have been built, and twelve plants are planned to provide a total of 3.8GW of coal power.

The report highlights that across Indonesia, the captive power capacity of 21GW planned is equivalent to half of the country’s 2023 coal-fired generating capacity of 40.7GW. The analysis reveals that 13GW of the current captive power projects comprised 32% of 2023’s coal-fired capacity. It is estimated that when the additional 21GW are added, it could add a staggering 52% to 2023 coal power capacity.

“Given that Indonesia has less than seven years to fulfill its Paris Agreement commitment of reducing CO2 emissions by 32% by 2030, the prospect of massive growth in newly built coal capacity is likely to prompt concern among Just Energy Transition Partnership (JETP) participants,” says Peh.

Read the report: Indonesia's coal companies: Some diversify, others expand capacity

Read this press release in Bahasa

Author contact: Ghee Peh ([email protected])

Media contact: Alex Yu ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)