India’s rooftop solar revolution gets a timely boost from PM Surya Ghar Yojana

Strong response to the scheme suggests a bright future for the country’s decentralised energy market

Key Takeaways:

The residential sector will grow at the fastest pace within the rooftop solar space in the next few years.

The residential rooftop solar market is becoming commoditised, and financers are establishing industry-wide tie-ups to offer a one-stop solution.

PM Surya Ghar Yojana will ensure a pan-India growth of residential rooftop solar, with significant demand from tier 2/3 cities and rural areas.

It is the ideal time to invest in household rooftop solar: module prices have dropped, there is strong government support and financers are willing to back rooftop solar projects.

Since the central government launched one of the largest-ever distributed solar interventions, the scheme has been embraced enthusiastically across India, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analysis.

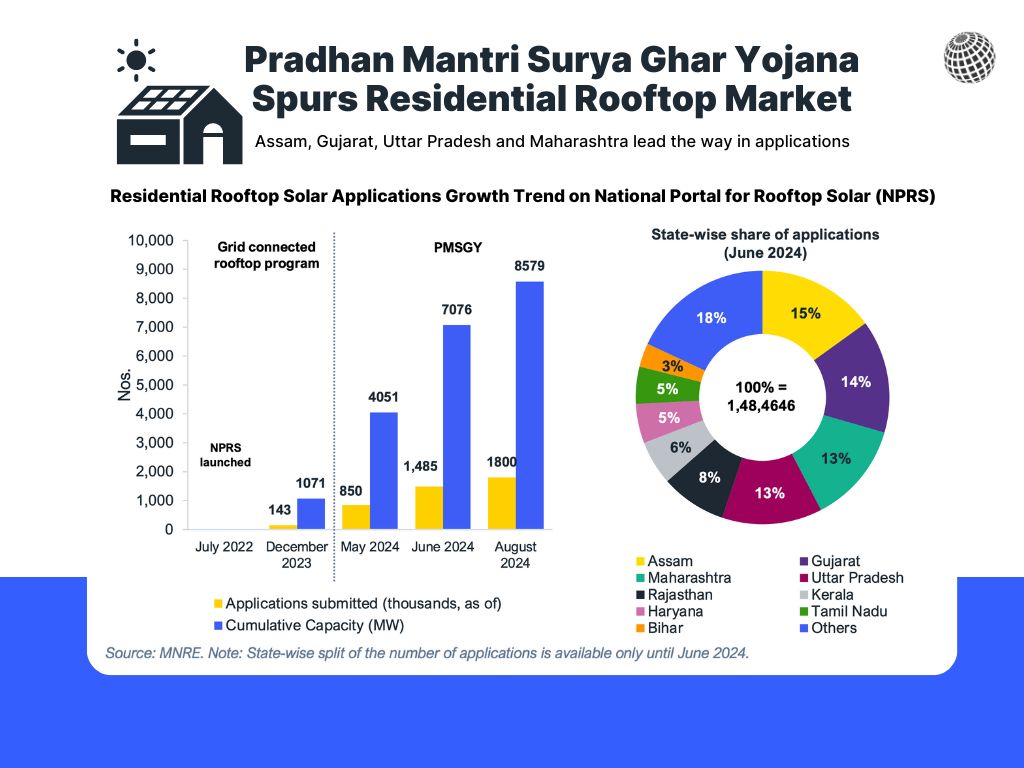

The central government unveiled the Pradhan Mantri Surya Ghar Yojana (PMSGY) in February 2024 with a total scheme outlay of Rs75,021 crore. The scheme aims to help install 30 gigawatts (GW)

of rooftop solar capacity across 10 million households in just three years. In its first six months, it has attracted 13 million registrations and 1.8 million applications, leading to 385,000 installations, equivalent to about 1.8GW of new capacity.

“The growth of the decentralised energy market in India (of which rooftop solar is a crucial component) will be critical to unlocking energy independence and ensuring energy security. With

8-10GW annual installations targeted under PMSGY, it will contribute immensely to India reaching its overall renewable energy target of 500GW by 2030,” said the report’s contributing author, Vibhuti Garg, Director – South Asia, IEEFA.

The report finds that the strong push from the central government has already helped one key hurdle to residential rooftop installations in the past, which is financing. The number of financers

has risen from just a handful a few years ago to more than 25, including all leading private and public sector banks, non-banking financial institutions (NBFCs) and fintech companies.

“Greater financial incentives, more financing options and better access to capital are some of the key factors that have driven the strong initial response to the PMSGY,” says the report’s co-author, Jyoti Gulia, Founder, JMK Research.

“Several financiers are focusing on industry-wide tie-ups with project-executing entities and equipment suppliers, offering a one-stop solution to rooftop solar consumers. For financers, this ensures supply chain reliability, enhanced cost dynamics and the ability to tap a broader consumer base by leveraging the skills of multiple entities involved,” says Gulia.

PMSGY has also increased the central financial assistance (CFA) for systems below 3 kilowatt-peak (kWp) capacity, set stringent process timelines and integrated with the National Portal for Rooftop Solar (NPRS) to provide a streamlined digitised experience for consumers.

The initial 385,000 installations under PMSGY represent an estimated 1.8GW in new capacity. When PMSGY was launched, residential installations comprised just 3.2GW or 27% of India’s total rooftop solar capacity. To meet its 30GW target by 2027, 8-10GW will need to be added annually.

Obstacles remain, particularly policy inconsistencies between states, such as local network charges or subsidy removal and technical issues with the NPRS since its integration into PMSGY.

“Differing regulations across states and their widely varying interpretations by state DISCOMs

are ongoing challenges,” says the report’s co-author, Prabhakar Sharma, Senior Consultant,

JMK Research.

“There are concerns over a need for more supply-side support in the underdeveloped and overpriced DCR modules market. In addition, technical issues such as NPRS glitches and weak distribution transmission infrastructure negatively affect consumer confidence,” he adds.

Nonetheless, market stakeholders say there has never been a better time to invest in rooftop solar due to a confluence of factors, such as falling solar module prices, strong government support and financers offering a one-stop solution for consumers.

The report finds that the growth of the decentralised energy market – of which rooftop solar

is a crucial component – will be critical to India’s energy independence and energy security.

“Adoption of residential rooftop solar is a “win-win” scenario, resulting in significant savings for consumers and state distribution companies (DISCOMs) on cross-subsidisation costs and reduced aggregate technical and commercial losses,” says the report’s contributing author, Gaurav Upadhyay, Energy Finance Analyst – India Sustainable Finance, IEEFA.

“The potential of solar energy on Indian rooftops is immense. Realising this potential will require collaboration and cooperation among all stakeholders in the market, including regulators, distributors, financiers, engineering, procurement and construction (EPC) companies, developers and consumers, to build a vibrant and resilient decentralised energy ecosystem in India,” he adds.

Read the analysis: Unleashing the Residential Rooftop Solar Potential

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Prabhakar Sharma ([email protected]); Jyoti Gulia, [email protected]; Vibhuti Garg ([email protected]); Gaurav Upadhyay ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and International clients across renewable energy, electric mobility and the battery storage market. (www.jmkresearch.com)