IEEFA Press Release: Coal Decline Steepens in 2016

Monday 16 May, 2016: Expectations that 2015 marked the low point in the thermal coal cycle are already looking severely misplaced following Indian reports showing coal imports in April 2016 declined 15% year on year (yoy). The calendar year to-April 2016 saw a record 18.7% yoy decline in imports to 64.3 million tonnes (Mt).

“The rate of Indian coal import decline is increasing every month. Following five years of 20-30% annual growth, this marks an historic turning point in energy market transformation,” said Tim Buckley, Director of Energy Finance Studies at the Institute for Energy Economics and Financial Analysis (IEEFA).

Indian Coal Secretary Anil Swarup reports in April 2016 India imported 15.9Mt of coal, a 15% decline from the 18.7Mt in the same month a year ago. This follows the 15% yoy decline in India’s 2015/16 financial year ended March 2016.

In value terms, Indian coal imports declined 32% yoy from Rs 8,942 Cr (US$1,355m) to Rs 6,023 Cr (US$913m) in April 2016. This is a significant saving that is reducing India’s current account deficit and stabilizing the currency.[i]

“Increased production by Coal India Ltd results in decrease in import of coal,” Coal Secretary Anil Swarup said.[ii] With Coal India and coal fired power plant inventory both hitting record levels in 2016,[iii] and solar power project construction at record high rates, IEEFA forecasts coal imports will continue to decline over 2016/17.[iv]

Indian Minister of State for Power, Coal and New & Renewable Energy Shri Piyush Goyal announced a record 6.93 gigawatts (GW) of new renewable energy projects were commissioned across India in 2015/16.[v] Minister Goyal targets the installation of 10.5 GW of solar in 2016/17 (equal to a fifth of the entire Australian electricity capacity), and treble the 3.1GW commissioned in 2015/16.

For all the coal industry continues to point to India as a source of growth for thermal coal, the reports out of India show that far from growth, India is looking to rationalize and modernize its coal fired power fleet in the face of increasing water stress[vi] and particulate pollution. Having doubled the coal cess in the latest budget, in May 2016 India announced plans to close 37 GW of coal fired power capacity that has reached the end of its useful life and where upgrades are not commercially viable.[vii]

“The global coal industry continues to reel under the inevitable triple pressures of excessive financial leverage, tightening global climate policy consensus and a technology driven transformation that is increasingly transferring pricing power from global fossil fuel conglomerates to energy consumers,” said Buckley. “The result is accelerating energy sector deflation across oil, liquid natural gas and coal.”

In Dubai, May 2016 saw a new solar project of 800MW tendered successfully at an unsubsidised price of just US$30 per megawatt hour (MWh).[viii] Not only the lowest priced utility scale solar project in the world (to-date), this price is below the cost of new coal fired power anywhere. The deflationary impact of renewables is clear; the cost of solar electricity in Dubai is down 50% in just over one year relative to the 200MW solar tender finalized in early 2015 at US$59/MWh.

In the US, coal production declined a record 33% yoy year to date May 2016.[ix] This coincides with reports that the US coal fired power fleet has now slated a cumulative 102 GW or 233 coal power plant closures this decade.[x] Analysts now forecast that the US could install 16 GW of solar in 2016; double that achieved in 2015.[xi]

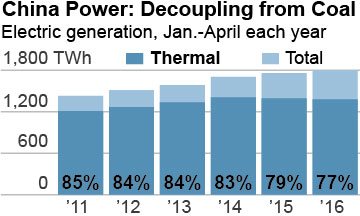

In China, the first four months of 2016 saw electricity consumption growth of only +0.9% yoy, continuing the decoupling of electricity from +5.8% industrial value-added growth. Within this is the continuation of a trend away from thermal power generation, with hydro-electricity generation up +15.5% yoy. Like in 2014 and again in 2015, thermal generation in January-April 2016 was down 3.2% yoy. Total Chinese coal output across China was down 6.8% yoy to 1,081Mt.[xii]

Figure 1: China’s Electricity System – Decoupled and Diversifying from Coal

Source: National Bureau of Statistics Published: 2016-05-14

In China in May 2016, Shenhua Energy Group has announced plans to invest in a US$2bn solar thermal plant in conjunction with Solar Reserve.[xiii] Shenhua’s move illustrates an emerging global theme where fossil fuel companies are looking to transform their businesses in light of this technology and policy shift.

In May 2016, Total SA announced the investment of US$1bn to acquire Saft SA, a world leading battery manufacturer.[xiv] This follows Total’s 2011 US$2bn acquisition of SunPower Inc., the manufacturer of the world’s most efficient solar modules. In India in May 2016, the Adani Group trumpeted its plans to build a US$10bn 10GW solar industrial park in conjunction with the Rajasthan Government and also commissioned the world’s largest solar project (a US$650m, 648MW plant in Tamil Nadu). In April 2016, Statoil of Norway invested US$1.4bn in German offshore wind.

Following the move by Peabody Energy into chapter 11 last month, the capital flight from the fossil fuel sector continues. Firms as diverse as Mitsui & Co,[xv] BHP Billiton,[xvi] Anglo American, Peabody, RIO Tinto, Glencore and Vale SA are all now trying to sell coal mines despite record low prices on offer and few buyers in sight.

“This all provides confirmation that the global electricity markets and leading firms are transforming a great deal faster than anyone expected,” said Buckley.

-ENDS-

Tim Buckley is the Director of Energy Finance Studies, Australasia for IEEFA. He has 25 years of financial markets experience, including 17 years with Citigroup culminating in his role as Managing Director, Head of Australasian Equity Research.

Tim Buckley (Australia) P: +61 408 102 127 [email protected]

Media: James Lorenz P +61 400 376 021 [email protected]

ABOUT IEEFA

IEEFA conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy and to reduce dependence on coal and other non-renewable energy resources.

More here on IEEFA research: https://ieefa.org/category/subject/reports/

[i] http://www.businesstoday.in/current/policy/govt-considering-thermal-coal-import-in-two-three-years/story/231166.html

[ii] http://in.reuters.com/article/india-coal-imports-idINKCN0VE15G

[iii] http://www.platts.com/latest-news/coal/london/indian-power-plant-thermal-coal-stocks-rise-further-26353652

[iv] https://ieefa.org/wp-content/uploads/2015/11/IEEFA-India-Electricity-Sector-Transformation_Global-Capacity-Building_11112015.pdf

[v] http://www.thehindubusinessline.com/economy/macro-economy/clean-energy-sector-achieves-recordcapacity-addition-of-6937-mw-in-fy16/article8490545.ece

[vi] http://indiatoday.intoday.in/story/thermal-power-plants-in-water-stress-areas-may-lead-to-drought/1/625387.html

[viii] http://renewables.seenews.com/news/analysis-how-low-did-solar-power-prices-just-go-524115

[ix] http://www.eia.gov/coal/production/weekly/

[x] http://content.sierraclub.org/coal/victories

[xi] https://www.seia.org/news/us-solar-market-set-grow-119-2016-installations-reach-16-gw

[xii] http://www.stats.gov.cn/tjsj/zxfb/201605/t20160514_1356331.html

[xiii] http://electrek.co/2016/05/03/worlds-largest-coal-supplier-building-one-of-worlds-largest-solar-power-plants/?utm_content=buffere6240&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

[xiv] http://www.bloomberg.com/news/articles/2016-05-09/total-to-buy-french-battery-maker-saft-in-1-1-billion-deal?utm_medium=email&utm_source=flipboard

[xv] http://www.reuters.com/article/us-mitsui-results-ceo-idUSKCN0Y20PW

[xvi] http://www.reuters.com/article/bhp-billiton-output-indonesia-idUSL3N17N1E9