IEEFA: Japanese and Korean investment in risky PJM gas-fired power calls for strategic decisions

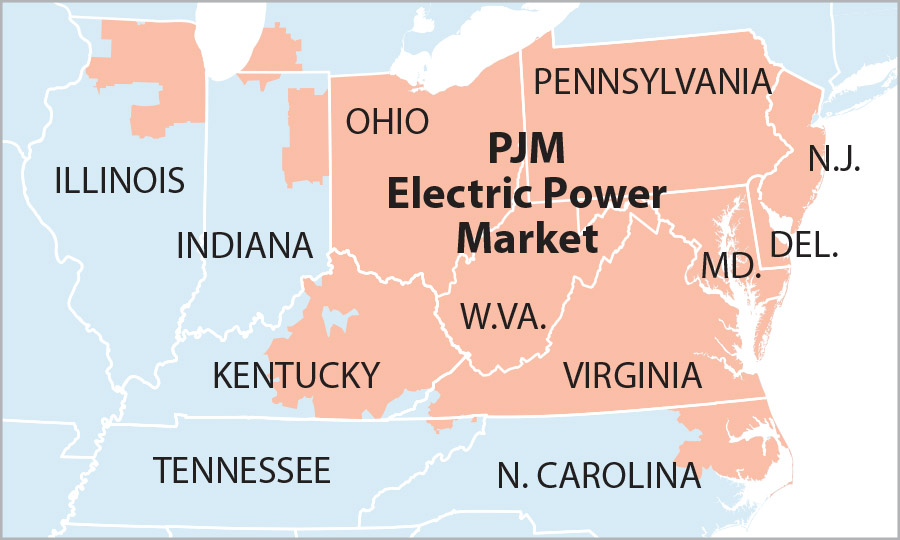

2 December 2020 (IEEFA): Japanese and Korean investors should reassess the growing financial risks to both their new and existing gas-fired power projects in the United States’ Pennsylvania-New Jersey-Maryland (PJM) system, finds a new report by Norman Waite at the Institute for Energy Economics and Financial Analysis (IEEFA).

2 December 2020 (IEEFA): Japanese and Korean investors should reassess the growing financial risks to both their new and existing gas-fired power projects in the United States’ Pennsylvania-New Jersey-Maryland (PJM) system, finds a new report by Norman Waite at the Institute for Energy Economics and Financial Analysis (IEEFA).

The report, Growing Risks to PJM Network’s Gas-fired Projects. Are Japan and Korea Ready? came in the wake of a recent joint study conducted by the Applied Economics Clinic and IEEFA titled Risks Outweigh Rewards for Investors Considering PJM Natural Gas Projects.

PJM’s gas-fired power will be increasingly challenged by renewable competitiveness

The landscape for developers of gas-fired power plants in PJM —the largest independent power system operator in the U.S.— has shifted dramatically over the last decade. PJM’s gas-fired power will be increasingly challenged by renewable competitiveness, PJM overcapacity, global events, gas prices, government actions, and local opposition going forward.

In reviewing Asian investment interests in the region, Waite found substantial Japanese and Korean investments into PJM gas-fired power plants.

“IEEFA estimates Japanese interests have cumulatively invested several billion U.S. dollars of equity into more than twenty PJM gas-fired power projects since 2000, while Korean players have invested nearly US$500 million in just two projects in the past three years alone,” says Waite.

“Whereas Japan has taken a deliberate investment path in PJM gas-fired power assets for over 15 years, Korea’s entry to PJM has been fast and aggressive since its first investment in 2017.

Japanese interests have cumulatively invested several billion U.S. dollars of equity

Waite says the U.S. energy transition will continue to be driven both by greater efficiency in consumption and renewable generation, as well as political forces from local communities to the federal government.

“As long-term strategic players, Japanese investors may be as prepared as any PJM investor for those risks ahead. In contrast, Korean investors are relative newcomers to PJM and may not be ready for what’s coming,” says Waite.

“Japanese and Korean investors need to appreciate the speed and magnitude of the forces driving the U.S. energy transition and the investment risks they pose to their PJM investments.”

“It’s time for Japanese and South Korean investors to review their PJM interests in light of political, financial, and energy market challenges that are not going to go away.”

Read the report: Growing Risks to PJM Network’s Gas-fired Projects. Are Japan and Korea Ready?

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

Author Contact: Norm Waite ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org