Local ammonia production the ideal early adopter for green hydrogen

Download Briefing Note

View Press Release

Key Findings

Ammonia production is a logical first beneficiary of the Australian government’s Future Made in Australia budget measures, which have allocated more than AUD15 billion of critical funding support for green hydrogen.

If near-term investment can be unlocked to deliver economies of scale, the government incentives could make green hydrogen cost-competitive with gas for ammonia production by the early 2030s.

Switching a portion of existing ammonia feedstock to green hydrogen could create large volumes of near-term demand; a proposed project in Western Australia presents a rare opportunity to demonstrate green ammonia production at scale.

Introducing progressive requirements for green explosives uptake by miners could help kickstart Australia’s green hydrogen industry while minimising the financial impact, especially if combined with further government support for early projects

In its 2024-25 budget announced in May, the Australian federal government unveiled a suite of measures to support the energy transition and Australia’s emergence as a “renewable energy superpower”. Central to these efforts is the AUD22.7 billion Future Made in Australia package, which includes roughly AUD8 billion over the next decade for Australia’s green hydrogen industry, and a further AUD7 billion through to FY 2040-2041.

The bulk of this funding – around AUD13 billion – relates to a Hydrogen Production Tax Incentive (HPTI). For green hydrogen projects that reach final investment decision by 2030, the HPTI will provide an incentive of AUD2 per kilogram (kg) of renewable hydrogen produced over a period of up to 10 years between 1 July 2027 and 30 June 2040. This is twice as high (on a per kg basis) as subsidies recently awarded in the European Hydrogen Bank’s first auction, but less than half the USD3/kg incentive available under the US’s much-vaunted Inflation Reduction Act.

The HPTI is complemented by a AUD2 billion expansion of the Hydrogen Headstart program, which provides a total of AUD4 billion in funding credit to help bridge the commercial gap for first-mover projects. These are significant commitments that should start to address the chicken and egg dilemma that has thus far frustrated development of global green hydrogen supply chains: where high production costs have suppressed demand and stymied cost reductions that come with economies of scale.

Alongside these announcements, the budget included other supporting measures for Australia’s hydrogen industry, such as the AUD1.7 billion Future Made in Australia Innovation Fund, a fast-tracked Guarantee of Origin scheme, and funding for infrastructure planning, social licence measures, and industry safety training and regulation.

Recent IEEFA analysis suggests Australia’s ammonia industry is in pole position to capitalise on these budgetary measures. As the initial hype over the many theoretical uses for hydrogen – such as in buildings and road transport – has waned in recent years, the field has narrowed to a handful of applications where electrification or fuel substitution may prove particularly difficult. In Australia, the most promising applications include green ammonia and green iron. Ammonia is a logical first mover, given that hydrogen (currently produced from methane) is already its primary chemical feedstock, and some green hydrogen can already be substituted in existing facilities.

Australia’s green ammonia ‘triple win’

In Australia, ammonia is used in about equal parts to produce fertilisers and explosives. Australia’s ammonia supply chain is energy- and emissions-intensive, accounting for roughly 5% of Australia’s total gas use and around 4 million tonnes of carbon dioxide equivalent a year. The potential to partially or entirely replace current gas-based hydrogen means that ammonia production offers a ready-made demand source for green hydrogen, with far lower technological or commercial risk compared with other sectors where potential uses remain nascent.

As such, IEEFA identified a potential ‘triple win’ from decarbonising Australia’s existing ammonia facilities: alleviating domestic gas market pressure; reducing emissions; and catalysing Australia’s emerging green hydrogen industry. Despite this potential, most proposed green ammonia initiatives in Australia remain in their infancy and primarily target exports rather than substituting gas in domestic production. These initiatives have been impeded by uneconomical production costs compared with conventional methods, a lack of demand due to higher prices, and inadequate policy incentives.

By helping to bridge the cost premium for green hydrogen, the Future Made in Australia announcements significantly bolster the economic argument for a rapid transition to green ammonia, and to potential derivatives such as green explosives. Eligibility for the HPTI requires projects to reach final investment decision before 2030. This advantages existing ammonia facilities given that they already operate within mature supply chains with established, reliable customers who could provide firm offtake agreements.

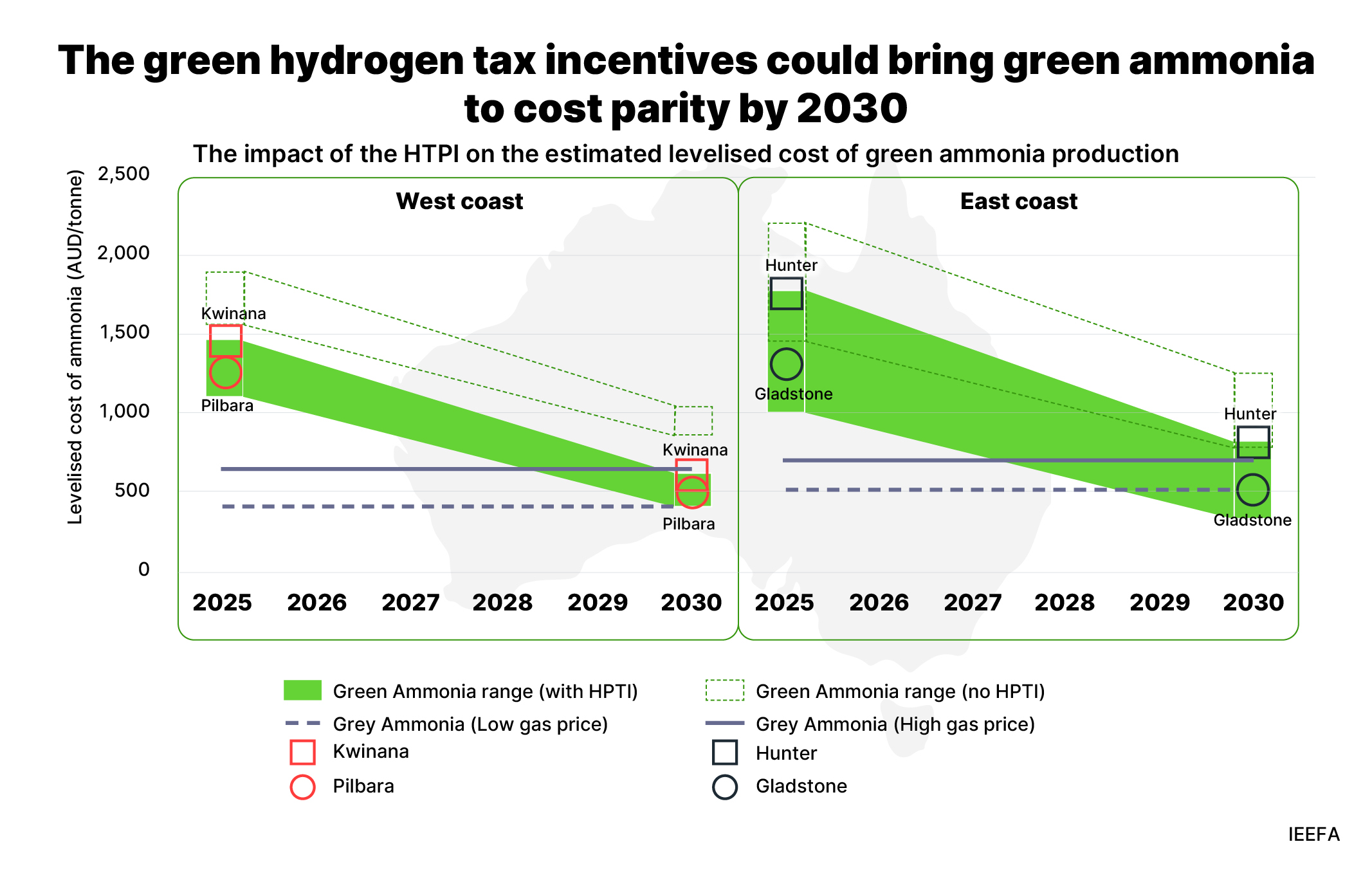

Applying the HPTI (available from FY 2027-28) will reduce production costs of green ammonia (made from green hydrogen) in coming years, such that they could reach parity with conventional grey ammonia (made from methane) in some regions for projects starting construction before 2030 (see the figure below). However, such cost declines won’t just happen; they depend on rapidly developing the green hydrogen supply chain to unlock learning benefits and economies of scale. Building this scale despite the cost premium on green ammonia will require near-term leadership and investment from ammonia producers and customers, potentially supplemented by additional government support.

Download the full briefing note to read more.