Key Findings

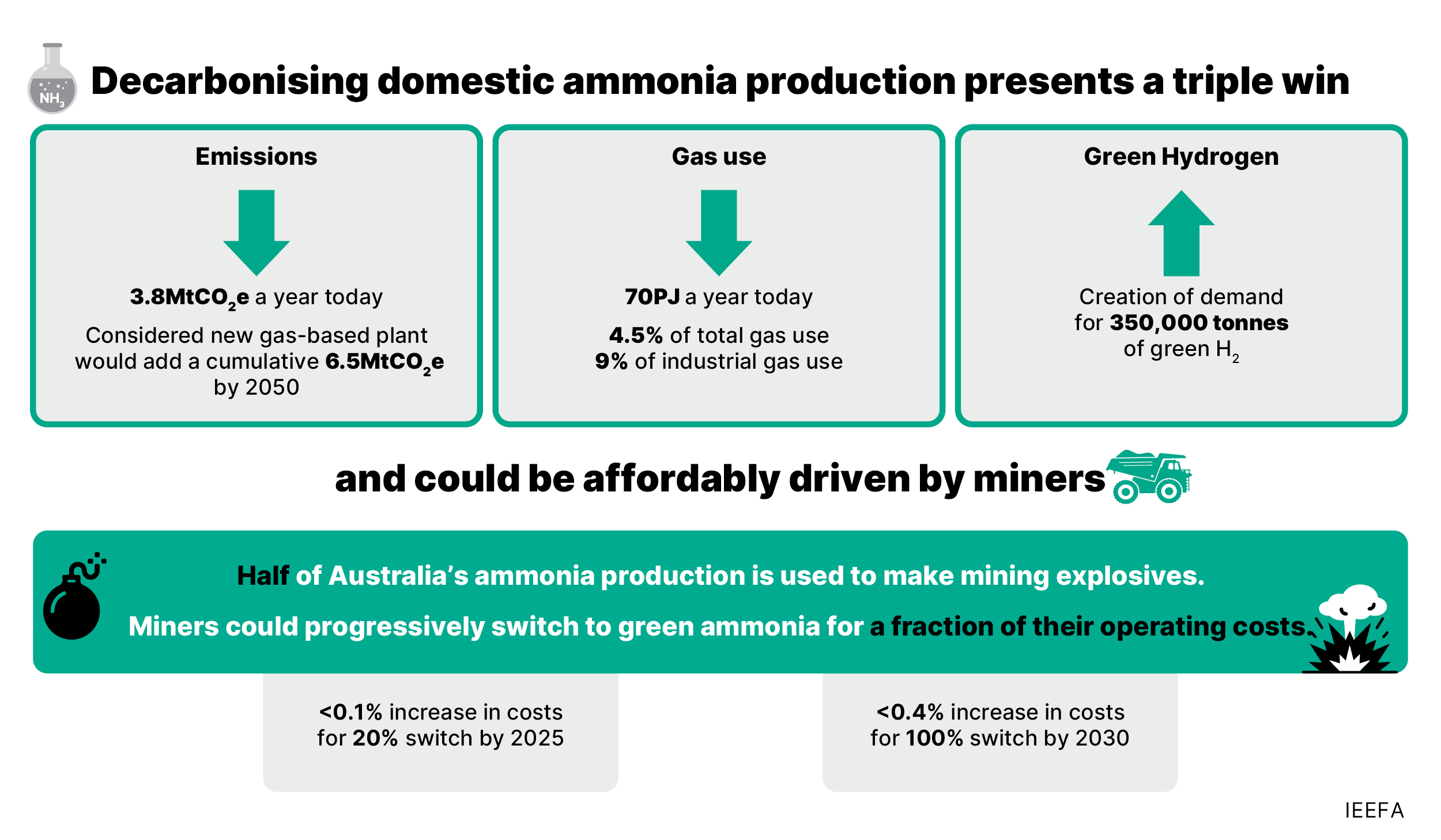

Decarbonising Australia’s ammonia production facilities would present a triple win: alleviating domestic gas market pressure; reducing emissions; and catalysing Australia’s emerging green hydrogen industry.

Adoption of green hydrogen in ammonia production is currently slow, but a proposed ammonia plant expansion in Western Australia, while currently gas-based, presents a timely opportunity to demonstrate large-scale integration of renewables and green hydrogen.

Miners consume about half of Australia’s ammonia through explosives; they could shift to green explosives for a minimal increase in operating costs, with the right incentives.

Government could help accelerate the shift to green explosives through improved data transparency, regulation and targeted support to complement miners’ commitments.

Executive Summary

Australia’s ammonia supply chain is currently energy- and emissions-intensive. Ammonia accounted for roughly 5% of Australia’s total gas use in 2021, making it the second-highest gas user across Australia’s manufacturing sectors. Combined emissions from facilities producing ammonia and its derivatives such as ammonium nitrate are around 4 million tonnes of carbon dioxide equivalent (MtCO2e), or just under 1% of Australia annual emissions.

Most of these emissions are from the use of fossil gas in the production of ammonia, with further emissions from the production of nitric acid. Mature technologies exist to eliminate most of the emissions from these sources, with the largest reductions coming from switching from gas-based hydrogen to green hydrogen.

Ammonia production stands out as a logical early adopter of green hydrogen, which is considered critical to global decarbonisation efforts. Unlike other sectors, ammonia’s production process already involves hydrogen as an intermediary product, and no viable alternative low-carbon routes exist. In addition, Australia’s existing ammonia plants are in regions with abundant renewable resources. These regions – Pilbara, Kwinana, Hunter and Gladstone – have all been identified as potential hydrogen hubs under Australia’s National Hydrogen Strategy and offer the potential of large-scale demand clusters. Switching all of Australia’s current ammonia production away from gas would create demand for around 350,000 tonnes of green hydrogen.

Decarbonising ammonia and ammonium nitrate facilities presents the opportunity of a triple win: alleviating domestic gas market pressure; reducing emissions; and catalysing Australia’s emerging green hydrogen industry.

However, progress is slow. Most proposed green ammonia projects remain at an early stage and are focused on exports rather than replacing gas in domestic production. High production costs for green hydrogen (and therefore green ammonia) compared with conventional methods, a lack of demand at premium prices, and insufficient policy drivers are hindering widespread adoption.

Current proposals for a gas-based expansion of CSBP’s ammonia plant in Kwinana, Western Australia, would add about 0.5MtCO2e to Australia’s emissions each year. However, instead of proceeding as planned, the expansion offers an opportunity to demonstrate large-scale integration of renewables and green hydrogen in the domestic ammonia supply chain. It could create demand for about 53,000 tonnes of green hydrogen – 18% of the green hydrogen production currently proposed across Australia for domestic use, and more than twice the planned capacity in Western Australia.

Just above half of Australia’s ammonia production is used to produce explosives, with the remainder used for exports or to produce fertilisers. As major ammonia consumers through purchased explosives, miners wield significant influence and purchasing power, and can play a pivotal role in accelerating the transition to green hydrogen and ammonia. However, miners currently lack incentives to adopt green explosives due to cost considerations, a lack of policy mechanisms, and limited transparency or scrutiny regarding their contribution to company emissions. By quantifying and setting reduction targets on upstream emissions from explosives products, miners could guarantee offtake and provide the certainty required to shift investment from suppliers.

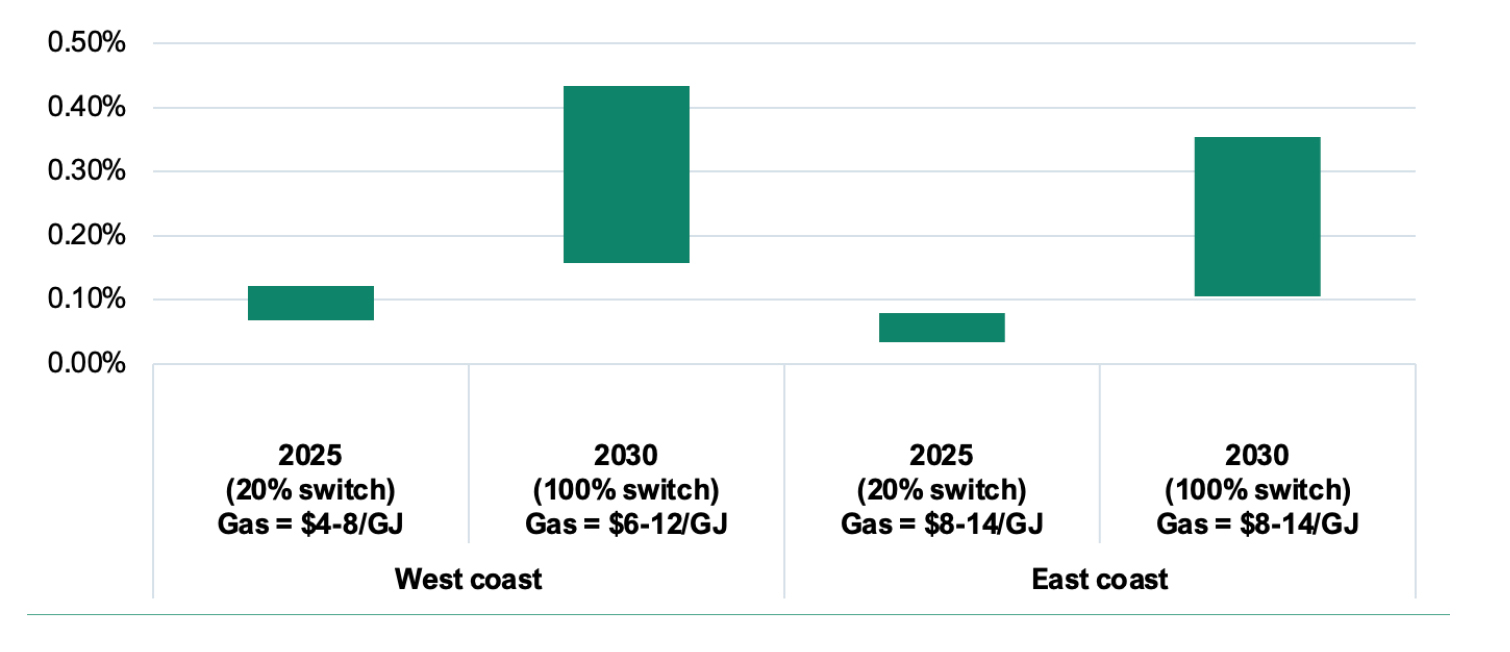

IEEFA estimates that a complete shift to green explosives would be affordable for miners. We found that switching to 20% green ammonia for explosives production by 2025 would increase mining operating costs by less than 0.1%. This could be done by blending green hydrogen and existing gas-based hydrogen with minimal asset upgrades. A full switch to 100% green ammonia for explosives production by 2030 would increase mining operating costs by up to 0.4%, but this impact could be much lower, and even eliminated, in particularly favourable regions or if future gas prices increase. This would mean up to a 0.7% reduction in mining profit margins.

Increase in mining operational costs for switching to green ammonia input for producing explosives

Government support will be crucial to drive and complement action by miners, by addressing data transparency challenges and reducing investment risk. Adapting existing schemes such as Renewable Energy Certificates could drive investment in explosives inputs. The creation of a similar market-based mechanism offers the opportunity of recognition for miners’ action, and financial incentives and competitive advantages for ammonia producers. Other emerging initiatives such as a hydrogen Guarantee of Origin (GO) scheme could also provide a consistent, accurate approach to tracking emissions from production of hydrogen and derivative products such as ammonia. Investment support can cover shortfalls in miners’ commitments, while regulatory measures can mandate full decarbonisation of explosives production. Other measures such as legislating Scope 3 emissions reductions or placing limits on the use of offsets would also accelerate action across the ammonia supply chain.

The convergence of miner influence, market-driven incentives and government support forms a compelling case for accelerating Australia’s transition to green ammonia. By embracing this opportunity, miners can not only contribute significantly to global decarbonisation but also position Australia as a leader in green ammonia production. The proposed CSBP plant expansion provides a timely and pivotal moment for miners to catalyse change and drive the adoption of green ammonia in Australian mining and the emergence of a green hydrogen industry.