Formosa needs to break its inertia on proposed Louisiana petrochemical plant

Key Findings

Formosa’s proposed petrochemical complex in Louisiana faces a new community effort to challenge its air permit.

Market conditions for the project, already weak, face more challenges from increased competition.

Laws and international negotiations to reduce plastic pollution will likely dampen market growth.

Formosa should break its inertia and reassess its pursuit of the Louisiana petrochemical project.

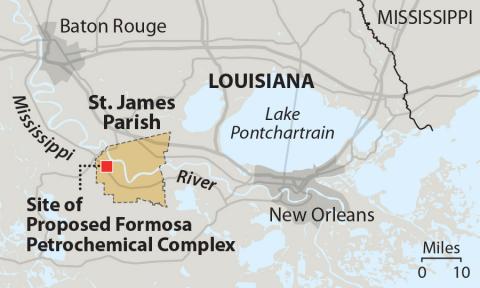

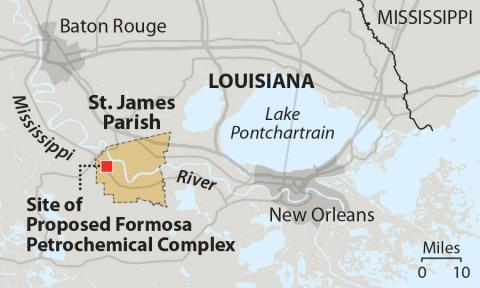

As it seeks to build a controversial petrochemical complex in St. James Parish, La., Formosa behaves like a moving object, resisting direction change unless forced. It’s called inertia. Formosa should heed the warning signs about this project and alter its course.

Market and regulatory factors—as well as international treaty negotiations—increasingly do not bode well for Formosa’s risky Louisiana venture. The impediments to success are substantial:

- The project involves multiple chemical plants clustered in a petrochemical complex that would be sited in an area of Louisiana dubbed “Cancer Alley.”

- The project has yet to undergo the full environmental impact statement process that the U.S. Army Corps of Engineers has determined it needs.

- The project flies in the face of repeated warnings from Standard & Poor’s that the investment is at risk from both political and market forces.

In January, a Louisiana appeals court overturned a lower court decision that had sent the project’s 15 air permits back to the state environmental agency for reconsideration. The district court had raised strong concerns about the environmental justice implications of the petrochemical project.

But Formosa did not go forward with the project—not only because it still lacked a federal wetlands permit from the Corps of Engineers, but also because Formosa has not yet made the final investment decision to build the petrochemical complex.

Now Formosa faces yet another hurdle as the community asks the Supreme Court of Louisiana to review the appellate court’s ruling that reinstated the permits. Rise St. James, the Louisiana Bucket Brigade, Sierra Club and other organizations argue that the court’s reversal was not supported by evidence in the record.

Formosa should reassess its plan

IEEFA has challenged the viability of this project since 2021, based on fundamental market factors that spell trouble for the project. The problems remain.

The company is not in a better position today to pursue the project. In October 2023, Standard and Poor’s—which had warned in 2021 of the financial risk to Formosa posed by the Louisiana project—downgraded its overall credit assessment of the company from stable to negative “on weak profitability.” The credit opinion reiterates its wariness of the Louisiana project and strongly counsels against “aggressive capacity additions,” suggesting that such actions would likely lead to a downgrade.

The domestic market for the proposed facility’s products remains oversupplied.

From July 2023 through January 2024, U.S. and Canadian polyethylene producers reportedly sold an average of 47% to 48% of their output abroad. The oversupply is not likely to abate because the domestic market demand is projected to see only slow growth.

Meanwhile, petrochemical plants completed since early 2021 or currently under construction will add millions of metric tons per year of polyethylene product to an already-oversupplied market.

Shell’s 1.5 million metric tons per year (mmtpa) petrochemical complex in Pennsylvania—despite fits and starts, including pollution violations after opening in November 2022, as well as the facility’s subpar investment performance—is currently operating under a construction permit. The company must apply for a Clean Air Act Title V permit by June 21.

Nova Chemicals’ new 453,600 metric tons (mt)/year unit near Sarnia, Ontario, which began operations in 2023, and a new Bayport Polymers 625,000 mt/y unit in Texas that opened in October 2023, are boosting domestic supply even more in North America. The Golden Triangle Polymers Plant under construction at a site east of Houston in Orange County, Texas—a joint venture of CPChem and QatarEnergy slated for a capacity to produce 2.8 mmtpa of polyethylene product—is expected to come online in 2027.

If Formosa is looking to the export market to save the Louisiana project’s bottom line, it is likely to be disappointed. The export market is unstable and experts expect it to remain unstable. John Richardson, senior consultant with ICIS, commented that much of the global market’s problem started in 2021, when many believed the demand for polyolefins in China would grow at 6% to 8% per year. Instead, he observed, the demand growth is 1% to 3%.

Richardson said the lower demand growth is important because China dominates global demand. At the same time, Richardson noted that China is building out its own capacity—so net imports are going down and demand growth is weak. S&P Global reported that it sees “no signs of a material slowdown” in China’s bid to increase its total ethylene capacity to about 70 mmtpa in 2025.

The rising pressure on the plastics industry from consumers, legislators and institutional investors to reduce single-use plastics also can reasonably be expected to dampen demand for virgin plastics production. In a 2023 report, Peak Plastics: Bending the Consumption Curve, Economist Impact and the Nippon Foundation found 11 of the countries in the G20 international forum have national bans that target plastic bags or other single-use plastics.

The European Union established a ban on the marketing of single-use plastic plates, cutlery, straws, balloon sticks and cotton buds for member states that began in July 2021. In the United States, plastic bag bans in Colorado and Rhode Island took effect in January 2024, raising the number of states with bans on single-use plastic bags to 13. Some 500 U.S. cities also have adopted such bans. In addition, institutional investors are stepping up shareholder resolutions related to plastics and pollution.

Finally, plastics pollution has become a proposed target for international governmental action.

Three sessions of the Intergovernmental Negotiating Committee to develop an international legally binding instrument on plastic pollution occurred from 2022-23. The fourth session, at which a draft text will be discussed, is set for April 23-29, 2024, in Ottawa and a fifth session is scheduled for late 2024 in Busan, South Korea. While it is too early to draw conclusions about the outcome of these negotiations, the process lends visibility and emphasis to the issue of plastics pollution. It is likely to boost public awareness and spur more movement on the issues, which may ultimately affect the global plastics market.

Cumulatively, the market and political factors indicate that Formosa needs to break its inertia and reassess its pursuit of the Louisiana petrochemical project. The corporation needs to chart a revised, sustainable course for its business future.

Formosa has an opportunity to pause and read the writing on the wall. It should do so.