Latest legal setback highlights need for Formosa to drop petrochemical project

Key Findings

Formosa has just been presented with a new legal hurdle as it tries to build a giant petrochemical complex in a low-income community of color in Louisiana.

A state court recently threw out the air permits that Formosa Plastics needs to build the project.

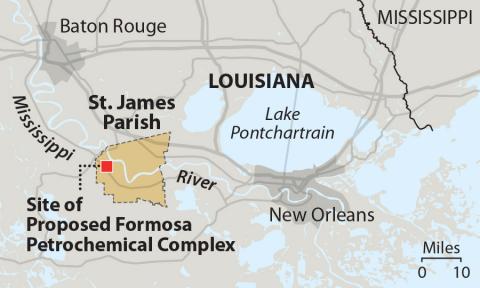

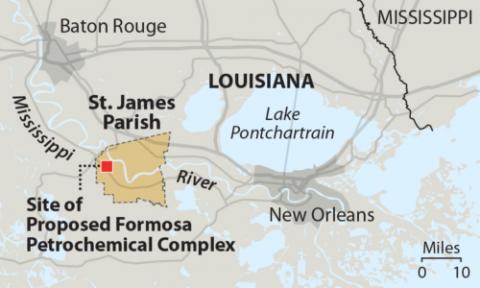

The court found that the permits would have allowed Formosa Plastics to emit more than 800 tons of toxic pollution into the air, posing health risks for the predominantly Black residents of St. James Parish.

Formosa has just been presented with a new legal hurdle as it tries to build a giant petrochemical complex in a low-income community of color in Louisiana. A state court recently threw out the air permits that Formosa Plastics needs to build the project. The company should recognize that the legal setback presents an opportunity to re-evaluate the economics of the ill-advised project. The wise move would be to abandon the project.

The court found that the permits would have allowed Formosa Plastics to emit more than 800 tons of toxic pollution into the air, posing health risks for the predominantly Black residents of St. James Parish. The petrochemical complex, located in “Cancer Alley,” an area along the Mississippi River with a high concentration of industrial plants, would also be a large new source of greenhouse gas emissions. The Sept. 12 decision nullifies the Louisiana Department of Environmental Quality’s approval of the project.

The proposed petrochemical project has been a bad idea from the outset, for economic as well as environmental reasons. A 2021 IEEFA report found the project posed significant financial and market risks. IEEFA warned that the project would begin operations at a time of market oversupply, low petrochemical prices, strong competition for market share, restrictive trade policies, rising construction costs and a weakened bond rating. It concluded the petrochemical complex would not likely be as profitable as predicted. Later in 2021, S&P Global advised that delays in construction of the complex had actually benefitted Formosa’s credit rating.

Formosa should cut its losses and move on

When IEEFA revisited its analysis in 2022, it found that although some improvement had occurred in the commodity price environment, four key conditions had changed: Construction prices had risen; regulatory scrutiny had intensified; credit agency support had withered; and community opposition had heightened questions among stakeholders.The prognosis was not positive.

The company, which intervened to become a party in the air permit case, has stated it intends to explore all legal options. It has taken the first step to appeal the court’s decision, but that is not likely to be an easy road. The district judge issued a 34-page decision that rested not only on the state’s air regulations but also on the federal Clean Air Act and the Louisiana Constitution.

Article IX of the Louisiana Constitution mandates protection of the air, water and natural resources of the state “consistent with the health, safety, and welfare of the people.” The court explained that the constitutional provision requires agencies to consider environmental costs and benefits along with economic, social and other factors in decisions.

The court also was particularly critical of the agency’s failure to evaluate the cumulative impacts of the project. It found the agency’s failure to weigh the project’s greenhouse gas emissions particularly egregious, especially given “the impact of climate driven disasters fueled by greenhouse gases on environmental justice communities and their ability to recover.”

Regardless of the ultimate fate of the vacated air permit, the risks associated with the project—regulatory, environmental and financial—loom large. The U.S. Army Corps of Engineers will subject the project to a detailed environmental review before making a decision on the required water permit.

The burden of the project’s economics only gets heavier with price pressures on ethane and ethylene further tightening the margins. Strong public opposition to ubiquitous plastics waste and pollution emissions from the petrochemical production industry makes permitting difficult. Pressures to reduce single-use plastics also may affect the market.

Formosa should consider not only its legal options but also its business options. Continuing to pursue the Louisiana petrochemical misadventure is not likely to be in the company’s best interests. Formosa and Louisiana’s environmental agency filed a motion for a stay of the air permit ruling and have until Nov. 22 to file the full substantive appeal. Rather than throw good money after bad, Formosa should cut its losses and move on.