IEEFA U.S.: S&P pushes Louisiana project cancellation as credit boost for Formosa

Formosa has been put on notice by Standard & Poor’s that delays in its proposed petrochemical complex in Louisiana have actually helped its credit rating. S&P implies that cancelling the project would be better for the company than laying out large sums of cash for a high-risk investment.

Cancelling the project would be better than laying out large sums of cash for a high-risk investment

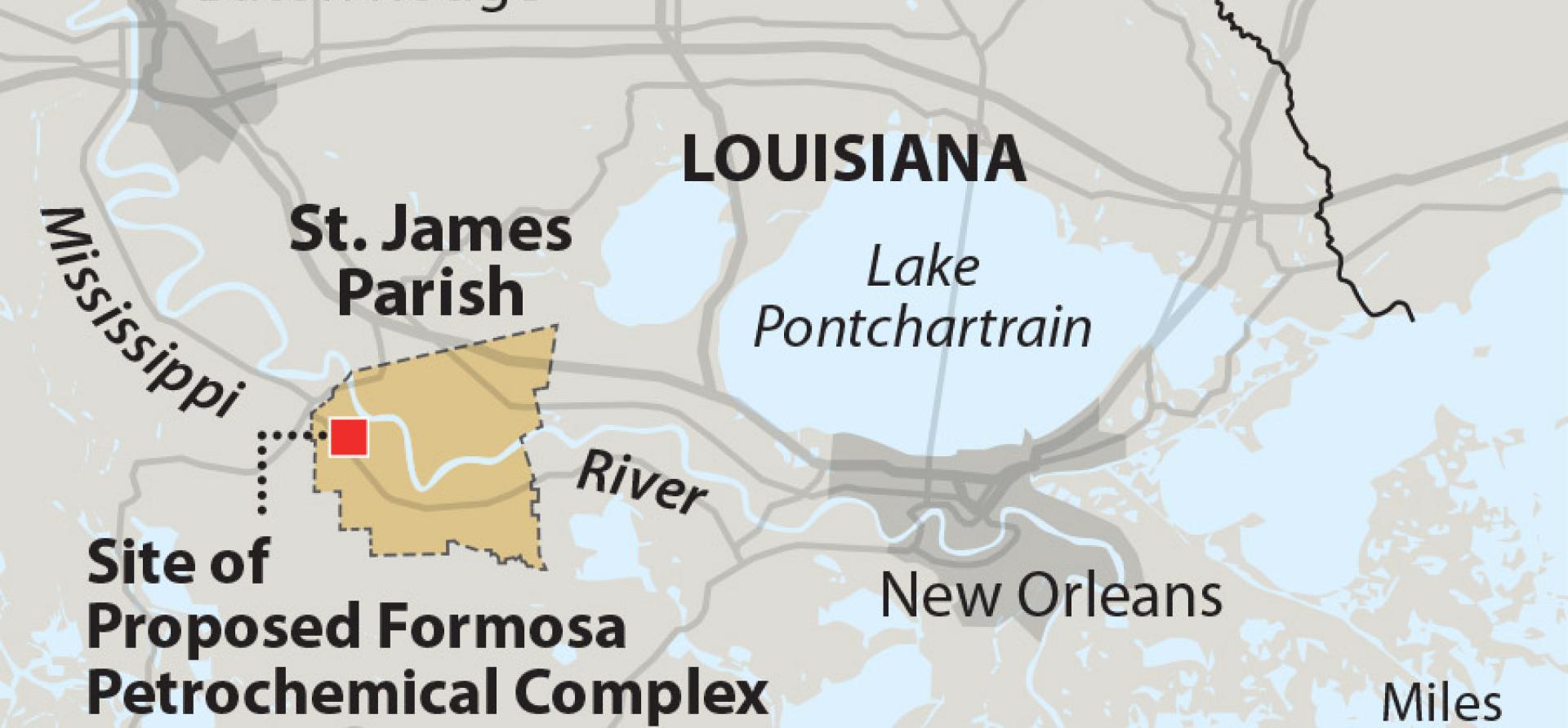

The company plans to build an ethylene cracker and large petrochemical complex in St. James Parish. If built, Project Sunshine would add 2.4 million tons per year of ethylene to a U.S. market that annually supports some 50 million tons. The facility would also provide a new source of polyethylene, polypropylene and ethyl glycol to the U.S. domestic market.

Overall, the company is quite strong financially and has a solid balance sheet. In October 2020, S&P downgraded Formosa in part due to the cash drain on the company from its Louisiana project. At the time, S&P noted that the estimated construction cost would be $12 billion, 25% more than Formosa’s own public estimates. The company has not confirmed the larger amount but has acknowledged rising construction costs.

In October 2021, S&P explained why Formosa’s credit would be helped by a delay or cancellation:

“A further delay in the Louisiana chemical complex, if the project is not cancelled, gives the companies more time to strengthen the financial buffer for the ratings. We see diminishing probability that the planned mega project in Louisiana will go ahead, given the changing political atmosphere in the U.S. A decision by U.S. officials in August 2021 to order an environmental impact statement for the project cast significant doubt over its future. The project has been on hold since November 2020 when the U.S. government suspended a permit amid protests from local environmental groups. Formosa Petrochemical Corp. planned to review the project’s feasibility by the end of 2021. This was based on further potential delays as a result of the impact statement, sharply higher construction costs due to high inflation in material prices and wages, hefty tariffs on imported equipment from China, and lower availability of local labor due to the pandemic.”

The financial bad news facing the project—rising construction costs, an uncertain trade picture and local labor force issues—comes against a backdrop of a market that has added substantial capacity in the last five years, including a Formosa petrochemical facility in Texas. When the project was planned, natural gas prices in the U.S. provided a decided advantage. With the prices in the mid-$4 per million British thermal unit (MMBtu) range, tailwinds are not as strong other market forces are hurting the balance sheet.

Standard & Poor’s is also looking beyond the balance sheet. It is also looking at how events taking place off the balance sheet are finding their way back into the financial calculus. The ratings agency cited the federal government’s suspension of a permit for the Formosa plant until a complete environmental impact study can be done. The study is expected to take a year, and the results could change the project’s design.

The financial bad news facing the project comes against a backdrop of a market that has added substantial capacity in the last five years

Protests by environmental organizations and the political climate in the United States are also identified as contributing risk factors. This view echoes a report by Moody’s in September 2020 that examined how regulatory decisions are having a material impact on project development. The role of U.S. regulation and citizen involvement as climate change concerns increase has been a matter of increasing public debate. The nature of the climate change debate and growing concerns over environmental pollution more broadly are producing changes in regulatory and political outcomes.

S&P noted that environmental issues are not just a quirk in the U.S. political and regulatory climate. “We believe the four companies (Formosa) will find it increasingly challenging to pursue mega-expansion projects in the commodity chemical field because of surging global pressure to reduce carbon emissions as well as chemical and plastic pollution worldwide, just as Formosa Petrochemical has already experienced in the U.S.”

The issue isn’t limited to the United States. S&P noted that “surging global pressure to reduce carbon emissions as well as chemical and plastic pollution” will cause intensive scrutiny for large mega projects. The challenge to the companies will be to devise investment strategies that facilitate the energy transition. S&P notes that the Formosa “companies are likely to shift their focus to specialty products, particularly electronic materials for emerging applications such as electric vehicles.”

Until then, Formosa and companies like it will face something that was unheard of even last year—cancellation of a project that will be a boon to their credit rating.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis.

Related items:

IEEFA. Skyrocketing plastics prices a major concern for public health, economy

IEEFA. Proposed Formosa, Louisiana petrochemical complex financially unviable

IEEFA. Plastics tax debate is health and safety issue for rest of U.S.