Louisiana court reinstates Formosa plant permit, but financial outlook still bleak

Key Findings

The court ruling rejecting community concerns about toxic air pollution and environmental racial discrimination does not change market forces.

Standard & Poor’s has offered repeated warnings that the investment faces continued pressure from “political and market” forces.

The market for the Formosa plant remains oversupplied, and demand is not likely to increase.

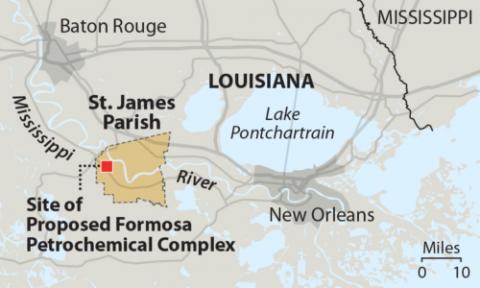

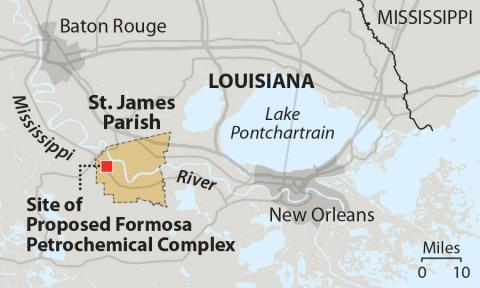

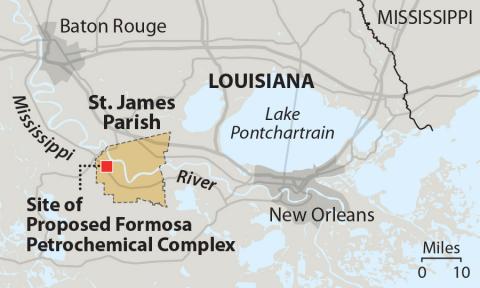

Last week, the Louisiana First Circuit Court of Appeals overturned a lower court decision and reinstated a permit for Formosa’s proposed petrochemical complex in St. James Parish, located in the heart of an area commonly known as “Cancer Alley.”

The decision reverses a lower court ruling that demanded closer scrutiny of the project’s potential to cause a discriminatory health impact due to industrial air pollution saturation in an already heavily burdened African-American community.

The decision provides a go-ahead for a project that has yet to pass environmental muster at the federal level, ignores repeated warnings from Standard and Poor’s, and flies in the face of community sentiments that the siting of the chemical project is unjust. Despite all the legal machinations, however, Formosa has not issued a final investment decision (FID) that would give the corporate go-ahead for the project.

The reinstatement of the Louisiana permit has not reversed the series of negative economic factors that plague the project. An IEEFA analysis has indicated the project is financially unviable based on fundamental market factors.

- The market for the products to be manufactured at the proposed facility currently remains oversupplied. On a global basis, world supply continues to outpace demand for polyethylene, polypropylene and ethyl glycols. This is likely to continue through 2030.

- The oversupply is likely to continue. New projects have recently been added to the market, and at least one more is in construction. CC Polymer’s Golden Triangle project in Texas is expected to come online in 2027, adding 1 million tons to U.S. markets. Shell opened its Pennsylvania petrochemical plant in 2021, which has shown modest performance, according to recent reports.

- The oversupply is not likely to be absorbed. Analysts see slow growth in North America. In the core export region (Northeast Asia and China), economic growth is expected to be slower than predicted when the plant was first planned.

- Increased demand also is likely to be dampened due to sustainability impacts, demographic change and legislative mandates.

- Export demand is unstable. In 2022, the United States exported 54% of the polyethylene produced. The industry’s reliance on exporting is likely to continue given the limited domestic market, with most of the exports going to China and Europe. Yet export scenarios predicated on these two arenas show instability in the medium and longer term.

- Competition with recycled plastic products will reduce the market share for virgin plastics. Recycling in the United States is expected to rise by 50%, achieving an 8.7% share of the market in 2030. The recycled plastics market share is expected to increase by 26% over the next decade, to 11% of the market in 2040.

- The company faces significantly higher construction costs. With rising costs also weakening prices from oversupply, the company has not offered any indication to its investors that explains how the financial structure of the facility still meets the company’s internal return targets.

- Standard and Poor’s, which offered strong cautions regarding the proposed petrochemical complex in October 2021, has not altered its opinion of the project. In October 2023, the company outlook was negative on lower demand, significant debt and higher competition in the commodity markets. The opinion repeated its concern that the Louisiana project faced a negative “political and market” environment. The negative outlook did not include any proposed new spending on the facility.

Any further development action on the project is likely to trigger credit concerns like those expressed in the October 2021 opinion. Moody’s, which holds the company’s rating stable, has still indicated concerns about Formosa‘s plastic business debt levels. - Moody’s, Standard and Poor’s and Fitch each issued new climate guidance in the fourth quarter of 2023 that tightens the link between the sustainability of today’s business investments and companies’ mid-to-long-term profitability.

The financial fundamentals of this scenario have been sufficient to prompt a continued warning from Standard and Poor’s. Moody’s has taken note that rising socioeconomic inequality, political polarization and deteriorating governance threaten the otherwise strong financial outlook for the nation. The Louisiana appeals court decision can only feed the underlying stresses identified in both credit advisories.