The case for virtual power plants

Virtual power plants (VPPs) are every bit as real as conventional generation resources. Essentially collections of distributed battery storage units and other controllable devices, VPPs also can be built quickly and cost effectively—key attributes today given the recent uptick in electricity demand and projections for continued growth in the years ahead.

Let’s look at some recent important VPP success stories.

During this summer’s peak demand periods, VPPs demonstrated repeatedly that they can provide reliable power at scale to utilities and system operators when called upon. They kept the lights on and air conditioners humming across the country, from large-scale projects in California and Texas to smaller but still-effective developments in New England, Puerto Rico, and elsewhere.

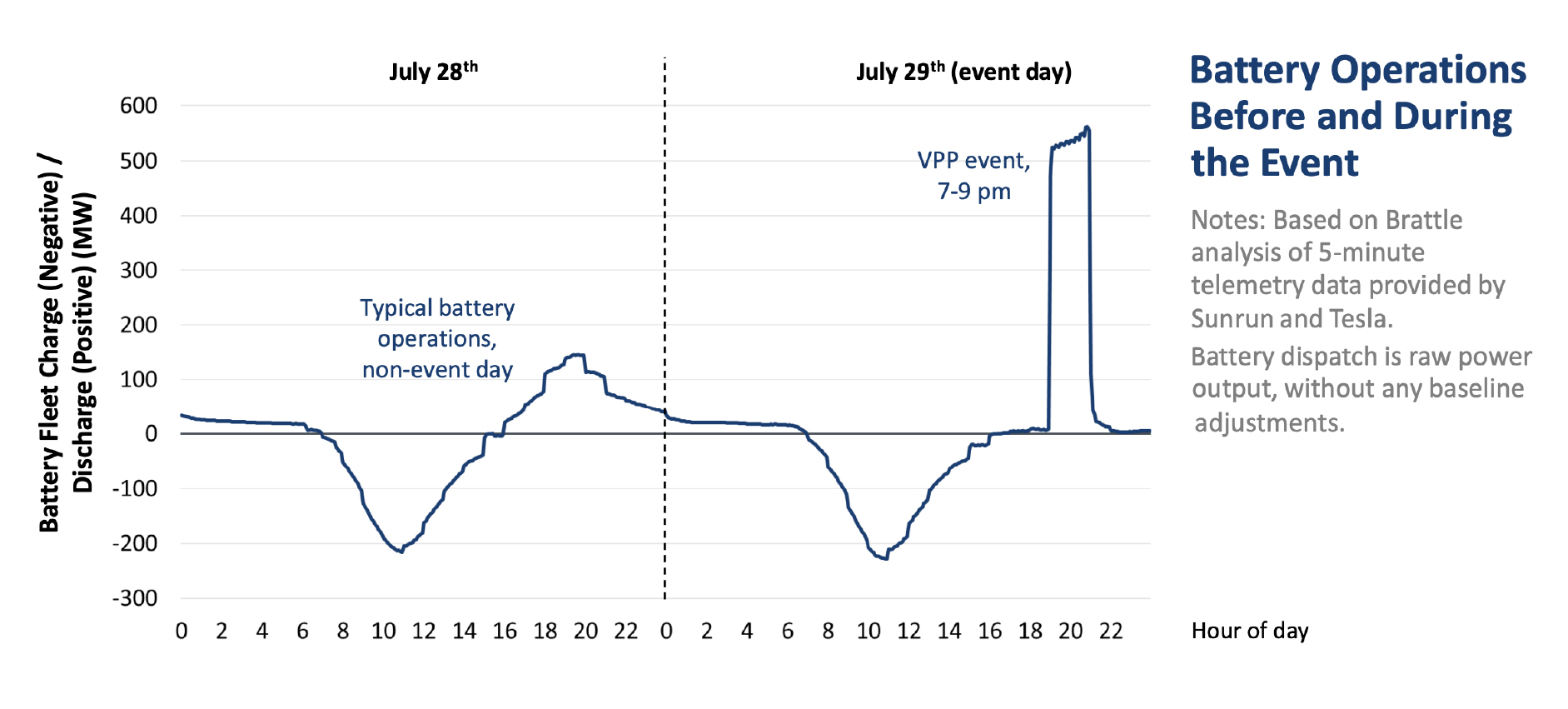

A July 29 California ISO (CAISO) demonstration showed the capability of VPPs. In the test, more than 100,000 participating systems were jointly dispatched during the 7 PM – 9 PM peak demand window. During that period, these behind-the-meter (BTM) batteries sent an average of 539 megawatts (MW) back to the grid, accounting for about 1.9% of CAISO net peak during the test period, according to an analysis of the event conducted by Brattle. CAISO runs the energy market that provides about 80% of the state’s power demand.

Source: Brattle

The graphic illustrates two key points. First, most of the BTM capacity injected into the system during the event was additive to regular daily operations. On July 28, BTM batteries never discharged more than 150 MW to the grid during the evening, far less than the amount recorded during the July 29 test. Second, the output from these disparate BTM batteries was consistent during the event, meaning the system operator could count on it just like any other generation resource.

In other words, BTM battery capacity can cut peak demand, reducing the need to invest in new peaking generation resources.

Sunrun, a residential solar company that has embraced distributed battery storage, is the largest player in the California VPP market. Its customers accounted for 361 MW of the total in the July test. What is particularly notable about that total is how quickly it has grown. Sunrun entered the California VPP market in 2023, signing up 8,500 customers that contributed 34 MW to the market during peak demand periods that year. In 2024, Sunrun’s customer base almost doubled, to 16,200, and was able to discharge just under 50 MW to help meet California’s peak needs. By the beginning of this summer, Sunrun’s customer base had jumped to 56,000, covering 75,000 batteries.

Sunrun is also a major participant in Puerto Rico’s rapidly growing VPP. According to the Puerto Rico Solar and Energy Storage Association, the archipelago now has 175,000 households with installed solar panels, and more than 160,000 of those also have battery storage. Sunrun says it controls 37,000 BTM batteries in the U.S. territory.

Together, that BTM capacity plays a key role in stabilizing the territory’s aging and hurricane-battered electric power grid. For example, on July 9, LUMA Energy, the company that operates Puerto Rico’s grid, said it had dispatched 70,000 batteries, sending 48 MW into the grid and helping it address a generation shortfall. This capacity, LUMA said, helped “in preventing multiple load shedding events and keeping the lights on longer in many communities across the island.”

VPPs are also growing rapidly in Texas, with NRG Energy, Base Power and Sonnen among the companies moving aggressively to build programs in this fast-growing, highly competitive market.

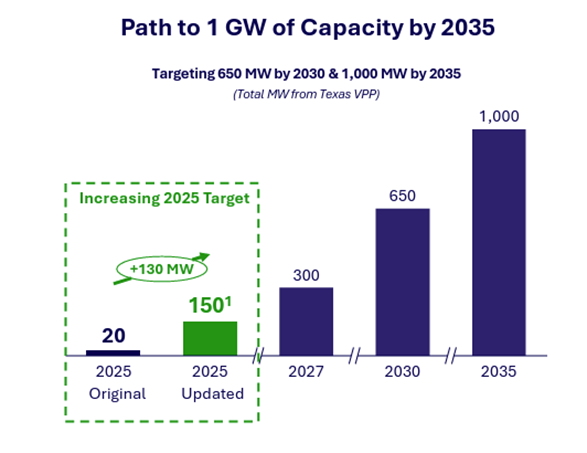

Early this year, NRG launched a VPP program in its home state, with the long-term goal of aggregating 1 gigawatt (GW) of dispatchable residential capacity by 2035. The company’s 2025 goal for the program was initially set at just 20 MW, but the company bumped that up to 150 MW in the second quarter due to stronger than expected demand. The company likely will release updated numbers at its third quarter earnings call, scheduled for Nov. 6.

Source: NRG

Base Power, a well-funded startup, also is optimistic about the Texas VPP market. Zach Dell, son of Dell Technologies founder Michael Dell, launched the company two years ago and recently raised $1 billion to fund its expansion plans. Dell describes Base Power as a gentailer, with its generation supplied by residential batteries. It offers batteries of 25 kilowatt-hours (kWh) or a two-pack of 50 kWh (both large by residential standards, but dwarfed by the size of utility-scale batteries) to potential customers for a monthly fee, sells them their electricity and promises them backup power if the grid goes down. In return, Base Power owns and operates the batteries as it sees fit in the Texas market. The company says it has deployed more than 100 megawatt-hours (MWh) of battery storage capacity in the Texas market to date, and it has big plans. Dell told the Catalyst podcast this month that the company was installing 20 MW of battery storage capacity a month now, and expected to increase that to 100 MW monthly by mid-2026.

Sonnen, the largest VPP operator in Europe, has been steadily expanding in the U.S., led by a growing program in Utah that now incorporates roughly 6,000 homes. Its CEO, Blake Richetta, also sees significant growth potential in the Texas market. In an interview in May he said the company would launch its Texas VPP with 60 MWh of battery capacity, and that the company expected to expand that to 150 MWh by the end of the year.

From the biggest, fastest growing state electricity market in Texas to New England, the smallest of the organized markets around the country, the results are the same: VPPs work. During a June heat wave, ISO-NE was able to cut peak demand by 375 MW through the region’s ConnectedSolutions VPP program, which includes smart thermostats and EV charging equipment as well as battery storage.

The New England example underscores the benefits of VPPs. Without the regional ConnectedSolutions program, ratepayers likely would be forced to pay for a new mid-size peaking power plant that would be expensive to build, particularly given the recent runup in gas turbine prices, and would sit idle most days of the year. Beyond this, Vermont’s Green Mountain Power has been able to use its long-running battery storage VPP to cut costs for its ratepayers. IEEFA has written about this program previously (here and here), and it continues to pay dividends for the utility’s customers. While the total is not final, a GMP spokesperson said the utility’s VPP program had saved ratepayers about $3 million in summer 2025 through reduced transmission demand charges.

VPPs still face opposition, particularly from utilities that have financial incentives to invest in new and expensive conventional generation resources to expand their rate base, thereby generating profits for shareholders. But as this summer’s results demonstrate, VPPs offer a quick, cost-effective means of meeting rising electricity demand.