IEEFA Update: Looking for innovation in the wrong place, ExxonMobil opens an energy-trading desk

ExxonMobil is said to be seeking a much-needed lift through an initiative on which the company has issued no official detail but that will vastly expand its trading capabilities.

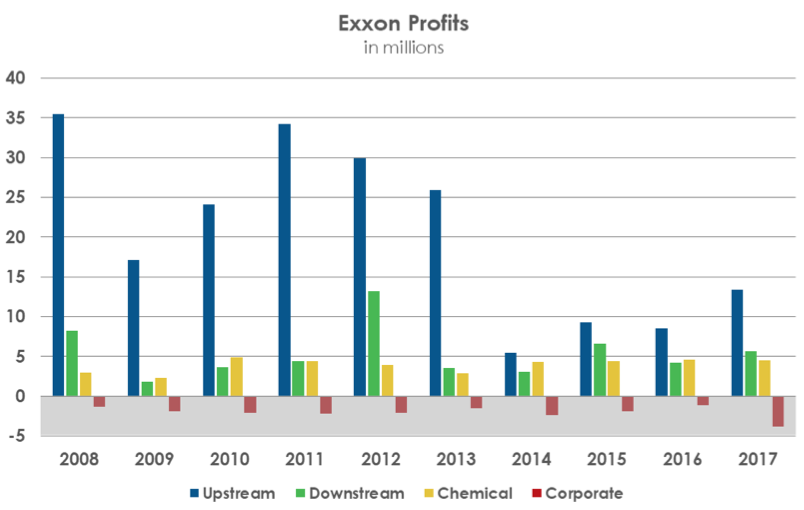

Hopes are, evidently, that by opening a bigger energy-trading desk Exxon—through speculation—can reverse its trend over the past decade toward shrinking profits, a trend driven by the fact that the company cannot sustain its historic gangbuster profits with its current business model.

Historically, global upstream oil and gas drilling have been the company’s profit workhorses, with downstream (refining) operations providing a solid second profit center. Petrochemical operations have added stable yields, with limited upside due to their smaller scale, and asset sales have typically rounded out the profit picture.

But lower core-business profits are the future, especially from upstream (exploration and production) operations, even though the company continues to pursue aggressive upstream-acquisition strategies, which have met with skepticism from analysts and investors.

Oil and gas investments generally are growing more speculative. The 2014 oil price crash did more than tank industry revenues. It exposed weaknesses in the thesis that a company’s value is best determined by the size of its reserves. Wholesale write-offs in recent years of large investments have led to enormous wealth destruction. As a result, investors today rightly want cash returns, not empty talk of new oil reserves in faraway places promising distant-future profits.

Oil and gas investments generally are growing more speculative. The 2014 oil price crash did more than tank industry revenues. It exposed weaknesses in the thesis that a company’s value is best determined by the size of its reserves. Wholesale write-offs in recent years of large investments have led to enormous wealth destruction. As a result, investors today rightly want cash returns, not empty talk of new oil reserves in faraway places promising distant-future profits.

Not much can be done to buoy the value of oil and gas assets as markets seek alternatives to fossil fuels. And, not much can be done, either, to address the negative outlook for the industry, which is being buffeted by competitors, fragmentation of industry alliances, climate change initiatives, popular opposition to oil and gas, litigation risk, and rising costs.

EXXONMOBIL, ESPECIALLY, HAS STALLED LATELY ON THE FINANCIAL-PERFORMANCE FRONT, even as oil prices have tripled since 2016. A new CEO is still proving his mettle, and while one corner of the company says “drill, drill, drill,” another urges greater emphasis on petrochemical operations, risk-sharing on the extraction side and—now—a bigger energy-trading operation.

Advances in fossil fuel technology development have reached their profit-increasing potential, a fact of special salience to ExxonMobil, which has always relied on engineering talent to find the next big thing. Markets have changed, though, and the last big thing, fracking, produced oil and gas at extraordinarily low costs and flooded the market with product so cheap that it had the paradoxical effect of undermining industry profitability. It also helped seal the demise of ExxonMobil’s oil sands operations in Canada.

An underwhelming move for an industry tiger.

ExxonMobil’s current trading capacity is limited to supply distribution and logistics related to the physical fundamentals of the oil and gas markets—moving vast quantities of both around the world. The company has avoided riskier trading strategies such as, say, betting on the forward oil price curve.

ExxonMobil’s trade-desk expansion introduces a potential new profit center, one driven not by fundamental supply and demand, but by data, analysis, and transaction execution. Though the company is late to this game, it could work, even though it would be a truly underwhelming move for an industry tiger.

And it comes with risks. A trading desk will require a new set of skills and a new breed of personnel; this is not a project that can be successfully staffed by lifetime ExxonMobil employees. Energy trading is inherently risky, even for experienced players. And ExxonMobil has only limited experience in this area.

How ExxonMobil designs its trading operations and dips its toe into the commodity markets will be a hot topic of industry discussion. Investors will scrutinize how the company defines and measures performance—and whether it succeeds or fails.

An expanded trading desk suggests a more aggressive short-term revenue pursuit and a determination by ExxonMobil to continue to meet its dividend promises. It also signals an open hunt for innovation, although with this move the company may be looking for innovation in the wrong place. This shift will trigger internal cultural changes in which immediate cash returns will drive corporate behavior, creating greater digitization, new decision-making algorithms, and some layoffs.

At bottom, ExxonMobil’s investment in a bigger trading desk tells us that the company’s stock is becoming more speculative as executives demonstrate less confidence in traditional way of doing business and less faith in traditional business partners in the electricity and transportation industries.

Win or lose, the move underscores how ExxonMobil’s core business is shrinking.

Tom Sanzillo is IEEFA’s director of finance. Kathy Hipple is an IEEFA financial analyst.

RELATED ITEMS:

IEEFA Update: How Gas and Oil Companies Are Starting to Look Like the Yellow Pages (Remember Those?)

IEEFA Update: As ExxonMobil Doubles Down on Oil and Gas, Investors Go Elsewhere