IEEFA: PLN still refusing to adapt, a move which will hurt investors, consumers, and the government purse

23 October 2020 (IEEFA Indonesia): PLN would be better served restructuring its business to address the current energy transition rather than relying on a lifeline of government support while channelling more capital to old polluting technologies of the past, finds a new report by public think tank, the Institute for Energy Economics and Financial Analysis (IEEFA).

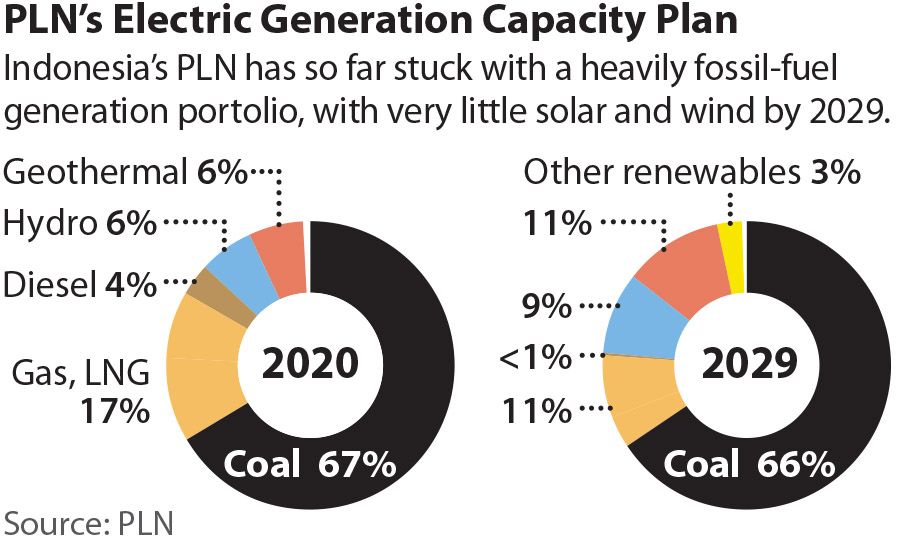

PLN’s Electric Generation Capacity Plan

Author of the new report Melissa Brown says Perusahaan Listrik Negara’s (PLN) planning document released in September 2020 provides insight into PLN’s precarious financial position out to 2022.

“Due to COVID and the global energy downturn, PLN’s chances of a material tariff increase, and more robust cash flow is very low for at least another 18-36 months,” says Brown.

“PLN is still counting on easy access to global bonds markets despite the fact that investors are increasingly shunning issuers that don’t have credible strategies to address energy transition.

“PLN may be better served by revamping its flawed planning process, prioritizing technology-agnostic grid investments, and restructuring.”

BROWN’S REPORT FINDS SIX RISK FACTORS IN PLN’S SEPTEMBER OUTLOOK:

- In its new scenarios for 2021-2029, PLN planners maintain average annual growth at 5.2% in line with their pre-COVID projections, despite much higher risks to economic growth and structural changes in the sector.

- Tariffs will need to increase by more than 30.0% to sustain PLN’s operating cash flow—a level that would surely test public approval.

- In the absence of tariff increases, the price tag of subsidies and compensation over the next two years to cover higher independent power project (IPP) payments will almost double to IDR 170.2 trillion (USD 11.4) as new IPPs come on-line.

- Planned capex cuts could come at a cost to badly needed improvements in system performance, including PLN’s grid which requires significant investment as a result of rapid capacity expansion and poor system control.

- Despite its target of 23% of renewable energy by 2025, PLN is locking-in new fossil fuel baseload in the energy mix for the coming decade, with cost competitive new renewables accounting for only 3.7%.

- The disconnect between the sovereign rating which anchors PLN’s access to debt markets and the company’s deteriorating fundamentals has the potential to bite investors and the Ministry of Finance.

“As the COVID-19 crisis continues to cast a pall over emerging markets and to reprice global energy markets, we expect investors to be more discerning in their approach to sector risks,” says Brown.

New coal lending has all but dried up

“THE ENERGY SECTOR IS IN A PERIOD OF GLOBAL CHANGE. New coal lending has all but dried up, and Moody’s and S&P are now forecasting a shorter and narrower window of opportunity for gas projects to compete effectively against industrial scale renewables.

“The winners in the current energy transition to cheaper, deflationary, renewable technologies are those who learn to reposition assets subject to stranding risk, and those that recognise which assets will bring long-term value in the more diverse energy system of the future.”

PLN may be better served by considering restructuring

Brown says PLN’s September statement is simply poor strategic positioning.

“The official release of the Indonesian government’s annual Electricity Supply Business Plan (RUPTL), when it comes, will be a catalyst for a new round of re-assessment concerning PLN’s financial situation,” says Brown.

“In the meantime, PLN may be better served by considering restructuring, including streamlining operations and shedding costs to realize more efficient market-based outcomes.

“Any restructuring should consider the importance of new capacity procurement, such as in renewable energy technologies, and market structures that will enhance transparency and provide incentives for system services that can displace traditional sources of baseload and peaking power.”

Brown concludes that any discussion of a clean energy pathway for PLN must be accompanied by credible disclosure of the company’s carbon emissions pathway.

Read the Report: Running Out of Options, Six Questions for PLN – Can the Ministry of Finance Find an Exit Plan?

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Melissa Brown ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)