IEEFA: $5.1 billion spend on offshore gas exploration until 2027 could have fostered 2.5GW of renewable capacity and 4,800 jobs

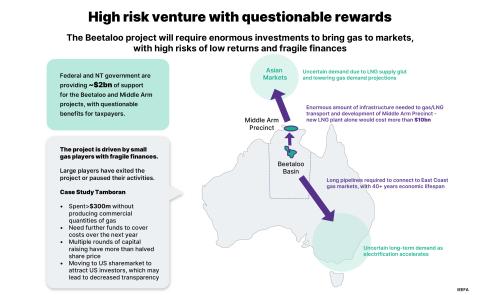

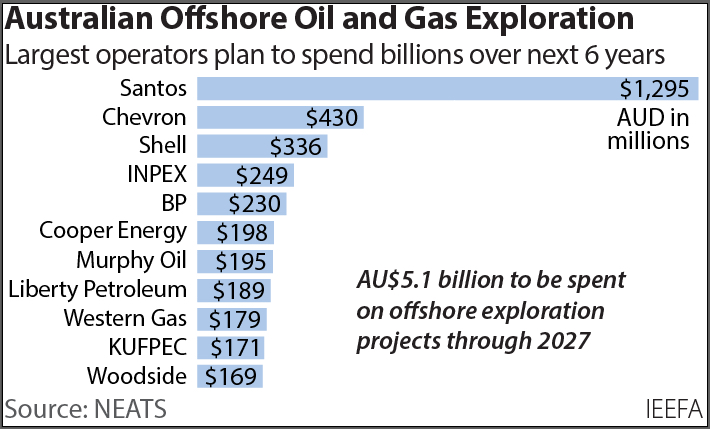

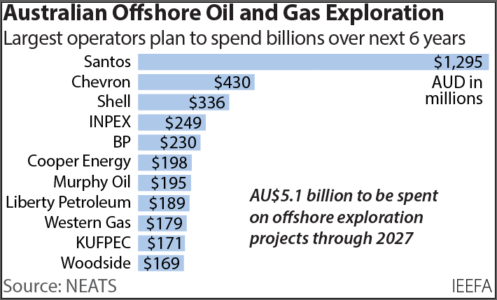

20 September 2021 (IEEFA Australia): Increasing issuance of exploration permits over production, the Australian government has given the green light to oil and gas giants including Santos and Woodside to potentially spend $AUD5.1 billion throughout the next six years on risky offshore exploration activities despite industry-low success rates and the global energy transition, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Although offshore exploration projects have a commercial success rate of only 20-40% according to industry global averages, oil and gas operators are planning to spend $5.1 billion to 2027 on offshore exploration activities likely knowing that over half of that spending – around $3.5 billion – will simply be ‘wiped out’.

Analyst and author of the report Milad Mousavian says the $5.1 billion exploration spend is equivalent to the current capital investment in around 2,500 megawatts of renewable energy projects under construction (or due to start construction soon) in Queensland and Western Australia, which are also creating 4,800 direct green jobs as a by-product, according to the Clean Energy Council.

“The government has opened up huge exploration areas to expand Australia’s offshore industry and in the next 10 or so years, will be expecting an explosion in development drilling like the one that started before the LNG boom began,” says Mousavian.

If Woodside and BHP merge, Woodside will be the biggest operator

“BHP, Exxon, Chevron, Santos, Shell and Woodside have the highest number of involvements (stakes) in Australian offshore ventures, with Santos operating 25% of the total offshore exploration capex. If Woodside and BHP merge, as has been flagged, Woodside will be the biggest operator – with the highest number of stakes in offshore projects – by a long shot.

“However, considering massive global divestment from fossil assets towards renewables, and the inherent risks in the offshore sector, seeing another wave of offshore development is unlikely to occur.

“Government and industry must quickly assess the risks and calibrate their vision to avoid stranded assets in Australian waters.”

Analyst and co-author of the report Bruce Robertson says in addition to global divestment trends, there are industry dynamics the government should be aware of.

“Oil and gas companies have drilled 50% less exploration wells than development wells in Australia over the last decade,” says Robertson.

Oil and gas companies have drilled 50% less exploration wells than development wells

“This is the first time such a divergence between the rate of development and exploration drilling has been seen in Australia’s 50-year offshore industry.

Despite companies’ reduced interest in offshore exploration, the government’s issuance of offshore explorations permits is on the rise while the issuance rate for development (production) licences has dropped dramatically. The Federal government granted 13 exploration titles in 2019 alone, the highest issued in one year during the last decade.

“These counterintuitive dynamics reflect an environment where companies’ bottom lines are at risk, and they know it,” says Robertson.

“Companies’ reluctance to drill exploration wells relative to previous decades shows the industry itself is losing confidence in future large-scale commercialisation of exploration projects and is focussing more on definite lower-risk cash generative production assets currently at hand.

“With more than 70% of the Australian LNG industry being fed by offshore gas, there can’t be a clearer message for the government to hear.”

More than 70% of the Australian LNG industry is being fed by offshore gas

Mousavian says the government is ignoring warnings by the International Energy Agency that no new oil and gas projects should be commissioned in order to reach zero carbon emissions by 2050.

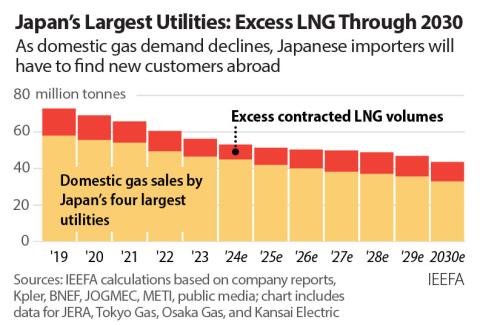

“Big economies like U.S., Canada, Brazil and South Korea have increased their commitments towards carbon neutral emission targets and Japan, Australia’s biggest LNG customer, wants to halve LNG use in its power sector by 2030,” says Mousavian.

“Oil and gas companies are cognisant of the global transition to low carbon economies and additional risks facing the sector, most of which they can’t control.”

IEEFA has identified five major risks specifically confronting Australia’s offshore sector and consequently the investors who finance offshore oil and gas projects.

- Australia’s export markets are abandoning gas, posing a serious threat for Australian LNG exports. Japan’s 50% reduction of the LNG share in its electricity mix by 2030 may have a domino effect on other southeast Asian LNG customers such as South Korea.

- LNG’s uncertain demand future has increased producer’s investment risk and the cost of financing. A growing number of customers are seeking 10-15 year shorter LNG contracts with more flexible conditions, including the ability to resell cargos in case of glut.

- Oil and gas companies are facing increasing climate-related financial risk. Enormous methane leakages detected in remote offshore areas by advanced satellite-based emission tracking technologies seriously threatening oil and gas companies’ social license and the validity of industry terminologies such as ‘carbon neutral LNG’, and will likely spur global adoption of more stringent carbon emission regulations.

- The cost of financing is rising as the risk is being centralised by fewer number of partners in offshore ventures. Big oil and gas companies are unable to sell down their holdings in billion-dollar projects due to partners now being unwilling to commit. Financial institutions are more likely to consider higher interest rates for a project with one or two partners, compared to a project with several partners.

- Project capex costs are rising due to deeper drillings. Companies have been drilling on average 20% deeper since last decade to reach oil and gas offshore, exponentially inflating a projects’ capex despite the emergence of more efficient drilling technologies.

“Like the demise of coal, it’s time for the government and industry to recognise the time to transition out of gas is now,” says Robertson.

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Bruce Robertson ([email protected]) and Milad Mousavian ([email protected])

Authors are available for background briefing and/or interview

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)