LNG exports boom but Australians pay the price

Domestic gas prices triple, factories close and hundreds of jobs lost

Key Takeaways:

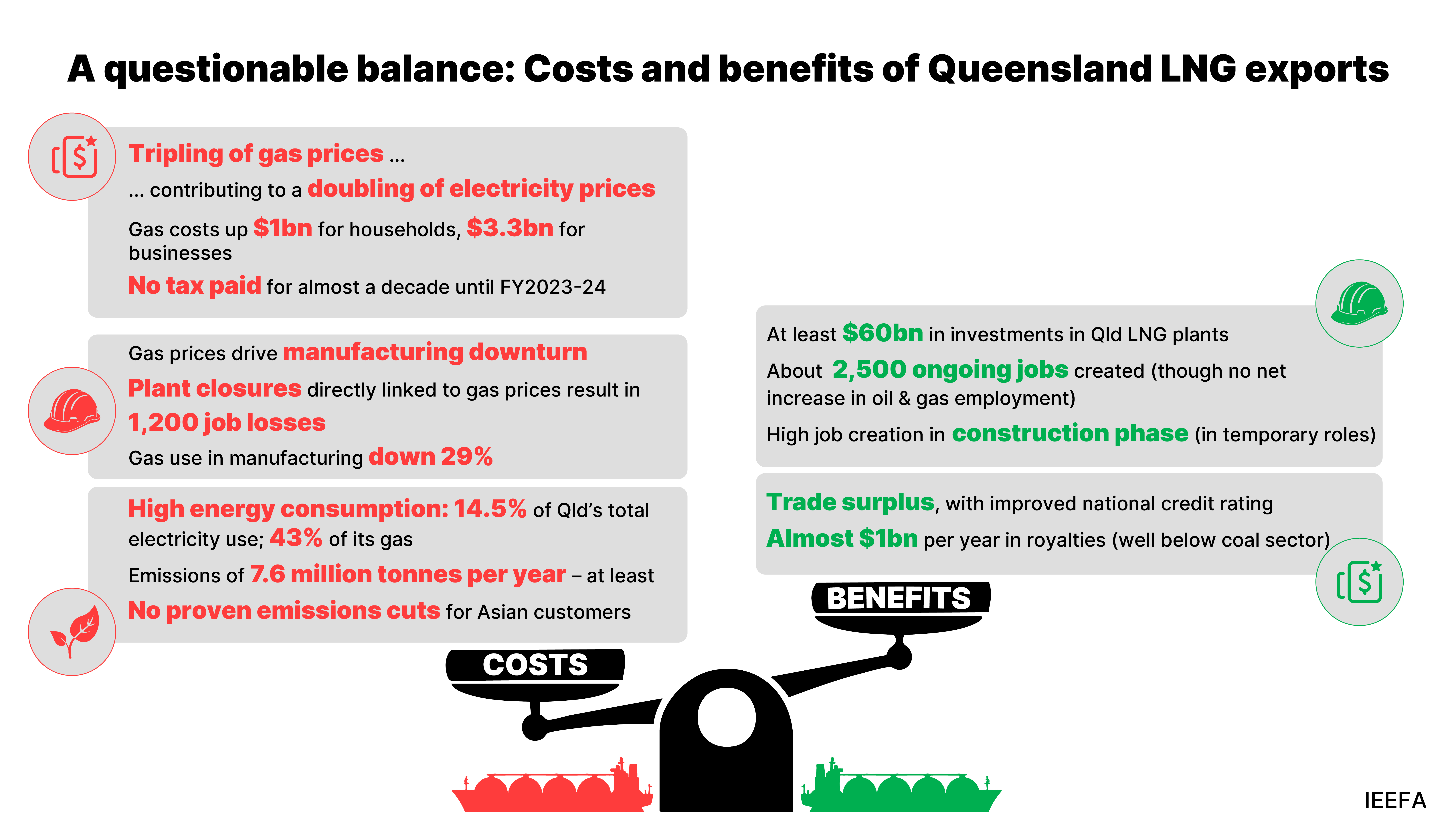

Queensland’s LNG projects have generated relatively limited ongoing economic benefits, with returns and royalties well below expectations and negligible tax paid until FY2023-24.

LNG exports have tripled gas prices, costing households and businesses an extra AU$4.3 billion in FY2023-24. High gas prices also contributed to a doubling in electricity prices and higher inflation.

LNG exports increased Queensland’s carbon emissions, comprising 5.5% of the state’s emissions in FY2022-23. If Queensland achieves its 2035 emissions target, the LNG sector’s share could reach 16%.

High gas prices have contributed to at least 1,240 manufacturing job losses, with 500 more under threat. This represents 70% of the Queensland LNG exporters’ total workforce, and raises questions about the best uses for Australia’s gas.

22 October 2025 (IEEFA Australia): A decade on from Queensland’s LNG export boom, the promised economic benefits have proved limited while coming at a cost to households, workers, businesses and taxpayers, according to a report released today.

Despite an initial $60 billion investment and a subsequent surge in construction, Queensland’s three LNG export ventures continue to earn substandard rates of return. Meanwhile, the new export industry has had economic repercussions throughout eastern Australia, with consumers paying billions in higher gas prices, and a manufacturing sector in retreat, finds the report The hidden costs of the LNG boom.

“Proponents of LNG exports point to the broader social and economic benefits from exports,” says the author Kevin Morrison, Energy Finance Analyst, Australian Gas at the Institute for Energy Economics and Financial Analysis (IEEFA). “However, assessing the net economic benefits of the industry requires a recognition of its adverse impacts and costs.”

These impacts include:

- Domestic gas prices in eastern Australia tripled in a decade, driving up inflation.

- The three LNG consortia paid no corporate tax for almost a decade, until FY2024.

- State royalties fell far below early forecasts, until changes in 2022.

- High gas prices are forcing factories to close, costing 1,240 jobs to date with 500 more at risk.

- The indirect cost of LNG exports for Australian businesses and consumers is estimated in the billions.

The report questions whether exporting so much LNG is the best use for Australia’s gas, particularly uncontracted gas siphoned from the local market to fulfill overseas contracts that could be redirected to domestic use.

“The economic costs and negative impacts from Queensland’s LNG sector have been felt across eastern Australia,” Mr Morrison says. “Domestic gas prices have tripled, leading to an estimated A$2 billion increase in residential gas costs when prices peaked in FY2022-23.

“Manufacturers also report paying nearly 50% more for gas in 2025 than they did in 2019. Based on wholesale gas prices, IEEFA estimates the total cost of gas to Australian businesses increased by more than $6 billion between FY2014-15 and FY2022-23.”

High gas prices have been cited in a string of factory closures in the fertiliser, chemicals, plastics and glass industries, and a subsequent steep drop in gas demand from manufacturing. The Australian Competition and Consumer Commission (ACCC) has warned of more job losses if high gas prices persist, with wider implications for the economy.

“Since 2021, these manufacturing closures, all in eastern Australia, have resulted in at least 1,240 job losses, with a further 500 jobs at imminent risk,” Mr Morrison says. “The combined total is about 70% of the estimated workforce employed at Queensland’s three LNG export plants.”

IEEFA estimates 1,500 jobs are created for each petajoule (PJ) of gas used in chemicals manufacturing, while only about four jobs are created in the oil and gas industry by that measure.

The LNG export industry has had other effects on Queensland’s energy market, adding more than 10% to the state’s electricity demand and contributing 5.5% of its total carbon emissions, a level that could rise to 16% by 2035.

As Queensland’s LNG exports surged over the past decade, gas supply to the domestic market has constricted and, as a result, gas and electricity prices have soared across eastern Australia.

“IEEFA estimates the total annual residential gas bill increased 44% to $7.8 billion in eastern Australia from FY2014-15 to FY2023-24,” Mr Morrison says. “This is partly attributable to increases in the wholesale gas cost component, which rose by $1 billion over this period. Victorian households were most affected, as they account for about two thirds of the total residential gas bill ($5 billion in FY2023-24), followed by NSW households ($2 billion).

“Higher gas prices also contributed to material increases in electricity prices due to the strong linkage between gas and electricity prices. The consequences, such as higher energy bills and food production costs, have added to the inflationary pressures facing Australian households and the economy.”

Read the report: The hidden cost of the LNG boom

Media contact: Amy Leiper, ph +61 414 643 446, [email protected]

Author contacts: Kevin Morrison, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)