Key Findings

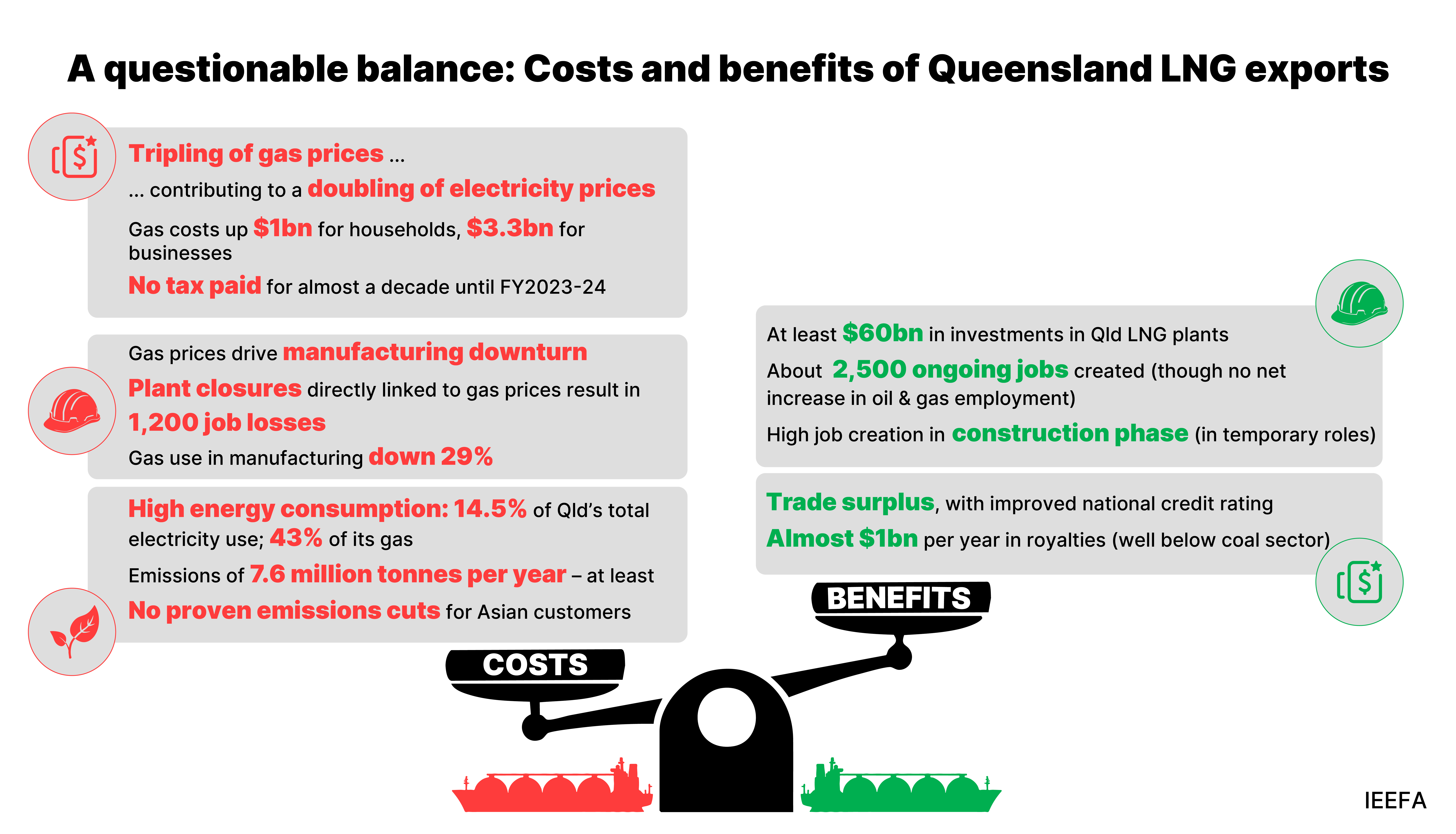

Queensland’s LNG projects have generated relatively limited ongoing economic benefits, with returns and royalties well below expectations and negligible tax paid until FY2023-24.

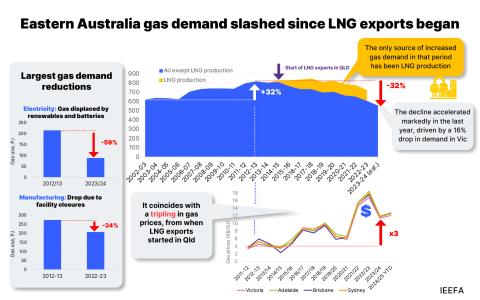

LNG exports have tripled gas prices, costing households and businesses an extra AU$4.3 billion in FY2023-24. High gas prices also contributed to a doubling in electricity prices and higher inflation.

LNG exports increased Queensland’s carbon emissions, comprising 5.5% of the state’s emissions in FY2022-23. If Queensland achieves its 2035 emissions target, the LNG sector’s share could reach 16%.

High gas prices have contributed to at least 1,240 manufacturing job losses, with 500 more under threat. This represents 70% of the Queensland LNG exporters’ total workforce, and raises questions about the best uses for Australia’s gas.

Australia’s liquefied natural gas (LNG) boom has been credited with driving material investment, employment and taxation in the country. In Queensland, about AU$60 billion was invested to build three LNG export plants, with the first shipments leaving in 2015. This investment generated thousands of construction jobs and contributed to Australia regaining a trade surplus.

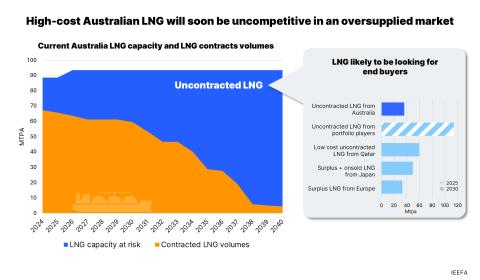

However, the lasting economic benefits have been limited. The LNG plants support a smaller number of ongoing jobs, and net employment in the Australian oil and gas industry has not increased since the 2010s. Each project has effectively achieved a negative net present value, earning substandard rates of return.

For almost a decade, none of the three LNG consortia in Queensland paid corporate tax. In the fiscal year (FY) 2023-24, the Australia Pacific LNG and Queensland Curtis LNG ventures began paying corporate tax. Royalties to the Queensland government were also well below expectations until the royalty regime was revised in 2022.

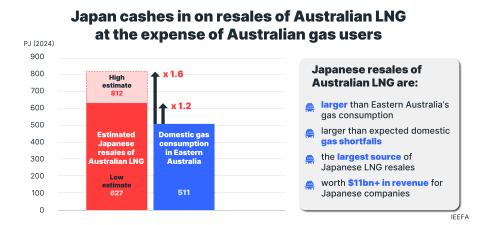

In contrast, the economic costs and negative impacts from Queensland’s LNG sector have been felt across eastern Australia. Domestic gas prices have tripled, leading to an estimated AU$1 billion increase in residential gas costs (in FY2023-24 from FY2014-15). Manufacturers also report paying nearly 50% more for gas in 2025 than they did in 2019. Based on wholesale gas prices, IEEFA estimates the total cost of gas to Australian businesses increased by more than AU$3 billion between FY2014-15 and FY2023-24.

Higher gas prices also contributed to material increases in electricity prices due to the strong linkage between gas and electricity prices. The consequences, such as higher energy bills and food production costs, placed inflationary pressures on Australian households and the economy.

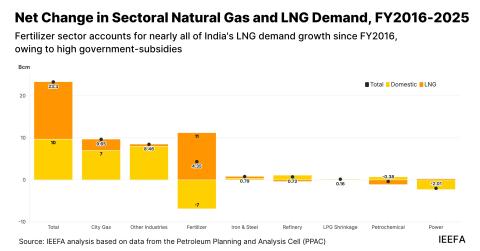

In manufacturing, high gas prices have contributed to plant closures and a subsequent significant drop in gas use. In eastern Australia, gas use in manufacturing in FY2023-24 was down 29% from its peak in FY2013-14, with recent data suggesting further declines. The fertiliser sector has been among the hardest hit, with several plants closing in eastern Australia, and another in serious doubt. Other facilities, such as plastics manufacturer Qenos, which employed 700 people, have cited high gas prices as a key factor in their closure.

Since 2021, these manufacturing closures, all in eastern Australia, have resulted in at least 1,240 job losses, with a further 500 jobs at imminent risk. The combined total is about 70% of the estimated workforce employed at Queensland’s three LNG export plants – about 2,500 people.

The Australian Competition and Consumer Commission has warned of further manufacturing closures if high gas prices persist, with broader repercussions for the economy.

This raises the question whether LNG exports are the most valuable use of Australian gas (particularly uncontracted gas that could be supplied domestically), given about 1,500 jobs are created for each petajoule of gas used in chemicals manufacturing, while only about four jobs are created for each petajoule of gas used in the oil and gas industry.

East coast LNG exports have also materially increased Queensland’s electricity demand, both on annual and peak bases, accounting for close to 15% of total electricity consumption in 2017. The surge in LNG exports also reduced gas supply to the domestic market.

The energy required to extract gas and liquefy it means the three LNG exporters are major greenhouse gas emitters, accounting for more than 5% of Queensland’s total emissions in FY2022-23. Their share of emissions is likely to grow as Queensland’s economy decarbonises to achieve its emissions reduction targets. IEEFA estimates the sector’s FY2023-24 emissions, if maintained, would account for 16% of Queensland’s carbon budget by 2035.

These emissions carry broader social costs. Based on Infrastructure Australia estimates, IEEFA calculates the social costs of the LNG sector’s emissions were AU$328 million to AU$492 million in FY2023-24. This would increase to AU$1.28 billion to AU$2.1 billion in FY2034-35 if emissions levels are maintained, which is possible given LNG production forecasts are relatively stable to 2035.

Proponents of LNG exports point to the broader social and economic benefits from exports. However, assessing the net economic benefits of the industry requires a recognition of its adverse impacts and costs.