How Japan cashes in on resales of Australian LNG at the expense of Australian gas users

Download Briefing Note

View Press Release

Key Findings

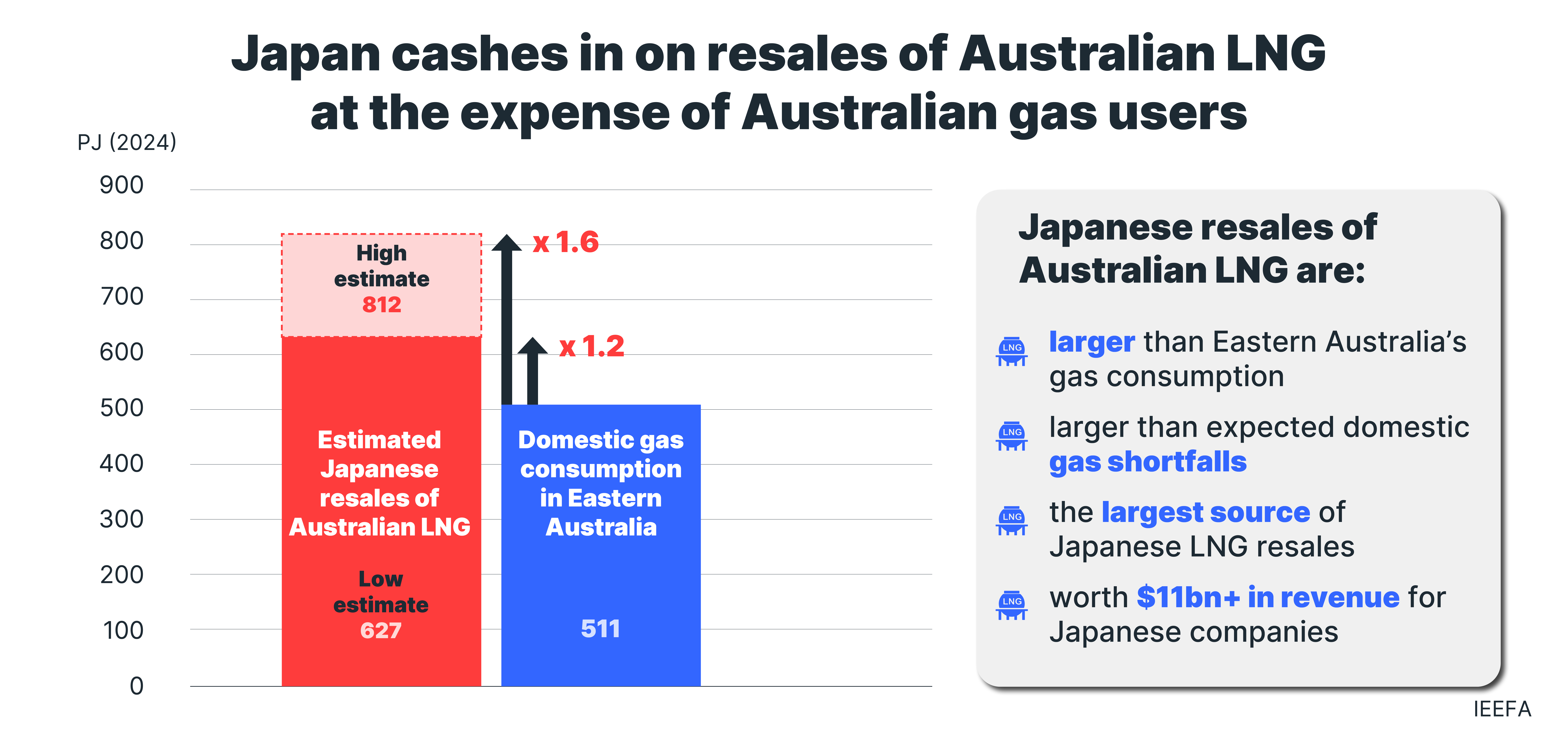

In 2024, Japan onsold at least 600 petajoules (PJ) of Australian LNG to overseas markets, and potentially 800PJ, more than Eastern Australia’s annual domestic gas consumption.

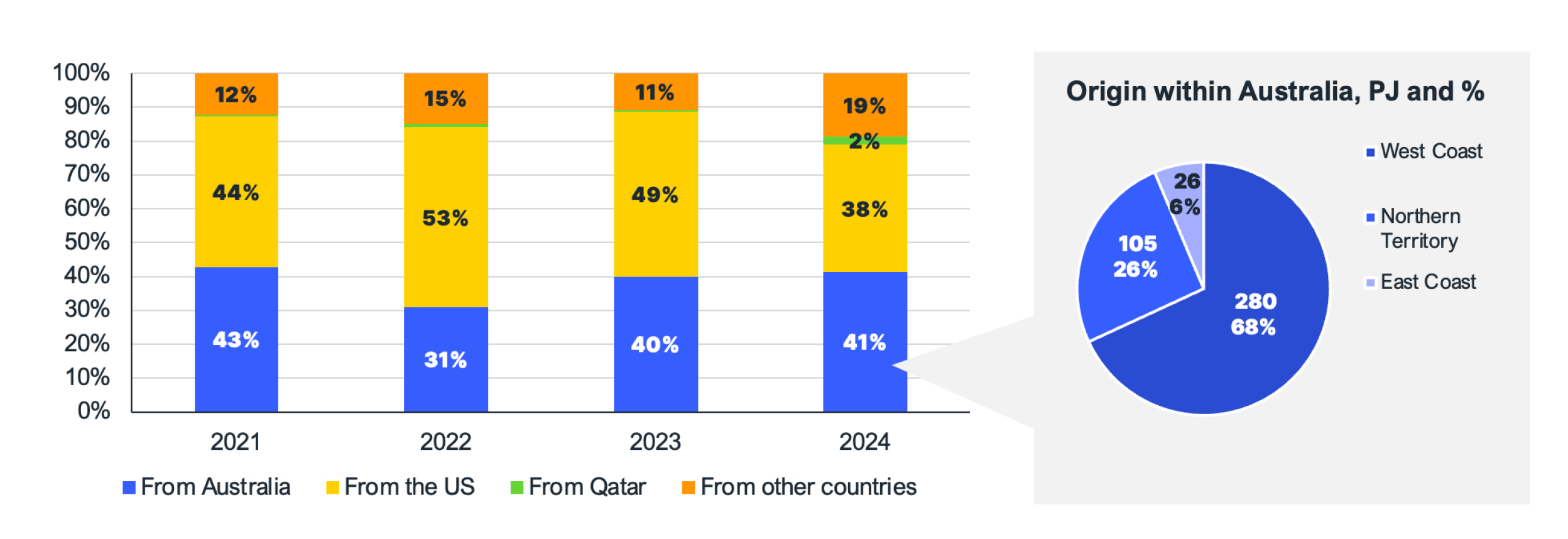

Australia was the largest source of Japanese-chartered LNG shipments sold to third countries in 2024, supplying 41% of cargos.

Japanese resales of LNG from both Eastern and Western Australia are larger than the projected annual gas shortfalls in those regions in the coming years.

Japanese resales are likely driving more than A$1 billion in profits for Japanese companies, raising questions about Japan’s interests in Australia’s energy policies.

As both Eastern and Western Australia face gas shortfalls, Japan is onselling vast volumes of Australian LNG at a handsome profit.

In-depth analysis of LNG shipment and contract data shows Japanese companies are lucratively onselling about half as much as they import from Australia. Last year alone, Japan onsold an estimated 11.3 million tonnes (Mt) to 14.7Mt of Australian LNG. In petajoule (PJ) terms, this means Japanese resales of Australian LNG likely amount to at least 627PJ and up to 812PJ, or 1.2-1.6 times Eastern Australia’s total domestic gas consumption.

Australia appears to be the largest source of LNG onsold by Japan, representing 41% of Japanese-chartered shipments sold to third countries last year, followed by the US. Very little LNG was apparently sourced from Qatar, which produces similar volumes as Australia and the US, likely due to strong destination restrictions in Qatari LNG contracts.

Within Australia, the largest sources are Western Australia, followed by the Northern Territory and then Queensland. In both Eastern and Western Australia, Japanese resales volumes are larger than the projected annual gas shortfalls in the coming years.

Origins of Japanese-chartered LNG shipments sold to third countries

With Japan’s domestic gas use steadily declining, LNG importers there have discovered a lucrative side hustle in this third-party trade. Last year alone, IEEFA estimates Japanese companies resold AU$11 billion to AU$14 billion of Australian LNG with profits likely exceeding AU$1 billion.

With such a large volume of Australian LNG being purchased and resold by Japan, the profit on those resales is likely a key driver for Japan’s interest in the Australian energy market. This is evidenced by the fact that the total volume of Australian LNG shipments going to Japan (26.4Mt) equals the total volume of contracts (26.6Mt), showing resales are not due to contract surpluses.

More than two thirds of the resold LNG ends up in Taiwan and South Korea, high-value markets for Australian gas producers. This should be concerning for Australian producers, for whom these are premium markets with high purchasing power and low credit risk. Based on Australian government estimates of market value in 2023, those two markets present the highest value of Australia’s major LNG markets at AU$979 and AU$1,086 per tonne of LNG respectively, compared with an average export value of AU$921 per tonne.

The Australian government should scrutinise Japanese companies’ resales of Australian LNG, how they affect Australia’s gas markets and how they compete with Australian producers. It would also be worthwhile to examine the motives behind the Japanese government’s persistent attempts to exert influence on Australian energy policy.