Understanding the competitive landscape for China’s LNG market

Download Briefing Note

Key Findings

Gas exporters have touted the potential of liquefied natural gas (LNG) to replace coal and reduce emissions in China. China’s LNG demand appears limitless when viewed as a simple substitute for coal.

However, LNG faces intense competition from coal, renewables, and other gas sources in terms of cost and energy security. For example, in the power sector, LNG has yet to reduce China’s coal usage due to high costs and the rapid growth of cheaper renewables.

Volatility in global markets and escalating tensions with suppliers like the U.S. have only weakened the case for LNG in China. If the country’s demand stagnates, Chinese companies may increasingly look to resell contracted LNG abroad, exacerbating the global market oversupply set to emerge later this decade.

Over the last decade, China has been a shining star in the liquefied natural gas (LNG) industry. When markets waned in 2016 due to global oversupply, China jumpstarted LNG purchases to become the world’s largest importer in 2021. Following Russia’s invasion of Ukraine, Chinese companies signed a flurry of LNG deals while European buyers hesitated to commit to long-term contracts.

Gas exporters have also touted LNG’s potential to replace coal and reduce emissions in China. A United States (U.S.) gas producer recently suggested that since China’s electricity mix “mirrors” that of Ohio and Pennsylvania in 2005, China might use LNG to pursue a similar coal-to-gas switching model. When viewed as a simple substitute for coal, China’s LNG demand appears limitless.

However, the role of LNG can only be understood in relation to its alternatives. LNG faces intense competition from coal, renewables, and other gas sources in terms of both cost and energy security. In the power sector, for example, LNG has yet to make a dent in China’s coal usage due to high costs and the rapid growth of cheaper renewables. As a result, many expect the rate of China’s gas demand growth to slow, curtailing the need for LNG.

Ongoing volatility in global markets and escalating tensions with suppliers like the U.S. have only weakened the case for LNG in China. If the country’s demand stagnates and remains price-responsive, Chinese companies may increasingly look to resell contracted LNG abroad, exacerbating global market oversupply set to emerge later this decade.

China’s 2024 LNG demand: Recovery or growth?

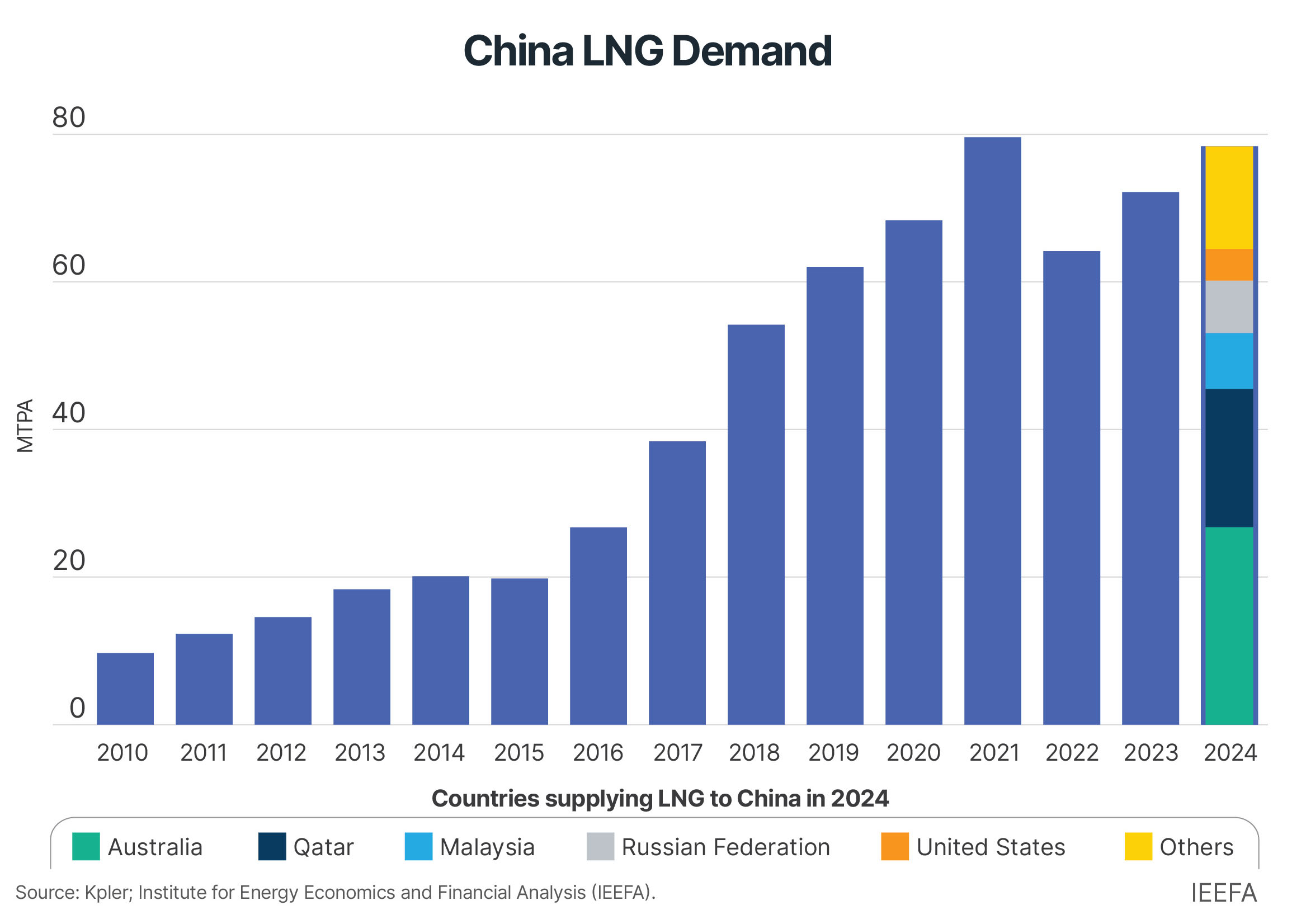

At first glance, China’s LNG market appears to be booming. Imports jumped nearly 9% in 2024 to 106 billion cubic meters (bcm) or 78 million tonnes (mt), according to Kpler data. The country’s supply came from Australia (34%), Qatar (24%), Malaysia (10%), Russia (9%), and the U.S. (6%).

Despite the year-on-year increase in 2024, China’s LNG imports fell 2% shy of record purchases in 2021 and grew at a slower pace than in 2023. The country’s multi-year demand recovery demonstrates the prolonged consequences of market volatility and geopolitical uncertainty on LNG demand.

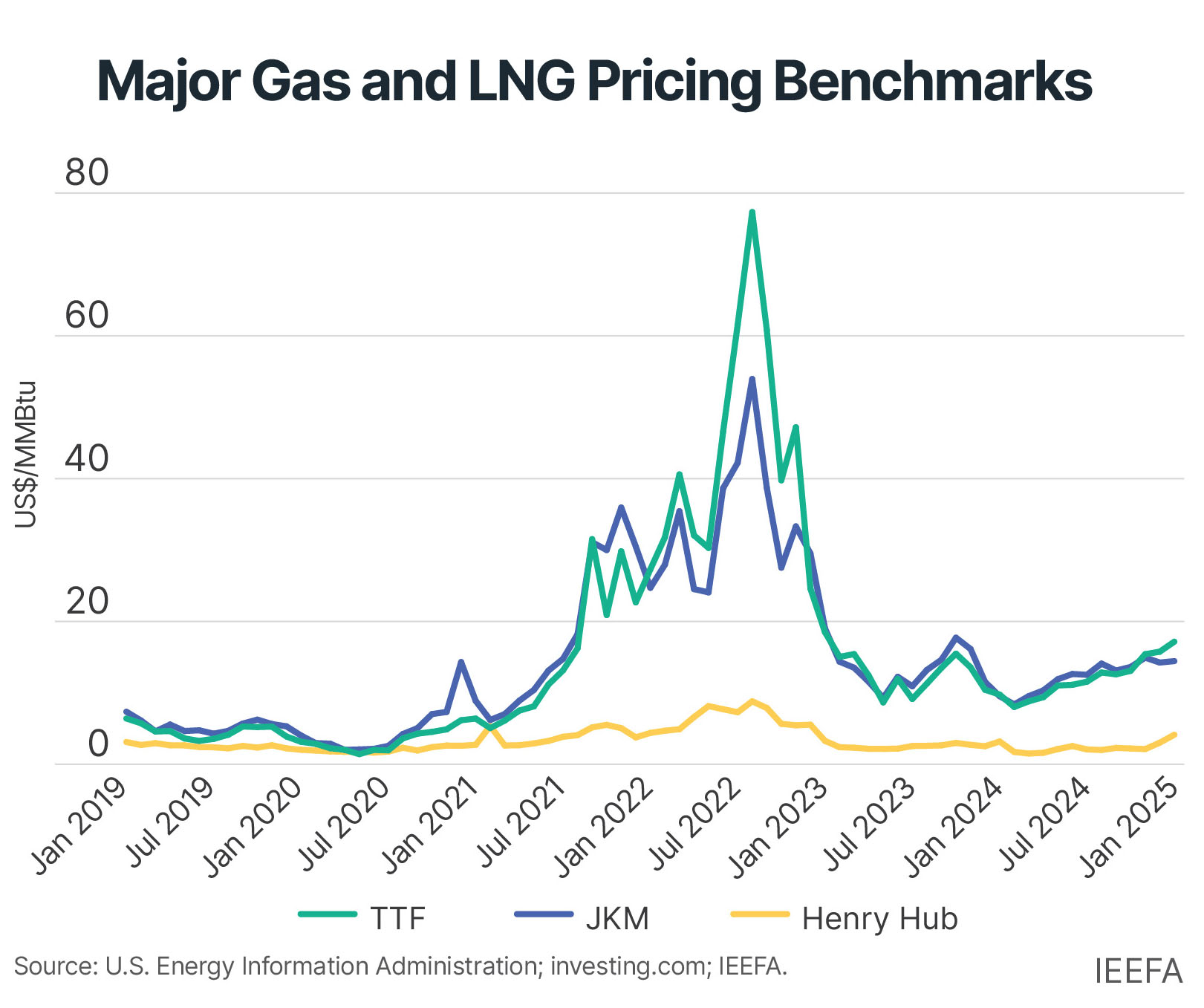

Lower imports compared to three years earlier reflect the country’s slower economic growth, COVID-19 lockdowns, and unaffordable LNG prices exacerbated by Russia’s invasion of Ukraine. As prices started to jump in late 2021, Chinese buyers were forced to withdraw from spot markets entirely. In 2022, Chinese LNG demand plummeted 19%.

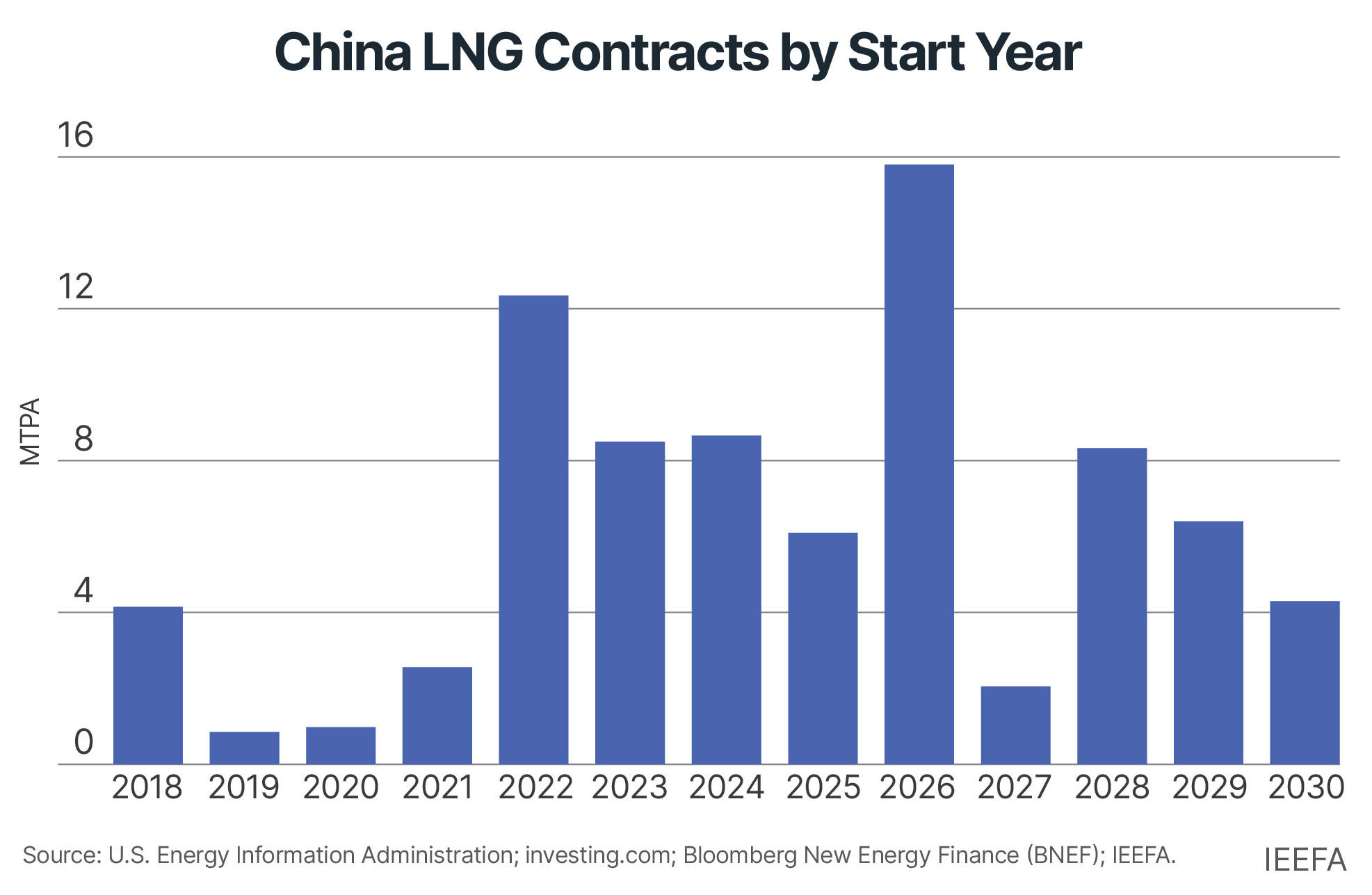

At the same time, Chinese companies dramatically reduced their future spot market exposure by signing long-term contracts. In 2021 and 2022, China signed a combined 44mt of LNG contracts, four times the volume signed in the two years prior. Most of those contracts were signed with the U.S., followed by Qatar, and the largest share will begin deliveries in 2026.

China may have sufficient LNG purchase agreements to satisfy LNG demand through 2030, which means Chinese buyers will likely sign fewer contracts in the future. However, this does not necessarily imply that contracted volumes will land in China. Since the majority are with U.S. suppliers offering flexible destination terms, Chinese companies, many of which are active LNG traders, can resell volumes abroad if fundamentals at home favor other energy resources.

The bigger picture of gas demand and supply

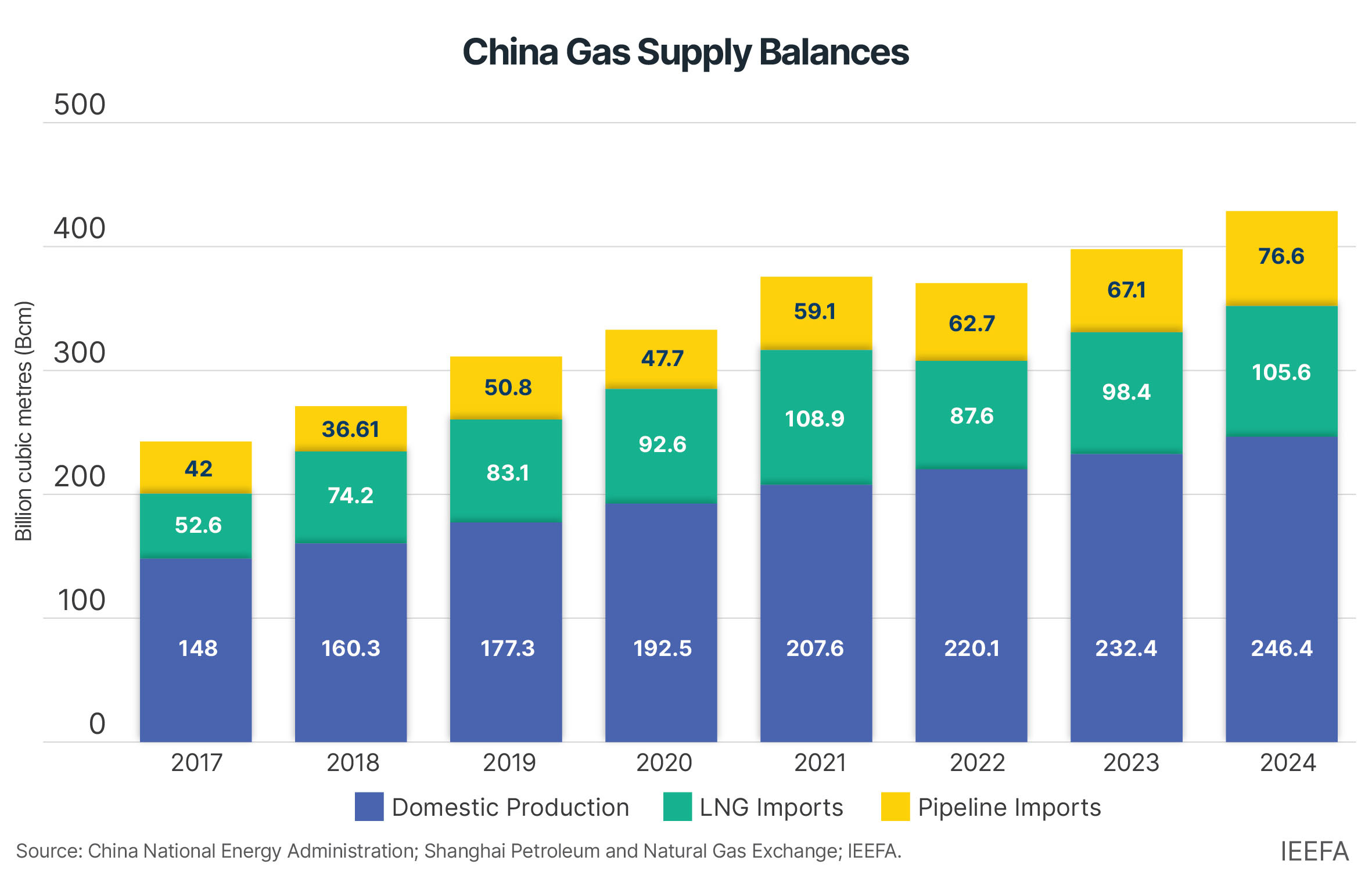

Although new LNG purchase contracts will begin in the coming years, China has met a growing share of its overall natural gas demand from cheaper, more reliable gas sources, namely domestic production and pipeline imports.

Preliminary figures indicate that China’s overall gas consumption increased by 30.7bcm, reaching 428bcm in 2024. Since 2017, China’s apparent gas demand — production plus imports — has increased at an average rate of 8% annually. The largest share of natural gas is consumed in the industrial and city gas segments — which account for 42% and 33%, respectively — followed by the power and fertilizer sectors.

Domestic gas production contributed nearly half of China’s incremental demand in 2024. In the last decade, the country has accelerated the development of unconventional and ultra-deep resources, particularly in the Sichuan, Ordos, and Tarim gas basins. China produces 23.8 billion cubic meters per year (bcm/y) of shale gas but is estimated to have 20 trillion cubic meters of reserves.

In 2021, President Xi Jinping emphasized the importance of domestic energy self-sufficiency, and investment in domestic oil and gas production spiked 19% the following year. In 2023, the China National Petroleum Corporation (CNPC) began extracting gas from ultra-deep shale formations in the Sichuan Basin, then completed 14 ultra-deep gas wells in Xinjiang’s Tarim Basin to supply an additional 1bcm to eastern provinces.

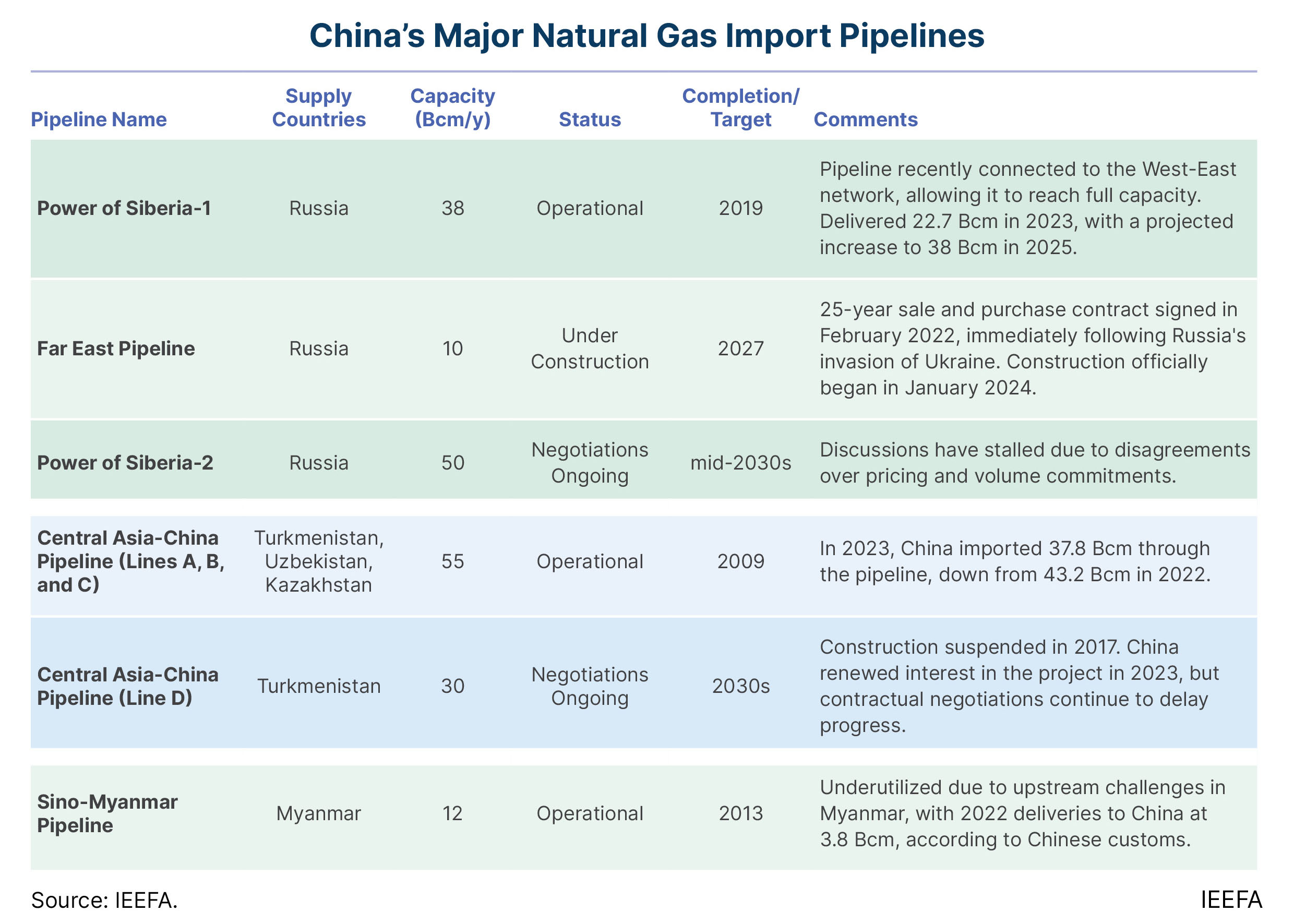

Higher pipeline imports from Russia and Central Asia also contributed to a large share of incremental demand. In particular, flows through the Power of Siberia-1 pipeline from Russia are set to increase from 22.7bcm in 2023 to the pipeline’s full capacity of 38bcm in 2025. In January 2024, China and Russia began constructing the 10bcm/y Far East Pipeline, extending an existing Russian pipeline system to northeastern China by 2027.

Larger projects from Russia and Central Asia have been discussed for years but may not come to fruition until the next decade, if at all. A second Power of Siberia pipeline with Russia could add 50bcm/y of capacity, and the Line D pipeline from Turkmenistan would add 30bcm/y of capacity to China. In both cases, Beijing holds the upper hand in negotiations due to the diversity of its gas supply sources, demanding low prices that remain untenable for counterparties in Russia and Turkmenistan.

Kazakhstan also aims to significantly increase gas exports to China by building an additional pipeline to feed the Central Asia-China network by 2027.

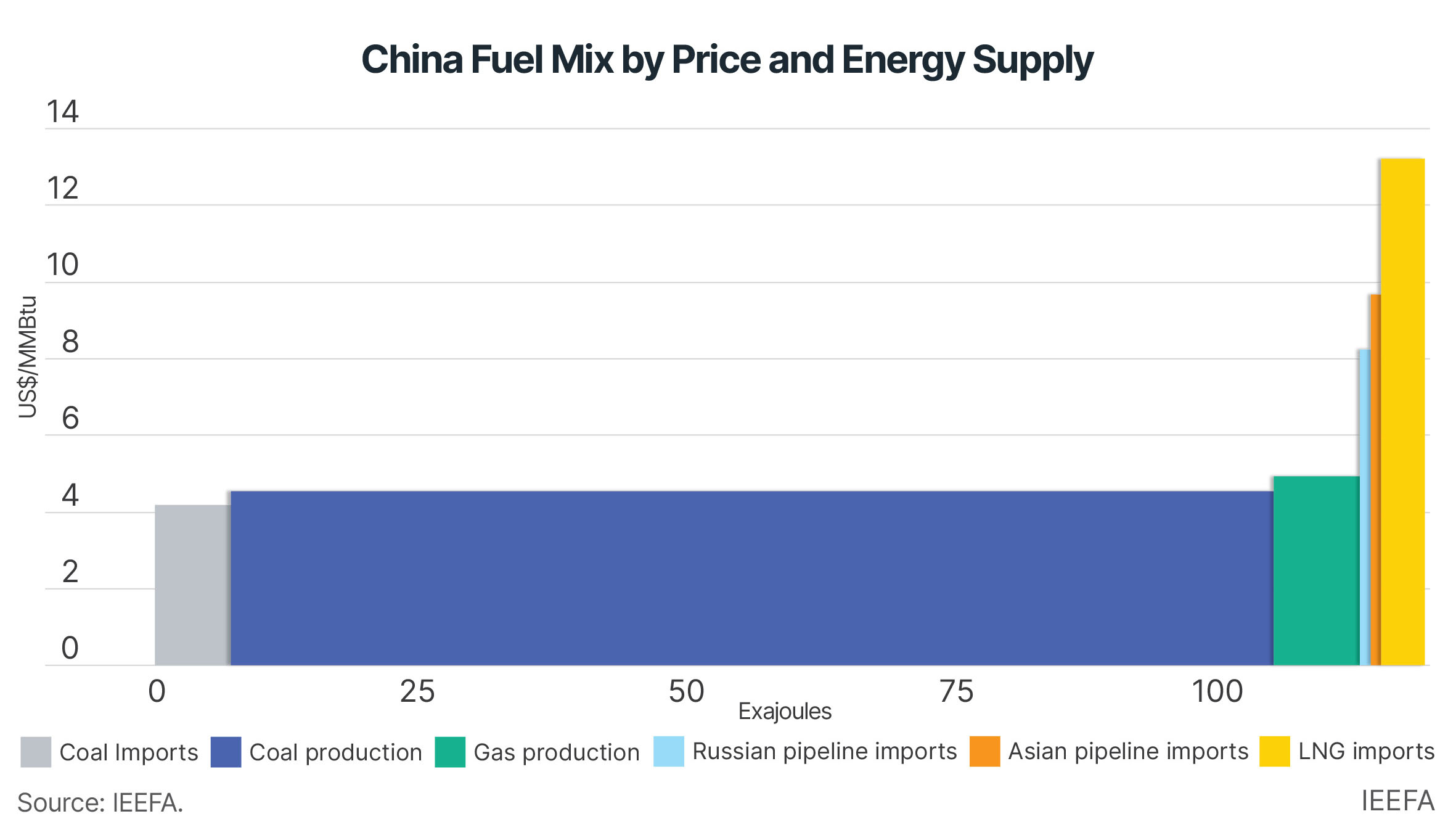

These new pipeline connections and higher domestic output could rein in China’s LNG demand over the long term on cost alone. Last year, the Institute for Energy Economics and Financial Analysis (IEEFA) estimated that the average cost of domestically produced gas was roughly US$5 per metric million British thermal units (MMBtu), compared to US$8-10/MMBtu for pipeline imports and over US$13/MMBtu for LNG. Competition between Central Asian and Russian suppliers enhances China’s ability to negotiate cheaper pipeline imports.

Renewables growth hinders China’s coal-to-gas switch

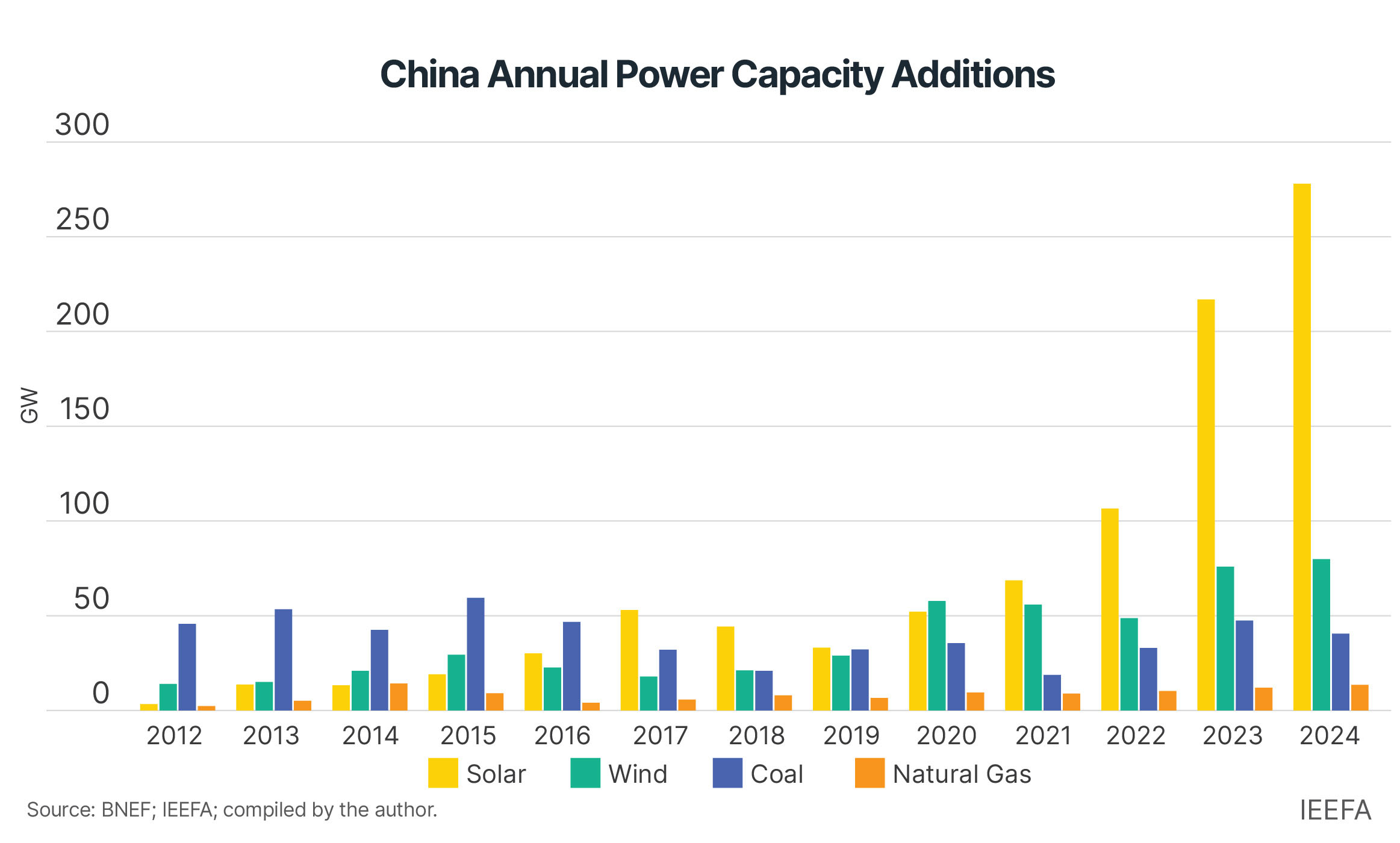

A closer look at China’s power sector shows how less expensive options are squeezing the role of gas. Between 2015 and 2023, the share of gas-fired power generation in the country’s electricity mix remained just 3%, while wind and solar quadrupled to 16%. Wind and solar generation increased by 1,250 terawatt-hours (TWh), while gas generation grew by 140TWh.

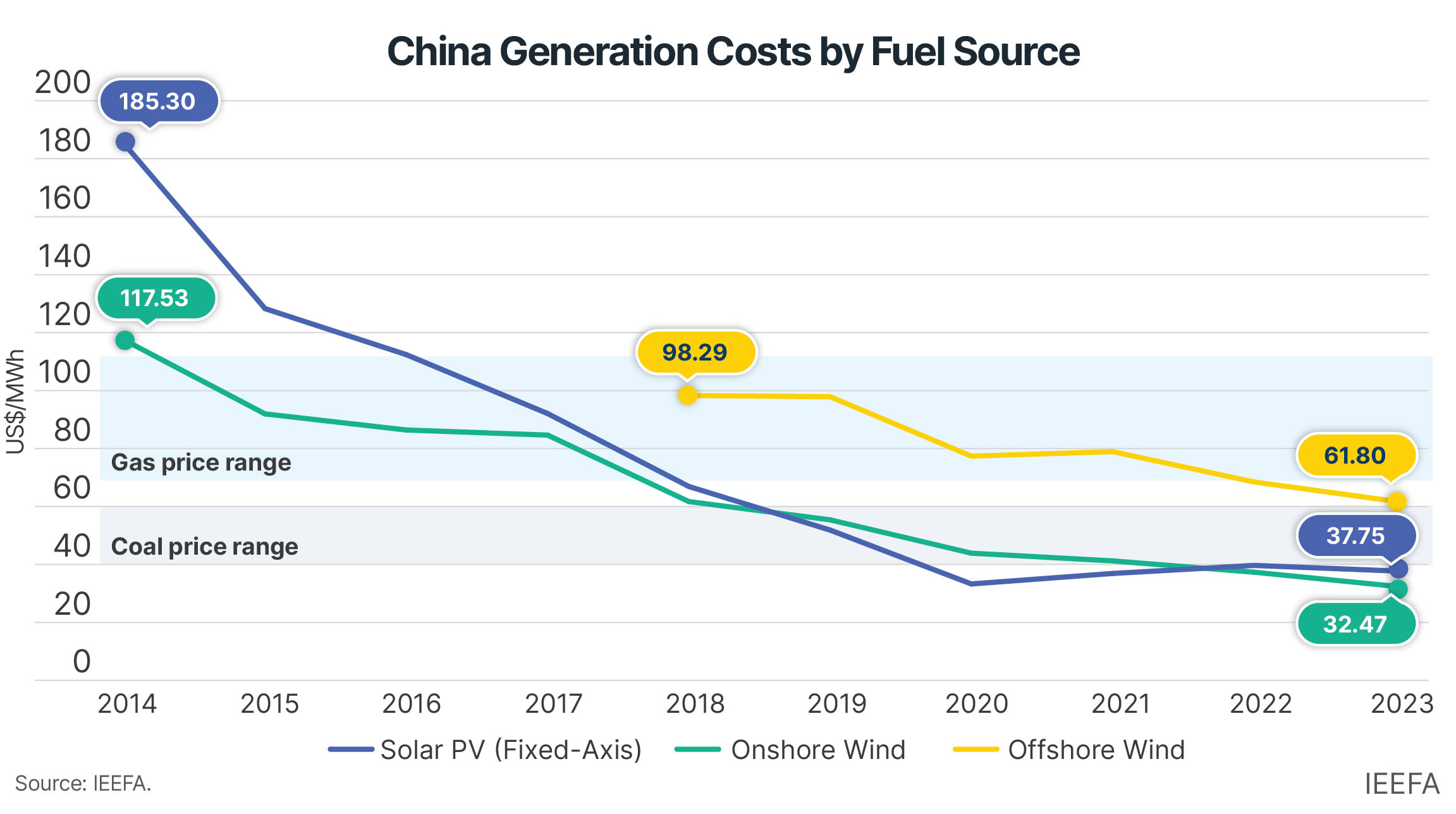

In 2024, China’s renewable energy deployment continued at an unprecedented rate. Solar capacity jumped 277 gigawatts (GW), a 46% increase, alongside nearly 80GW of new wind projects. Total wind and solar capacity reached 1,408GW, surpassing the country’s 2030 target of 1,200GW six years ahead of schedule. Solar and onshore wind are the cheapest sources of power in China, ranging from US$30-90 per megawatt-hour (MWh) lower than gas generation.

PetroChina’s Global Head of LNG and New Energies, Yaoyu Zhang, believes that the cost of solar and wind falling beneath that of natural gas has “severely hindered the large-scale coal-to-gas switch.”

China continues to approve large capacities of coal power, adding 40GW in 2024, based on preliminary data. While coal generation is increasing in absolute terms, its market share has steadily declined from 70% in 2015 to 61% in 2023 due to the growth of renewables. The average utilization of China’s coal fleet has fallen 20% since 2005, while government plans position coal as a flexible energy source to support wind and solar integration.

Meanwhile, the push for gas power pales in comparison. Estimates indicate that China added 13.5GW of gas capacity in 2024. In 2023, the government said it would “strictly control the expansion of projects to replace coal with natural gas.” In 2024, the country’s Natural Gas Utilization Policy designates gas usage as “restricted” for baseload electricity in 14 coal-producing regions.

Analysts often point to Guangdong province, one of China’s largest gas-consuming regions and industrial powerhouses, to demonstrate LNG growth potential. In 2023, however, gas-fired power generation provided less electricity than coal, imports, and nuclear. Meanwhile, Guangdong recently slashed power tariffs by 16%, likely hurting margins for power producers using costlier LNG. While subsidies are in place for gas plants to bear high fuel costs, a push toward market-based electricity pricing could see large buyers opt for cheaper power.

Moreover, provincial energy plans suggest the share of non-fossil fuels in the energy mix could reach 32% in 2025 — toward a goal of 35% — while prioritizing domestic gas production, solar, wind, nuclear, and battery storage.

Prospects for LNG in non-power sectors

Given the challenging pathway for LNG growth in China’s power sector, some hope that other sectors, like industry and transportation, will face better prospects. The industrial sector consumes the largest share of China’s gas, particularly manufacturing and petrochemical segments. However, industries like iron and steelmaking primarily use coal as a non-combustible feedstock, so switching to gas would require newbuild production capacity.

From 2017 to 2023, there were proposals for 389mt of new or replacement coal-based blast furnace capacity, compared to just 4.3mt of non-blast furnace capacity. Even if all 4.3mt uses gas, coal-to-gas switching in these sectors would remain limited. Like the power sector, industries may encounter similar cost and energy security incentives favoring coal and renewables.

China’s transportation sector has garnered global attention for its rapid uptake of LNG as a replacement for diesel in heavy-duty trucking. This development is not new, but the LNG truck fleet has nearly tripled in size since 2019. In the first half of 2024, gas and LNG trucks comprised 35% of heavy-duty truck sales compared to 9% for battery electric trucks. LNG trucks consumed roughly 22mt of LNG in 2024, though some of this came from China’s fleet of domestic liquefaction plants for pipeline or domestic gas, not exclusively from LNG imports.

However, LNG truck sales remain highly susceptible to volatile fuel pricing dynamics. The increase in LNG-fueled trucks in the first half of 2024 was driven by falling LNG prices relative to diesel. When LNG prices rose in the second half of the year, LNG vehicle registrations slowed. In 2025, a combination of high LNG prices and falling diesel demand in China could threaten the rapid growth of LNG trucks.

Battery electric truck sales have also risen sharply in China, presenting a longer-term structural risk for LNG and diesel vehicles. Heavy-duty electric and fuel cell vehicle sales increased from roughly 3,000 in 2020 to 35,000 in 2023. Amidst rapidly declining global battery prices — Goldman Sachs expects an additional 50% decline by 2026 — some suggest that electric trucks are already cheaper than diesel in certain regions of China. Wood Mackenzie expects the LNG trucking surge to be temporary, with battery-electric technologies evolving as the main long-term diesel displacer.

Lastly, following the achievement of air quality targets, coal-to-gas switching in the building sector is likely to slow in favor of electric systems. For example, Beijing recently prohibited newbuild, independent gas heating systems, prioritizing the use of some electric heating systems.

Energy security: The bottom line?

LNG faces serious economic competition from various alternative fuels, but its implications for China’s energy security may be even more important. China has delicate trading relationships with some of the largest global producers of LNG — namely the U.S. and Australia — adding incentives to develop domestic energy resources and trade with nearby allies. The recent U.S.-China trade war reflects these geopolitical realities and may cause Chinese companies to resell U.S. cargoes overseas rather than absorb them at home.

This does not bode well for the global LNG industry. Demand from key regions like Europe and Northeast Asia is falling, so exporters and traders will compete to secure emerging market buyers amidst a record increase in LNG supply this decade. Ultimately, slower LNG demand in China and more aggressive reselling by Chinese traders may only exacerbate oversupply and margin erosion for LNG investors.

This analysis was first published in LNG Industry magazine.