IEEFA report: Powering up sunshine – how India’s commercial and industrial sector can drive rooftop solar power

23 July 2020 (IEEFA India) – Increasing electricity demand and rising grid tariffs for commercial and industrial customers are driving business users to rooftop solar, which is not only cleaner and cheaper but also gives them tariff certainty for 25 years.

In Powering up Sunshine – Untapped Opportunities in India’s Rooftop Solar Market, a new report from JMK Research & Analytics and the Institute for Energy Economics and Financial Analysis (IEEFA), authors Jyoti Gulia and Vibhuti Garg explore the increasing awareness of the benefits of rooftop solar electricity for India’s corporate consumers.

C&I rooftop solar has vast potential.

“Commercial and industrial (C&I) users consume approximately 49% of the electricity generated in India, but only 3.5% of the power procured by India’s C&I segment is from renewable sources,” says Gulia. “C&I rooftop solar has vast potential, and already accounts for 70-80% of all the country’s rooftop solar installations.”

Garg says this situation is quite different from other economies where the residential segment leads rooftop solar.

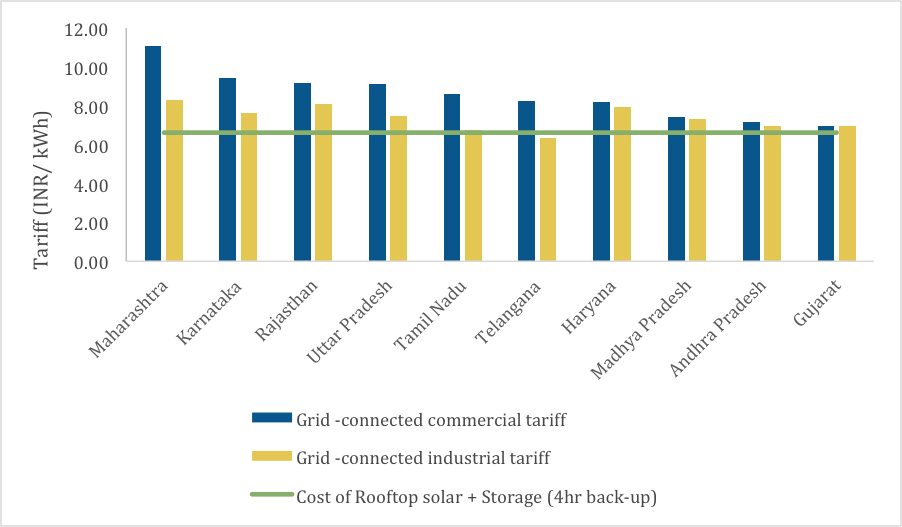

“The reason is that, in India, residential and agricultural users are subsidized while C&I consumers are levied an additional significant cross-subsidy surcharge leading to higher than average mains electricity tariffs,” says Garg. “As a result, rooftop solar is an economically viable solution for C&I consumers.”

INDIA’S ROOFTOP SOLAR MARKET HAS, BROADLY, TWO BUSINESS MODELS – Capex & Opex. From the perspective of a power consumer, Capex is a self-financing model while Opex is a third-party financing model. Opex accounted for nearly a third of all cumulative rooftop solar installations in India at the end of last year.

With the falling equipment cost, the payback period for rooftop solar projects in India is also gradually shortening. Currently, in a capital expenditure (Capex) model, payback can be realised by a shorter duration of 3-4 years, while for an Opex project the tariff rate is about Rs3.5-4/ kWh (USD 0.047 –0.053), which is less than half the average of C&I grid tariffs prevalent across most states.

MSMES are likely to aggressively adopt solar in coming years.

In the C&I segment itself, medium, small, and micro enterprises (MSMES) are likely to aggressively adopt solar in coming years.

“MSMEs are the backbone of the Indian economy, contributing 6.1% of gross domestic product (GDP) and about 45% of total manufacturing output,” says Gulia. “Electricity costs are up to 50% of their total expenses, so cutting such costs via solar power sustainably improves their competitiveness in a big way.”

The report notes there are ample growth opportunities in C&I rooftop solar, but two fundamental issues, financing and regulatory uncertainty, must be tackled to speed up adoption in this segment. Distributed, domestic generation is a key solution to meet India’s energy security and energy needs.

THE GOVERNMENT HAS PLANNED SOME LARGE-SCALE INVESTMENTS intended to drive this market. One of them is the Ministry of New and Renewable Energy’s Rooftop Phase II program that targets adding 18GW of rooftop solar via incentives to power distribution companies (discoms).

Under the recently issued Draft Electricity Amendment Act 2020, several progressive measures are also planned for the renewable energy sector such as introducing a pan-India renewable purchase obligation (RPO) with a stringent penalty mechanism. RPOs compel discoms and other large electricity consumers to buy a certain percentage of the power they need from renewable energy sources. Such a measure would provide a significant boost to the uptake of rooftop solar in the C&I segment.

“To be sure, not every rooftop solar venture is a shining success,” says Garg.

“Many small engineering, procurement, and construction (EPC) players have quit the market in the past year because they could not raise sufficient funding to expand their portfolio, putting warranties at risk.

A diversified portfolio across different geographies is needed to stay afloat.

“Most of these players have a specific regional focus and any change in policy can make their business unviable. A diversified portfolio across different geographies is needed to stay afloat in this highly price-sensitive and competitive market.”

GULIA SAYS THE NEXT REVOLUTION IN ROOFTOP SOLAR will be in storage.

“It is likely that in the next 2-4 years, 20% of all C&I installations will be connected to the grid, coupled with battery storage,” she says.

“Technological innovations such as more cost reflective time-of-day tariffs, smart meters, high-efficiency modules and battery storage will drive the growth of this market.”

Some of the detailed case studies in appendices to the report highlight the key innovations that leading players have adopted in rooftop solar projects and how that innovation is related to the scale of the rooftop project, type of roof, use of trackers, use of high efficiency modules, and the viability of battery storage.

Read the report: Powering up Sunshine – Untapped Opportunities in India’s Rooftop Solar Market

Author contact: Vibhuti Garg [email protected], Jyoti Gulia [email protected]

Media contact: Kate Finlayson [email protected] (+61) 418 254 237

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy.