IEEFA briefing note: India’s electricity sector transition still on track despite a weak FY2018/19

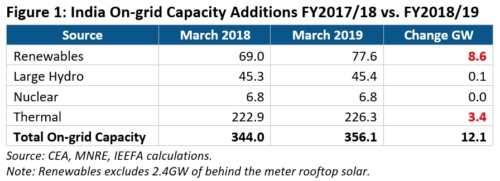

(IEEFA India) – FY2018/19 turned out to be a sluggish year for both the thermal as well as renewable sectors in India in terms of increased generation capacity. In total, only 12GW of net new power generation capacity was added; compared to an average of 22GW added between FY2012/13 and FY2016/17 and 17GW in FY2017/18.

India introduced 5.8GW of new coal-fired capacity but shuttered 2.4GW of end-of-life thermal power plants during the year, resulting in net new thermal capacity adds of just 3.4GW. This is the lowest level of thermal coal power plant net adds in a decade.

New on-grid capacity additions in renewable energy stood at 8.6GW (6.5GW of solar, 1.6GW of wind and 0.5GW from other sources) for the financial year ending in March 2019 – a disappointing 40% drop from the peak renewable energy installs achieved in 2016/17.

The briefing note, India’s electricity sector transition still on track despite a weak FY2018/19, projects renewable additions through 2021/22 based on auction and tender activities during the past 18 months.

According to co-author and IEEFA research associate Kashish Shah, “the continued decline in thermal capacity additions was foreseeable given the ongoing financial distress of the thermal power sector and the loss of competitiveness compared with domestic renewable energy. Against this, the slowdown in renewable capacity additions at half the government’s targeted run-rate contradicts expectations.”

The briefing note underscores policy uncertainties as well as a lack of grid infrastructure as some of the key reasons for below-expected renewable capacity installations in FY2018/19.

Despite the evident chaos in incomplete installations, India exited the year with 22.5GW of renewable capacity auctions awarded but yet to be built, and another 37GW under various stages of tendering and bidding.

Given the existing trajectory of wind and solar as well as other renewable sources of biomass and run-of-river (RoR), IEEFA forecasts India will reach 144GW renewable energy capacity by FY2021/22, not far from the aspirational 175GW target set back in 2015. This places India on track for a run-rate that will exceed its 275GW target in 2027.

IEEFA expects another near flat year for utility-scale solar with 7-8GW commissioned by March 2020, owing to import restrictions on solar modules for two years (imposed in July 2018). In spite of this, 9GW of rooftop solar could be installed in the coming three years given the 68% growth rate in annual installs during calendar year 2018.

Wind power will most likely bounce back with potentially 5GW of new capacity under construction right now with a commissioning deadline in FY2019/20.

“There are challenges which could hinder acceleration of renewable energy capacity. The government of India must anticipate these challenges and plan to mitigate the risks as soon as possible,” Shah added.

The briefing note outlines some of the challenges of grid expansion: ‘time-of-day’ pricing policies, land allocation issues, and setting fair upper caps on auction tariffs.

Tim Buckley, co-author of the briefing note and IEEFA’s director of energy finance studies, views FY2018/19 as a ‘blip’ for the Indian renewable energy industry and expresses confidence that the long-term technology and price-based fundamentals of renewable energy will continue their upward trajectory.

The energy security gains for India are compelling, particularly now that 100% electrification coverage has been achieved. This opens up enormous potential for progressive decarbonisation and growth in both the transport and stationary power sectors. In addition, the country’s ballooning annual oil import bill provides ample justification for supporting Prime Minister Narendra Modi’s grand solar ambitions.

“India’s coal-fired capacity expansion has already declined to just 3-4GW of annual net additions, down 80% on installation activity from just three years ago. Ongoing reliance on domestic coal-fired power is a ‘necessary evil’ over the medium term to keep the lights on in a giant economy that is targeting sustained 7-8% annual GDP growth and further electrification,” says Buckley.

IEEFA deems as necessary the successful resolution of some of the 96GW of proposed new coal-fired power plant capacity that is currently stuck in the planning, approval and construction phases, in order to facilitate the retirement of 40-50GW of approaching end-of-life, highly polluting thermal power plants.

For India to reverse the trend of over 20GW of annual thermal power capacity additions in the first half of this decade and be able to exit the decade with 20-40GW of annual renewable energy additions, would provide the world with a shining example for others to emulate.

Briefing Note: India’s electricity sector transition still on track despite a weak FY2018/19

Kate Finlayson ([email protected]) +61 418 254 237

Analysis: Tim Buckley ([email protected]) +61 408 102 127

Kashish Shah ([email protected]) +61 452 498 253

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.