EU pipeline gas imports continue to fall

Key Takeaways:

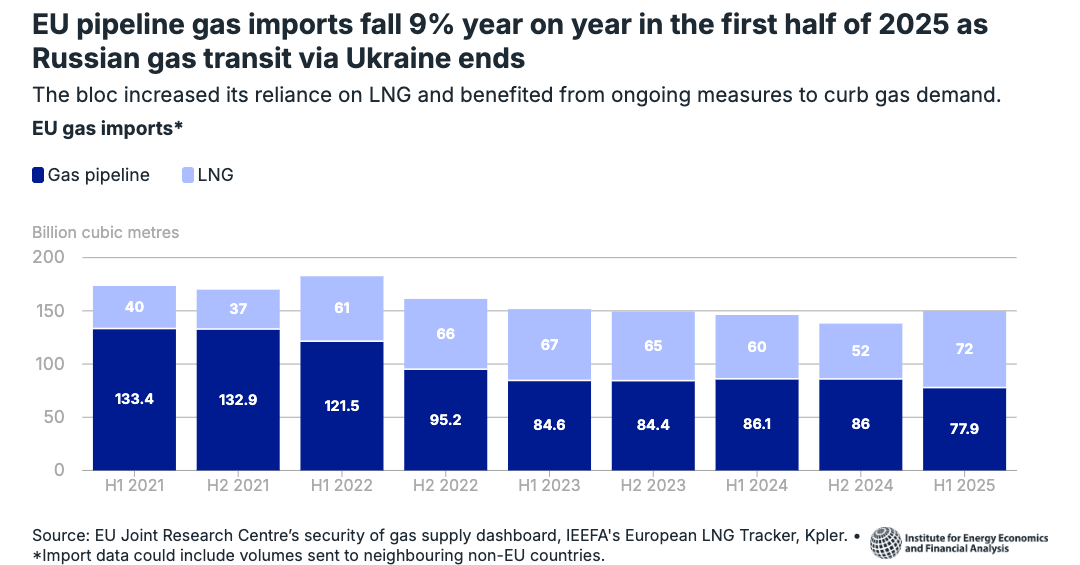

EU pipeline gas imports declined by 9% year on year in the first half of 2025, as Russian gas transit via Ukraine ended on 1 January. The bloc increased its reliance on LNG and benefited from ongoing measures to curb gas demand.

Given the risks of depending on LNG, EU Member States must accelerate renewable energy and heat pump installations to boost their energy security and protect consumers from volatile gas prices.

Since the beginning of 2022, EU countries have spent about €380 billion on pipeline gas imports.

EU imports of Russian pipeline gas via Türkiye have risen in recent years.

18 September 2025 (IEEFA) | The EU cut its pipeline gas imports by 9% year on year in the first half (H1) of 2025, as the bloc increased its reliance on liquefied natural gas (LNG) and benefited from ongoing efforts to lower demand for the fuel.

The latest decline comes after EU piped gas imports fell by more than one-third between 2021 and 2024. Energy efficiency measures and the growth of renewables helped reduce the bloc’s gas consumption in recent years, according to the updated EU Gas Flows Tracker from the Institute for Energy Economics and Financial Analysis (IEEFA).

Combined EU gas pipeline and LNG imports grew 3.4% year on year in H1 2025. IEEFA expects EU gas imports to continue falling from 2026.

“EU gas demand is in structural decline. But this year’s slight rise in gas imports should be a wake-up call for Member States falling short of their energy efficiency and renewables targets,” said Ana Maria Jaller-Makarewicz, lead energy analyst, Europe, at IEEFA.

“Faster deployment of solar, wind and heat pumps, as well as rapid grid modernisation, will reduce EU countries’ vulnerability to LNG supply disruptions, improve energy security and protect consumers from volatile gas prices.”

The research reveals that since the beginning of 2022, EU countries have spent about €380 billion on pipeline gas imports, €83 billion of which was from Russia.

The end of Russian gas transit via Ukraine on 1 January 2025 contributed to the decrease in EU gas pipeline imports in H1 2025. Some EU countries shifted their gas flows and used existing infrastructure to guarantee security of supply.

The EU plans to gradually stop the import of Russian oil and gas by the end of 2027. But the bloc’s imports of Russian pipeline gas via Türkiye have increased in recent years.

The top-three sources of EU pipeline gas imports in H1 2025 were Norway (55%), Algeria (19%) and Russia via Türkiye (10%).

EU gas pipeline imports from Azerbaijan, Libya and Norway decreased year on year in H1 2025, while those from Algeria, Russia via Türkiye, Türkiye and the UK slightly increased.

Press contact

Jules Scully | [email protected] | +447594 920255

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org