CCUS for steelmaking rapidly losing its lustre

Mounting costs, challenges and failures stall carbon capture plans

Key Takeaways:

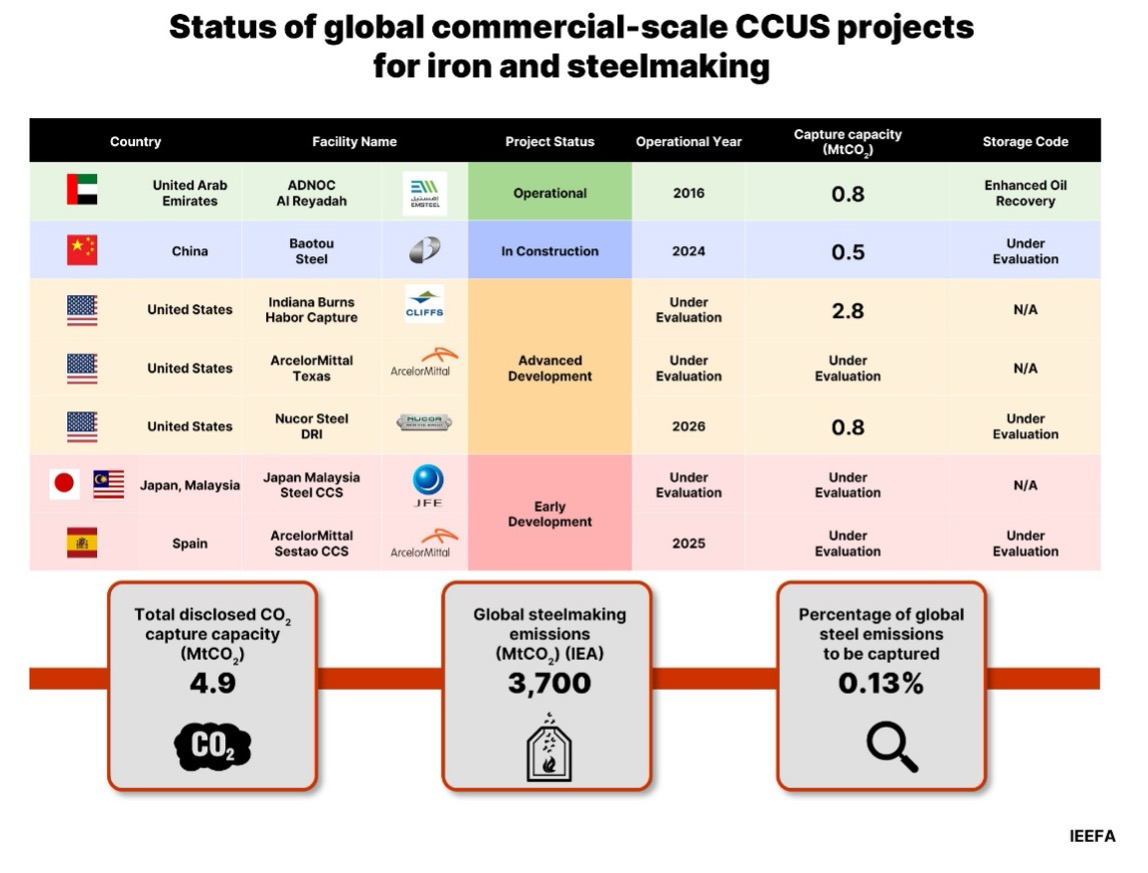

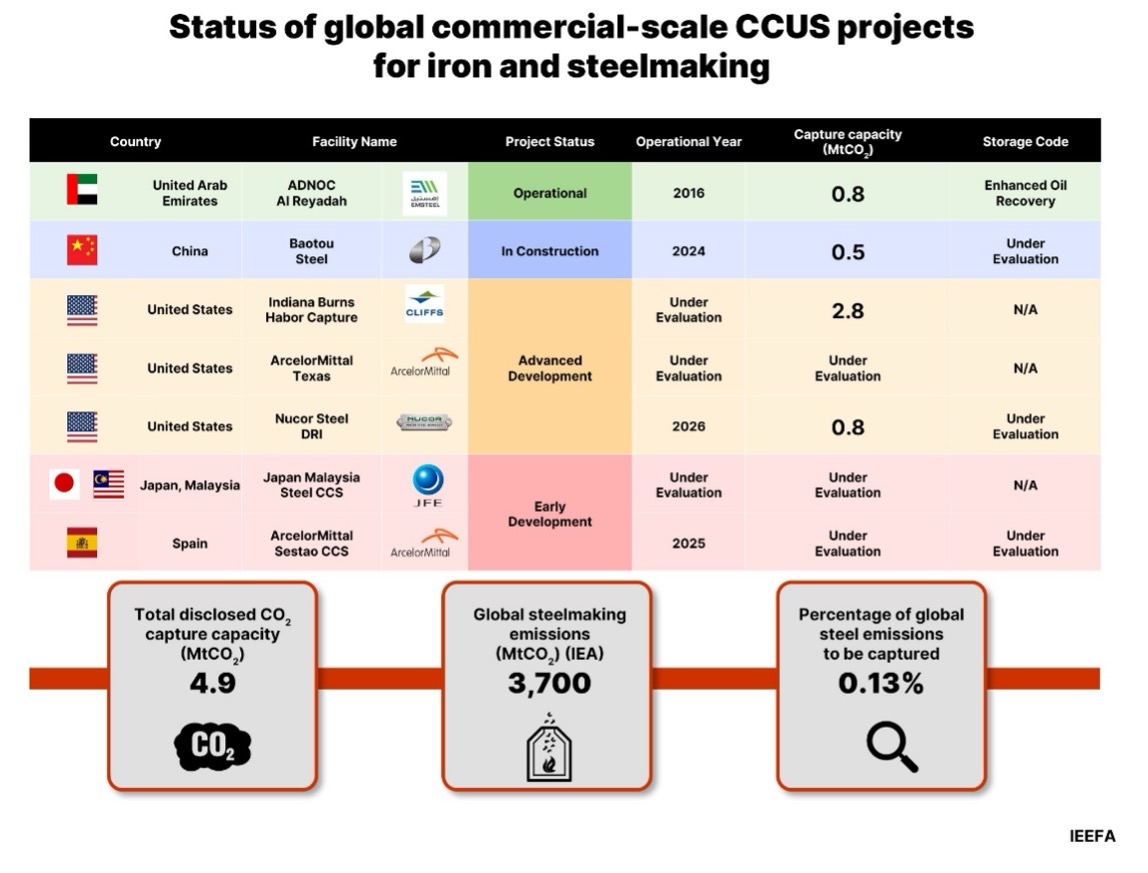

Six commercial-scale carbon capture, utilisation and storage (CCUS) projects for iron and steelmaking are in the development pipeline, up from three in 2023. However, the lack of available detail casts doubts over their development status and timelines.

The Al Reyadah project in the United Arab Emirates (UAE) is still the world’s only operational commercial-scale CCUS project for steelmaking. It captured only 26.6% of the gas-based steel plant’s emissions in 2023. There are still no commercial-scale CCUS plants for blast furnace-based steelmaking in operation anywhere in the world.

Since IEEFA’s April 2024 report on steel CCUS, carbon capture projects have continued to fail and underperform in other sectors. Equinor recently admitted over-reporting the performance of its flagship Sleipner CCUS project for years due to faulty monitoring equipment.

Despite mounting evidence to the contrary, major steelmakers and miners such as Nippon Steel, ArcelorMittal and BHP continue to insist to their investors that CCUS will play an important role in meeting their decarbonisation targets.

14 October 2024 (IEEFA Australia): Hailed as the solution to reducing greenhouse gas emissions from steelmaking, carbon capture and storage’s prospects in the industry look increasingly bleak, according to the Institute for Energy Economic and Financial Analysis (IEEFA).

Nonetheless, major steelmakers and iron ore miners such as Nippon Steel, ArcelorMittal and BHP continue to insist to their investors that the flawed technology will play a significant role in meeting their decarbonisation targets despite growing evidence to the contrary, say IEEFA analysts Simon Nicholas and Soroush Basirat in their briefing note Steel CCUS update: Carbon capture technology looks ever less convincing.

Behind the hype, the reality is few if any of these projects will likely enter operation.

“CCUS is predisposed to major financial, technological and environmental risks,” the authors say. “Low capture rates is a key ongoing issue that is often under-appreciated.

“The amount of carbon targeted for capture at a project tends to be significantly below its overall emissions. Furthermore, CCUS projects consistently struggle to meet even these low capture targets.”

For example, the world’s only operational commercial-scale CCUS plant for steelmaking is the Al Reyadah project in the United Arab Emirates (UAE). In 2023, it captured only 26.6% of the gas-based steel plant’s emissions, which are then used for enhanced oil recovery (EOR).

IEEFA highlighted the poor global track record of CCS projects across all sectors in its report Carbon Capture for Steel? Since the report was released in April, the technology has suffered further setbacks, such as:

- A C$2.4 billion CCUS proposal for power generation near Edmonton, Canada, was cancelled in May on the grounds it was not financially viable.

- Revelations the flagship Sleipner CCUS project off Norway had been grossly over-reporting its carbon capture rates for years due to faulty monitoring equipment.

“Sleipner is often held up by advocates as proof of CCUS’s technical feasibility,” the authors say. “Instead, the project further highlights the risks of attempting to implement CCUS at scale around the world.”

Of the six CCS projects in the global pipeline according to the Global CCS Institute, fundamental details remain undisclosed, unknown or “under evaluation”, casting doubt over their prospects (see table below). Should any reach completion, they face a host of technical, financial and site-specific challenges.

Despite 50 years of attempts, the cost of CCUS remains stubbornly high. Innovative steelmakers are looking elsewhere to reduce their emissions, moving away from coal-based production to direct reduce iron (DRI) steelmaking, a mature, proven technology that can run on green hydrogen.

A major obstacle is that coal-burning blast furnace steel plants require multiple points of carbon capture to allow production of low-carbon steel, increasing the costs significantly.

“There are still no commercial-scale CCUS plants for blast furnace-based steelmaking in operation anywhere in the world,” the authors say. “The cost involved means capturing sufficient carbon at coal-based steelmaking sites will likely never be financially viable.

“Virtually all steelmakers planning or constructing commercial-scale low-carbon steelmaking capacity have turned to hydrogen-based or hydrogen-ready DRI plants, not CCUS.”

The 2030 project pipeline capacity of DRI plants has reached 96 million tonnes a year (Mtpa) while commercial-scale CCUS for blast furnace-based operations remains stuck on just 1Mtpa.

“The cost of green hydrogen – a key enabler of truly low-carbon iron and steel production – is also high but has a much better chance of declining through economies of scale and renewables cost reduction,” the authors say.

“CCUS for blast furnace-based steelmaking is being left behind by a better alternative that can outcompete it on both cost and emissions reductions.”

Read the analysis: Steel CCUS update: Carbon capture technology looks ever less convincing

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Simon Nicholas [email protected]; Soroush Basirat [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)