The case for a stability mechanism in India’s carbon market

Building timely stability mechanisms into the Carbon Credit Trading Scheme can help avoid pitfalls encountered by other Emissions Trading Systems

Key Takeaways:

Like most Emissions Trading Systems (ETSs), India’s forthcoming Carbon Credit Trading Scheme (CCTS), could face supply-demand imbalances and suppressed carbon prices. With institutional mechanisms to manage supply and prices, the scheme can navigate similar challenges observed in other global carbon markets.

Lessons from other ETSs show that markets without timely Price or Supply Adjustment Mechanisms (PSAMs) suffer prolonged periods of low prices, investment inertia, and ultimately require costly, politically contentious reforms. In contrast, systems that integrate stability tools early on have sustained stronger and more credible carbon prices.

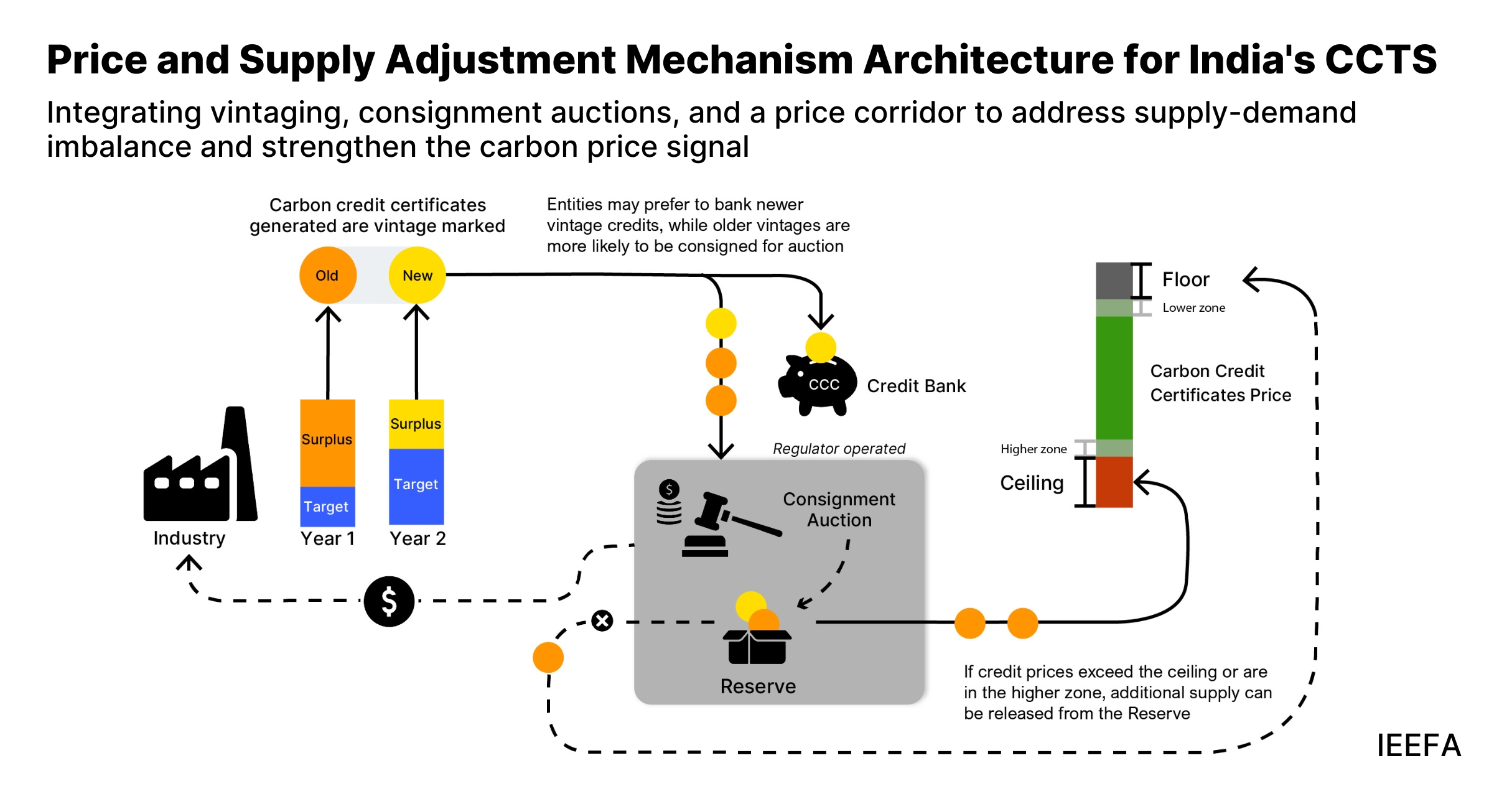

This report recommends a PSAM tailored to India’s CCTS that comprises three elements: a consignment auction system for transparent, rule-based credit interventions; a vintage-based credit classification to limit the impact of older surplus credits on future prices; and an existing price corridor to guide interventions when carbon prices deviate from expected levels.

28 October 2025 (IEEFA South Asia): Adopting Price or Supply Adjustment Mechanisms (PSAMs) in India’s upcoming Carbon Credit Trading Scheme (CCTS) can help avoid market imbalances and ensure credible carbon pricing, suggests a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and Environmental Defense Fund (EDF).

The report underscores the importance of integrating stability mechanisms to avoid disruptive interventions; prevent structural oversupply; create predictability for long-term investment; and allow gradual calibration when introducing reforms.

“In India’s CCTS, the need for a PSAM is significant. While credit banking offers flexibility, the absence of limits allows credits from early, low-cost reductions to accumulate, which could lead to supply-demand imbalances, depressed prices and weaker long-term decarbonisation incentives,” says Subham Shrivastava, co-author of the report and climate finance analyst at IEEFA.

The report recommends adopting a legally and administratively efficient as well as fiscally prudent PSAM tailored to India’s CCTS design that can operate within existing institutional capacity while still providing a credible framework for supply control.

“Consignment auctions and vintaging offer pragmatic, rule-based tools to address risks without disrupting the core intensity-based design, while offering a transparent lever for supply control,” highlights Saurabh Trivedi, co-author and sustainable finance specialist at IEEFA.

India's CCTS is more than just an environmental policy. By tying rewards to performance, it incentivises firms to improve operational efficiency, adopt cleaner technologies, and strengthen data management systems.

“In India, where accelerating industrial development is a strategic priority, this alignment between emissions performance and broader economic efficiency offers a compelling rationale for adopting emissions trading,” says Saloni Sachdeva Michael, co-author and energy specialist at IEEFA.

By assigning intensity-based targets to obligated entities and creating a framework for trading surplus reductions, the scheme aligns domestic mitigation efforts with India's Nationally Determined Contributions. Intensity-based systems suit India’s diverse industrial landscape by leveraging differences in firms’ abatement costs while encouraging cost-effective reductions.

The CCTS allows entities to bank surplus Carbon Credit Certificates across compliance cycles, offering flexibility to manage production volatility and cost uncertainties. While this intertemporal flexibility is useful, the report notes that in the absence of limits on banking, early overperformance – driven by low-cost abatement – could result in surplus accumulation. This risks locking in long-term imbalances and undermining price signals critical to sustained decarbonisation.

“India's CCTS, like all emissions trading systems, is not a market in the classical sense. It is a policy instrument shaped by institutional and market design to control emissions through regulatory definitions of supply, demand, and compliance,” explains Shrivastava.

While the Performance, Achieve and Trade (PAT) mechanism succeeded in establishing a foundation for baseline-and-credit trading, it also demonstrated important design considerations that could provide lessons for the evolution of the CCTS.

“Building on PAT’s foundation, the CCTS can incorporate dynamic benchmarks, robust trading infrastructure and strategic auction mechanisms to create a system that is effective and politically sustainable,” says Michael.

The report notes that PSAMs are not substitutes for strong benchmarks or accurate allocation, rather, they are essential complementary levers. Among the proposed features, the report highlights the role of consignment auctions in creating a transparent, rule-based “control panel” for the market.

Another complementary feature proposed in the report is a vintage-based credit control system for India’s CCTS, where credits are tagged by issuance year and expire or devalue after a certain duration. “For example, if a three-year window is chosen, then 2028 emissions could be offset using credits from 2028, 2027 or 2026, but not earlier. This would limit surplus buildup, preserve price signals, and support timely emission cuts,” explains Trivedi.

Drawing on the EU’s Emissions Trading System, Alberta’s Technology Innovation and Emissions Reduction system, and Australia’s Safeguard Mechanism, the report highlights that incorporating timely corrective mechanisms can minimise the cost of reform and build market trust.

“Embedding a PSAM early in the lifecycle of CCTS could signal that India’s carbon market is built for durability, and long-term effectiveness. It lays the foundation for a market that can scale with ambition and support India’s broader net-zero transition,” says Shrivastava.

Read the report: Strengthening India’s carbon market

Media contacts: Prionka Jha ([email protected]) Ph: +91 9818884854, Tejas Patel ([email protected]) Ph: +91 9999105600

Author contacts: Subham Shrivastava ([email protected]), Dr Saurabh Trivedi ([email protected]), Saloni Sachdeva Michael ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About EDF: A global nonprofit, Environmental Defense Fund (www.edf.org) collaborates with governments, NGOs, research and academic institutions, corporates, and others to support and advance India’s vision of shared, sustainable prosperity. It combines scientific and economic foundations, a broad network of partnerships, and a pragmatic approach in support of India’s ambitions. Areas of interest include demonstrating the viability of sustainable livelihoods in agriculture, livestock, and fisheries, establishing the shareholder value potential through responsible business, informing of the potential of market-based mechanisms, and catalysing the climate technology ecosystem in India.