Which DRI solutions can deliver green iron for Australia?

Key Findings

Direct reduced iron (DRI) technology will be a key foundation of Australia's green iron opportunity, but choosing the right pathway – and avoiding locking in dependence on fossil gas – will be essential.

Carbon capture and storage (CCS) is not a viable solution for decarbonising DRI production. As leading technology providers have acknowledged, CCS remains a niche technology that is only applicable in very specific circumstances.

The first 100% green hydrogen-based DRI facility is due to begin commercial-scale operations next year. Other projects aim to start by using a mix of fossil gas and hydrogen; for example, Meranti Green Steel in Oman will start on 15% green hydrogen.

This sets a precedent for DRI plants in Australia, where 100% green hydrogen use may initially be out of reach. Starting with some green hydrogen in the mix and setting a clear ambitious timeline to phase out fossil gas could present a viable pathway for Australia to true green iron. No gas lock-ins, no CCS.

Last month, the Western Australian Environment Protection Authority (EPA) approved the establishment of a new iron production facility in the state. The plant will initially use fossil gas, even though fossil gas cannot produce truly green iron.

The move highlights the critical choices that will dictate Australia’s prospects in the emerging green iron industry. Direct reduced iron (DRI) is widely recognised as the future feedstock for low-emissions steelmaking, with capacity expansions accelerating worldwide. Importantly, however, not all DRI pathways are alike, and only some genuinely lead to low-emissions outcomes. The next generation of shaft furnace-based DRI facilities is being designed with this goal in mind.

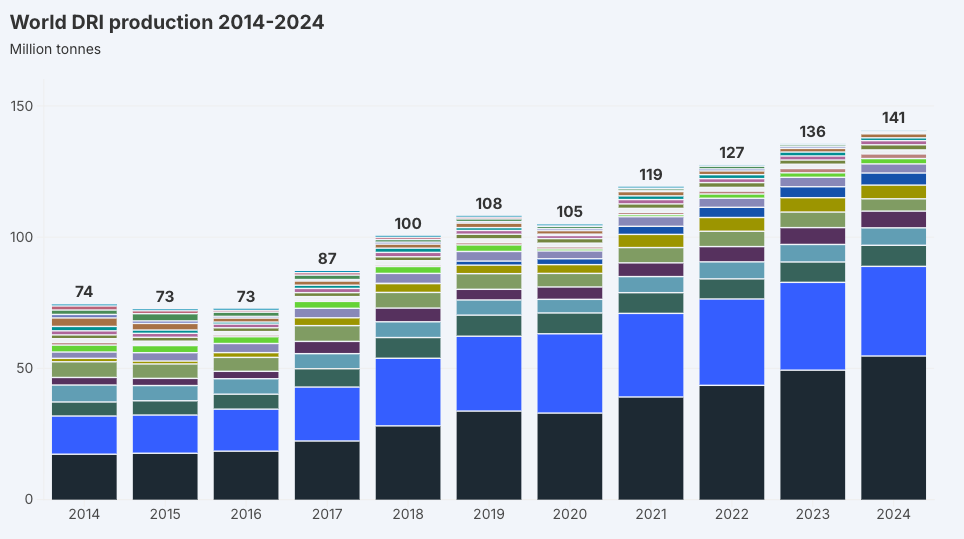

According to Midrex’s World DRI Statistics 2024, global DRI production reached 140.8 million tonnes (Mt), with more projects now under construction. The first ever commercial-scale hydrogen-based DRI project is being built in Sweden, alongside several other flexible-technology initiatives.

Source: Midrex, Australian Green Iron Tracker

However, various unproven pathways continue to be promoted to newcomers in this space such as Australia. These approaches ultimately cannot deliver truly green iron and steel.

How can DRI deliver on decarbonisation?

Carbon capture and storage

Carbon capture and storage (CCS) is touted as a solution to reduce emissions from DRI plants. However, its history of underperformance and failure indicates it cannot play a role in decarbonising the steel sector.

Midrex is the leading provider of gas-based direct reduction (DR) shafts, with 80% market share. The company has emphasised that deploying CCS with this technology faces significant challenges. In a recent article, Midrex questioned the role of CCS in decarbonising the steel sector and specifically the DRI pathway:

“For now, CCS remains a niche technology for steel and is likely to work only in very specific locations and under particular circumstances… Despite being promoted as a decarbonization tool for heavy industry, CCS has delivered limited success in practice… Most Direct Reduction plants lack access to users or local CO2 [carbon dioxide] storage sites on a scale that could make CCS commercially viable. Transporting the CO2 long distances to such sites is too expensive.”

EMSTEEL is the host of the only commercial-scale CCS facility in the steel sector, launched in 2016. The Al Reyadah CCS facility, operated by ADNOC, captures only about 25% of the total emissions from the EMSTEEL mill, which uses fossil gas to produce DRI. The captured carbon is used for enhanced oil recovery (EOR), helping to release more carbon emissions. Without the EOR element of the project, the CCS plant would probably never have been constructed.

In the nine years since Al Reyadah became operational, not a single other commercial-scale CCS plant for iron and steelmaking has come online. EMSTEEL is now shifting to using hydrogen to produce low-emissions steel.

Green hydrogen

To produce green iron via DR technology, the use of green hydrogen is inevitable; no other reducing agent can yield truly green iron. Gas-based DRI falls short of the threshold to be considered green iron – at best it can only be classified as “grey iron”. “Blue hydrogen” – made using fossil fuels coupled with CCS – suffers from the same issues faced by any use of CCS.

In Sweden, Stegra is currently constructing the first commercial-scale DRI-EAF [electric arc furnace] plant designed to run on hydrogen from the outset, scheduled to commence operations next year. The plant has already installed 200 megawatts (MW) of its planned 740MW of electrolysers, and from late 2026 it will be in continuous operation producing green steel.

One of the most recent entrants to Australia’s green iron sector, Progressive Green Solutions (PGS), has appointed thyssenkrupp nucera, also the supplier for Stegra, as its preferred partner for 1.4 gigawatts of electrolysers. In its first phase, the project targets production of 7Mt of iron ore pellets and 2.5Mt of hot briquetted iron (HBI), using green hydrogen.

Other projects aim to start with more flexible technologies that can use a mix of fossil gas and hydrogen. In some cases, such as the Baowu DRI facility in China, they can even use coke oven gases.

Meranti Green Steel in Oman plans to begin operations with a mix of green hydrogen and gas, gradually increasing the green hydrogen share over time. The project is expected to reach a final investment decision by mid-2026. According to announcements, the facility will start with 15% green hydrogen, scaling up to 85%, and is projected to achieve an emissions intensity of around 200kg of CO2 per tonne of steel once fully implemented.

Gradual transition from gas to hydrogen in DR shafts allows scope for further emissions reductions. EMSTEEL is one of the first movers and a good example of gradual transition for current DRI users. In 2024 it started deploying hydrogen in its facility with a pilot-scale plant. It recently completed its first delivery of green steel to end users.

This demonstrates that even in the Middle East & North Africa (MENA) region, which is traditionally known for its low-cost gas, a gradual transition is taking shape, with new projects and existing producers moving toward steadily increasing the share of green hydrogen in their reducing gas mix.

What path should Australia take?

While Australia plans to enter the iron industry through DR technology, having a clear vision for the future of this emerging sector is even more important.

Gas producers are interested in participating in Australia’s shift to DRI production, but you can’t make green iron with gas. Moreover, gas-based production in Australia would struggle to compete with international rivals that have access to cheaper gas. Locking an emerging Australian DRI industry into a long-term dependence on fossil gas and CCS risks squandering the green iron export opportunity.

Instead, Australia’s competitive advantage lies with green hydrogen-based DRI. International initiatives such as Meranti Green Steel show how starting with around 15% hydrogen presents a more credible pathway toward truly green iron production than CCS. A gradual transition from fossil gas to hydrogen within a reasonable timeframe would help avoid gas lock-ins and keep Australia aligned with other global contenders.

For new entrants in the DRI realm such as Australia, the rule is simple: start with flexible DRI technologies that enable some use of green hydrogen from the outset; but have a clear, ambitious plan to progressively reduce fossil gas use and shift to 100% green hydrogen. No gas lock-ins, no CCS.