Key Findings

The steel technology transition away from coal has accelerated in recent years, with Europe leading the way, but two of Europe's leading steelmakers have recently appeared to be slowing their planned shift to lower-emissions technology.

This is partly because the cost of green hydrogen production hasn't declined as fast as expected, but investors and governments should question any steelmaker suggesting carbon capture and storage (CCS) will play a meaningful role in decarbonising steel.

The cost of producing green hydrogen in Europe may see a shift to green iron imported from locations that have cheap, clean power as well as suitable iron ore, but while this may involve effectively "offshoring" ironmaking jobs, it could protect far more European steelmaking jobs in the long run.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

The steel technology transition away from coal has accelerated in recent years, with Europe leading the way. However, as 2024 drew to a close, two of Europe’s leading steelmakers appeared to be slowing their planned shift to lower emissions technology.

This is partly because the cost of green hydrogen production hasn’t declined as fast as over-optimistic forecasts suggested it would. Despite this, investors and governments should question any steelmaker suggesting carbon capture and storage (CCS) will play a meaningful role in decarbonising steel.

Transition slowing?

In November, Thyssenkrupp announced it would cut 11,000 jobs at its steel unit as it struggles amid global overcapacity and the resultant increase in cheap steel imports from China. Over the past two years, Thyssenkrupp has written down the value of its steel unit by €3 billion.

Thyssenkrupp Steel states that it “remains committed to the green transformation and carbon-neutral steel production” and that its under-construction direct reduced iron (DRI) plant – which is intended to eventually run on hydrogen – will be completed.

Yet, it seems that the company’s overall DRI ambition has been scaled back. In 2022, Thyssenkrupp suggested that all four blast furnaces at its Duisburg site would be progressively replaced with four DRI plants. Now the company states that the first DRI plant will replace two blast furnaces, while another may be replaced by an electric arc furnace (EAF) at some point in the future.

Also in November, ArcelorMittal confirmed what had already been rumoured – that it is delaying final investment decisions (FID) across its portfolio of decarbonisation projects. This includes a number of hydrogen-ready DRI plants planned to replace blast furnaces.

It also seems likely ArcelorMittal will revise down its 2030 emissions intensity targets.

ArcelorMittal states that it “remains committed to all technologies that offer the potential to take steelmaking to near-zero. This includes carbon capture utilisation and storage (CCUS), although like green hydrogen, this technology is likely to only make a meaningful difference after 2030. It already has one industrial scale CCU facility operational at its plant in Gent, Belgium, and a further two pilot projects underway in Gent.”

This “industrial scale” CCU (carbon capture and utilisation) facility is the Steelanol project, which captures less than 2% of the Gent plant’s annual emissions.

The very low capture rate of the Steelanol CCU project helps illustrate why steelmakers that are planning or implementing low-carbon technology have turned to hydrogen-ready DRI instead of carbon capture. The 2030 pipeline of commercial-scale, low-carbon steel capacity is dominated by DRI projects totalling almost 100 million tonnes a year (Mtpa), according to Agora Industry. Commercial-scale CCS projects remain stuck on 1Mtpa.

Some of the early hype surrounding green hydrogen is rightfully being questioned. In some ways it is unsurprising that steelmakers are rethinking their timetables. But in the medium to long term, green hydrogen-based DRI is far more likely to reduce steel emissions than CCS.

Green hydrogen-based DRI will outcompete CCS on performance and cost

CCS has a poor track record in all sectors where it has been applied with no signs of this changing on the horizon as the latest performance results from the world’s largest CCS project attest.

The Gorgon CCS project in Western Australia captures CO2 that is mixed with extracted natural gas for storage underground. CO2 injection started in August 2019 – 3½ years late.

The plant was approved on the condition that it injected 80% of captured CO2 underground but its performance is well below this level and getting worse. In recent years, it has injected about one-third of captured CO2, and in the most recently released performance results, this dropped further to 30%. Any captured CO2 not injected is vented into the atmosphere.

Gorgon isn’t the only flagship CCS project to reveal worsening performance. Oil and gas producer Equinor recently admitted the performance of its flagship Sleipner CCS project had been significantly over-reported due to faulty monitoring equipment. Advocates of CCS often point to Sleipner as proof of CCS’s technical feasibility. In fact, the project further highlights the risks associated with carbon capture implementation.

Low capture rates are often glossed over. The world’s only operational CCS plant for steelmaking – the Al Reyadah CCS project in the United Arab Emirates (UAE) only captures about 25% of the DRI-based steel plant’s overall emissions.

For the steel industry, CCS faces the same issues experienced in other sectors with the added difficulty that an integrated, coal-based steel plant has several sources of carbon emissions. There are still no commercial-scale CCS plants for blast furnace-based steelmaking in operation anywhere in the world.

There is also the high cost of transporting captured carbon, questions over where carbon will be stored and uncertainty over the long-term effectiveness of underground storage.

Each carbon storage project faces different geological conditions and issues, making it difficult to take any learnings from one project to the next. This limits the potential for cost reductions.

The cost of CCS remains high despite decades of attempted deployment. Green hydrogen is expensive but the cost has a much better chance of declining through economies of scale and the falling cost of renewable energy.

Furthermore, installing CCS at steel plants does nothing to tackle methane emissions from metallurgical coalmines that supply blast furnace-based steel plants. In 2024, the scale of the methane emissions issue has become more apparent. In Australia – the world’s largest exporter of metallurgical coal – a new online methane emissions tool (Open Methane) was released by the Superpower Institute in October. Initial results suggest Australia’s methane emissions may be far higher than official figures.

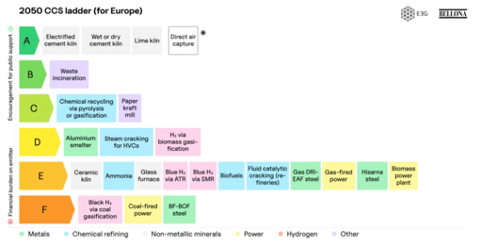

IEEFA is far from the only organisation sceptical of the role CCS will play in steel decarbonisation. A CCS ladder for Europe developed by E3G and Bellona – similar in principle to Liebreich Associates’ Hydrogen Ladder – places CCS for both blast furnace- and DRI-based steelmaking on the bottom rung (Figure 1)..

Figure 1: E3G and Bellona – Europe CCS Ladder 2050

In October 2024, the Kleinman Center for Energy Policy at the University of Pennsylvania published a CCS ladder for industrial decarbonisation in the US, which made similar findings.

Both the International Energy Agency and Wood Mackenzie have reduced their expectations of steel CCS, lowering the amount of CO2 they see being captured in the steel sector. It seems likely these expectations will continue to be lowered in future.

Will green iron imports be reconsidered in 2025?

With green hydrogen production looking expensive in Europe, an alternative is to import green iron from locations that have cheap, clean power to produce it at lower cost as well as suitable iron ore.

Both ArcelorMittal and Thyssenkrupp have been publicly resistant to this idea, partly because they are set to receive significant government subsidies to switch to low-carbon iron production domestically.

If cost were the only issue, relocating ironmaking to places where green hydrogen can be produced at lower cost seems like a no-brainer. However, European governments have other issues to consider: industrial policy, employment, geopolitics as well as energy and materials security.

However, Thyssenkrupp’s plan, which includes government subsidy support for its technology transition, clearly hasn’t been enough to protect the 11,000 jobs to be lost. Is it time for Europe to reconsider the role of green iron imports in its steel transition away from coal?

Iron ore giant Vale is seeking opportunities in green hydrogen production to supply a “mega hub” it has planned in Brazil. Under this concept, Vale will supply DR-grade iron ore to industrial hubs producing low-carbon iron for local steelmakers and for export. Vale also has three other mega hubs planned for the Middle East. Vale expects to make two final investment decisions regarding mega hubs in 2025

CWP Global is examining green iron export opportunities from Canada and Mauritania.

Meanwhile, the South Australian government is heavily backing its green iron exports opportunity. South Australia has leapt ahead of Western Australia – the key iron ore exporter in the country – based on the state’s wind- and solar-based power grid, which is heading for net 100% renewable energy by 2027.

With CCS continuing to flounder and iron ore electrolysis some years away, green hydrogen-based iron will be needed to decarbonise primary steel in Europe. Where clean power grids are already available, some early green output could use locally produced green hydrogen. Stegra aims to begin commercial-scale green iron production from 2026 on this basis.

But elsewhere in Europe, green hydrogen production – as well as green hydrogen shipments – may be too expensive to position the steel sector for a decarbonised world and protect jobs.

Decoupling iron and steelmaking involves effectively “offshoring” ironmaking jobs to other countries. But if the impact is to lower the cost of Europe’s steel technology transition, it may end up protecting far more European steelmaking jobs in the long run.

This article first appeared in the January/February 2025 edition of Steel Times International.