Gorgon CCS underperformance hits new low in 2023-24

Key Findings

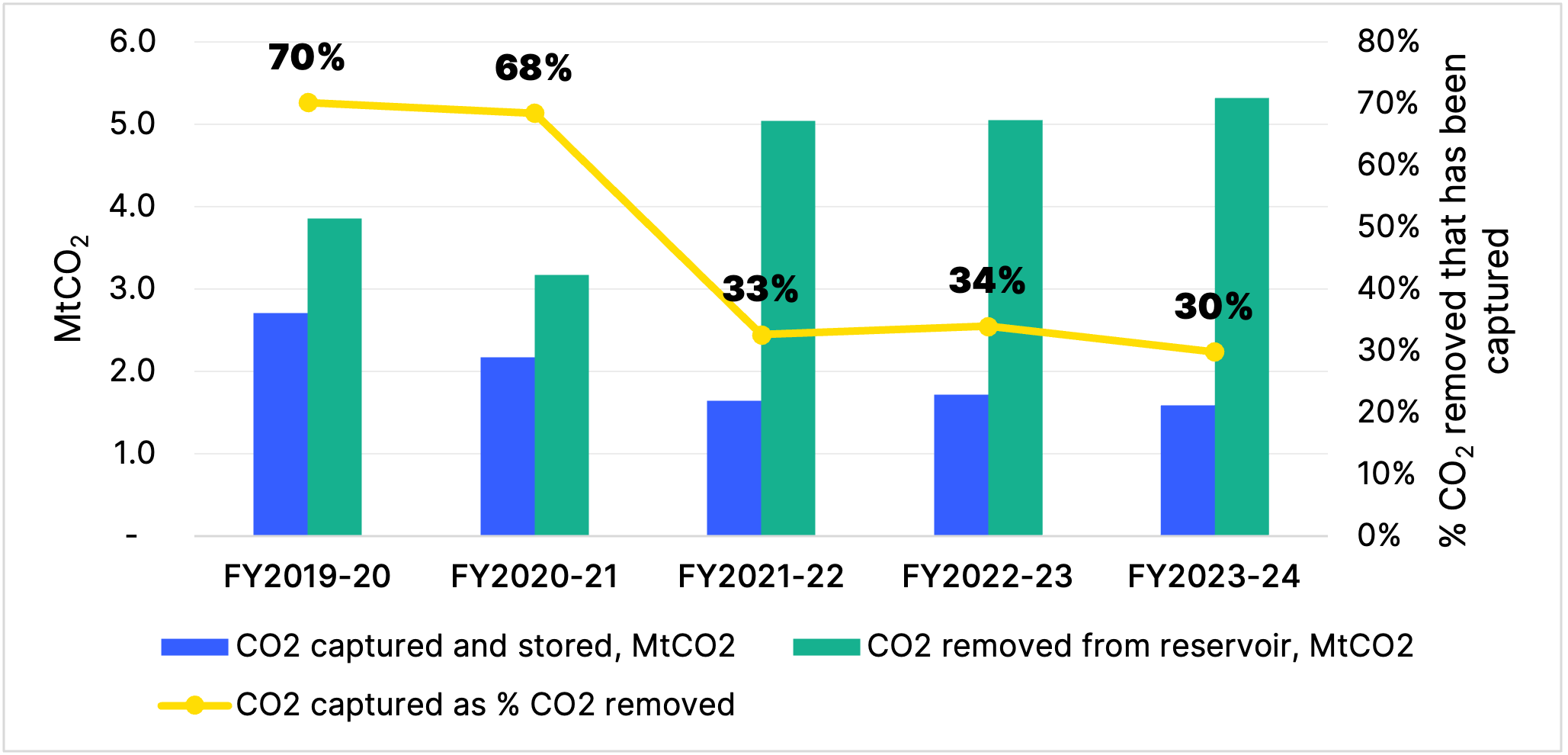

In the last financial year, the Gorgon CCS project captured only 30% of the CO2 it removed from its reservoir, its weakest performance to date.

As a result of technical challenges and underperformance, the cost per tonne of CO2 captured increased again in the last year to $222.

The technical challenges faced by the world’s largest CCS project are not unique; most large CCS projects globally have failed or underperformed materially.

The Gorgon carbon capture and storage (CCS) project is the world’s largest CCS project, located at Chevron’s Gorgon LNG facility on Barrow Island just off the coast of Western Australia. The project removes carbon dioxide (CO2) that is mixed with the natural gas extracted from the reservoir, and then captures and stores it underground. The project was approved on the condition that it would capture 80% of the CO2 it removed from its reservoir on a five-year rolling average from July 2016. However, it only started injecting CO2 in August 2019, three years behind schedule, and to date it has captured 44% of the CO2 removed between FY2019-20 and FY2023-24.

Particularly concerning is the fact that Gorgon’s performance has decreased over time, with a marked drop in the percentage of CO2 captured in the past three years. In FY2021-22, it captured 33% of the CO2 it removed, in FY2022-23 34%, and in FY2023-24 just 30%, its lowest performance to date. Since the start of its operation, the project has not achieved its target to capture 80% of the CO2 it removes in any single year. Instead, over the last five years, it underperformed by 45% against that target, and over the last three years by 60%.

Figure 1 – CO2 captured and stored, compared with CO2 removed from reservoir, MtCO2 and %

Source: Chevron, IEEFA analysis.

The captured reservoir emissions represent a very small proportion of the project’s total emissions. In one of its planning documents, Chevron estimated that the Gorgon project would emit around 50 million tonnes a year. This includes Scope One (emissions from removal of CO2 in gas field), Scope Two (CO2 in the gas liquefaction process) and Scope Three emissions (when gas is combusted by consumers such as electricity generators). Scope Three represents the largest share of total emissions. Assuming total emissions of about 50 million tonnes of CO2-equivalent (MtCO2e) since FY2019-20, this would mean that the CCS plant would have reduced those emissions by about 10 MtCO2 to 240 MtCO2e, or a 4% decrease.

The key reason behind Gorgon’s underperformance is issues with the reservoir pressure, which has to stay within a certain range. As a result, the pressure of the CO2 injection system has had to be constrained. In order to mitigate those issues, Chevron has implemented measures to remove water found in the reservoir and reduce the reservoir pressure. The company has built a number of water-producing and injection wells, as well as water-processing infrastructure. In addition, to compensate the shortfall in CO2 captured, Chevron bought about 10 million carbon offsets.

All these measures have added costs to the project. Capital costs increased from $2.5 billion in FY2019-20 to $3.2 billion in FY2023-23 (unchanged in FY2023-24). Chevron has announced that “further investment [is] planned to improve system performance and increase injection rates.”

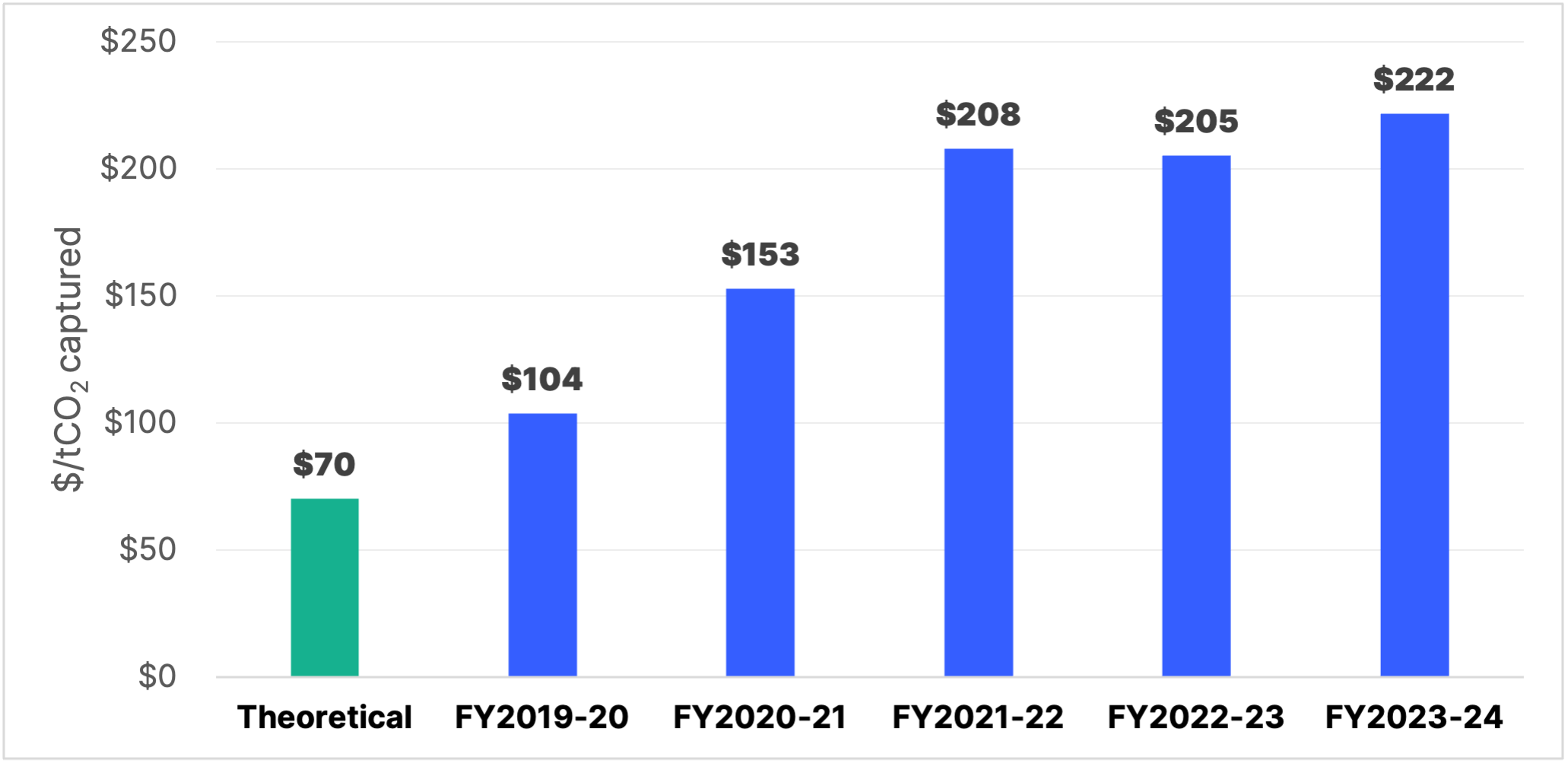

As a result, the cost per tonne of CO2 (tCO2) captured for the project has increased from an initially estimated $70/tCO2 to more than $200/tCO2 captured. The figure of $70/tCO2 was calculated by IEEFA based on the project’s initial capital costs, and 4 MtCO2 captured a year, which correspond to the project’s capacity. Figure 2 shows the actual cost per tonne captured at the project, which range from about $100/tCO2 to $222/tCO2 in the last financial year.

As can be seen on the graph, costs have been consistently high in the last three financial years. These cost numbers do not include a $60 million government grant Chevron received for the project, nor the cost of purchasing carbon offsets.

Figure 2 – Theoretical vs actual costs for the Gorgon CCS project, $/tCO2 captured

Source: Chevron, IEEFA analysis. Note: the theoretical cost is calculated based on initial project costs of $2.5 billion and annual capture rate of 4 MtCO2.

The underperformance and technical issues faced by the Gorgon project are not an exception. In 2022, IEEFA conducted a global review of 13 flagship CCS projects covering a range of sectors and countries, which represented half of the global CCS capacity. It found that of the 13 projects, only three achieved their targets. Two projects failed, one was suspended after four years of operation (recently restarted), five projects materially underperformed their own targets – by about 20% to 50% – and two projects provided no performance data.

IEEFA then conducted a review of two of the three successful projects, both based in Norway, and found that they faced significant challenges. In one project, the CO2 unexpectedly migrated to a previously unknown geological layer, with was fortunately contained. In the other project, a new storage location had to be found after just 18 months of operation. The main reason the project proponents were compelled to fix the issues they faced was a high CO2 emission tax in place in Norway.

These issues cast doubt on the financial viability of ambitious CCS plans by Australian governments and companies. For example, the proposed Bayu-Undan CCS project by Santos is much more complex than the Gorgon CCS project. It involves moving CO2 through almost 800km of pipelines and across maritime boundaries, compared with Gorgon’s 7km pipeline.

The new Gorgon CCS data also comes just as the Western Australian government revealed an ambitious vision and action plan for the state to become a global leader in carbon capture, utilisation and storage (CCUS). To support the plan, $26 million in government funding was granted to two Western Australian projects. Investors and governments should consider the risks associated with CCS carefully before allocating funds to those projects.