Renewables could help Bangladesh overcome power sector woes

Key Findings

The high degree of import dependence and the limited contribution of renewable energy are two parameters that explain the power system’s low-capacity utilisation.

While renewable energy projects appear hard to implement, Bangladesh has significant untapped potential.

Bangladesh can now multiply efforts for expanding utility-scale solar projects on the back of success in recent projects. The falling prices of accessories will make future utility-scale solar projects more competitive.

A new solar capacity of 2,000MW can immediately provide substantial dividends and flexibility - either help contain load shedding during the day-peak demand or minimise the use of expensive electricity, reducing staggering fuel import bills.

Nobody could imagine that the load-shedding would resurface in Bangladesh with a vengeance just months after the declaration of 100% electricity access in March 2022. Apart from a geopolitical crisis, the power sector’s contrasting development trajectory explains the situation well.

For instance, the country has drastically ramped up imported fossil-fuels-based power capacity but found renewable energy quite hard to install at scale.

While the ongoing sufferings are due to an energy and power crunch, renewable energy can help Bangladesh manage the situation better in the foreseeable future. But for this, government support is indispensable to expanding renewable energy in Bangladesh.

Bangladesh’s energy and power crisis continues

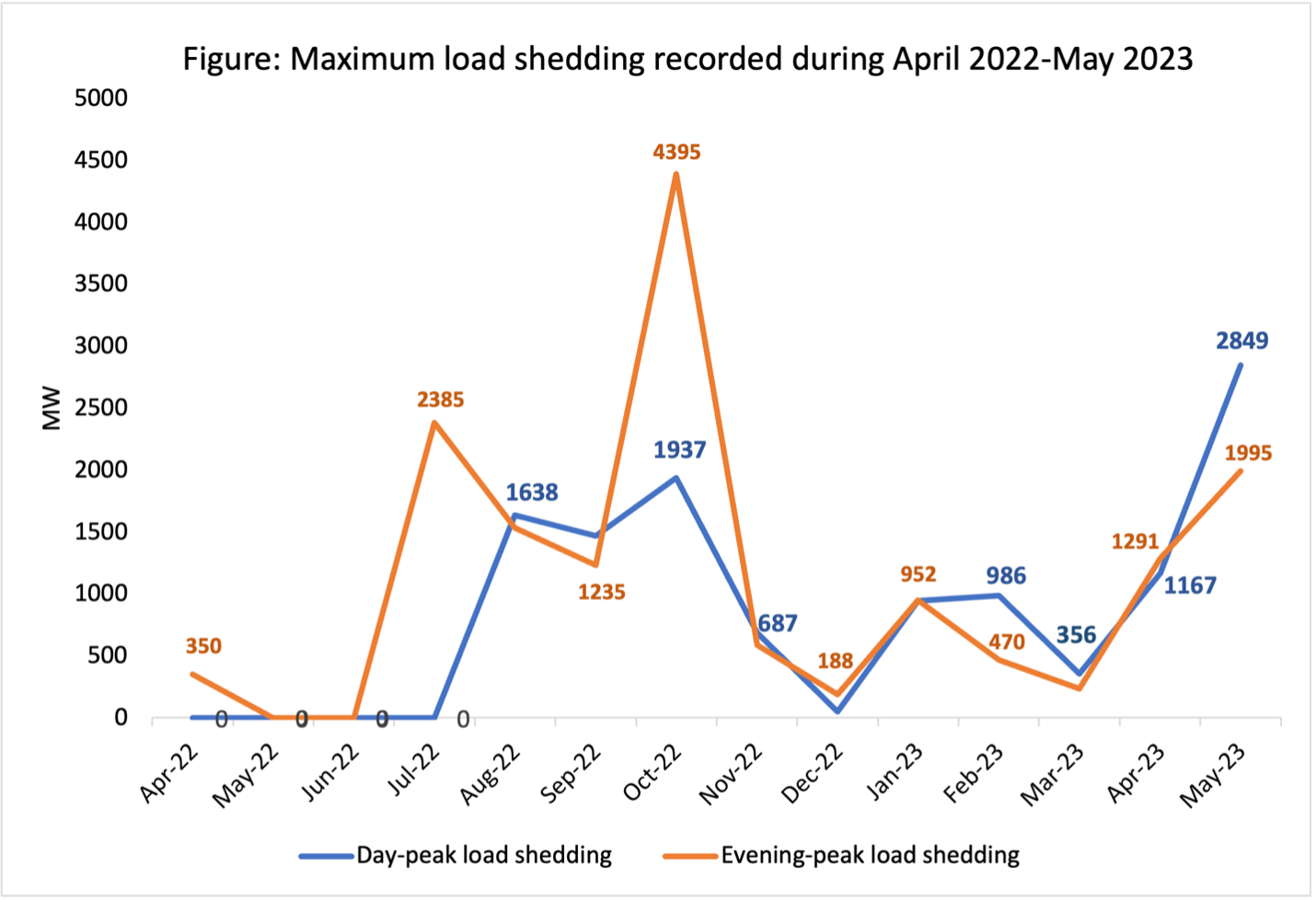

The euphoria around 100% electricity access lasted just four months as geopolitical circumstances changed. The situation abruptly worsened in July 2022 when Bangladesh had to reduce fossil fuel imports and opt for precautionary load shedding after the price surge of fossil fuels in the international market. While there was no load shedding in May and June 2022, the maximum evening load shedding during peak demand soared to 2,385 megawatts (MW) in July 2022 (see figure below).

Load shedding of 2,849MW and 1,995MW during day and evening peaks, respectively, continued till May 2023 (see figure below). Notably, the highest evening peak load shedding reached a whopping 4,395MW.

Source: Collated from monthly operational reports of PGCB; IEEFA analysis

Source: Collated from monthly operational reports of PGCB; IEEFA analysis

The power crisis is compounding the problems as industries have reduced production and people suffer amid the hot summer. Worse still, immediate relief is unlikely even after a series of energy and electricity price adjustments. The price stabilisation of different fossil fuels in the international market has thus far also had minimal impact on the power sector.

What explains the current power and energy sector situation?

There is a growing divergence between the reported power system capacity and the power demand served. Notably, the highest peak power generation in May 2023 was only 12,887MW compared to the total installed generation capacity of 24,911MW, representing an idle capacity of 48%.

The high degree of import dependence and the limited contribution of renewable energy are two parameters that explain the power system’s low-capacity utilisation. For instance, the power sector’s fuel costs stood at Bangladeshi Taka (Tk) 35.64 billion (US$328 million) in May 2023. Of this, Bangladesh perhaps spent over Tk30 billion (more than US$276 million) to import oil, coal, liquefied natural gas (LNG) and electricity. In May 2023, Bangladesh spent Tk19.547 billion (US$180 million) on imported liquid fuel. In the same month, it imported electricity worth Tk3.81 billion (US$35 million). The country normally imports most of its coal and a part of its gas as LNG.

The May 2023 episode underlines the acute challenge Bangladesh faces in fulfilling its power demand with a high import bill for fossil fuels against renewable energy’s share of only 0.75% of the total generation.

As the power demand increases next summer, Bangladesh will likely require spending even more on imported fossil fuels and electricity per month, aggravating the sector's financial health.

Therefore, without overhauling the power system model, the country might continue to perceive it is non-viable to import all of the fossil fuels necessary for an uninterrupted electricity supply and see its foreign currency level erode or become insufficient.

Renewables may help

Bangladesh has struggled to amplify grid-connected renewable energy capacity despite successfully implementing a highly impactful solar home systems programme. Reportedly, grid-connected renewable energy capacity is only 689MW, excluding rooftop solar under the net metering system.

Coincidentally, rooftop solar under net metering guidelines also stands at a paltry 84MW.

While renewable energy projects appear hard to implement, Bangladesh has significant untapped potential. Several thousand garment and textile industries and the under-development special economic zones are some places where rooftop solar can rapidly scale to a couple of thousand MWs. It is encouraging to note that the government of Bangladesh has floated an international tender to lease some 6.3 million square feet of rooftop spaces of the state-owned 13 jute mills to solar engineering, procurement and construction (EPC) companies. The goal is to make the space available to EPC companies to install rooftop solar systems of around 90MW capacity.

Alongside this, Bangladesh can now multiply efforts for expanding utility-scale solar projects on the back of success in recent projects. The falling prices of accessories will make future utility-scale solar projects more competitive. Bangladesh should employ a competitive energy procurement process for utility-scale projects to maximise the benefits.

A new solar capacity of 2,000MW can immediately provide substantial dividends and flexibility - either help contain load shedding during the day-peak demand or minimise the use of expensive electricity, reducing staggering fuel import bills.

Additionally, two Danish companies, namely, Copenhagen Infrastructure Partners (CIP) and Copenhagen Offshore Partners (COP), recently submitted an investment proposal to build a 500MW offshore wind project in Bangladesh. If the investors ultimately find the project viable and spearhead implementation, it may accelerate renewable energy deployment in the country with the potential for more investment from global companies pouring in both solar and wind power.

In parallel, Bangladesh should plan for small pilots with energy storage systems to prepare when costs would make them convenient for round-the-clock or evening peak usage.

IEEFA foresees that the renewable energy sector needs support

The situation for renewable energy promotion is not yet entirely favourable. While renewable energy accessories are mostly imported, suppliers are experiencing delays in opening Letters of Credit (LC) for their renewable energy projects under the strained foreign currency reserve of the country. This is affecting the project implementation.

Although the amount of LC openings decreased in the fiscal year (FY) 2022-23 with respect to FY2021-22, different banks combinedly issued LCs worth US$69.36 billion. Despite an upsurge in demand for rooftop solar due to the prevailing energy crisis, the LC amount for imported accessories of even 1,000MW solar capacity would be around US$500 million, which is just a fraction of the country's overall import. Therefore, delays in opening LC for a relatively low amount on the ground of foreign currency shortage is somewhat startling.

As a banking sector regulator, Bangladesh Bank may direct commercial banks to expedite issuances of LC for solar accessories to solvent clients. The Institute for Energy Economics and Financial Analysis (IEEFA) recommends urgent regulatory support to motivated and solvent industries and commercial building owners for swiftly executing rooftop solar projects. Additionally, the National Board of Revenue (NBR) of Bangladesh may declare solar accessories as essential goods in light of the country’s vision for 40% renewable energy by 2041.

The Prime Minister of Bangladesh, Sheikh Hasina, expects the country to yield significant success on the renewable energy front. To reiterate her support for the sector, she recently mentioned that duties and taxes for solar energy would be waived if needed. IEEFA’s analysis exhibits that the one-off revenue from import duties on solar accessories is way too low compared to the overall benefits rooftop solar will deliver for 25 to 30 years.

Finally, Bangladesh should start preparing for the future hot summers and prudently assess the advantages of renewable energy compared to the future capacity addition of fossil fuel systems. Even excluding the climate change mitigation component, renewables will offer Bangladesh partial relief from the astonishing level of fossil fuel imports and related foreign currency concerns.

This article was first published by Renewable Watch.