Reliability forecast confirms Australia needs to stay on track with energy transition

Key Findings

The latest Electricity Statement of Opportunities (ESOO) from the Australian Energy Market Operator (AEMO) shows the importance of keeping on track with the energy transition.

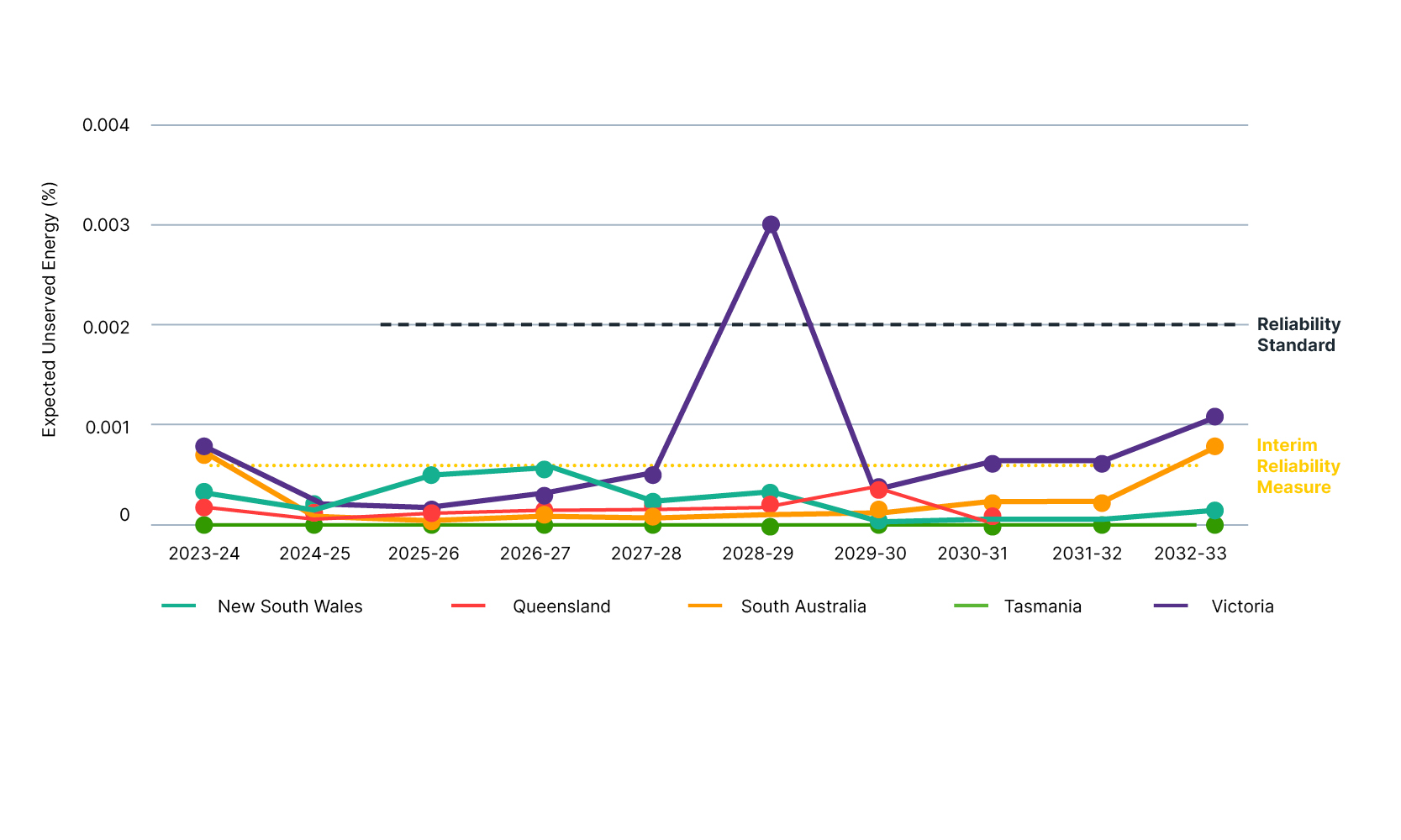

The ESOO shows that if appropriate measures proceed on schedule, the market is forecast to remain within the reliability standard in all regions except for Victoria in 2028-29. If such measures face delays, reliability gaps are forecast to arise in a number of regions after 2025-26.

In a scenario where government schemes and other actions do not proceed on schedule, the resultant short-term reliability gap does not appear to support calls to keep the Eraring Power Station in New South Wales open.

The latest Electricity Statement of Opportunities (ESOO), released today by the Australian Energy Market Operator (AEMO), shows the importance of keeping on track with the energy transition, by building large-scale zero-emission energy resources and increasing the uptake of co-ordinated distributed energy resources and demand flexibility.

The ESOO shows that if measures such as renewables and storage build, government schemes and actionable transmission projects proceed on schedule, alongside growth in investments in co-ordinated distributed energy resources (DER) and demand response, the market is forecast to remain within the reliability standard in all regions except for Victoria in 2028-29.

Expected unserved energy. Federal and state schemes sensitivity, 2023-24 to 2032-33 (%)

Source: AEMO

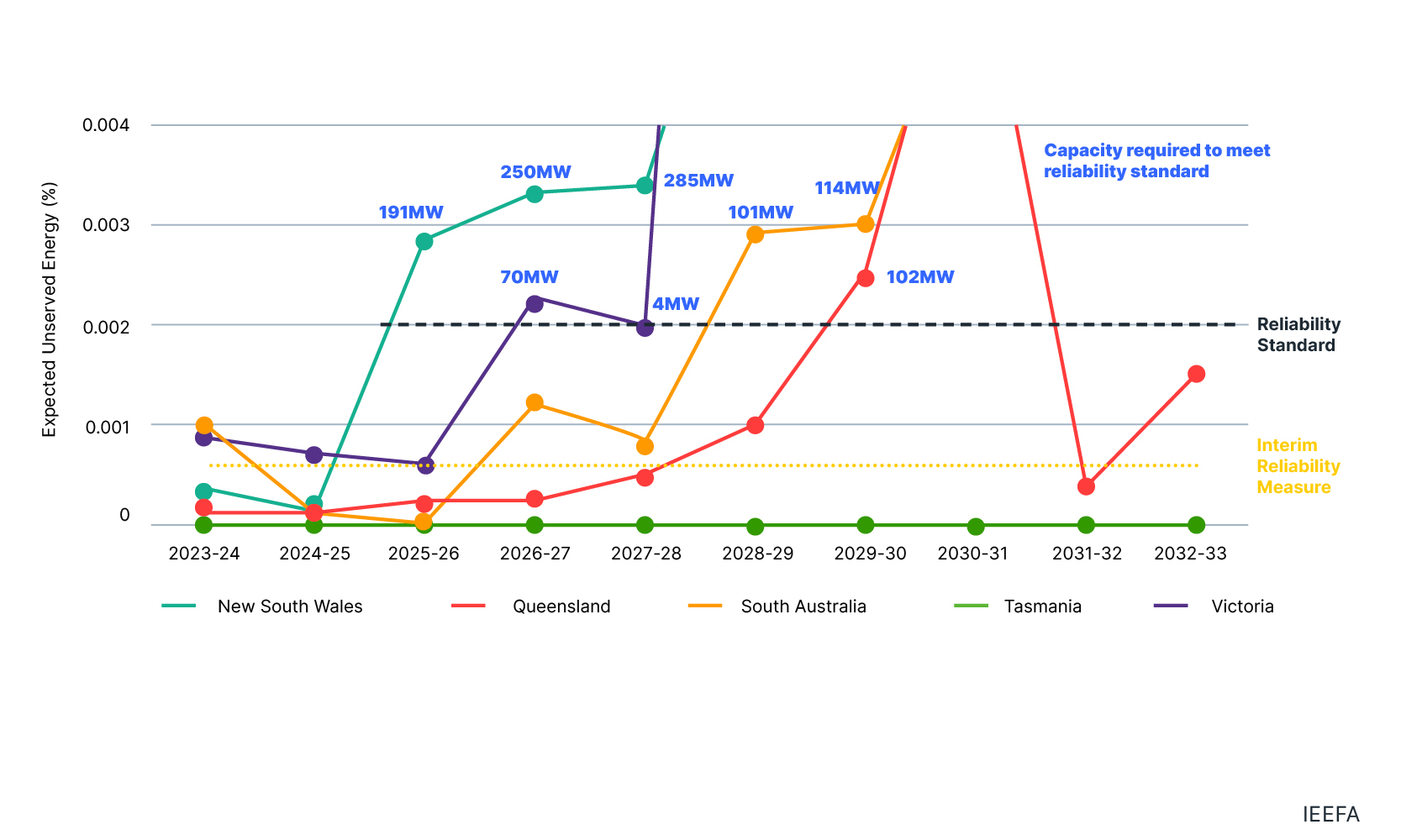

If these measures do not progress on schedule, reliability gaps are forecast to arise in a number of regions after 2025-26.

In the central scenario in which government schemes and other actions do not proceed on schedule and co-ordinated DER and demand response growth is less strong, the 2025-26 gap identified in New South Wales (NSW) after Eraring Power Station closes in 2025 is 191 megawatts (MW). This is not a large gap, being just 22% of the Waratah Battery capacity. The gap in 2026-27 is 250MW and in 2027-28 is 285MW. A gap of this size does not appear to justify keeping the entire 2,880MW Eraring plant open as its capacity is around 10 times the size of that gap.

Expected unserved energy, ESOO Central scenario, 2023-24 to 2032-33 (%)

Source: ESOO. IEEFA superimposed the data from Table 10 in the ESOO onto this chart.

Source: ESOO. IEEFA superimposed the data from Table 10 in the ESOO onto this chart.

The ESOO explains that the 2026-27 gap in NSW (250MW) could be filled by 252MW of eight-hour duration storage, or 477MW of solar paired with 238MW of four-hour duration storage. This is not an unrealistic amount of new build.

NSW installed 829MW of rooftop solar photovoltaic (PV) capacity in 2022 and aims to bring online 930MW of firmed capacity in NSW through the Capacity Investment Scheme (anticipated to include a large amount of storage).

NSW is in a strong position to build additional renewables and storage – or implement demand-side measures –to ensure Eraring can close on time in August 2025. This is clear from AEMO’s ESOO, as the sensitivity in which government initiatives and other actions were included suggests no reliability gap in NSW for the whole outlook period.

There is also a huge amount of additional proposed energy projects that are not included in AEMO’s ESOO (in any scenario or sensitivity) because they have not progressed far enough along the development pipeline. These could come online in future years, replacing exiting coal power stations and strengthening the reliability outlook. AEMO has identified 248GW of proposed projects across the National Electricity Market: 173GW of variable renewable energy (VRE), and 74GW of dispatchable resources.

The NSW project pipeline itself includes 68GW of proposed projects that are not included in AEMO’s ESOO and so would improve any reliability outlook. That is larger than the NEM’s existing capacity right now (59GW).

IEEFA notes that meeting the Interim Reliability Measure (IRM) – a more stringent reliability target that is set to end in 2025 but may be extended – is not a major focus of the recent ESOO. This is welcome as the proposals to extend the IRM have not been well supported by stakeholders.

AEMO’s ESOO shows that reliability risks can be well managed if the energy transition proceeds at pace. If it stalls, reliability gaps forecast to occur in the short term could be filled with relatively small additional capacity build.

The report makes it clear that government schemes, actionable transmission projects and energy generation and storage installations need to keep to schedule, alongside growth in coordinated consumer energy resources and demand-side participation, to ensure reliability is maintained through the coming years.