Proposed CCS projects need careful review for cost, technology risks

Key Findings

The U.S. Department of Energy last week selected five power projects for potential funding in its carbon capture and storage program; IEEFA continues to oppose the retrofit of coal-fired power plants with CCS.

CCS technology does not work as promised, and the length of time required to design, permit and build the projects will hinder efforts to move away from fossil fuels as quickly as possible.

DOE should stop spending more taxpayer dollars chasing the myth of CCS: We don’t know how these projects will perform because large-scale CCS capture on gas-fired power plants has never been commercially demonstrated.

These projects may ultimately warrant DOE funding for front-end engineering studies, but only after department officials have undertaken a clear-eyed review of the serious financial and technology risks involved.

The U.S. Department of Energy (DOE) last week selected five power projects for potential funding in its carbon capture and storage program. IEEFA has consistently opposed the retrofit of coal-fired power plants with CCS, believing that the technology does not work as promised; high project capital costs will only exacerbate coal’s already tenuous competitiveness in the power market; and that the length of time required to design, permit and build the projects will hinder efforts to move away from fossil fuels as quickly as possible. We continue to hold that opinion.

The proposed retrofit of the Four Corners coal plant in New Mexico fits squarely in that mold. The facility is majority owned by Arizona Public Service (APS), which has previously announced plans to close the 1,540-megawatt (MW) station in 2031. The Navajo Transitional Energy Company (NTEC), a minority owner of the plant, is proposing the CCS retrofit.

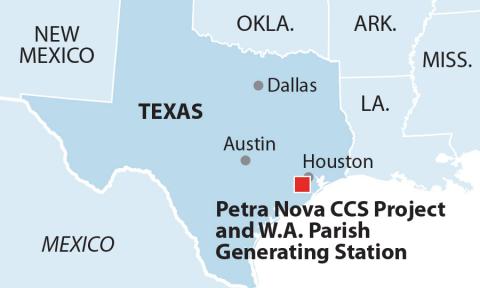

Leaving aside the significant liability and operational issues that would need to be resolved before NTEC and its partners could pursue their retrofit plans, DOE needs to focus on the technology risks associated with the proposal. The Four Corners plan would be more than six times bigger than the largest previously installed coal-fired CCS facility, the 240MW Petra Nova capture unit at the W.A. Parish plant in Texas. IEEFA has chronicled the problems there and sees no reason to believe that those performance issues have been resolved, or that new problems wouldn’t surface due to the project’s much larger size.

One of NTEC’s partners, Enchant Energy, had pushed for a CCS retrofit at the now-closed San Juan coal plant in New Mexico. The front-end engineering and design (FEED) study they completed for that project estimated that the plant’s net output after the retrofit would drop from 914MW to just 482MW, at a projected capital cost of $1.55 billion. Given that the Four Corners project would use the same technology, similar high parasitic load levels and capital costs can be expected.

There are cheaper and quicker ways to get clean, reliable capacity.

Last week, APS announced that it had energized a fleet of battery storage projects with 141MW of capacity located at solar projects across its service territory. The company expects to add another 60MW by the middle of the year, all with three hours of energy that can be used to store solar generation during the day and discharge it during peak evening hours.

There also is the simple fact that Four Corners is an old facility; Unit 4 is 54 years old and Unit 5 is 53 years old. Any retrofit is unlikely to be completed in less than five years, meaning the new capture equipment would be bolted onto what amounts to a 60-year-old frame. Is it reasonable to assume that the aging frame can continue to operate for the 20 years required to amortize the cost of the CCS equipment? We don’t think so.

Another project DOE needs to closely examine before signing off on any federal funding is a proposal by Duke Indiana to add CCS equipment to its Edwardsport integrated gasification combined cycle (IGCC) facility in Indiana. The 618MW facility was built in 2013 and has had serious performance problems. Although Duke initially said that the plant would run all the time on gasified coal, repeated problems with the plant’s gasification system have limited Edwardsport to only a 39% capacity factor on gasified coal. More problematic, it is a very expensive coal-fired generator. According to Standard & Poor’s, its operations and maintenance costs in 2022 were $59 per megawatt-hour (MWh).

A better option than adding expensive CCS equipment to an already-expensive power plant would be to end both the use of coal gasification at Edwardsport and any effort to add CCS. Retiring Edwardsport, rather than spending more taxpayer (and ultimately, ratepayer) dollars chasing the myth of CCS, is the best option.

Edwardsport was a bad idea when Duke first proposed it in 2005, and it has turned out far worse for ratepayers and the climate than the company predicted. The company’s ratepayers have paid well over $1.5 billion more for the power from Edwardsport since it went into service in 2013 than it would have cost to buy the same amounts of capacity and energy from the MISO markets.

Three other power projects were tapped by DOE for negotiations. Two are at conventional combined cycle gas facilities—the 1,120MW Polk plant owned by Tampa Electric in Florida and the 1,000MW Lake Charles plant owned by Entergy in Louisiana. The fifth facility is Dallman Unit 4, a 196MW coal-fired plant owned by the city of Springfield, Illinois.

In evaluating the combined cycle projects DOE needs to take seriously the first-of-a-kind nature of the two proposals. The happy-talk press release from DOE says the projects would “capture a minimum of 95% of the CO2 emissions.” The reality is we don’t know how those projects will perform because large-scale CCS capture on gas-fired power plants has never been commercially demonstrated. It would be advisable for DOE to consider 95% capture claims as aspirational, not actual.

The Illinois plant may be the most sensible of the proposals since it is by far the smallest of the projects and would represent an incremental learning opportunity. Here, it also is important to be clear about what is possible. The DOE press release says the project will capture an estimated 2 million tons of CO2 annually. That is impossible.

Dallman’s Unit 4 has an operating summer capacity of 196MW. If it operated at 100% every day for the whole year it would generate 1,716,960 MWh of electricity. Using its CO2 emissions rate from 2022, that would amount to 1,880,930 tons of CO2.

But no unit ever operates at 100%, and certainly not for years at a time.

Unit 4’s actual CO2 emissions over the past two years have been just under 1.4 million tons. So, let’s use real figures when evaluating this and all other proposals.

The DOE announcement includes this disclaimer: “DOE’s selection of an application for award negotiations is not a commitment by DOE to issue an award or provide funding … Before a funding agreement is executed, DOE may cancel award negotiations and rescind the selection for any reason.”

It is time for the DOE to take those words to heart. These projects may ultimately warrant DOE funding for front-end engineering studies, but only after department officials have undertaken a clear-eyed review of the serious financial and technology risks involved.