Prabowo’s ambitious decarbonization goal requires visionary project implementation

Download Briefing Note

Key Findings

Indonesian President Prabowo Subianto has outlined an ambitious goal to phase out all coal-fired and fossil fuel power plants within the next 15 years and pledged to develop over 75 gigawatts (GW) of renewable energy capacity. This plan includes leveraging Indonesia's rich potential in geothermal, solar, wind, and hydropower resources and will need international cooperation and private investment.

The planned phase-out of coal in Indonesia requires both commercial and operational considerations. The initial step involves identifying the coal-fired power plants (CFPPs) to be retired, starting first with state-owned power plants under PT Perusahaan Listrik Negara (PLN) and then moving to deal with Independent Power Producers (IPPs), which involve more complex contractual negotiations.

Candidate CFPPs for shutdown can be prioritized based on age, efficiency, current capacity, and utilization factor. While grid stability needs to be considered, in areas such as Suralaya in Banten, an abundance of older, redundant, PLN-owned units creates ample shutdown opportunities without sacrificing grid operations.

Considered project prioritization, robust commercial structures, and transparent, replicable bidding processes are needed to realize the Indonesian President’s vision. Implementing an investment program that delivers multiple gigawatts of projects year-on-year for over a decade requires a fresh approach to procurement.

Clear and efficient processes will allow the country to attract the vast sums of capital needed to achieve a successful transition, potentially helping to unlock promised funds and supports that have languished under Indonesia’s Just Energy Transition Partnership (JETP) proposal.

At the G20 summit in Brazil in November 2024, President Prabowo Subianto made a significant announcement regarding Indonesia's commitment to green energy and climate action. He outlined an ambitious vision to phase out all coal-fired and fossil fuel power plants within the next 15 years and pledged to develop over 75 gigawatts (GW) of renewable energy capacity. The 75GW plan refers to the Accelerated Renewable Energy Development (ARED) initiative by the national electricity utility, PT Perusahaan Listrik Negara (PLN), which aims to tap Indonesia's rich potential in geothermal, solar, wind, and hydropower resources.

President Prabowo expressed optimism about Indonesia achieving net-zero emissions (NZE) by 2050, a decade earlier than the government’s previous target. He underscored the importance of international cooperation and private investment to support Indonesia's energy transition, as government funding alone would not be sufficient.

On the same day, the head of Indonesia’s COP29 delegation, Hashim S. Djojohadikusumo, mentioned the importance of transitioning to cleaner and greener energy to tackle climate change. He also stated that Indonesia’s grand vision is to reduce greenhouse gas emissions to zero in 2060 or sooner and to avoid 1 billion tonnes of carbon dioxide emissions. Djojohadikusumo added that affordable clean energy would accelerate economic development, create jobs, ensure food security, and eradicate poverty while balancing industrial growth, environment, and sustainability considerations.

The Indonesian government’s announcements at the G20 and COP29 summits mark a significant step towards addressing climate change and transitioning to cleaner energy sources. The President’s ambition to phase out all coal-fired power plants (CFPPs) and develop 75GW by 2040 and NZE’s acceleration to 2050 also needs to be translated into laws and regulations, which will become the cornerstone for PLN to plan its next steps in prioritizing the development of clean and renewable energy development instead of fossil fuel power plants.

Ambition to action: Best approach to phasing out coal by 2040

The critical issue is finding the best approach to retiring all CFPPs by 2040. Planning the phase-out of coal in Indonesia is complex and requires various considerations. The initial step involves identifying the CFPPs to be retired, prioritized from among those owned privately by Independent Power Producers (IPPs) and those owned publicly through subsidiaries of the state utility, PLN. Separating the existing CFPPs into these two categories and then examining their individual characteristics will help determine the opportunities, costs, benefits, and obstacles in retiring specific plants.

CFPPs owned by IPPs operate under concession contracts, necessitating extensive retirement negotiations. This often reduces to determining appropriate compensation and addressing legal implications. Conversely, retiring PLN-owned CFPPs is more straightforward. Only internal assessments by PLN and the government are required to issue the necessary policies and regulations for writing off shuttered assets, thus avoiding negotiation and potential compensation issues.

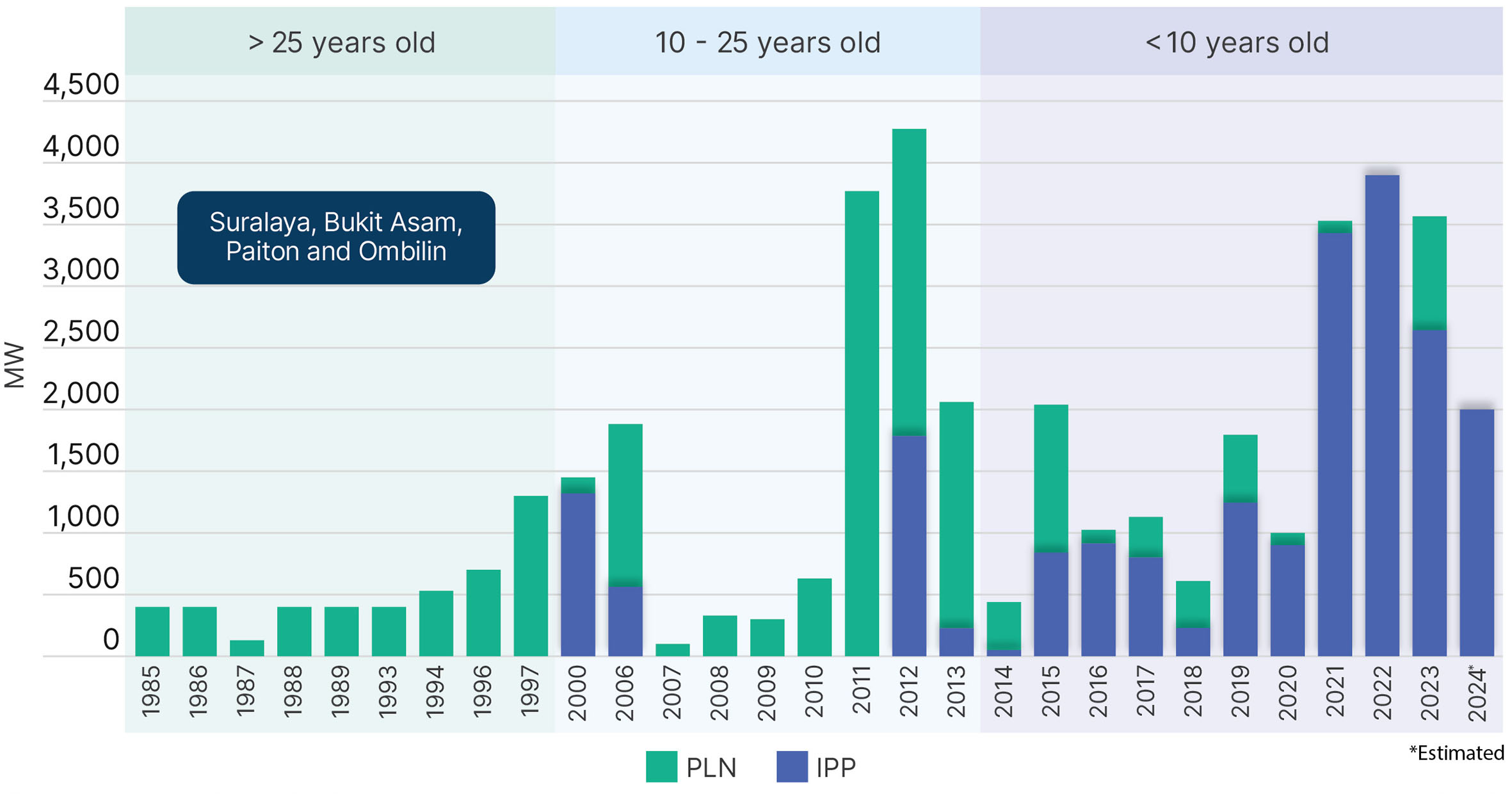

As of June 2024, Indonesia operates CFPPs with a total capacity of almost 50GW. Of this, 22GW are under PLN's management. Notably, 23% of PLN's CFPPs have operated for over 25 years. CFPPs typically have a 25 to 40 year lifespan, depending on maintenance quality, technological efficiency, and environmental regulations. Addressing the phased retirement of these plants, especially those over 25 years old, is essential for transitioning to a more sustainable energy future. PLN boasted an electricity reserve margin of nearly 40% in 2023 and over 40% on the main grid of Jawa Bali. This reserve provides considerable flexibility to retire the oldest and most inefficient publicly held plants. The first of these shutdowns can be implemented almost immediately, even while the government is figuring out the best course for adding replacement renewable energy power plants.

Figure 1: Annual Capacity of Coal-Fired Power Plants, 1985 – 2024

Source: Global Energy Monitor (GEM); PLN; IEEFA.

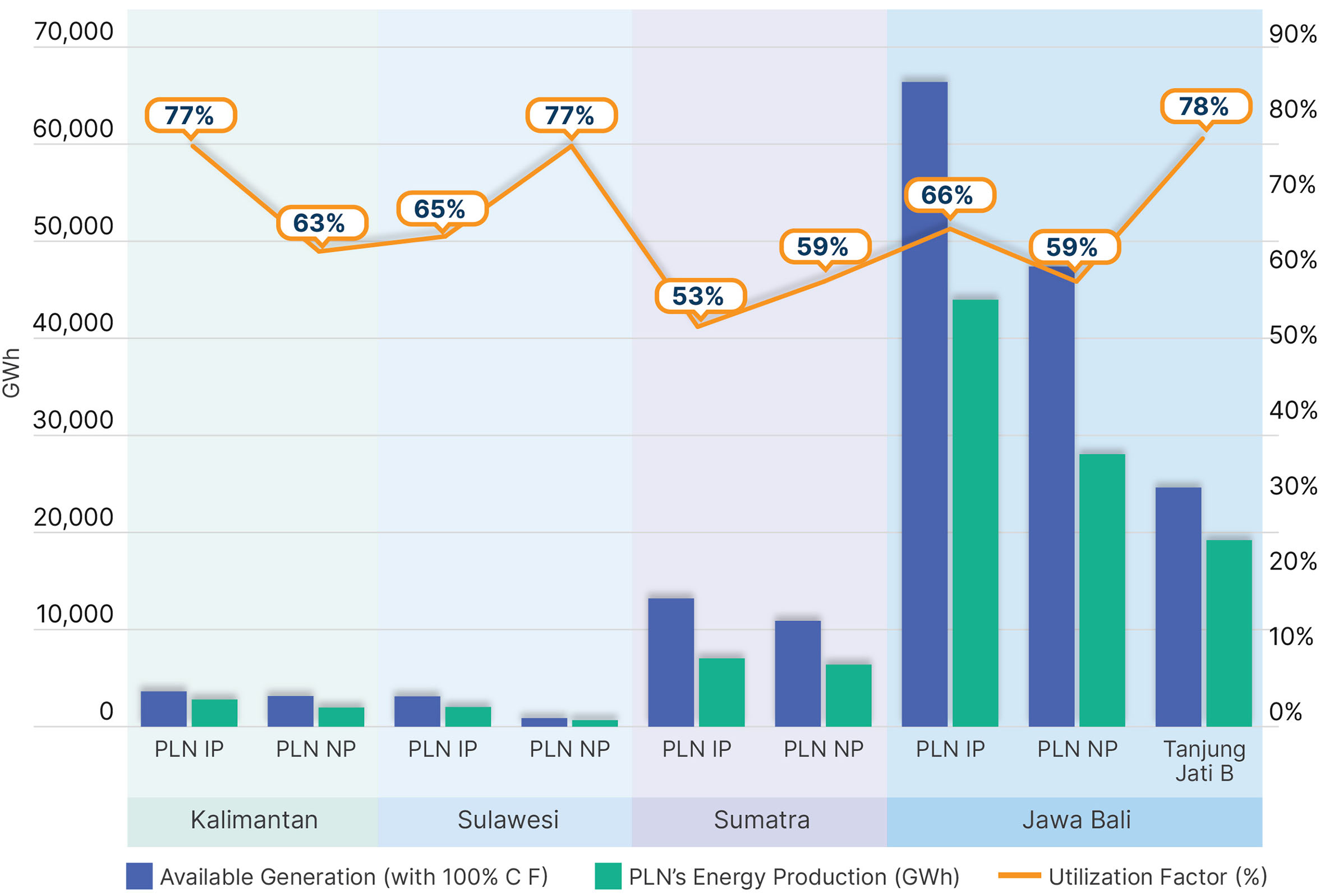

Due to the current oversupply condition, PLN-owned plants have not been fully utilized. Under normal circumstances, the capacity factor of coal plants should be around 80%. However, in 2023, most PLN-owned coal plants operated below this threshold, particularly in the Sumatra and Jawa Bali grids (Figure 2).

Currently, 17GW of PLN’s CFPPs have been consolidated under two main subholdings, PLN Indonesia Power (PLN IP) and PLN Nusantara Power (PLN NP). Additionally, PLN holds 2.8GW of Tanjung Jati B CFPP directly. Data from 2023 indicates that coal plants managed by PLN Nusantara Power operated at 59% capacity in the Jawa Bali grid. In the Sumatra grid, coal plants managed by PLN Indonesia Power operated at an even lower capacity of 53%.

Figure 2: PLN’s CFPP 100% Capacity Production, Actual Production, and Utilization Factor in 2023

Source: PLN Annual Statistical Report 2023; IEEFA.

Several CFPPs are suitable candidates to be pilot projects for retirement based on the criteria of capacity production, actual production, and utilization factor.

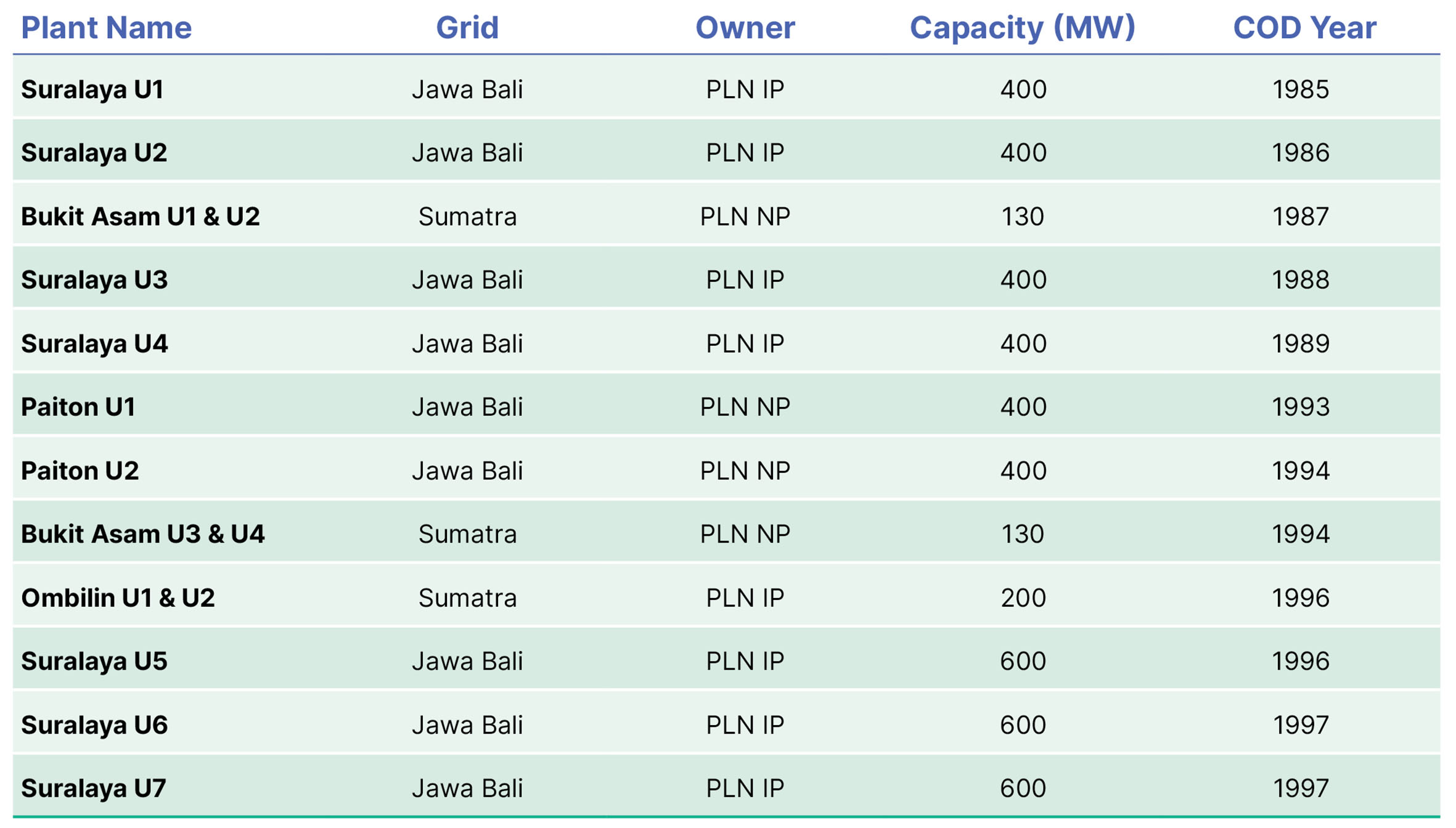

Table 1: Coal-Fired Power Plants Operating for Over 25 Years

Source: GEM; PLN.

Apart from CFPP's age, prioritization based on factors such as grid stability will also need to be considered. However, in areas such as Suralaya in Banten, a generation cluster with 4,025 megawatts (MW) of mostly PLN-owned plants, multiple units create supply redundancy. In such locations, unit shutdowns have less impact on grid operations. Further, given that some units are already nearly 40 years old, this creates opportunities for early progress on shutdowns.

Balancing act of coal phase-out and renewable energy development

To fully retire all CFPPs, it is essential to rapidly accelerate renewable energy development on a large scale. A smooth transition from coal to renewable energy involves careful planning and execution across multiple fronts.

President Prabowo’s plan to build 75GW of renewable energy by 2040 has been incorporated into the Electricity Supply Business Plan (RUPTL) 2024 – 2040 draft. Indonesia’s ambition and commitment to energy transition deserve support from developed countries, especially in funding. PLN has clearly stated that around US$235 billion will be required to achieve the target.

Indonesia has long been a proponent of transitioning from fossil fuels to greener and cleaner energy sources. The country has set an ambitious target of 23% renewable energy by 2025 and 31% in 2050. This target was also stipulated in the RUPTL 2021 – 2030, hailed as the “greenest” RUPTL at the time. It featured 21GW of renewable energy capacity, with half to be delivered in 2025. Despite the ambitious goals, the progress in renewable energy procurement has been far slower than expected. The previous RUPTL goal of 21GW implied that PLN would have to add 2.1GW of renewable capacity every year. Instead, the addition rate is 0.6GW per year, a fraction of what was envisioned.

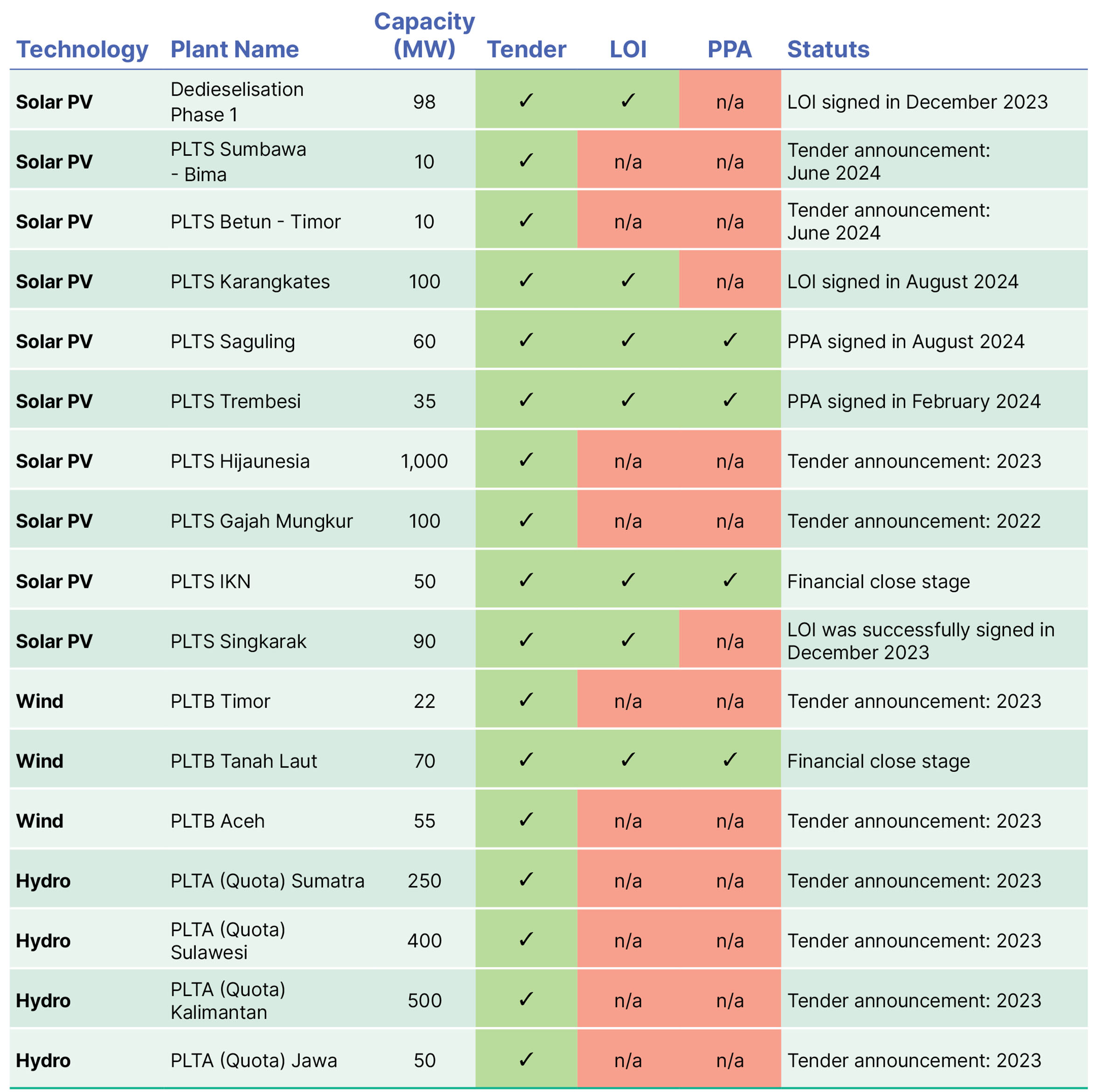

While PLN aimed to expand its renewable capacity significantly, the procurement process has been slow. Most projects under the current plan are still at the bidding and negotiation stages. These procurement challenges are illustrated in PLN’s Dedieselization Program, initiated in 2022. The program aims to replace up to 5,200 diesel power plants at 2,100 remote locations nationwide with renewable energy sources. Tenders were held for Phase 1 of this program, and Letters of Intent (LOI) were signed in December 2023. However, the deals remain incomplete. The lack of a clear timeline for signing Power Purchase Agreements (PPA) indicates that negotiations and planning are still required before the implementation phase can begin.

In 2023, PLN subsidiary PT PLN Indonesia Power was tasked with developing 1GW of utility-scale solar generation under the Hijaunesia Program. However, similar to the Dedieselization Program, the project is still in the planning and partner selection phase nearly two years later.

An overview of PLN’s current renewable energy program is provided in Table 2.

Table 2: List of Renewable Energy Bids, 2022 – 2024

Note: LOI = Letter of Intent. An LOI only provides an indication that PLN wants to proceed with a specific private party to reach a contractual agreement. Thus, projects holding an LOI are still under negotiation.

PPA = Power Purchase Agreement. A PPA is the negotiated contract between the private party and PLN that sets the sale price of power from the project and defines the way in which the project will be built, operated, and maintained over its life. A PPA is required before the private party can complete its financing and commence construction.

Source: IEEFA.

Restructured procurement procedures needed to promote renewable projects

Delays are common in large-scale projects, especially those involving multiple stakeholders and significant financial investments. However, unclear and uncertain procurement processes exacerbate these challenges and hinder investment inflows to Indonesia.

As highlighted in IEEFA’s report, Unlocking Indonesia’s Renewable Energy Investment Potential, the current approach to bidding and commercially challenging contractual structures have limited the attractiveness of renewable energy investment in Indonesia. Imbalanced contract provisions, such as mandatory shareholdings, share transfer restrictions, low price caps, and a project-by-project negotiating process, limit the private sector’s desire to participate in Indonesia’s renewable development.

A comprehensive restructuring of the government’s procurement procedures should be considered to achieve the multi-gigawatt annual additions needed to realize President Prabowo’s vision. Prioritized project procurement pipelines need to be established, backed by rational bidding and contracting principles, and augmented with development support funding to produce the 3-5GW annual renewable capacity necessary to meet the goal. This is possible but requires a carefully considered, comprehensive approach that engages broad cross-sections of government, imbued with robust practices, and implemented with a sense of urgency.

The Indonesian Government already possesses many tools, supports, and institutional knowledge to affect this change, but these need to be refined, expanded, and effectively coordinated.

Resources must be pooled in a new and enhanced manner to meet the scale and ambitious timeline of the Indonesian President’s vision. Institutions like PT Sarana Multi Infrastruktur, Indonesia Infrastructure Finance, and the Indonesia Investment Authority can partner with the Ministry of Energy and Mineral Resources, Ministry of Finance, and PLN to create the necessary resources and processes. For such a massive clean energy procurement program to succeed, prioritized portfolios of projects that ideally have land and resources available for early implementation should be identified. Key project preparation aspects should be undertaken to reduce risk, supported by commercially sound contracting and transparent procurement processes. This approach needs to be consistently replicated, in a predictable manner, for numerous projects, year after year.

PLN will need to evolve broader institutional management and oversight mechanisms to ensure partners deliver high-quality energy as contractually expected. Rolling out significant renewables additions will require a specialized workforce and adequate technical and financial resources. Tracking financial and economic benefits will be essential for effective fiscal management, accounting for the eliminated costs of legacy CFPPs and the benefits of new, potentially more cost-effective obligations arising from renewable energy assets.

The underlying premise of the US$20 billion Just Energy Transition Partnership (JETP) proposal introduced in November 2022 was the combined retirement of CFPPs and the large-scale addition of renewable energy plants. To mobilize those funds, Indonesia’s JETP secretariat, comprised of government, private sector, and non-government advisors, created the Comprehensive Investment and Project Plan (CIPP) in November 2023, with 400 projects indicating nearly US$100 billion in investments. To date, and as IEEFA has previously addressed, Indonesia’s JETP has languished due to a need for aggressive plans to prioritize and implement renewable energy projects under the CIPP.

However, with the President’s bold announcement and comprehensive decarbonization vision, these plans, funds, and management resources have a focus and added urgency. It is time to match the vision with detailed plans, principles, and processes for implementation. Implementing a progressive plan to shut down CFPPs, both public and private, is key to demonstrating a commitment to net zero by 2050. Establishing a clear and efficient renewable energy procurement process to deliver replacement energy at great scale is essential. Together, this will ensure that Indonesia attracts renewable energy investment, which can help the country meet its ambitious renewable targets and successfully transition to a more sustainable energy future.