Overshadowed by pandemic, war and economic concerns, the electric power transition has become a juggernaut in the U.S.

Key Findings

The growth of renewables in the U.S. electricity grid is poised for a huge leap.

Wind and solar have accounted for more than 15% of U.S. demand on 126 days in 2022.

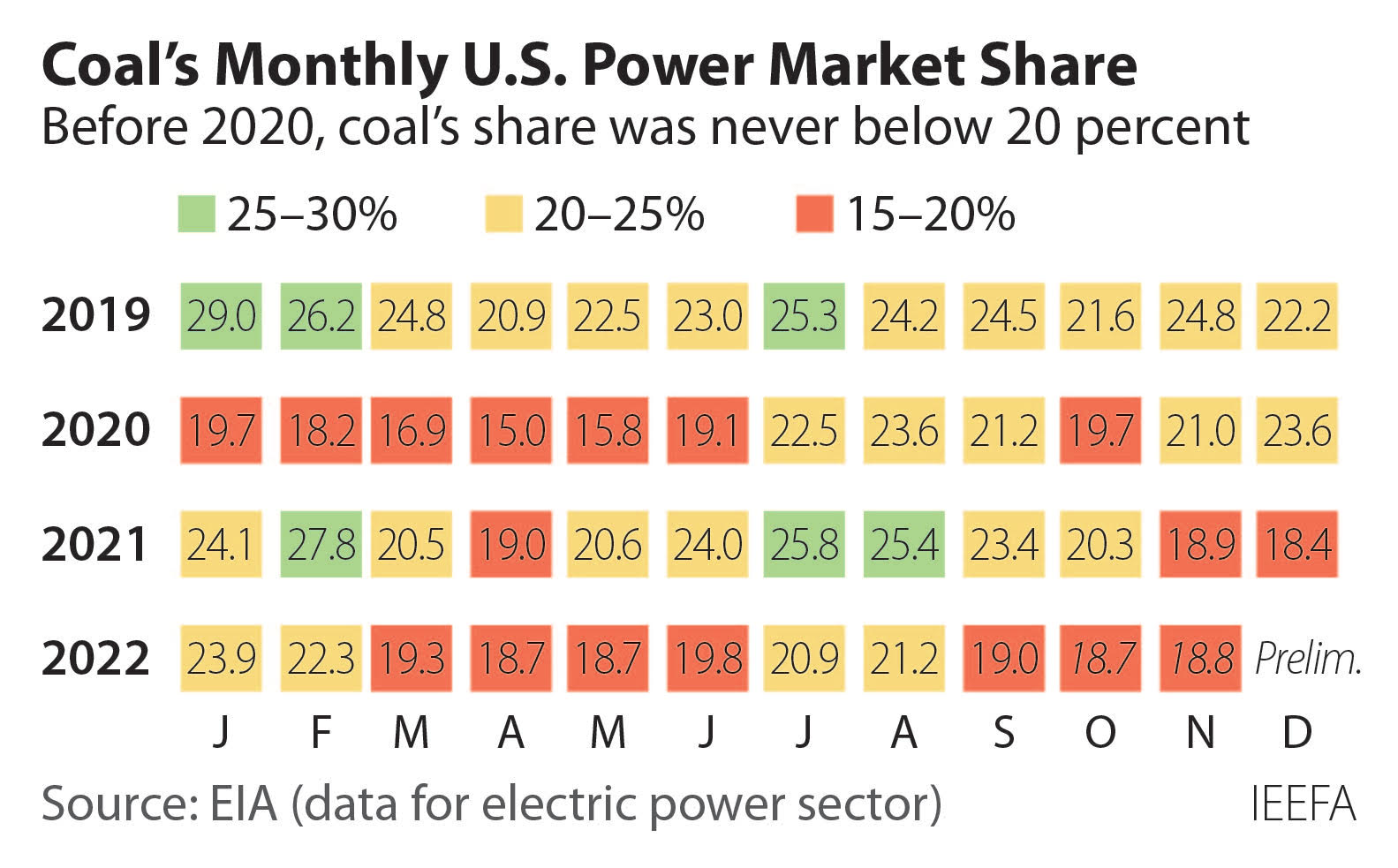

So far this year, coal’s share of consumption has fallen below 20% for seven of 11 months.

Years of groundwork are paying off in momentum for renewables, battery storage

A massive transition has occurred in the U.S. electric power system in the past three years, largely overshadowed by the COVID-19 pandemic, Russia’s invasion of Ukraine and the economic turmoil that both have left in their wake. Despite these events, the growth of solar and wind generation and battery storage has not slowed. The growth is poised to accelerate as incentives in the Inflation Reduction Act (IRA) begin to take effect.

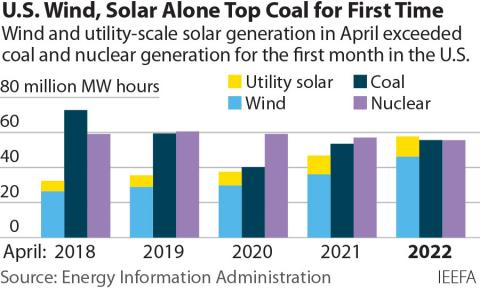

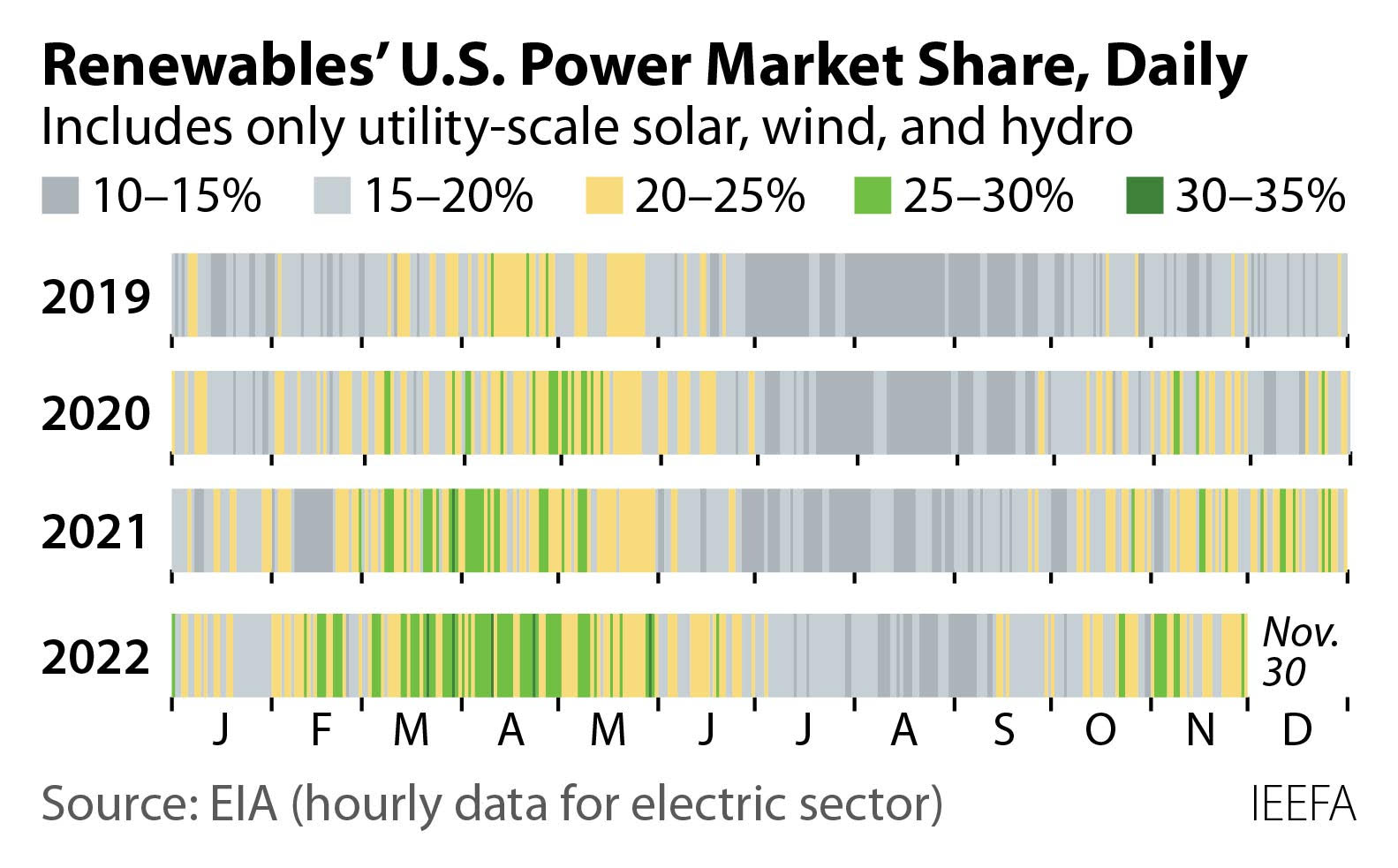

The numbers are stunning. In 2019, there were just four days during the entire year when solar and wind generation accounted for more than 15% of total U.S. demand. Through the end of November 2022, wind and solar have topped that marker on 129 days. Notably, of those 129 days, the market share for wind and solar topped 20% of total demand 41 times; that did not happen once in 2019.

Adding hydro to the mix further underscores the rise of renewables. So far this year, wind, solar and hydro have generated more than 25% of daily demand on 69 days (or 20.7% of the time); for all of 2019, that happened just three times. The transition is also notable at the other end of the spectrum: As renewable capacity has increased, there has been a steady decline in the number of days that its market share has been below 15%, as the following graphic illustrates.

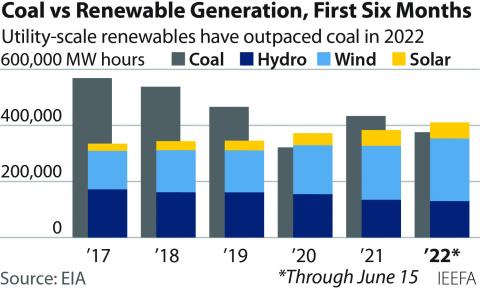

The rising renewable numbers are occurring even as total U.S. generation has grown—in other words, renewables are outgrowing a growing market. Through November, total U.S. generation (using information from the Energy Information Administration’s hourly grid monitor) is up 94.3 million megawatt-hours (MWh) or 2.6% from 2019. Wind and solar generation during the same period increased by 192 million MWh, with solar output almost doubling and wind rising by about 50%.

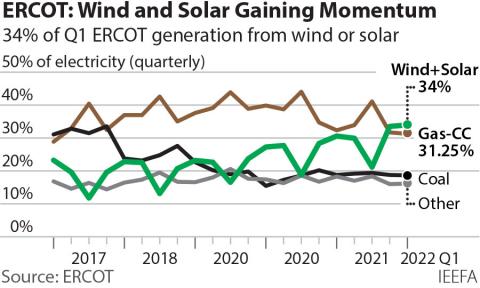

The numbers show that wind and solar have more than matched the growth in U.S. generation in the past three years, and are pushing fossil fuels—especially coal—off the grid. Generation from coal-fired power plants has fallen by 96 million MWh, or 11%, in the past three years. The graphic below shows the trend: Before 2020, coal’s monthly market share never fell below 20%—but in 2022, it has been below 20% for seven of the 11 months. Planned retirements in the next eight years will only accelerate the downward trend. IEEFA research shows that more than 90 gigawatts (GW) of installed coal capacity are slated for retirement by 2030. The retirements would push total capacity down to about 117GW, almost two-thirds below the 2011 peak of 311GW.

IEEFA also believes the retirement numbers are likely to rise. Just in the past several weeks, Xcel Energy and DTE Energy have both announced new coal plant retirements (not included in our 92.5GW estimate) that will take effect by 2030.

Xcel said it was going to accelerate the retirement of its two-unit, 1,067 megawatt (MW) Tolk coal-fired plant in Texas to 2028 from 2032 because of serious water supply shortages at the facility. Low-cost gas and rapidly rising renewable generation in Texas have also weighed against the plant, which has steadily lost market share since 2013 when its capacity factor topped out at 88.5%. By 2021, it had fallen to just 26.6%. The Tolk announcement, coupled with a decision earlier this year to close Xcel’s troubled Comanche 3 unit in Colorado by the end of 2030, means the utility will be coal-free by the end of the decade.

Meanwhile, DTE proposed closing two units at its four-unit, 3,086MW Monroe coal-fired power plant in 2028, and then shuttering the other two boilers in 2035. The DTE announcement is particularly significant because the utility previously had been planning to keep all four units at the plant running until 2040. Monroe, currently the third-largest coal plant in the U.S. in terms of operating capacity, is also the third-largest emitter of carbon dioxide, averaging more than 16 million tons annually the past 10 years.

Developments over the past three years, capped by these two utility announcements, are the curtain raisers for an accelerating renewable transition that is about to take center stage.

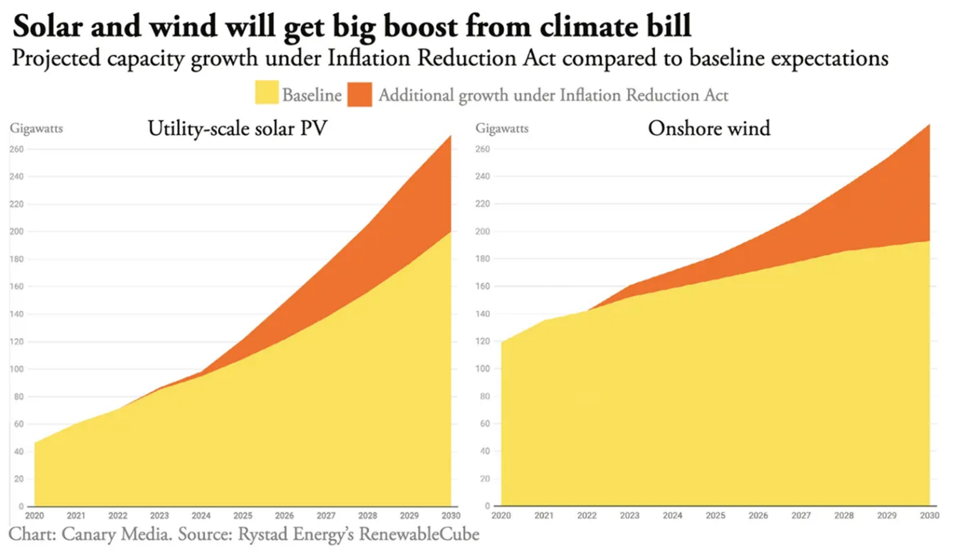

Project development queues were already overflowing with planned solar, wind and storage projects. Now, even more rapid growth is on the way with the IRA’s extended wind and solar tax credits and new support for standalone storage. The graphic below highlights these two factors: The significant growth that was already expected, and the additional growth on the drawing board.

Another increasingly important component of the transition is small-scale rooftop solar generation, which has been growing quickly recently and will benefit from a host of new tax benefits in the IRA. The Energy Information Administration’s (EIA) Electric Power Monthly shows that small-scale solar generation through August has grown to 41.9 million MWh, up 7.3 million MWh or 21% from a year ago, and already 20% above the total generation from 2019 (estimated at 34.9 million MWh by EIA). Rooftop solar is still a small portion of the electric power sector, but its impact is beginning to show up across the U.S.

The developments of the past three years show clearly that despite significant headwinds, the transition toward renewables has gained speed. The next several years will see even faster growth.

Dennis Wamsted ([email protected]) is an IEEFA energy analyst

Seth Feaster ([email protected]) is an IEEFA energy data analyst