Nuclear options: New research on SMRs raises questions over Australia's energy debate

Key Findings

Following the recent publication of CSIRO research showing that large-scale nuclear would be costly and slow to implement in Australia, a new report from IEEFA shows that similar challenges exist for small modular reactors (SMRs).

SMRs remain a relatively new, unproven technology that are too expensive, would take too long to build, and would present too many risks to play a significant role in Australia’s energy transition.

IEEFA's research also raises questions over claims SMRs would be a complementary resource for electric grids dominated by renewables, as they are best placed to provide continuous generation with a high capacity factor.

Investing in SMRs would risk derailing the transition away from fossil fuels, potentially delaying it significantly. Policymakers, utilities and investors should embrace the reality that renewables, storage and DER offer the near-term solution to Australia’s energy transition.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

After CSIRO released modelling in May showing that large-scale nuclear is highly costly and would take a long time to implement, some might conclude this puts the other nuclear option – small modular reactors (SMRs) – back on the table.

Well… perhaps not.

Nuclear power is now a debated topic in Australia, with the opposition Coalition flagging it as a cornerstone of its energy policy. Although details remain scarce, news reports suggest it may entail building nuclear reactors on the sites of decommissioned coal power stations. The Coalition was originally focused on installation of SMRs, but later changed focus to large-scale nuclear.

However, questions were raised on 22 May with the release of the 2023-24 annual GenCost report by Australia’s national science agency. For this year’s report, CSIRO included large-scale nuclear power for the first time. It concluded that large-scale nuclear would be more expensive than renewables, and would require at least 15 years to develop, including construction.

The opposition has disputed the report’s findings and asked CSIRO to rerun its modelling. However, given the numerous political, regulatory, financial and logistical challenges that nuclear generation projects routinely encounter, as well as the absence of any large-scale nuclear industry in Australia, it seems reasonable to assume that – at the very least – the timeline for such a plan would carry a high degree of uncertainty.

So, with the prospects for large-scale generation somewhat diminished, perhaps the focus may turn to SMRs. SMRs have long been touted to be quicker and cheaper to construct than we’ve seen previously with more conventional nuclear plants.

However, the Institute for Energy Economics and Financial Analysis (IEEFA) is this week releasing new research that suggests SMRs do not represent any more credible an option than large-scale nuclear plants. IEEFA’s report, SMRs: Still Too Expensive, Too Slow and Too Risky, reinforces previous research by IEEFA, showing that SMRs are too costly, they would take too long to build, and they would present too many risks to play a significant role in Australia’s energy transition away from fossil fuels.

The nuclear industry remains beset by frequent cost overruns and schedule delays, and SMRs have not been exempt from these problems. SMRs remain a relatively new, unproven technology. Drawing on the experiences of operating and proposed SMRs, our researchers found the reactors would continue to take much longer to build than their advocates claim, and at a much higher costs.

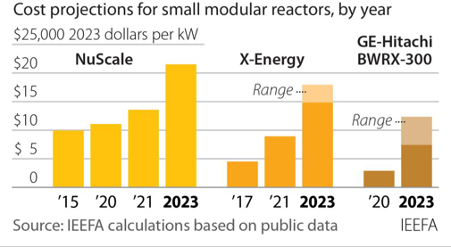

SMR construction cost estimates keep rising

SMRs in operation or under construction in China, Russia and Argentina have seen their costs increase three- to seven-fold since their original cost estimate. Cost estimates for US SMRs have also multiplied by between two and four in recent years. In addition to the cost issues, long delays have been the norm, not the exception, with projected schedules of three to four years at the start of construction stretching to 12-13 years.

The report also raises questions regarding claims that SMRs would be complementary resources for electric grids dominated by renewables – as is increasingly the case in Australia. SMRs are best placed to provide continuous generation with a high capacity factor. The less they run, the more their cost per megawatt-hour (MWh) increases. With a utilisation factor of 25%, the cost for an American SMR would be US$400/MWh, or about A$600/MWh.

Importantly, investing in SMRs would risk derailing the transition away from fossil fuels, potentially delaying it significantly. It would divert funding and resources away from the carbon-free alternative technologies like renewable energy generation and battery storage, the costs of which have plunged in recent years with further reductions to come.

These are technologies that can have a meaningful impact on Australia’s energy transition in the coming 10 years. IEEFA research has highlighted a wealth of opportunities to accelerate the transition through the likes of large-scale renewables and storage, distributed energy resources (DER), electrification of households, optimising large-scale energy storage, and smart demand-side measures. All of these are proven, low-cost options that are ready to be deployed now.

Policymakers, utilities and investors should embrace the reality that it is renewables, storage and DER, not SMRs, that offer the near-term solution to Australia’s energy transition.

This article was first published in ReNew Economy