Key Findings

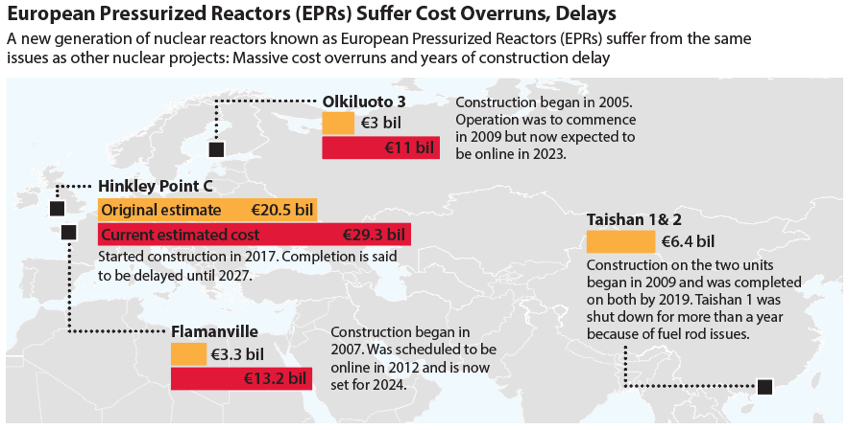

The five European Pressurized Reactors (EPRs) designed by French utility EDF have all suffered unanticipated issues that have led to costly delays and soaring price tags.

The issues with the EPRs underscore the findings of a 2020 Massachusetts Institute of Technology analysis that found successive iterations of a new nuclear design generally cost more than the original project.

Although a pair of Chinese EPRs have been completed and are generating power, one unit was shut down for more than a year because of faulty fuel rods. Costs and delays have also plagued EPRs in France, the United Kingdom, and Finland, where the completion of the Olkiluoto 3 reactor has been delayed 17 years.

Executive Summary

A basic axiom of engineering is that the first product is always the most expensive. As designers and builders gain experience, subsequent products take less time and cost less money than the original product. The newest generation of nuclear reactors, however, is an exception to the rule.

One of the latest iterations of nuclear reactors, the European Pressurized Reactor (EPR), is a prime example of how a promising design has fallen victim to realities on the ground, resulting in massive cost overruns and years-long construction delays.

Five EPRs have either been built or are being built; another one is planned. Four of the five EPRs built have suffered enormous cost overruns and/or significant construction delays. The Taishan 1 reactor in China, the first to be completed, was taken offline in July 2021 because of damaged fuel rods. Two EPRs, the Flamanville reactor in France, and the Olkiluoto 3 reactor in Finland, have been delayed because of operational concerns. The newest reactor to begin construction, the Hinkley Point C reactor in the United Kingdom, after less than four years of construction, is already one-third over its original budgeted estimate and is currently delayed at least two years.

The nuclear buildout comes as governments, corporations and individuals struggle to curb emissions from fossil fuels in hopes of limiting global temperature increases to 1.5⁰C by 2050. The International Atomic Energy Agency (IAEA) predicts that nuclear energy capacity will more than double to 715 gigawatts (GW) by 2050 but still make up no more than 12 percent of global electricity. The small increase in nuclear energy’s share reflects the expectation that electricity will be used for a wide variety of activities such as heating and transportation that are currently fueled by carbon-based energy sources. However, it also likely illustrates the cost-effectiveness and increasing popularity of other, faster-growing non-carbon sources of energy, such as solar and wind power.

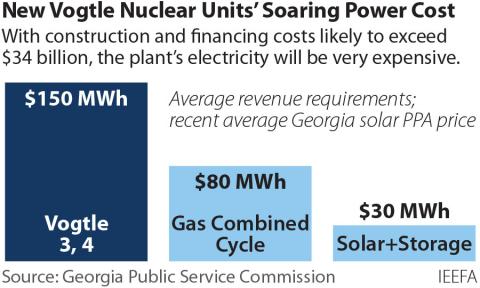

With an anticipated lifespan of 60 to 80 years, nuclear energy has advantages over solar and wind (25 years) and natural gas-fired facilities (30 years). However, overnight construction costs for nuclear energy—the amount of money it would take to build a facility without interest being charged—are much higher than most other sources. A study by the U.S. Energy Information Administration (EIA) pegged the typical overnight cost of a nuclear reactor at USD$6,695 per kilowatt (kW), which compared extremely unfavorably to USD$1,718/kW for onshore wind, USD$4,833 for offshore wind, and USD$1,748 for a solar-plus-storage project.

Moreover, the costs of wind and solar have been plummeting, and are expected to continue to decline, while nuclear construction costs, especially in the United States, have risen sharply. Utility-scale solar fell 88 percent between 2010 and 2021; the average cost of land-based, wind-driven energy has fallen 68 percent since 2010. The costs of nuclear energy, meanwhile, rose almost 33 percent between 2015 and 2020.

The problems with EPR reactors cast the nuclear dilemma into sharp relief. Nuclear energy may be part of the climate change solution, but among its other pitfalls, it is a very expensive alternative to renewables. And as the costs of renewable energy sources continue to fall, nuclear facilities that have cost investors and ratepayers billions face a very real risk of becoming stranded assets well before the end of their projected lifespans.