Key Findings

Switching gas appliances to efficient electric alternatives at end of life from 2025 is crucial to addressing Victoria's urgent gas supply shortfalls and emissions targets.

Gas distribution networks may face billions in unrecovered costs, but these are outweighed by the savings to consumers, and a plan is needed to wind the networks down.

Any delays increase the difficulty of the task, jeopardising emissions targets, and locking in hundreds of millions in costs for consumers.

State and federal governments must act to smooth the electrification transition by implementing standards and market arrangements for energy efficiency and demand-response capabilities, and building strong workforces and supply chains.

Victoria faces gas supply shortfalls, and must dramatically

cut emissions

Both the Victorian state and federal governments have committed to significant reductions in greenhouse gas emissions that are likely to require a rapid phase-out of fossil fuels.

A wide range of energy and climate experts internationally and within Australia have presented evidence that transitioning to all-electric homes offers one of the fastest and cheapest options to reduce emissions.

The Australian Energy Market Operator (AEMO) has also forecast that Victoria may face a long-term shortfall of gas supplies by 2027, driven by the rapid depletion of fossil gas reserves in Bass Strait. Without a significant reduction in Victoria’s fossil gas demand, new supplies will need to be sourced from other states. This would require significant investment in new infrastructure that would likely need to be prematurely retired shortly after it was built if governments are to meet their emissions targets.

This is not only a problem for Victoria, as Australia’s exposure to international gas markets has raised challenges for consumers in other jurisdictions. However, Victoria, where residential consumption accounts for the highest end-use fossil gas demand, has the greatest opportunity to benefit from rapid reductions in residential fossil gas demand.

Ending sales of new household gas appliances the most logical next step

The analysis in this report goes a step further than prior Australian analyses, focusing specifically on the economic implications of ending sales of residential gas appliances in Victoria from 2025.

While this may appear a bold proposition, it is unlikely that alternative approaches could address the simultaneous challenges of:

- Reducing and delaying projected long-term gas supply shortfalls, while also contributing to emissions targets;

- Delivering significant financial savings to households; and

- Avoiding inequitable outcomes for renters, if rental providers opt to replace like-for-like while homeowners shift to electricity on economic grounds.

Alternative approaches, such as increasing onshore gas supply, would entail longer lead times, higher uncertainties and poorer outcomes for energy bills, and would be incompatible with emissions targets.

There is a strong case for ending sales of gas appliances as early as 2025. If gas appliances were required to be replaced with efficient electric alternatives at their end of life, the average Victorian home could save $1,200 a year on their energy bills. If upfront costs were amortised as a 10-year loan, consumers would see net savings of over $75 a month.

Overall, Victorians could save a collective $912 million in locked-in costs for each year that appliances were converted to electric at end of life rather than staying with gas, and be protected from the material risk that those appliances become stranded assets.

Transitioning gas appliances to electric alternatives could reduce Victoria’s projected long-term gas supply shortfall by a cumulative 22% compared with AEMO’s central Step Change Scenario, and by 53% compared with a worst-case scenario. The onset of a shortfall would also be delayed. It would also do most of the heavy lifting to align Victoria’s residential fossil gas emissions with the state’s economy-wide emissions reduction target, although additional measures would also be needed.

Benefits offset costs of winding down gas distribution networks

Electrification presents an inherent risk to gas distribution businesses, which is reflected in their high historic rates of return. Interim measures have been approved to accelerate their cost recovery, and regulate customer abolishments. However, the AER has acknowledged that these are not sustainable long-term solutions.

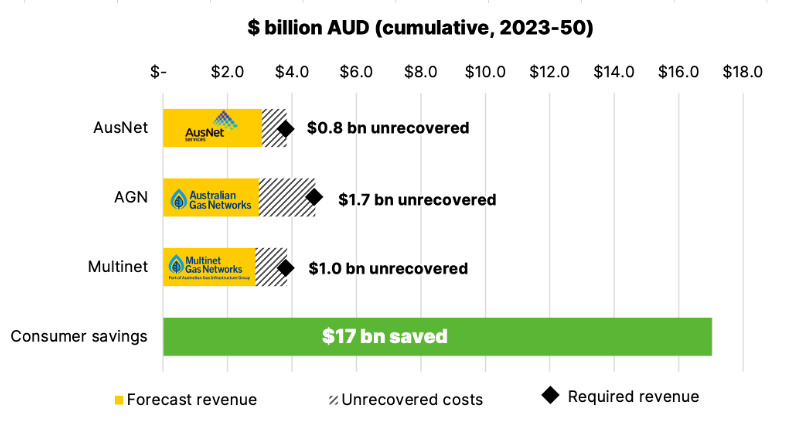

If consumers are to be protected from unprecedented cost rises, Victoria’s three main distributors may face billions of dollars in unrecovered costs between now and 2050. However, these costs are much smaller than the total savings consumers could realise over the same period (Figure 1).

Figure 1: Victorian gas distribution networks’ unrecovered costs vs consumer savings

Source: IEEFA analysis of network costs (described in Appendix B) and appliance upfront and running costs (drawing on Appendix A and C) Note: Assumes consumer prices are limited to a 2.5% pa real price cap.

Conversely, if networks continue to fully recover their costs from residential customers, those customers could face unprecedented price rises. This could trigger a “gas death spiral”, where users leave the network in an uncontrolled and unpredictable fashion, leaving costs to be disproportionately borne by renters and low-income households.

Decision-makers will need to plan for winding down gas distribution networks, which includes a decision on who will bear the costs of decommissioning them. This decision ought to consider the inequitable outcomes that could occur if costs were passed onto consumers. It should also consider the high rates of return that networks have enjoyed over the past decade, and the degree to which they have already been compensated for their risks.

Victoria well placed to take immediate actions to accelerate transition

The cost of delaying the transition to electrification are significant, as the locked-in costs and stranding risks compound for every year Victorians continue to invest in gas appliances. Victoria also has a narrow window in which to avoid forecast annual gas supply shortages by 2027.

However, IEEFA’s analysis finds several key actions Victoria can take to set the state up for a successful transition to all-electric homes:

- Ensure gas appliances are replaced with efficient electric alternatives at end of life from 2025 in all applicable homes.

- Encourage gas appliances to be replaced with efficient electric alternatives before end of life, where it makes financial sense.

- Develop a plan to wind down gas distribution networks.

- Identify and implement solutions for hard-to-electrify homes.

- Strengthen standards and market arrangements to support greater uptake of energy efficiency, Distributed Energy Resources (DER) and demand flexibility.

- Develop a strong electrification workforce and supply chain.

Technical appendices to this report are available to download from the IEEFA website.