Key Findings

The recently published code of conduct by the Financial Services Agency of Japan (JFSA) helps improve the transparency and function of the ESG ratings. However, the effectiveness of a voluntary code is yet to be tested in this nascent sector.

In IEEFA’s view, while a voluntary code of conduct provides flexibility to the firms, it suggests that subjectivity in the sector would still be prevalent if the code is not widely adopted.

Mandatory adoption of the code could help facilitate credible ESG ratings and data.

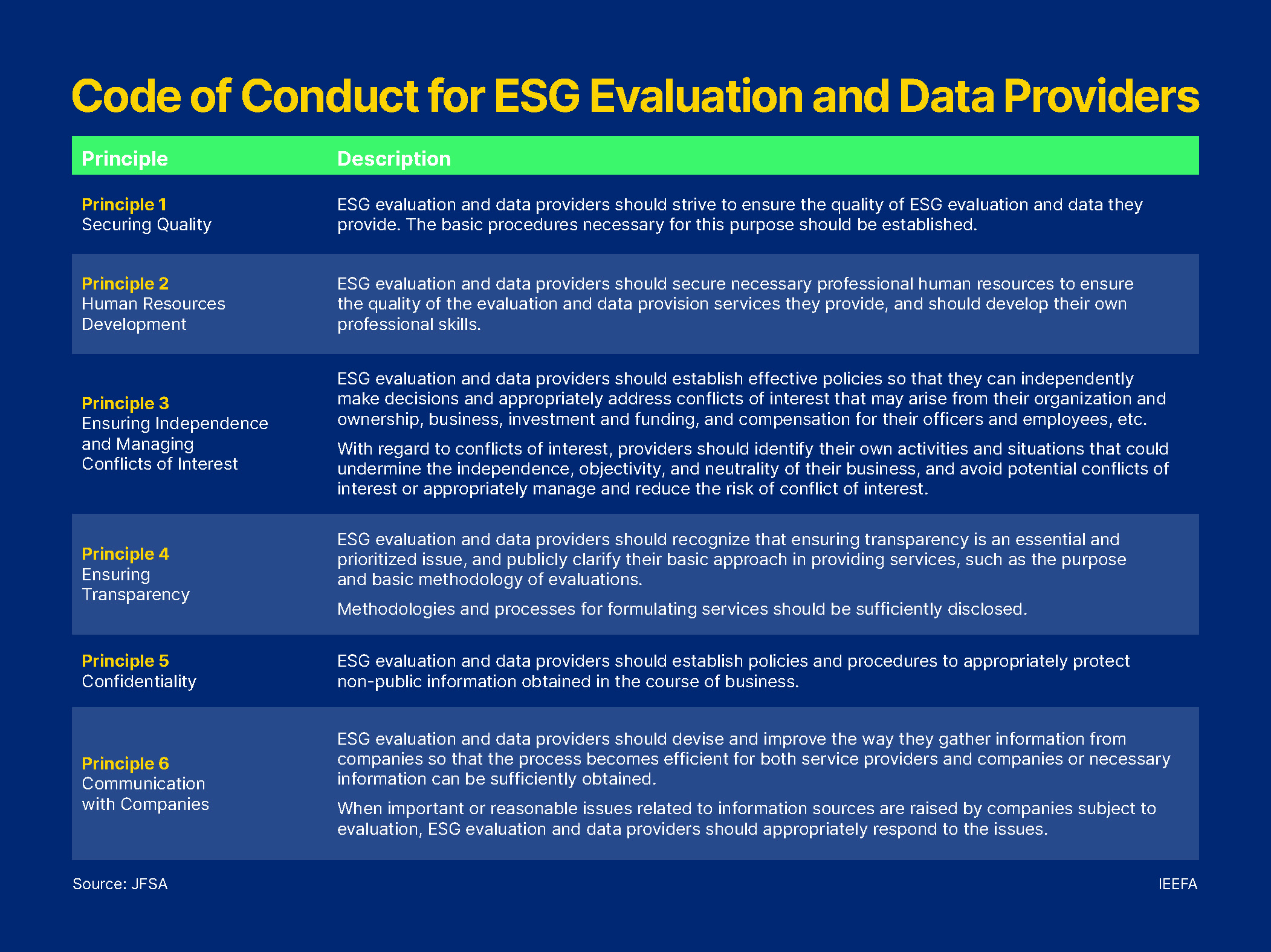

Last December, Japanese regulators finalized the code of conduct for providers of environmental, social and governance (ESG) data and evaluation.

The code is designed for voluntary adoption on a “comply or explain” basis. Firms may choose not to comply with the code if they can explain why. This suggests that the regulatory body, Japan Financial Services Agency (JFSA), is allowing flexibility for ESG rating and data providers to determine the best way to implement the code based on circumstances.

As highlighted in our report published in October 2022, the Institute of Energy Economics and Financial Analysis (IEEFA) is very supportive of greater oversight of ESG rating and data product providers through regulatory intervention, just as JFSA is trying to do.

While not perfect, JFSA’s approach takes Japan one step closer to improving the transparency and function of ESG ratings. However, the effectiveness of a voluntary code is yet to be tested in this nascent sector. The regulator’s permissive stance over the possibility of diverse ratings results is also questionable.

Notably, Japan is not the only jurisdiction looking to tighten standards in the ESG data and ratings sector. The United Kingdom Financial Conduct Authority, the Securities and Exchange Board of India and the European Commission are also exploring regulatory intervention.

Wide variety of ESG services is a problem

Japan’s final code highlights the stance that, “given a wide variety of ESG evaluations and services are provided, it is not necessarily a problem that evaluation results differ from institution to institution.”

IEEFA disagrees. A key shortcoming in the ESG rating sector is a lack of comparability, transparency or alignment. ESG ratings are currently assessed using a wide range of factors with little alignment on definitions. Our research shows that the varying methodologies used by rating providers can result in significant disparities, making them difficult to compare and lacking clarity over how ESG integration affects a security or asset.

Differing ESG evaluation results would inevitably lead to mispricing of stocks and bonds which, in turn, could mean inaccurate inclusion or exclusion of an asset in investment strategies. These are issues of a flawed ESG rating market that have created divergence and confusion among investors.

Therefore, harmonized data obtained through requiring stringent standards for ESG reporting, clearly defined ESG outcomes and transparent methodology for ESG assessment is needed to converge ESG ratings across providers over time. This would mirror the regulatory structure and consistency of credit ratings.

Voluntary code unlikely to fully resolve market concerns

As with any new sector, the ESG rating space has had the liberty of operating without rules, to allow for innovative offerings and development. But as market concerns grow around the inconsistencies and incomparability across providers, regulators must act in a timely manner to progress to the next phase and provide market clarity and standardization.

A unified approach through baseline regulation would enable a common language for all market participants, and a principle-based regulatory intervention could be the way to start.

That said, the success of such intervention in Japan will depend on its track record with implementing similar codes.

It is noted that JFSA has limited authority over rating and data providers, a regulatory shortcoming underlined by the “comply or explain” approach. Given that each firm has developed its own proprietary methodology, interpretation and application of ESG evaluation and data, it is unclear how relying on ESG firms to voluntarily adopt the code would be effective in improving the overall reliability of the ESG investment chain.

ESG firms in Japan, particularly the ones headquartered in other jurisdictions, such as FTSE Russell, MSCI, Sustainalytics, Moody’s ESG and ISS ESG, have spoken in favour of Japan’s code of conduct for ESG data providers. However, none have explicitly pledged to implement the final code, while a few have expressed concerns about the scope of the guidelines.

In IEEFA’s view, while a voluntary code of conduct provides flexibility to the firms, subjectivity in the sector could still be prevalent if the code is not widely adopted. Mandatory adoption of the code would instil the discipline that is needed to facilitate credible ESG ratings and data.

Notably, the UK is also considering regulating the sector, and it recognizes that a voluntary code of conduct is only an interim step to mandatory adoption of standardized practices.

One step at a time

The effectiveness of JFSA’s voluntary code in addressing market concerns is yet to be seen. It has only been recently finalized, and JFSA is seeking endorsement from ESG evaluation and data providers.

The silver lining: it is unlikely that this will be the end of the regulatory road for ESG data and ratings providers in Japan. JFSA has indicated that additional or tighter actions will be considered if and when necessary.