ESG ratings space needs regulatory intervention

Key Findings

IEEFA considers ESG ratings to be instrumental, but their lack of comparability, clarity and alignment could create divergence and confusion among investors.

Regulatory intervention is a crucial step for developing market confidence and protecting investors. The relevance of ESG ratings will otherwise remain uncertain.

Market supports interventions to safeguard healthy, sustainable finance

The pressure is on. Securities regulators are focusing on environmental, social and governance (ESG) ratings. In 2022, at least four—including the European Securities and Markets Authority and the Securities and Exchange Board of India—have proposed regulating the ESG ratings sector.

But a key group of market participants is not loving the attention.

Rating providers have disagreed with moves to regulate the market in the European Union (EU). Some argue that regulatory intervention could stifle innovation, in addition to significant time and cost burden. However, improving the reliability and transparency of ESG ratings to safeguard the wider financial system should instead be their priority.

At present, the costs of misaligned ESG investment strategies and resultant impact on investors' demand for genuine sustainable investments have only increased the capital cost for sustainable firms and heightened greenwashing risk.

As the market is struggling to comprehend the rating system at its infancy, the need for a more focused, reliable and consistent system should outweigh innovation.

Addressing ESG shortcomings

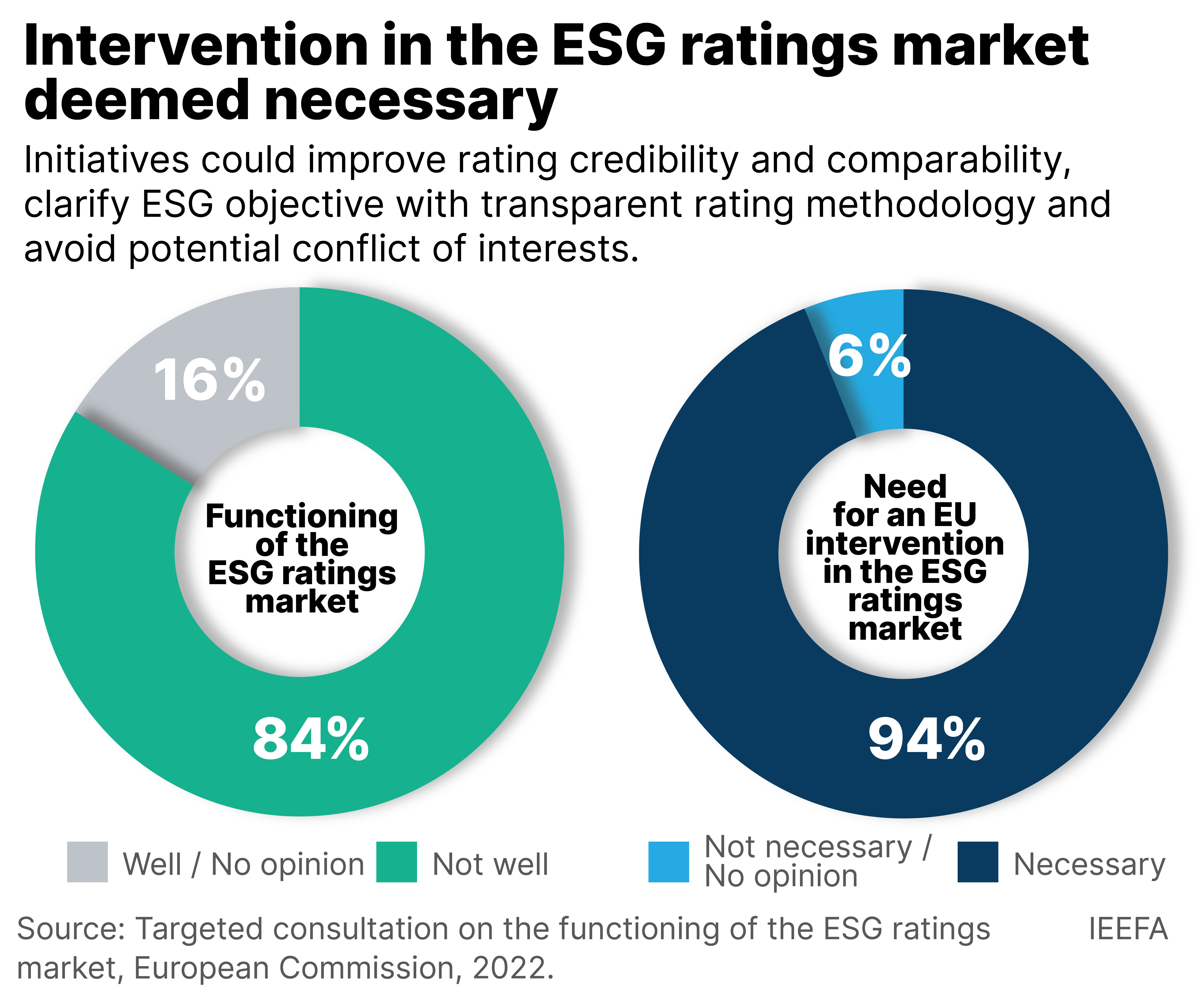

In August 2022, the European Commission (EC) published its findings following a targeted consultation on the functioning of ESG ratings in the EU and the consideration of ESG factors in credit ratings.

Most respondents considered that the ESG ratings market is not performing as intended due to lack of transparency and significant biasness in the methodologies used. However, Sustainalytics, MSCI and S&P Global claimed that the market is functioning well.

While IEEFA considers ESG ratings to be instrumental, our recent report has highlighted their key shortcomings, including the lack of comparability, clarity and alignment. ESG ratings are wide and conflicting, making them difficult to compare. Companies often have overrated or underrated impact on the planet and society, due to the aggregation of E, S and G into a single metric, as well as biases due to industry, geographical location or company size.

What inevitably follows is the mispricing of stocks and bonds, and inaccurate inclusion or exclusion of a company in investment strategies.

Our view is confirmed by a university study which found such uncertainty has made sustainable investing riskier and dampened investors demand for green investments. Firms adapting to greener business models could be undervalued and face challenges in generating capital, and could eventually fail to make a positive impact on the environment and society.

These issues point to a flawed ESG rating market that have created divergence and confusion among investors, and therefore warrant closer scrutiny and harmonization.

Necessity of intervention

Almost all respondents of the EC consultation supported legislative intervention, whereas MSCI, Moody’s and Rep Risk backed non-regulatory intervention in the form of guidelines and code of conduct. While a voluntary code of conduct or guidance may provide flexibility for rating providers in their internal quality control, subjective and poor implementation could be ineffective to improve the transparency and the function of the sector.

It remains questionable how non-regulatory initiatives could address the issues, given that each rating provider has developed proprietary methodology, interpretation and use of ESG ratings.

As rating providers increasingly play an important role in sustainable investments, they should be subjected to the same regulatory scrutiny as other actors in the financial services sector.

For example, credit rating agencies are subjected to comprehensive regulatory framework that aligns their business practices and disclosure requirements. As such, a credit rating agency regulation structure should be mirrored in ESG ratings.

Baby steps forward

IEEFA believes that a unified approach through baseline regulation would enable a common language for all market participants, and a principle-based regulatory intervention could be the way to start.

This determines directed measures to achieve a guided regulatory outcome, paving the way in aligning ESG data, methodologies and converging ESG ratings.

A centralized registration system as suggested by ESMA (a “register and be supervised” model) for all entities issuing ESG ratings would also address market concerns. ESG rating providers would be legally bound to a common organizational standard for conflict of interest and transparency.

Ultimately, regulatory intervention should start with the standardization and specific definition of ESG ratings, along with more transparent and consistent disclosure of ESG data, measurement as well as rating methodology. Requiring providers to back-test their methodologies against their results, tighter scrutiny on ESG data disclosures and other legislative measures could help improve ESG rating quality.

Regulation is a crucial step in developing market confidence and protecting investors. Until ESG ratings are regulated, their relevance will remain uncertain.

This commentary was first published in Regulation Asia.