Insight on the demise of the Keystone XL pipeline project

An international tribunal has finally closed the door on the controversial Keystone XL crude oil pipeline project sponsored by TC Energy, a Canadian company.

When the Biden Administration revoked a presidential permit for Keystone XL in 2021 — which otherwise would have allowed the pipeline to cross the Canada-U.S. border — TC Energy filed a damage claim against the U.S. government for US$15 billion. TC Energy argued a provision of an old trade pact between the United States and Canada, which had allowed such damage claims, applied to the Keystone XL permit denial even though a new trade pact in place since 2020 excluded such claims. The international arbitration tribunal disagreed and dismissed TC Energy’s claim on July 12, 2024.

The revocation of the presidential permit for the crude oil pipeline project was well justified.

The Keystone XL pipeline was never needed. It was initially proposed to transport up to 830,000 barrels of heavy crude oil daily from Hardisty, Alberta, to the U.S. Gulf Coast. Between 2014 and 2022, however, U.S. pipeline companies found ways to leverage existing excess pipeline capacity to transfer additional oil without Keystone XL. As IEEFA reported in 2022, minor pipeline upgrades and a reversal of flows on one major pipeline were more economical and flexible than building costly new infrastructure with an uncertain future. The approach adopted leaves a system better suited to adapt to the energy transition.

Moody’s Investors Service (now Moody’s Ratings) concluded in July 2021,“The revocation of the presidential permit and subsequent cancellation of Keystone XL earlier this year was credit positive,” allowing the company to rely primarily on internally generated cash flow and a modest increase in debt to address its reduced capital program execution risk.

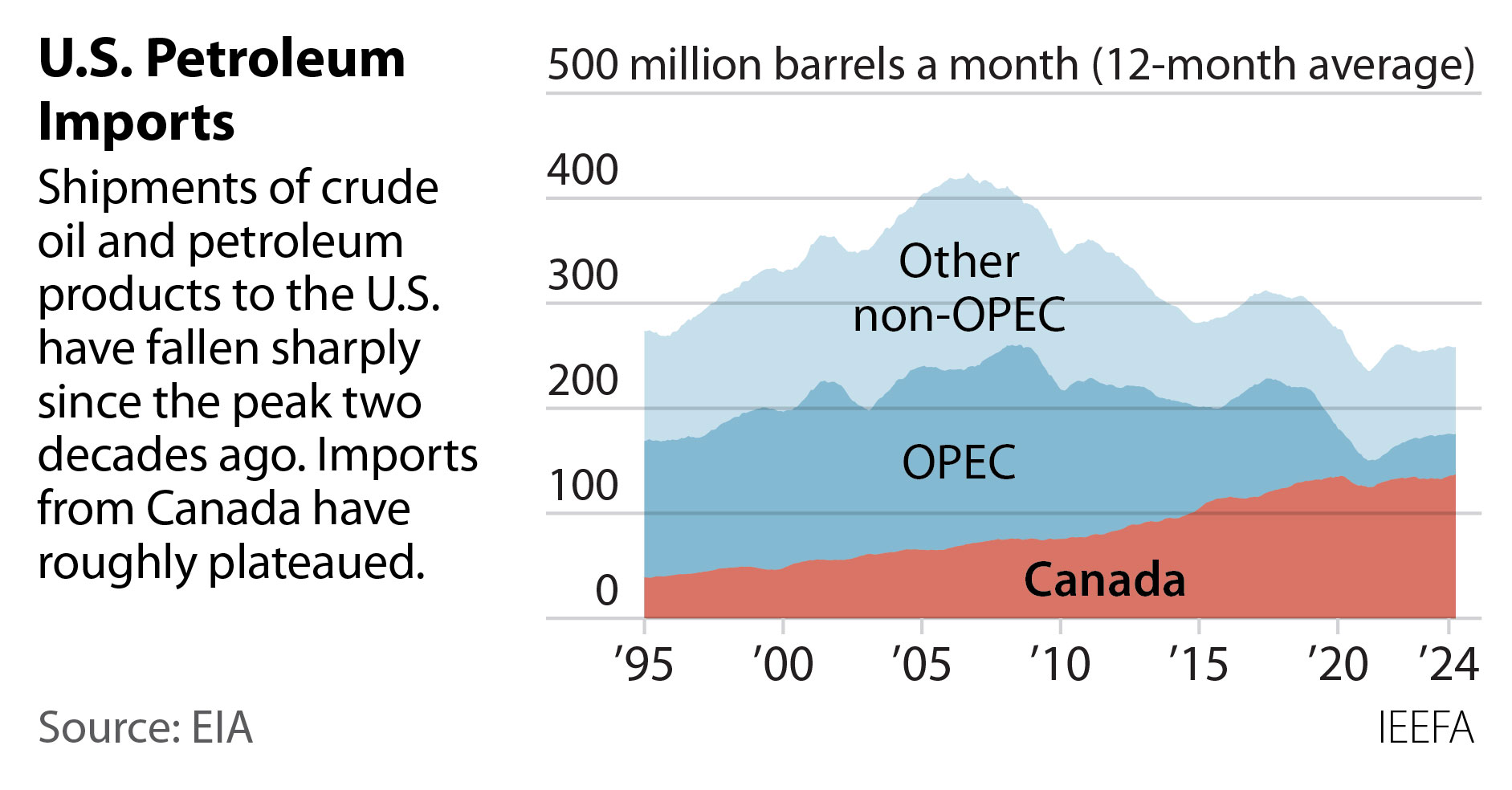

The initial rationale for Keystone XL was based on an assumption that future Canadian oil sands production growth would be robust, but the outlook declined significantly instead. Although Canada’s share of U.S. oil imports rose from 1980 through 2019, the trajectory has since plateaued.

Figure 1: U.S. Petroleum Imports—total and from OPEC, Persian Gulf and Canada, Jan. 1994-April 2023

Source: EIA

Market demand for crude oil is changing as electric vehicles (EVs) take an increasing share of the automotive market. According to the International Energy Agency (IEA) Global EV Outlook 2024, around one in nine cars sold in the United States are expected to be electric this year, and the IEA Executive Director Fatih Birol projects the tally will reach nearly one in five by 2030.

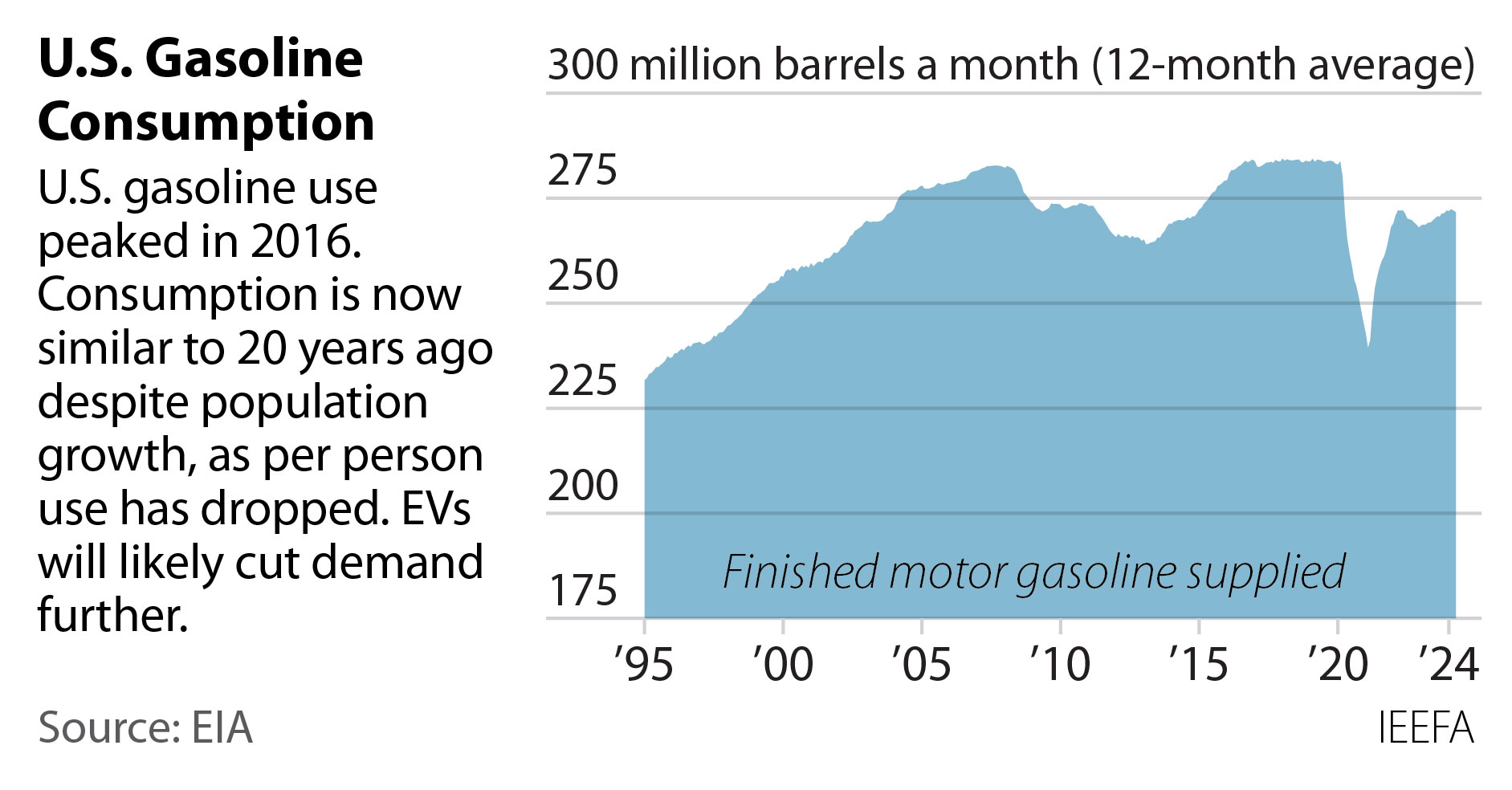

According to the Energy Information Administration (EIA), roughly 41% of a barrel of oil is directed toward producing motor gasoline for transportation. Consequently, the impact of a growing EV market will reduce oil demand substantially. The EIA reports, for example, that total gasoline consumption in the United States peaked in 2016 and has already fallen more than 6% despite population growth. Per capita gasoline demand, adjusted for population growth, has also dropped by 12% since 2016.

Source: EIA

The U.S. government’s decision to revoke the Keystone XL permit was made on the grounds that the project was not in the public interest. Land use groups, indigenous tribal entities, and environmental groups had vigorously fought the pipeline. In the years since the decision, concerns about greenhouse gas emissions have grown, and oil and gasoline alternatives have increased in feasibility and availability. The international tribunal’s decision means the U.S. government will not be penalized for making a decision that was in the public’s best interest.