IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals

We’re out this morning with our annual outlook for U.S. coal markets, and the picture isn’t pretty.

We see the potential for some short-lived strength in the current uptick for coal producers but the title of our assessment sums up the larger view: “Short-Term Gains Will Be Muted by Prevailing Weaknesses in Fundamentals.”

You can read the full briefing here.

Our outlook starts by acknowledging that the U.S. coal industry begins 2017 with better optics than it had a year ago. A new administration comes to power in Washington this week promising regulatory relief and a coal resurgence, major industry players are emerging from bankruptcy, and a recent spike has occurred in global prices.

While these optics are positive on their face, IEEFA sees the industry as a sector saddled with a fundamental problem it has failed to address after being riddled with bankruptcies: Too many companies are still mining too much coal for too few customers.

Modest improvements for the industry in 2017 will be driven almost exclusively by the relative rise in the price of natural gas, which is coal’s main competition. This dynamic will create some regional advantages and some marginal profitability gains for coal producers. Contura (formerly Alpha Natural Resources) and Arch Coal are coming out of bankruptcy now and may see some initial improvements due in large measure to the debt relief supplied by the bankruptcy process. It remains to be seen how Peabody Energy, which has recently filed its reorganization plan, will emerge from bankruptcy. Other coal producers with manageable debt levels should also see some improvement.

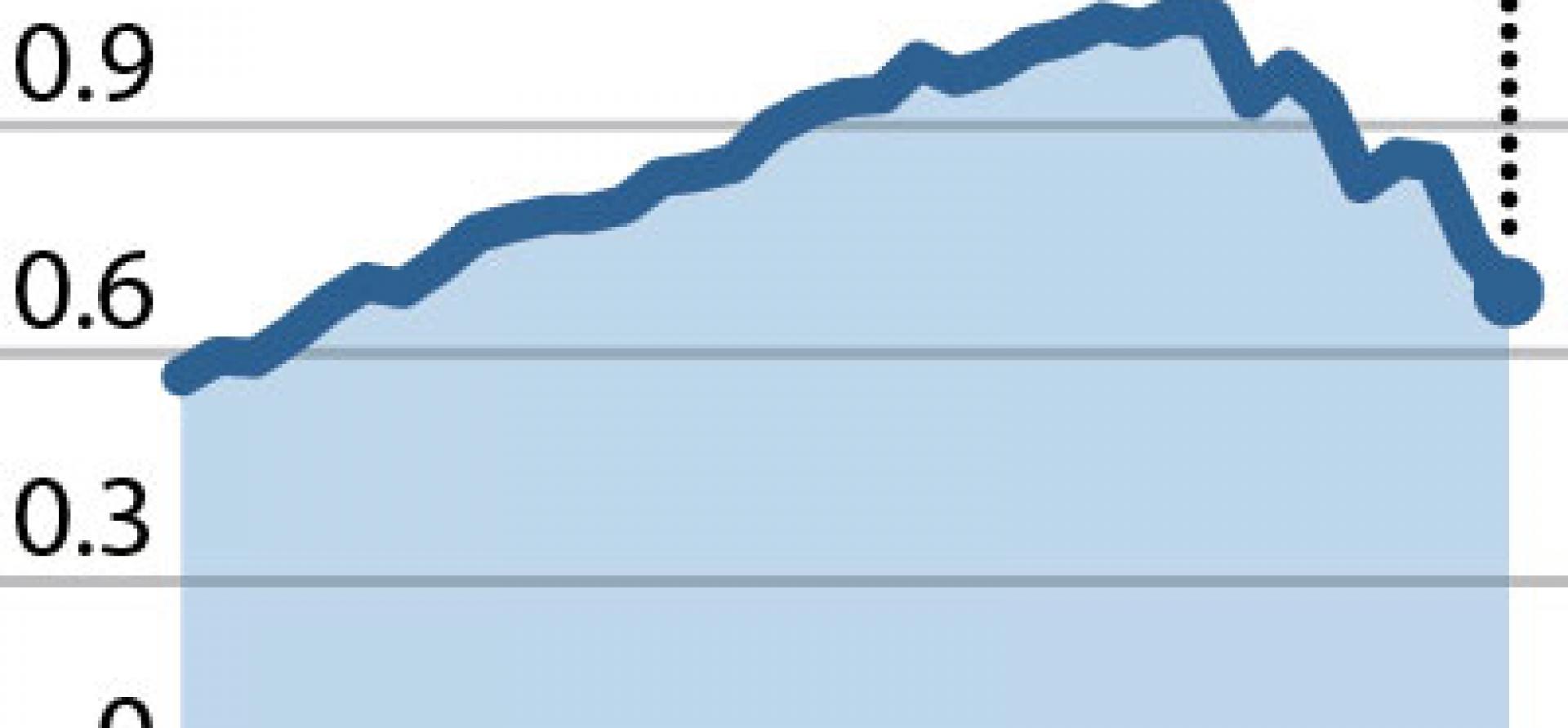

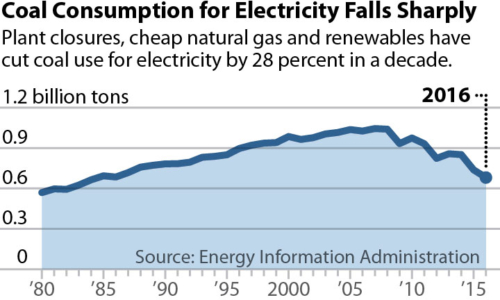

Coal’s value as an investment will remain clouded, however, by market competition from natural gas, wind, solar and gains in energy efficiency. Potential benefits from regulatory relief that has been promised by the new administration will provide little or no gain. And the long-term prognosis for the coal industry in every coal-mining region from now through 2050 is poor, as more coal-fired power plants will close and as utilities will continue to allocate capital away from coal.

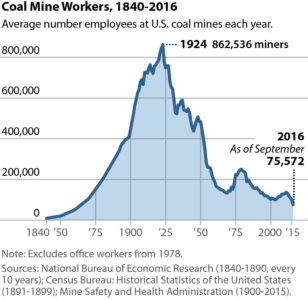

Promises to create more coal jobs will not be kept—indeed the industry will continue to cut payrolls. These employment trends are rooted in the coal industry’s long-term business model of producing more coal with fewer workers. Job losses will be exacerbated further by the current low-coal-price environment and by the inability of the industry and its component companies to adapt to a smaller customer base.

Our outlook has the following occurring across the U.S. coal industry in 2017:

- Coal production declining by as much as 40 million tons.

- Coal prices failing to increase enough to benefit shareholder or stimulate new investment.

- Coal exports remaining weak.

- Little or no gain from regulatory relief as capital continues its flight from coal.

- Increasingly dim employment prospects.

The U.S. coal industry is not on a path to recovery in either the short or the long term and that’s due mostly to market dynamics unrelated to regulation.

Expect declining demand and low prices going forward as coal producers continue to demonstrate an inability to compete with natural gas and renewables.

See the full report here.

Tom Sanzillo is IEEFA’s director of finance. David Schlissel is director of resource planning analysis.

RELATED POSTS:

IEEFA Update: Renewable Energy, Gone Mainstream, Is a Rising Tide

IEEFA Update: Wind Is Blowing Away Fossil-Generated Power in Middle America