IEEFA Report: A Renewables Path to Japanese Energy Security in a Post-Nuclear Era

We’ve just published a report that details how Japan’s post-nuclear electricity-generation economy can be viably retooled around renewable energy.

We’ve just published a report that details how Japan’s post-nuclear electricity-generation economy can be viably retooled around renewable energy.

Our report—“Japan: Greater Energy Security Through Renewables: Electricity Transformation in a Post-Nuclear Economy”—emphasizes the potential for national energy security through renewables, most especially wind and solar.

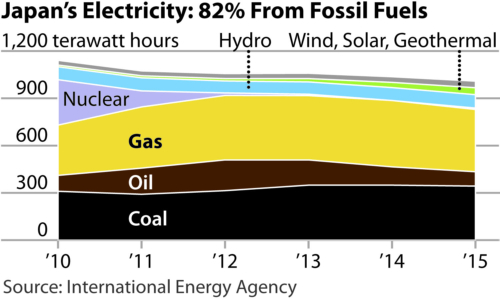

This report documents how government policies adopted in the wake of the Fukushima disaster in 2011 have favored replacement of nuclear baseload with fossil fuel baseload—a strategy that has proven costly and resulted in lost opportunities in the development of increasingly available renewable energy.

At stake in Japan’s energy transition are issues that transcend economics. Indeed Japan’s very energy security is at risk. Before the Fukushima disaster of 2011, Japan had enough nuclear fuel to ensure nuclear power played an important role in long-term domestic production of electricity. Since Fukushima and the shutdown of the Japanese nuclear industry, the country has become deeply reliant on fossil fuel imports, a perilous position that leaves it at the mercy of foreign markets and geopolitical upheaval.

At stake in Japan’s energy transition are issues that transcend economics. Indeed Japan’s very energy security is at risk. Before the Fukushima disaster of 2011, Japan had enough nuclear fuel to ensure nuclear power played an important role in long-term domestic production of electricity. Since Fukushima and the shutdown of the Japanese nuclear industry, the country has become deeply reliant on fossil fuel imports, a perilous position that leaves it at the mercy of foreign markets and geopolitical upheaval.

Highlights of our report:

- Energy productivity gains will drive down electricity demand from 1,140 terawatt hours (TWh) in FY2010 to 868TWh in 2030. With population decline limiting economic growth and Japan’s world-leading energy efficiency driving further energy productivity gains, electricity demand is set to decrease until at least 2030, as it has done for the past six years.

- As Japan reconfigures its electricity industry, solar PV can account for 12 percent of its electricity-generation mix by 2030, up from 4 percent at present. Japan was the second largest installer globally of solar PV from 2013-2015, but new policy support by the Japanese government will be required to perpetuate solar growth. A recent move towards reverse auctions for large-scale solar suggests Japan can realize significant further solar cost reductions, like those currently being achieved around the world. A policy focus on rooftop solar and ongoing market reforms will expand Japan’s renewables footprint, while large pumped hydro storage capacity and greater regional grid connectivity will help integrate increased solar PV into the still largely regional grids.

- Japanese offshore wind-power resources have been largely overlooked but have tremendous potential, and can viably contribute to baseload power demand. While onshore wind development has been slow due to Japan’s lengthy approvals process for the limited suitable land available, significant and overlooked opportunities exist in offshore wind development. Japan has one of the best manufacturing industries in the world—perhaps the best—and one that is becoming more and more suited to wind-turbine production. Mitsubishi Heavy Industries, for instance, is currently researching and developing offshore wind technology as well as supplying offshore turbines via its joint venture with MHI Vestas Offshore Wind. Offshore wind’s inherent absence of land constraint issues works in its favor, as do its utilization rates of 45 to 50 percent, an indication that it can contribute to baseload power. IEEFA sees 10 gigawatts (GW) of offshore wind in Japan by FY2030.

- Japan can meet 35 percent of its electricity needs with renewables by 2030. Assuming a much-needed policy push to increase solar and offshore wind capacity, and factoring in the country’s probable electricity demand reduction, Japan’s total renewable energy share will double to 35% of generation by 2030. IEEFA sees this including hydro and biomass and acknowledges that it depends on the Japanese government delivering on its COP21 pledge. It will require a major lowering of regulatory and grid barriers to renewable energy projects, changes that will allow Japan to tap capital markets to support national renewable energy programs.

- Japan’s nuclear industry, mothballed after the Fukushima disaster, will probably not recover. IEEFA sees only a quarter of Japan’s 40GW of offline nuclear power capacity coming back into service by 2030. Although Japan is seeking to restart nuclear production as a way to diversify its generation mix and improve energy security, the industry will face strong headwinds, as financially distressed operators struggle to achieve new safety standards before reactors reach their retirement dates.

- Japan will very likely scale back plans to construct a new fleet of coal-fired power plants. Most of the 45 new coal-fired power plants Japan is proposing to build are still in the planning stages and — because of Japan’s declining electricity demand — many will not reach the construction phase. Whether the proposed coal fleet expansion would add overall capacity or merely replace existing thermal capacity is unclear anyway, and momentum for the initiative is fading. Japan’s major electricity power companies (EPCOs) have recently started to reassess their coal-fired generation plans.

Japan can gain enormously and in a myriad of ways by adopting an electricity-transition model built on renewables.

If Japan takes this path, it will have overhauled its electricity system by 2030 in a way that will drastically increase its energy security, reduce its current account deficit and build long-lasting technology capacities in industries of the future.

Tim Buckley is IEEFA’s director of energy finance studies, Australasia. Simon Nicholas is an IEEFA energy finance analyst.

RELATED POSTS:

IEEFA Update: China Is Now Three Years Past Peak Coal

IEEFA India: Latest Record-Low Bids Underscore Solar’s Commercial Viability